Weekly Roundup, 11th April 2022

We begin today’s Weekly Roundup with a look at energy insecurity.

Energy Security

The Economist had two articles on the energy transition.

- The first looked at why energy insecurity is here to stay.

The war in Ukraine has been a shock that adds urgency to the creation of an energy system which depends more on sun, wind and nuclear reactors than on derricks and rigs. Yet don’t fool yourself that this new era will allow an easy escape from the curse of energy crises and autocrats.

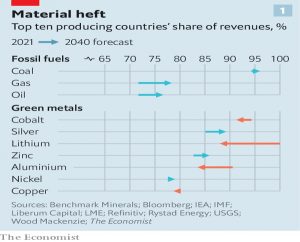

The Economist has modelled global spending on ten natural resources, including oil and coal and the metals needed for power generation and the move to electrify industry and transport.

- Spending on the basket will fall from 5.8% of GDP today to 3.4% by 2040.

- Green metals increase from 0.5% to 0.7% (but triple in absolute terms).

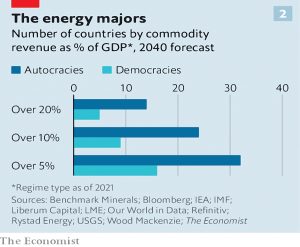

But more than half of that money will still go to autocracies, including those that supply copper and lithium.

- The top ten countries in each mineral have a market share greater than 75%.

The newspaper also worries about the flood of money into (different) resource economies.

Some beneficiaries, such as Australia, are well-equipped to deal with this. More fragile states, including Congo, Guinea and Mongolia, are not. Mountains of cash distort economies and feed grievances.

There will need to be an acknowledgement of the trade-offs required in rich-world governance regulations.

- And of course, China wants the same resources and may have fewer scruples about who it does business with.

The second article goes into more detail.

Wind and solar could account for 70% of power generation by 2050, up from 9% in 2020, if the world embarks on a course to become carbon-neutral by 2050.

Which has a huge impact on commodities:

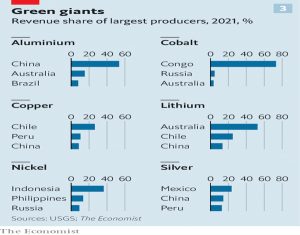

Huge demand for the metals, such as cobalt, copper and nickel [used in] electric cars to renewables; the market size of such green metals would increase almost seven-fold by 2030.

Which is not very far away.

Something similar happened with oil and gas after the war:

Between 1940 and 1970 the share of hydrocarbons in the energy supply of rich countries rose from 26% to nearly 70%. Once-marginal economies in the Middle East were transformed into uber-rich petrostates.

The new commodity transformation will be more than just a supercycle:

The green transition stems from the decisions of many governments, not one [China]. And decarbonising the world is likely to be the job of decades.

The winners will be Australia, Chile, Congo, China, Indonesia and Peru.

- The low-cost producers of OPEC – Iran, Iraq, Saudi Arabia and Russia – should see flat revenues.

Losers will be the higher cost petrostates, including Norway and Britain.

Wage-price spiral

Joachim Klement looked at what we might need for a wage-price spiral to accelerate.

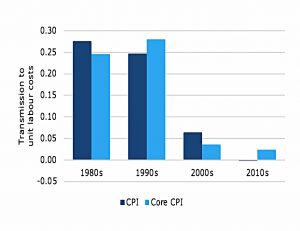

- Something similar happened in the 1970s but the line between wages and inflation was much stronger then.

A recent report from economists at the BIS tracked how well a change in inflation translated into higher labour costs (across 21 developed countries).

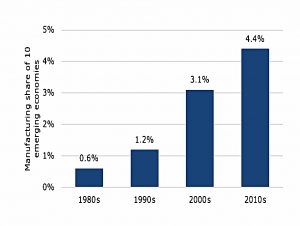

Back in the 1980s, a 1% increase in inflation led to a 0.28% increase in wages.

- But by the 2010s, the impact was close to zero.

The explanation seems to be the rise of globalisation and in particular China joining the WTO in 2001.

A study in 2013 found that for every percentage point of the manufacturing market captured by six large emerging markets (China, India, Mexico, Philippines, Thailand, and Malaysia), producer prices dropped by 3%.

This chart shows the share of 10 EMs (Czechia, Hungary, Poland and Turkey were added) in developed markets’ manufacturing.

So a wage-price spiral is unlikely if global supply chains remain intact.

- The pandemic and the war in Ukraine have disrupted these chains and prompted thoughts of national and regional supply security.

But reshoring and the shortening of supply chains won’t happen overnight, and will probably take years.

- And re-shoring to higher wage developed countries will itself put pressure on inflation.

