Weekly Roundup, 16th May 2022

We begin today’s Weekly Roundup with inflation.

Inflation

John Authers looked at the monthly US inflation figures.

- Although both headline and core annual inflation figures fell, they didn’t fall by as much as hoped, so the general reaction was one of disappointment.

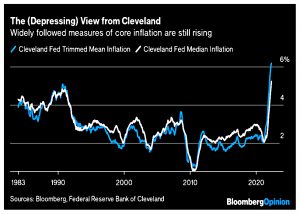

The Cleveland trimmed mean and median are still rising.

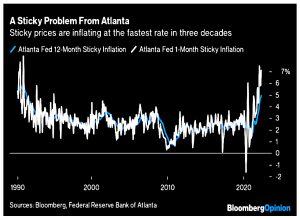

And so are sticky prices.

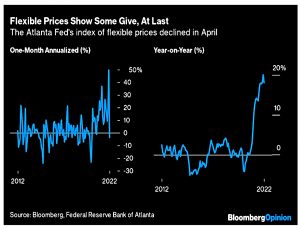

But at least flexible prices appear to have peaked.

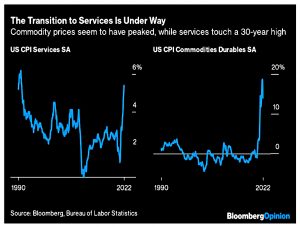

There has also been a switch to services:

As the economy reopens, the prices of durable goods have stopped rising as expenditure switches to services. Unfortunately, services prices are rising at the fastest rate in three decades.

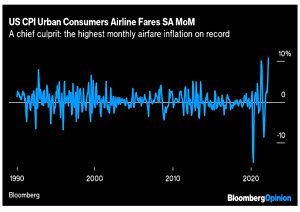

John singles out airfare inflation as a potentially transitory outlier.

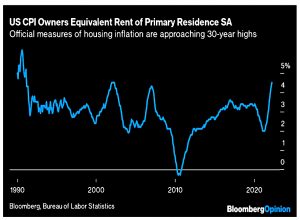

Owners’ equivalent rent is also at a 30-year high.

The market reaction was predictable:

- The NASDAQ and the FANGs continued to fall

- The sell-off of consumer discretionary stocks continues

Bonds have recovered somewhat:

Bonds are rallying compared to stocks, and the two asset classes are down about the same amount for the year.

Looking forward, markets are forecasting 3% yields:

The 10-year Treasury yield and the implied prediction for the fed funds rate after the Federal Open Market Committee meeting next February are beginning to coalesce just below 3%.

This means that the Fed would have to stop raising before it wants to (because of a recession).

Overall, John is pessimistic:

Even if this inflationary episode is in some sense transitory, that interlude of higher prices will last longer than hoped, maybe enough to inculcate new habits and assumptions that help keep inflation rising in the future.

Nowhere to hide

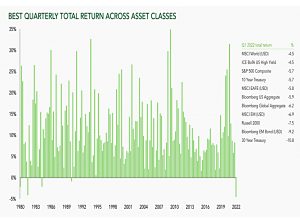

Duncan MacInnes from Ruffer reminded us how difficult it is to predict the financial markets.

If you had had [a] crystal ball and could have picked exactly the best place to be invested each quarter [across global stocks and bonds]. Over the decade to the end of 2021, you would have delivered a 35x return on your original investment.

Looking further back, if you had started in 1980 with a portfolio of £100,000, this would have compounded to £4.8 billion by the end of last year.

But in 1Q22, all subdivisions of stocks and bonds showed negative returns, even before adjusting for raging inflation.

The only place to hide was commodities.

In the 165 quarters since 1980, only five have markets been so dismal even Mystic Meg couldn’t have conjured a positive return.

Duncan expects more of the same in 2Q22 and draws a comparison with the 1970s:

A period of political, economic and inflationary turmoil – with all the market volatility investors rightly dread. To preserve capital, [investors] will require a new approach to constructing portfolios – flexible, adaptable, robust and responsive. Being unbenchmarked and unconventional could prove crucial.

Pension costs

Pensions Expert reported on research from B&CE (the operators of workplace pension The People’s Pension), which found that only 48% of UK investors care about their pension charges.

- They commissioned a YouGov poll of 1,618 adults.

Meanwhile, 71% care about their mortgage costs, and 70% are interested in their current account costs.

Of the 52% who don’t care about pension costs, 18% don’t know what they are paying, 16% believe their pots are too small for charges to be significant, and 14% think that charges will not make a difference to their post when they retire.

Phil Brown, B&CE director of policy, said:

This is further evidence that the average saver doesn’t understand the impact that charges can have on their pension pot. At a time when people are naturally watching what they spend, it’s important that consumers are aware of what they are paying for their pension, which is potentially the most valuable asset many people own.

Cash protection

As the war on cash rages, accelerated by the idea that paper money could be a Covid vector, the Queen’s Speech announced new rules to protect UK withdrawal and deposit facilities.

