Rethinking 60-40

Today’s post is about whether the traditional 60-40 stocks/bonds portfolio still makes sense.

Contents

Rethinking 60-40

The 60-40 stock-bond portfolio has been around for so long that its origins are no longer clear.

- Perhaps the simplest way to think of it is as the middle option of three standard portfolios offered by financial advisors to customers with differing levels of risk appetite.

Stocks are riskier (more volatile in price) than bonds but have higher long-term returns.

- So the riskiest portfolio recommended by most advisors would be 80-20, and the safest would be 40-60 – 60-40 is the middle option.

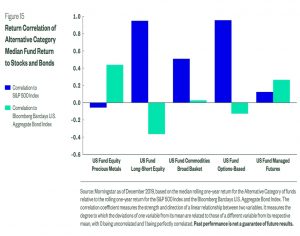

The logic of blending two assets together comes from the idea that their prices will move in opposite directions.

- When stocks go down, you hope that bonds will move up in price.

If you are already in decumulation (drawdown/retirement) you would sell bonds to generate income, so that you didn’t have to sell stocks at low valuations, locking in your losses.

Stocks and bonds

The need to rethink 60-40 all starts with the prospect of higher inflation and its potential impact on the bond-equity relationship. (( We looked at this in March 2020, in one of our Weekly Roundups ))

- If inflation rises for an extended period, this could be bad for both stocks and bonds.

In quant speak, the bond-equity correlation might turn positive.

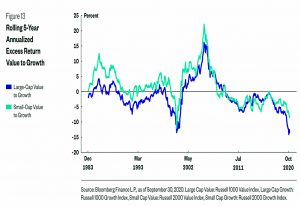

This is actually the normal relationship, but in recent years, investors have become used to bonds rising when stocks fall.

- In particular, recession-driven stock market crashes lead to a demand for safe-haven assets, which are traditionally government bonds.

So the price goes up, and the yield goes down.

- When the economy recovers, so do stocks, but bond prices fall back.

Lower bound

The longer-term positive relationship is based on yields.

This has led to lower yields (and higher prices) in other (riskier) assets, such as stocks, property and credits (corporate bonds).

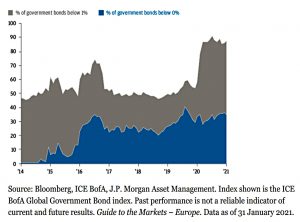

- But as bond yields approach zero during the good times, they don’t have far to fall in a crash.

And so they have a limited ability to protect you.

In fact, with bond yields close to rates on savings accounts, there’s little incentive for private investors to hold bonds at all.

Inflation

The impact of inflation on stocks is linked to monetary regimes.

- Since the gold standard was abandoned in the 1970s, inflation is no longer mean-reverting.

Inflation was good for stocks, then bad, then good again after the 1990s when central banks were given inflation targets.

- But the new generation of government officials worries more about climate change and inequality than inflation.

So we could be due for another flip.

Diversification

If bonds and stocks track together in the future, then bonds won’t provide a diversification benefit against stocks.

- Which could mean the end of the traditional 60:40 stock/bond portfolio. (( We looked at an article by Merryn Somerset Webb on this topic back in March ))

In fact, bonds are a pretty bad hedge for stocks in any case, unless you either hold a lot of them (bad for overall returns) or use a lot of leverage (risky).

- But the 60:40 portfolio is easy to understand and has proved pretty easy to market to investors.

Its also done pretty well over the decades, so many investors would miss it.

Alternative assets

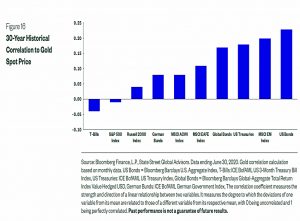

Some obvious candidates are gold and cash.

- More adventurous investors might consider other precious metals, commodities in general, private equity and venture capital, hedge funds, infrastructure funds, royalty companies and even crypto.

Real assets – like property, art and farmland – are another way to go.

- But most investors in the UK have too much property exposure through their home (since prices are high) and the other two assets are difficult and expensive to access.

Whichever mix of assets you decide upon, the goal is to achieve returns close to those of stocks alone (something that bonds are unlikely to deliver from here) with lower volatility.

Stock pickers, market timers, factor buffs and sector rotators might come to other conclusions (eg value stocks).

- We’ll park active tweaks to the traditional passive 60-40 for the moment.

State Street report

Since we first recorded our thoughts on the implications of rising inflation on portfolio construction, I’ve come across a couple of institutional reports on the topic.

- First up is State Street Global Advisors, probably best known in the UK for their SPDR range of ETFs.

Their report is called Portfolio Construction in and out of the Core for the Next Decade.

The standard 60/40 portfolio bonds provided 91% of the return of stocks but with 64% less volatility and a 36% lesser max drawdown. However, in 45 out of the past 50 (90%) rolling five-year windows, the rolling five-year return was below both the long-term median figure of 9.9% and levels from prior years.

The report notes that daily volatility is increasing, and bonds face headwinds:

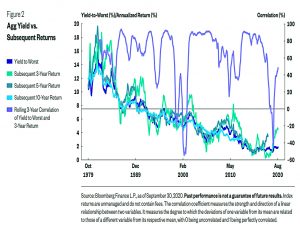

For bonds, there is a strong relationship between the yield at the time of purchase and the subsequent returns. As yields move lower, so do the subsequent future returns. However, there can be brief periods of decoupling.

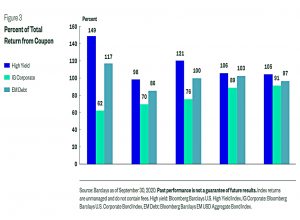

Most bond returns come from the coupon.

