How I Invest 3

Today’s post is our third visit to How I Invest My Money by Joshua Brown and Brian Portnoy.

Contents

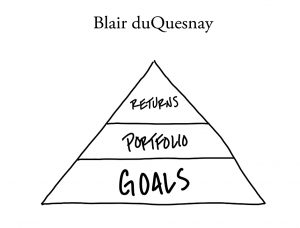

Blair duQuesnay

Blair duQuesnay is an investment advisor at Ritholtz Wealth Management (where Josh Brown works).

I pursued a career in finance because I fell in love with markets and investing during college. At first, I was a stock picker who admired Warren Buffett.

Then she read Winning the Loser’s Game by Charles Ellis.

Ellis convinced me that trying to beat the market is a losing proposition. I have not purchased an individual stock since reading that book.

But she is still a saver.

I have always prioritized saving by paying myself first. A portion of every paycheck is automatically added to my 401(k) plan, a 529 college savings account for both children, and a cash reserve account.

I try to keep six months of living expenses in a cash reserve, which gets dipped into throughout the year for various home repair projects and unexpected expenses.

For investments, she eats her own dog food:

I invest my retirement and after-tax accounts in the same portfolios I recommend to clients. The result is a globally diversifi ed mix of stocks and bonds invested in low-cost mutual funds and ETFs.

My mix of stocks and bonds is based on two things: time horizon and risk tolerance. My time horizon is long. My risk tolerance is high. I place 80% in stocks and 20% in bonds.

Blair has one exception to her client portfolios:

Over the years I have formed relationships with some incredibly talented people whose investment recommendations are available through ETFs. One is Perth Tolle, the creator of Life + Liberty Indexes.

Her methodology ranks emerging market countries based on their human and economic freedoms. The thesis is that freedom wins in a capitalist market. I purchased a small amount of her ETF. I expect I will make an additional exception or two for products from people I admire.

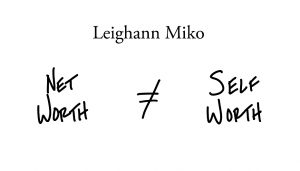

Leighann Miko

Leighann Miko is the founder of Equalis Financial, a financial planning firm in LA that focuses on LGBTQ+ creatives in the entertainment industry.

- Leighann grew up poor and as a young adult oscillated between spending and hoarding – mostly spending.

She doesn’t have anything to say on investing, writing instead about her spending.

I try to spend my money in ways that have the greatest benefit to the most people.

That sounds deceptively difficult to me.

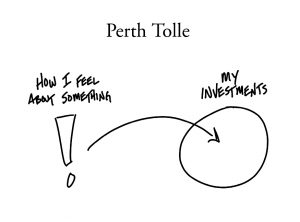

Perth Tolle

Perth Tolle is the founder of Life + Liberty Indexes. Before that, she was a private wealth advisor at Fidelity.

For me, investing is as much a creative pursuit and form of expression as an intellectual or scientific exercise. And I express myself through indexing.

By which she means, the indices she constructs. She says she fits two investing cliches:

Perth has four investing buckets:

1 – I keep a couple years of living expenses and emergency funds in money markets.

2 – General investing and cash for investment opportunities (50% stocks, 50% cash). I hold stocks and ETFs that are not part of my core strategy. – companies I enjoy and believe in, or ETFs with themes that I think are promising.

3 – Retirement (90% stocks, 10% bonds). This is the largest asset pool. I have some extremely low-cost Fidelity index funds – large, mid, and small cap US equities. I also have some bond funds. The bulk of this account is in emerging markets equities in the form of the Freedom 100 EM ETF (Ticker: FRDM).

We met Perth’s ETF in the section above on Blair DuQuesnay.

It is a freedom-weighted emerging markets strategy that uses personal and economic freedom metrics to determine country weights and allocations. Freer countries get higher weights, less free countries get lower weights, and the worst actors are excluded.

This excludes China (as well as Russia and Saudi Arabia).

Perth’s fourth pool is charitable giving.

I use a charitable gift account to contribute highly appreciated stocks in kind, organize distributions, and get immediate tax benefits without having to keep a receipt for each recipient.

This fund is 20% stocks, 80% bonds. Perth also has capital tied up in her business, but she doesn’t go into detail here.

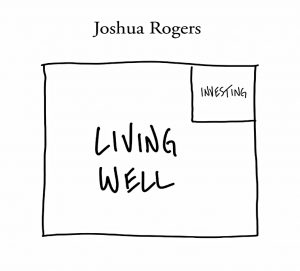

Joshua Rogers

Joshua D. Rogers is the founder of Arete Wealth, a wealth management firm for high-net-worth individuals and institutions.

- Joshua’s chapter consists of a series of aphorisms.

He thinks that public markets are efficient.

I am more interested in investing in markets that are less efficient and where information advantages can be easily and legally gained – real estate, privately held businesses, venture capital, art, wine, watches, collectables, rare earth metals, and cryptocurrencies.

