HedgeFundie’s Excellent Adventure

Today’s post looks at HedgeFundie’s Excellent Adventure with a leveraged portfolio.

Contents

Leverage

Today’s article is the first in a series of posts that will investigate the use of leverage in portfolios.

Leverage is an emotive subject and many investors will have horror stories of friends who went bust after margin calls from their brokers.

- Or perhaps they will bring up Long Term Capital Management, the hedge fund run by Nobel Prize winners whose use of excessive leverage led to its downfall.

But it doesn’t have to be like that – moderate leverage can be used to enhance returns and reduce risk.

- It’s the risk/return trade-off that we will be focusing on in this series.

Most people’s use of leverage is limited to their mortgage.

- They might not realise that their home is a leveraged property play, but it is, and the leverage goes a long way towards explaining the decent returns that many homeowners have enjoyed (in the UK, at least).

I paid off my own mortgage twenty-three years ago, and my own use of leverage is now limited to a few spread bets.

- Although my passive portfolio follows risk-parity principles, and our risk parity uses leverage, I don’t use leverage there, preferring instead to boost returns by using a higher allocation to stocks, and a lower allocation to bonds. (( Strictly, to DB pensions and cash ))

The headline gearing per contract is a scary (to many people) five to twenty times.

- But I am usually borrowing between 0.5% and 3% of my net worth, which shouldn’t get me into too much trouble.

A leveraged portfolio is not an all-or-nothing choice.

- Keep an eye on the bottom line – understand how much leverage you have overall, rather than how much you have on this position.

HedgeFundie’s Excellent Adventure

HedgeFundie is an ex-member of the Boglehead online forum.

- The Bogleheads are a group that follow the investing principles of Vanguard founder John Bogle, which basically means sticking with index funds for decades.

In a 2019 forum post, HedgeFundie proposed his Excellent Adventure (usually abbreviated to HFEA) which was to use leveraged ETFs in a risk parity (40/60) portfolio:

- 40% 3x S&P 500 (UPRO) and

- 60% 3x Treasuries (TMF)

The post generated a lot of discussion and ended up producing two long threads that will take you a day to work through.

- This is a recurring issue with HFEA – a lot of the discussion is in rambling, unstructured threads on social media.

The best summary I’ve found is on Optimized Portfolio, and I’ll be borrowing from that to make sure we set off with a clear understanding of HFEA.

Features

- The allocation was later revised to 55% UPRO, 45% TMF, largely to reflect historical performance under the prevailing low interest rates.

- This makes it difficult to describe as a risk parity approach, though it could be seen as just another way of fixing the “low returns” issue with our risk parity.

- The portfolio is targeting a similar risk profile to the S&P 500, but with higher returns.

- The portfolio is rebalanced quarterly, though alternative approaches have been analysed.

- Backtesting shows that HFEA outperforms, but the questions remain about future conditions and the “all-weather” properties of HFEA.

- The outperformance relies heavily on the lack of correlation between stocks and long-term treasuries.

- HedgeFundie recommended the strategy as particularly appropriate for younger investors (like the Lifecycle Investing strategy of borrowing when young) and also says that it should only be used with a small portion of your total net worth.

- Other assets apart from UPRO and TMF have been considered, most notably TQQ (3x Nasdaq 100).

- Implementation in the US is usually in a tax-sheltered account using “pies” for easy rebalancing (M1 Finance is the usual broker).

- Here in the UK, Trading 212 and InvestEngine are the brokers with the closest approaches to pies, but I have not yet investigated the implementation of HFEA with them.

Critiques

The main critiques of HFEA are:

- Leveraged ETFs shouldn’t be held for the long term.

- This is to do with volatility decay, but it’s a myth.

- We’ll address this in a later post.

- The past does not predict the future, and future conditions may be unfavourable to HFEAs.

- This is valid, but it’s true of all strategies – the way to deal with this is to allocate across many strategies.

- The particular danger to HFEA is runaway inflation as in the 1970s, which is clearly a risk at the time of writing.

Alternatives

Optimized Portfolio runs through a few alternative approaches to the HFEA concept:

- PIMCO has a US mutual fund that does something similar, called StocksPLUS Long Duration Fund (PSLDX).

- I don’t think UK investors can access this fund.

- WisdomTree’s NTSX is a 1.5x leveraged 60/40 portfolio (constructed from 90% stocks and 10% Treasury futures).

- You can (sometimes) make spread bets on this ETF.

- 43% UPRO and 57% EDV (Vanguard extended duration Treasury ETF) is apparently a cheaper and more tax-efficient version of the portfolio for US investors.

- US investors also have a wide range of leveraged ETFs that they might consider adding, particularly if they are worried about inflation and rising interest rates.

-

- LTPZ – long term TIPS (inflation-linked bonds).

- FAS – 3x financials (banks tend to do well when interest rates rise).

- EDC – 3x emerging markets (diversify outside the U.S.).

- UTSL – 3x utilities (lowest correlation to the market of any sector; tend to fare well

during recessions and crashes). - YINN – 3x China (lowly correlated to the U.S.).

- UGL – 2x gold (lowly correlated to both stocks and bonds, but a long-term expected real return of zero; no 3x gold funds available).

- DRN – 3x REITs (arguable diversification benefits from “real assets”).

- EDV – STRIPS

- TYD – 3x intermediate treasuries

HFEA Performance

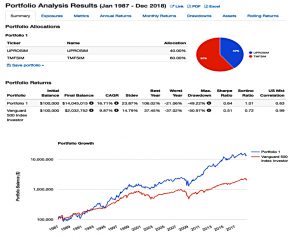

The first chart (from Optimized Portfolio) shows the HFEA outperformance from 1987 to 2018.

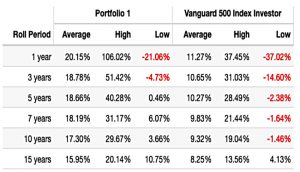

The table shows rolling returns from 1 year to 15 years.

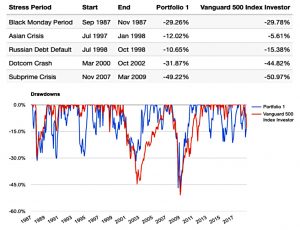

Drawdowns are mostly smaller than the S&P 500.

All stocks

Optimized Portfolio also gets into why we need the (leveraged) bonds.

- With 100% UPRO, we would expect very severe drawdowns that would be hard to recover from.

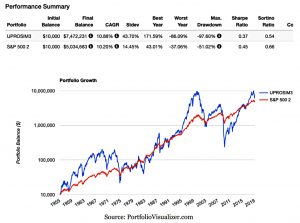

The backtest shows that 100% UPRO underperforms.

100% UPRO slightly outperforms the S&P 500, but it’s much more volatile.

That’s it for today – we’ve taken the first step down the rabbit hole.

- HFEA looks interesting, but there’s a lot more work to be done.

Until next time.