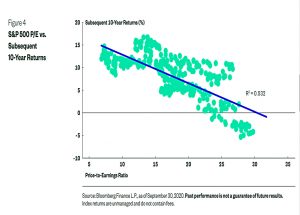

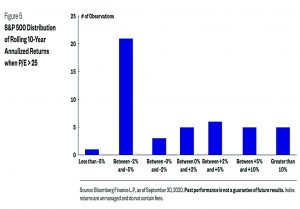

Meanwhile, stock returns are driven by starting PE.

A high PE (like today) doesn’t bode well.

SPDR has four suggestions for rethinking the core portfolio:

- Active management with a strong track record of beating benchmarks

- This is hard to find – less liquid markets are the most promising areas to look.

- Additional markets

- Easy for many US investors who stock to home turf, but more difficult for those of us who are fully diversified.

- Hard to happy to bonds at the moment, as none have positive prospects.

- Factor premia (smart-beta funds)

- Again, already implemented by many of us, and factors seem to outperform by less once they have been identified.

- Patience and diversification are required since no single factor works all the time and many factors underperform for years (eg. value right now).

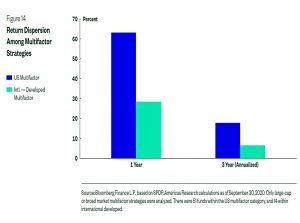

- Multifactor funds are now available, though they have varying returns (see chart below).

- Non-correlated strategies

- These are not specified at this point, but they mean alternatives.

The authors note that care is needed to minimise impacts on fees and taxes.

Next, we come onto the alternatives.

Some of these are easier to access than others (for UK investors).

- Precious metals and commodities are fairly easy to get hold of.

- There are a few hedge funds available, though not primarily long-short equity.

- Options and managed futures (trend-following) are very much DIY pursuits.

As well as stock and bond correlations, the report has a chart of asset correlations to gold:

JP Morgan report

The JP Morgan report comes from its European team.

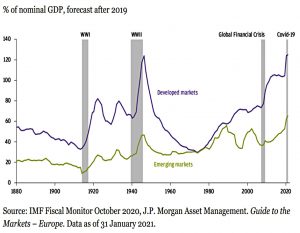

They note that levels of government debt are increasing.

And yields are low.

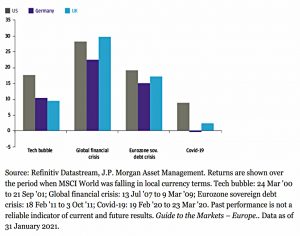

The Covid-19 crash has provided evidence that with rates already low, government bonds won’t provide returns during equity market shocks.

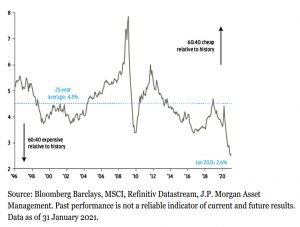

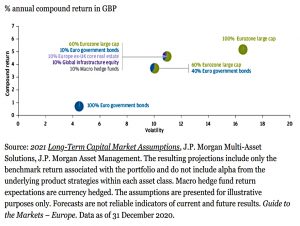

In the next decade, a traditional euro market 60:40 stock-bond allocation is expected to earn only around 3.5% a year.

The current yield on a 60:40 portfolio is the lowest for decades.

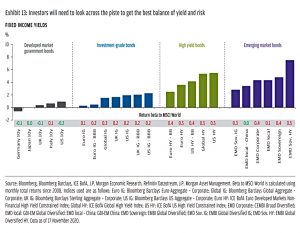

More esoteric bonds offer higher yields, but also higher correlations with equities.

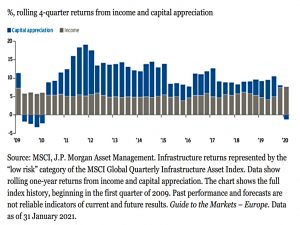

So instead JP Morgan recommends alternatives, favouring real estate and infrastructure over bonds.

- They recommend selectivity with property, preferring warehousing over office space and retail.

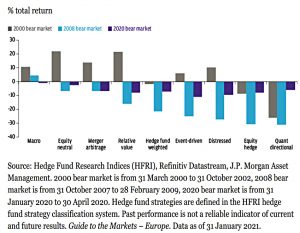

They also back hedge funds, and in particular macro strategy hedge funds, which have done the best job of providing downside protection.

Their blended portfolio should produce higher returns with only a modest increase in volatility relative to 60:40.

Conclusions

- I would never recommend a simple 60-40 portfolio to anyone.

- The 80-20, 60-40 and 40-60 portfolios are reasonable proxies for the positions on the risk tolerance spectrum where most people place themselves.

- You might also argue for the 70-30 and 50-50 portfolios on the same basis.

- But two assets are not enough.

- This error is compounded in the US (home of the 60-40) by often limiting the two assets to US-only versions.

My own target allocation (for my core passive portfolio) is 75-20-5, with a 5% allocation to true alternative assets.

- But I use equity and bond alternatives as well as the core assets, and I track around 50 asset classes.

I am also lucky to have a set of DB pensions that I can consider as a bond portfolio.

- This amounts to around 13% of my net worth, which means that I can get to my 20% allocation using cash rather than actual bonds. (( I actually own around 1% of true bonds ))

My bond alternatives include infrastructure (including renewables), and royalty funds (like the recently-launched song funds).

- I class property as an equity alternative, and as I live in London, I am already over-exposed via physical property.

Beyond the base allocation, we must consider timing.

- The potential for higher inflation and hence higher interest rates and bond yields means that this is not a good time to be getting into a basic 60-40 allocation.

Investors need to work harder to diversify away from their stock risk under the current (and looming) macroeconomic conditions.

- Until next time.