So we are not as safe as in recent decades.

Redwood

In his regular FT column, John Redwood looked at the implication of the retreat from globalisation, trade sanctions, Covid and war on economic growth.

Overall world output and efficiency will drop compared with a pure free trade model, but there will be new winners as some countries and regions succeed in building new capabilities to replace imports.

John highlights several themes:

- digitalisation

- tech regulation

- microprocessor production capacity

- the green energy revolution

- ESG

He foresees a Chinese bloc and a US-Europe bloc:

Both blocs will court India, Brazil, and parts of Africa.

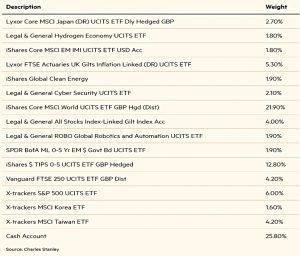

His fund is suffering a little:

The fund is down 4 per cent this year, thanks to the falls in holdings of world equities and in the specialist indices in both green and digital global technology. The fall has been limited by holding a quarter in inflation-linked bonds and a quarter in cash.

He will put the cash to work when the bond market bottoms, which will be when inflation is under control and/or the central banks stop raising rates.

Pensions Cap

The Department of Work and Pensions (DWP) has confirmed that they plan to exempt performance fees from the 0.75% cap on charges in automatic enrolment schemes.

- This will allow the schemes to invest in funds using less liquid and higher cost strategies, such as private equity.

Pension schemes with over £100 million in assets will also be required to explain their policy on illiquid investments.

The government’s aim is to increase the amount of money invested in green energy infrastructure and tech start-ups.

Minister for Pensions Guy Opperman said:

I am passionate about ensuring pension schemes have the necessary information, and a broad range of options, to deliver the best possible outcomes for the record number of Brits now saving for retirement.

Opening up greater illiquid asset options to DC scheme investment will help do just this and enable schemes – and savers – to benefit from more diversified portfolios, while also bolstering the role pension investments can play on our journey to a carbon-free economy.

AJ Bell’s head of retirement policy Tom Selby said:

Policymakers clearly firmly believe illiquid investments can deliver better overall returns for members than more mainstream asset classes. While there is some evidence to suggest this could be the case, there are no guarantees and many trustees will understandably be wary.

[They] have a fiduciary duty to invest members’ hard-earned funds in a way that is most likely to deliver the biggest retirement pot possible.

AE contributions

Nigel Peaple, director of policy and advocacy at the Pension and Lifetime Savings Association, has told the parliamentary work and pensions committee that the level of mandatory auto-enrolment contributions needs to rise from 8% to 12% because not enough people are making voluntary contributions in excess of the minimum:

We believe the answer is to increase the automatic enrolment contributions over the next decade.

He noted that people will struggle to meet the targets set by the now-disbanded Pensions Commission.

- The Commission targeted a pension of two-thirds of former income, someone of half average for those on median earnings, 80% for those on half the average and 50% for those on twice the average.

For people who are only in defined contribution saving, only 3 per cent of them are going to hit those Pension Commission targets.

Nigel accepted that the middle of a cost-of-living crisis was not the best time to start, and he suggested that the change be phased in:

The first step being you increase the employer contribution from 3 per cent to 5 per cent, which would match the employee contribution. Do that by 2030, and then you could try and add on an extra per cent or so after that.

I think we should aim for 15%, but we should probably beat inflation first.

Crypto

The government has announced its intention to make the UK a global crypto hub.

- This comes as something of a surprise to me, given the steps that the FCA has taken in recent years to dissuade private investors from putting their money into crypto.

This includes a ban on crypto ETPs and derivatives and a crackdown on crypto advertising.

The Treasury plans to use the Royal Mint to “mint” an NFT (!) and to allow stablecoins (presumably including their own yet-to-be issued version) to be used for payments.

- There will also be a “regulatory sandbox” and an “engagement group” for the crypto community.

The government also promised to look at ways to make the tax system more attractive to crypto, including a review of how DeFi loans are treated and a consultation on extending the tax advantages of investment funds to crypto-assets.

- ETPs and derivatives were not mentioned.

Chancellor Rishi Sunak said:

It’s my ambition to make the UK a global hub for cryptoasset technology, and the

measures we’ve outlined today will help to ensure firms can invest, innovate and scale up in this country.We want to see the businesses of tomorrow – and the jobs they create – here in the UK, and by regulating effectively we can give them the confidence they need to think and invest long-term.

This is part of our plan to ensure the UK financial services industry is always at the forefront of technology and innovation.

Quick Links

I have just one for you this week:

- Alpha Architect wondered whether Sector-neutrality in Factor Investing a Mistake?

Until next time.