How I Invest 4

Today’s post is our fourth visit to How I Invest My Money by Joshua Brown and Brian Portnoy.

Contents

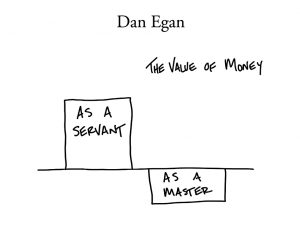

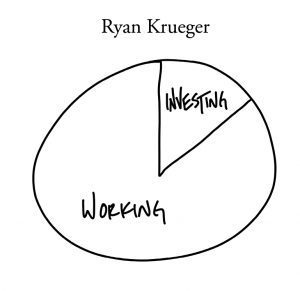

Dan Egan

Dan Egan is the MD of Behavioral Finance and Investing at robo-advisor Betterment.

- Dan presents his assets in a table, the first of the book.

I save because there are things in the future I want to be able to afford, plus a bit more to deal with the unexpected.

Human capital is Dan’s biggest asset since he is only 40 and plans to work until 62.

- This suggests he is on a pretty big wage.

He is a big fan of investing in yourself, to improve your skills.

- This is definitely a good idea up to the age of 30, after which people start to ignore the improvements you make to yourself.

And he believes in networking:

While I love other behavioral finance practitioners, I’m probably not going to learn as much from them as I will from somebody who comes from a slightly different field where we can both cross-pollinate.

His retirement fund is vanilla, apart from a somewhat high stock allocation (90%).

Since we have multiple tax account types in our retirement goal, we can strategically place different asset classes into different accounts.

Dan has a 30-year mortgage on his house and is paying it back slowly.

- He also owns 10 acres of land in upstate New York.

His emergency fund is 80% bonds, 20% stocks – and no cash.

He also gives to charity:

We give away about 10% of our income every year. We don’t do that with cash however, we do it (mostly) by donating stock that has large embedded taxable gains.

Dan keeps almost all of his money with Betterment, and this charitable giving helps with the automated tax-loss harvesting process.

- This is less important in the UK, where you can tax-shelter £60K per year in SIPPs and ISAs.

Betterment is responsible for pretty much everything: fund due diligence, rebalancing, managing in flows and out flows, tax loss harvesting, managing the glide path, and asset location.

End of ad. Betterment uses Vanguard and iShares funds.

Dan also has share options in his firm, which for some reason he values at zero.

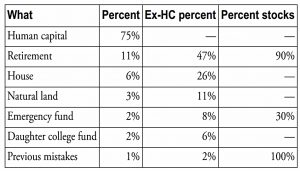

Howard Lindzon

Howard Lindzon is a VC – an early stage investor in fintech startups like Robinhood, Koyfin and Etoro through his company Social Leverage.

- He is the co-founder and chairman of StockTwits and he has a blog (which I read every week).

I love individual stocks and not index investing. I do not believe there is such a thing as passive investing.

Most of Howard’s net worth is in Social Leverage, and he also invests in other VC firms.

My wife and I own real estate as well, which are our largest investments outside of Social Leverage.

Howard also partners with Charlie Bilello in Compound Capital Advisors.

Charlie uses low cost ETFs (Vanguard, Schwab) for building client portfolios.

Howard believes in specialisation:

It is hard to be a generalist long term. A bull market will bail out generalists, but recessions, bear markets and illiquidity happen. Having domain experience is an edge.

And he keeps a fair amount of cash:

Because of the high risk and illiquid nature of my career as a venture capitalist, I tend to keep a high cash position with my remaining liquid net worth. I have zero allocation to bonds. I don’t believe bonds make sense in a zero interest rate world.

He also does some stock-picking:

I am very aggressive with my stock picking. Companies have to be growing very fast and the stock prices are generally at or near all-time highs.

I also have core positions that I have held for years and hope to hold for many more years. I call them 8 to 80 stocks.

They are stocks whose companies have products that 8-year-olds and 80-year-olds can’t live without: Zoom, Amazon, Bitcoin, Netflix, Nike, Tencent, Shopify, Google, Apple, Mastercard, McDonald’s, and Facebook.

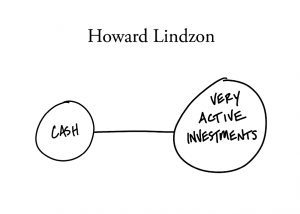

Ryan Krueger

Ryan Krueger is Co-Founder of Krueger & Catalano Capital Partners, an investment planning and private money management firm in Houston.

- Ryan believes that working (and saving) is more important than investing:

Working moves the needle more, both for the math of deposits but also in the discipline of a purpose.

As previously discussed, this is only true up to a point.

- If you invest properly, eventually it will become more important than work.

Despite this bias, Ryan seems to be a stock-picker.

- He runs a concentrated portfolio and likes dividends, which he calls mailbox money.

