ILC on the State Pension Age Increase

Today’s post looks at a report from think tank ILC on the potential increase in the State Pension Age.

Contents

State Pension Age Increase

We’ve come across ILC before, but this report is a bit unusual in having the form of a slide deck.

- It was written by Professor Les Mayhew who works both at ILC and at Bayes Business School. (( Formerly City University Business School and Cass Business School, and one of my alma maters ))

The context of the report was the announcement by the government in December 2021 of the second review of the State Pension Age (SPA, which is 66 at the moment).

There are two currently scheduled increases to the SPA:

- To 67 for those born after April 1960 (including me)

- To 68 for those born after April 1977.

The first review (in 2017) recommended that this second review should consider the timing of the second increase.

- It’s currently scheduled for 2044-6 but could be brought forward to 2037-9.

The population is living longer and the number of retirees is increasing as the baby boomers join their ranks.

The questions

The ILC wanted to answer six questions:

- Is the State Pension Age correct?

- Is the present timetable too fast/slow?

- Is it fair generationally speaking?

- Is it fair to everybody?

- How do we calculate it?

- How much will it cost?

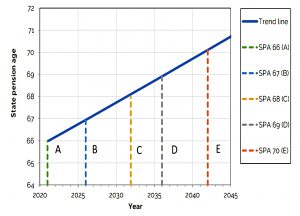

To do this, they looked at four ways of calculating what the SPA should be:

- Equivalence rule: Constant expectation of life on reaching SPA

- Fiscal rule: Constant relationship between the size of the population above and below SPA

- The one-third rule: Constant proportion of adult life spent in retirement

- Fairness rule: Constant proportion of the population surviving to SPA

Life expectancy

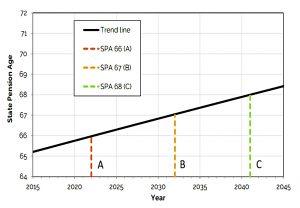

The first approach aims to keep the length of retirement constant, using 2022 as the base year.

- Someone retiring at 66 in 2022 (born 1956) has a life expectancy of 22.5 years (to age 88.5)

This means that the SPA would need to rise to 67 in 2032 and to 68 in 2041.

Support ratio

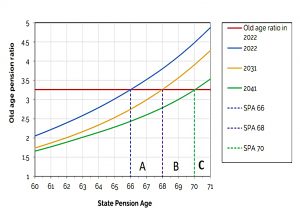

The second rule tries to keep the support ratio of workers to pensioners constant.

- This is in line with the Pay As You Go (PAYG) philosophy of the national insurance system. (( Note that the system isn’t actually run in this way, it’s just conceptual ))

The ratio in 2022 is 3.36, and the chart above shows the ratio curves for 2022, 2031 and 2041.

- These curves intersect the red horizontal line (support ratio = 3.36) at pension ages of 66, 68 and 70 respectively.

The second chart plots the SPA against the calendar year, and we can read off several increases:

- to 67 in 2027

- to 68 in 2031

- to 69 in 2034

- to 70 in 2039

The one-third rule

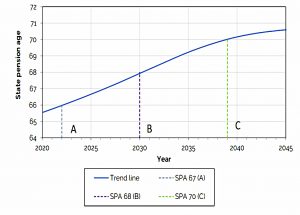

The government has expressed an intention that retirement should average one-third of a person’s adult life.

- Adulthood is for some reason assumed to start at 20 rather than 18.

In 2022, someone aged 66 has been an adult for 46 years, and the expected remaining lifespan of 22.5 years matches pretty closely to the one-third rule.

Using the 1/3 rule, the SPA doesn’t need to increase to 67 until 2042, and wouldn’t reach 68 by the end of this study (2045).

Probability

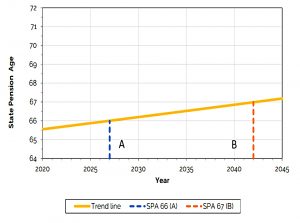

The final rule aims to give everyone an equal shot at reaching the SPA.

- In 2022, 85.5% of people (( In the relevant cohort, born in 1956 )) could expect to reach age 66.

We can read off four increases in SPA from the chart:

- to 67 in 2026

- to 68 in 2033

- to 69 in 2036

- to 70 in 2042

Comparisons

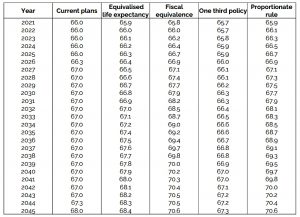

The table shows the SPA for each year under the five systems (including the existing plans).

- I didn’t find it very easy to read, so I turned it into a chart.

Costs

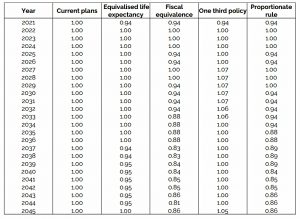

The second table shows the relative costs of the options, with the existing plans held flat at 100% in each year.

- This isn’t easy to follow, either, so I made another chart.

Apart from the one-third rule, all of the options are cheaper than the existing plans.

- Even the one-third rule doesn’t hit 110% of planned spend.

Conclusions

The spread of the plans isn’t as wide as I feared, but two of them require an acceleration in SPA increases after 2030, and three of them are ahead of current plans by 2035.

- So the review can be expected to bring forward SPA rises, but the financial consequences of whichever rule is adopted will be muted.

The report is very concerned with the PAYG principle:

Only the fiscal rule is consistent with the PAYG principle and is the cheapest of all the methods to implement, with savings of 15% to 17% compared with existing plans. Other methods break the PAYG principle and so adjustments may be needed to contribution rates and/or benefits in payment to keep costs down.

The author also believes that SPA rises could be postponed through increases in productivity and longer working lives (to beyond the SPA).

- Until next time.