Which makes a change from the rest of the book.

- PE, VC and real estate make sense, at least as diversifiers.

- SWAG is problematic because of transaction and holding costs, and a lack of yield.

- Rare earth metals and crypto are hard for private investors to access.

My largest asset and biggest single investment is my own business. I have always felt that I would much rather invest in something that I control as opposed to something that I have no control over, like the S&P 500 index.

After you invest in yourself – aka your own business – invest in real estate. In my experience real estate is the second most reliable way to build wealth over the very long term.

I have to disagree with this.

- Plenty of people have become rich through real estate, but usually by treating it more like a job than an investment, and by using a lot of leverage.

That’s it for investments.

- Joshua moves on to giving and Deepak Chopra, and then to taxes.

Worry less about the fees involved in investing and more about the taxes. Taxes create a drag on your investment of somewhere between 20%-35%. Fees will never exceed 5% even at their most egregious.

I have yet to meet any person whose primary focus in investing is minimizing fees, who is also a happy, well-adjusted, enjoyable person to be around.

I think Joshua is wrong here.

- There’s no need to make fees your primary focus (that should be asset allocation), but fees should be at least third on your list (after taxes).

Taxes are indeed potentially significant, but the point about fees is that they compound up each year.

- Avoidable fees can add up to 33% or even 50% of your portfolio over your investment lifetime.

Joshua also recommends a prenup (still not watertight here in the UK) before getting married, and a financial advisor:

Everyone should have a financial advisor if for no other reason than to have a sounding board who is less emotional about your money than you are.

Once again, I can’t agree.

- Advisors charge too much for most people, and it should be possible to train yourself to be less emotional.

If not, perhaps you need a coach?

Joshua is also a crypto fan:

In my experience, the more intensely and emotionally a lot of people “hate on” a particular investment, that is a good signal to buy. This is exactly what has happened to me with Bitcoin over the past three years (my returns have been approximately 500%), and what happened to me with buying multi-family real estate in early 2009.

And he believes in cutting your losses:

What opportunity cost are you giving up by holding onto the losing investment? Allowing yourself to excessively focus on the losers) drags down your whole mental state.

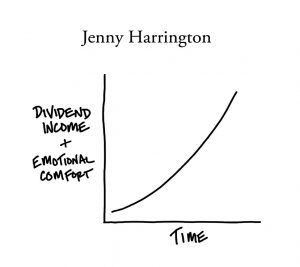

Jenny Harrington

Jenny Harrington is the CEO of Gilman Hill Asset Management and Portfolio Manager its Equity Income strategy.

- Before that, she worked at Goldman Sachs and Neuberger Berman.

I am a dividend income investor – personally and professionally. In my personal portfolios, I own only publicly traded stocks, and high dividend payers at that. No funds of any sort, no alternatives, no bonds, just stocks.

I buy MLPs for their consistent income and tax-favorability. I love the real estate investment trusts that collect rent and pay it out to shareholders.

And as with so many of the contributors to the book, Jenny has money in her own business.

This chapter won’t detain us for long – in my view, dividends don’t matter – apart from the fact that you shouldn’t spend them during accumulation.

- They are not magic/free money.

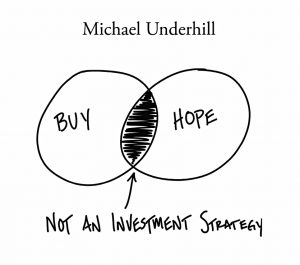

Michael Underhill

Michael Underhill is the Founder of Capital Innovations and has been a pioneer of global listed infrastructure, listed timber, listed agribusiness, and “multi-asset real return”.

- Before starting his own firm, Michael worked at Lehman’s, Janus, Invesco and AllianceBernstein.

His firm allocates assets on the basis of GDP growth and the inflation rate.

They use four asset classes:

- fixed income

- absolute return (no details are given)

- equities

- real assets

Michael has some interesting observations about inflation:

The greater (lower) the degree of government involvement in the provision of a good or service the greater (lower) the price increases (decreases) over time, e.g., hospital and medical costs, college tuition, childcare vs. software, electronics, toys, cars and clothing.

Prices for manufactured goods (cars, clothing, appliances, furniture, electronic goods, toys) have experienced large price declines over time relative to overall inflation, wages, and prices for services (education, medical care, and childcare).

The greater the degree of international competition for tradeable goods, the greater the decline in prices over time.

Inflation will make a comeback in this cycle. Aggressive, coordinated expansion of monetary and fiscal policy will be reflationary.

But he doesn’t say much about his own portfolio:

My approach has been to incorporate a healthy allocation to real assets (infrastructure, natural resources and real estate) in the range of 10%-20%.

Conclusions

That’s it for today.

- We’ve looked at nineteen “investors” so far, and there are six more to come, which means that there will be one more article in this series, plus a summary.

I don’t think that we’ve learned very much so far, and I don’t expect things to change.

- Until next time.