The challenge is measuring companies in a way to eliminate most. Distraction is a bigger risk than concentration, and too many allocations are diworsified. One of the best metrics to judge any businesses is: Does it produce increasing cash flow?

This approach works for some but is beyond most investors.

Ryan also has an account full of muni bonds (tax-efficient in the US) and cash, as an emergency reserve.

Thanks to his business partner, Ryan has also invested in an annuity.

- I fail to see how that can be a good idea, given current interest rates/bond yields, but Ryan seems to view it as a form of income insurance for his wife should he die.

Ryan also owns his company’s offices, which he built from scratch.

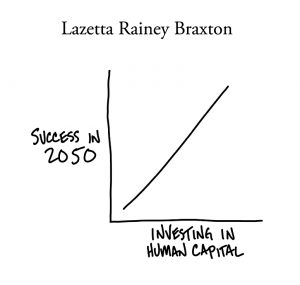

Lazetta Rainey Braxton

Lazetta Rainey Braxton is Co-Founder of 2050 Wealth Partners, whose mission is to provide access to financial planning for “the rest of us”, by which she means not the 1%.

- It might have been interesting to see what this means (though my own plan is to remain within the 1%), but Lazetta doesn’t say too much about her investments, supplying a potted biography instead.

I am a staunch believer in index investing as the core investment and satellite investments to include real estate, stocks, and business ownership.

Lazetta is also another believer in human capital and investing in yourself.

My career and that of my husband serve different purposes in our partnership. My husband represents a bond investment – he maintains jobs with steady income and low risk. As an entrepreneur and business owner, I represent an equity investment with higher risk.

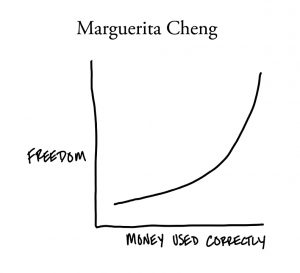

Marguerita Cheng

Marguerita Cheng is the CEO Blue Ocean Global Wealth.

I like to build flexibility and discipline in my investment plan. I try to automate my savings and investment plan.

I have a long-term perspective to investing. I believe that tax diversification is just as important as investment diversification. It is important to have tax- deferred, tax-free and taxable accounts so that you can plan for changes in tax rates.

I am not the type of investor who will set it and forget it, nor will I day trade in my account either.

And that’s about all she tells us.

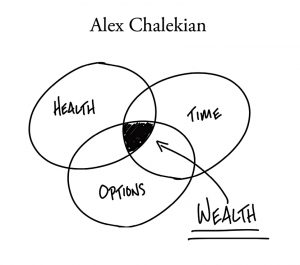

Alex Chalekian

Alex Chalekian is the founder of Lake Avenue Financial.

His largest asset is his business.

Approximately 80% of my assets are in my company stock. As the years have gone by, this number has steadily crept up from 30%. If I didn’t have the opportunity to invest in acquisitions, I would have a larger portfolio of publicly traded stocks and ETFs.

This is not a situation I would be comfortable with unless my net worth was north of $50M (and perhaps Alex is that rich).

- In any case, Alex is able to buy practices from retiring advisors on a PE of 2.5, so he is making good money on this process.

It would be equivalent to a bond with a 40% coupon. And you would take that cash flow and parlay it into another acquisition. The compounding effect over the years can be huge.

He does have some other stuff:

The remaining 20% are in a mix of cash, individual stocks, ETFs and mutual funds. I don’t buy into the argument that you have to choose between active or passive management. Depending on what you are looking to do, you can use either investment option or both.

I have utilized individual stocks and ETFs for the equity allocation in my portfolios and mutual funds for the fixed income portion. Passive investments like ETFs and index funds are my preference in my retirement accounts.

In my non-retirement accounts, I prefer holding individual stocks and actively managed funds. If I want to take any losses, I want to be able to write them off. I can’t do that inside of a retirement account.

Conclusion

Brian Portnoy begins his conclusion – which reads more like a second introduction – with one of my favourite quotes from Taleb:

Don’t tell me what you think, tell me what you have in your portfolio.

That’s what I expected from this book, and although it has technically delivered in most cases, the answers are pretty disappointing for a collection of supposed experts.

- For the most part, they have a lot of index funds, stocks and bonds, some real estate and quite a chunk of change tied up in their businesses.

I had been hoping for a few more interesting strategies than that.

- If you were looking for a bunch of personal stories on how people’s attitudes to money were formed, you might be a lot happier with the book.

Brian’s opinion is that:

There is no one right way to manage your money.

I think that’s only half right.

- The answer is not the same for each person, but common principles can be applied for everyone to reach their goals.

Index funds are a non-answer, the fast-food solution for people who don’t want to confront the problem.

- Which of course, people, in general, are perfectly entitled to do.

But you might expect financial experts to give it some thought.

- It will be hard to take any of these advisors and market commentators seriously when I know they only have index funds in their portfolio.

Until next time.