John Glen, Economic Secretary to the Treasury, said:

We are reforming our financial services sector now we have left the EU to ensure it acts in the interests of communities and citizens, creating jobs, supporting businesses, and powering growth across all of the UK.

We know that access to cash is still vital for many people, especially those in vulnerable groups. We promised we would protect it, and through [the Financial Services and Markets Bill] we are delivering on that promise.

The price of Twitter plunged to $38 last week after Elon Musk tweeted that his deal to buy the firm for $54.20 was “temporarily on hold”.

- My own small bet on the deal going through was stopped out early in the slide – my trailing stop loss meant that I lost very little.

This is a strange development though perhaps less strange considering that Muck is involved.

- Elon is worried that Twitter has more bots than it claims (p[presumably because bots are difficult to monetise).

Elon will no doubt claim that lots of bots are a breach of Twitter’s “representations and warranties” under the deal agreement.

- This would entitle him to the $1 bn break up fee included in the contract.

It sounds unlikely since Elon has already talked about cleaning up TWTR’s bot problem.

- He also waived his rights to non-public information in order to get the deal done quickly.

So unless there are lots more bots than anyone thought, TWTR will expect the purchase to go through at $54.20, or it will all end up in court.

- TWTR might not want a long-drawn-out court case, so perhaps the price will come down a bit.

That would suit Elon, since his Tesla stock is also down since he made the deal (and by 36% since his initial TWTR position was revealed).

- The TWTR stock price is still slightly above the price that Musk paid.

Elon later tweeted that he was ” Still committed to acquisition”, but the stock price hasn’t recovered.

Stablecoins

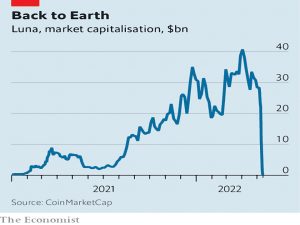

The Economist looked at the collapse of the Terra stablecoin.

- Stablecoins are supposed to be pegged to another currency, often a fiat one, and most often the dollar.

Last week, the peg for Luna (the Terra stablecoin) collapsed.

Most stablecoins used collateral (dollars in banks, or Treasury bills) to maintain the peg.

- Many people believe that Tether (one of the largest stablecoins) is poorly collateralised and ripe for collapse.

Terra was an “algorithmic stablecoin” and used an automated process (of creating and destroying coins) to maintain value.

Terra is backed with luna, a cryptocurrency issued by the same firm that issues terra. The theory was that holders of terra could always redeem it for one dollar’s worth of luna.

The process was managed by a “smart contract”.

Lines of code that execute automated transactions that created more luna when a terra holder wanted to redeem. If for some reason terra was trading at less than $1 then arbitrageurs would swoop in, buy a terra, redeem it for luna and sell them for a profit.

But when the price of luna started to fall, people sold terra as well.

Arbitrageurs failed to swoop in to save the peg, by redeeming their terra for luna, instead staying away. The terra peg broke and by May 11th had dipped as low as 30 cents, before recovering to 40 cents.

The collapse hit other stablecoins, including tether, which fell to 95 cents before recovering.

- USD coin, another major stablecoin, and dai (another algorithmic coin) were more solid.

The perception that these assets might not be stable will deter widespread adoption, and damage trust in them.

You can say that again. I’ve never understood the argument for stablecoins, or why something backed by BTC couldn’t be used instead.

- It might be a long time before I change my mind.

Crypto

In the FT, Joshua Oliver reported on comments from Sam Bankman-Fried (founder of crypto exchange FTX) that Bitcoin has no future as a payments network because of its inefficiency and high environmental costs.

He said:

The bitcoin network is not a payments network and it is not a scaling network.

Instead, he sees the role of BTC as a store of value (a role that it’s performing particularly badly at the moment).

Proof of work won’t scale to support millions of transactions per hour.

Countries such as El Salvador have adopted Bitcoin as a legal tender. But recent research found that Bitcoin has scarcely been used for daily payments in El Salvador, despite the rollout of bitcoin ATMs.

Sam would prefer the less energy-intensive proof of stake – soon to be adopted by ETH – or something else to be used instead:

Things that you’re doing millions of transactions a second with have to be extremely efficient and lightweight and lower energy cost. It has to be the case that we don’t scale this up to the point where we’re spending 100 times as much eventually as we are today on energy costs for mining.

Sam was also in the news last week for buying a 7.6% stake in Robinhood, causing the stock price to jump by 20%.

Quick Links

I have eight for you this week, the first four from The Economist:

- The Economist said that tech bubbles are popping all over the place

- And that India is likely to be the world’s fastest-growing large economy this year

- And that activist investors are becoming tamer

- And that the world’s largest legal weed market (California) is going up in smoke.

- Alpha Architect wondered what would happen to momentum investing if we excluded stocks prices at over ten times sales

- And whether institutional trading against anomalies is informed.

- Risk Parity chronicles demonstrated an easy way to visualise diversification

- And UK Dividend Stocks asked whether AG Barr’s 2% yield was high enough to make it worth holding.

Until next time.

US April headline CPI of 8.3% down from 8.5% in March – could be just about noise IMO!