Irregular Roundup, 16th October 2023

We begin today’s Weekly Roundup with the bottom.

Not the bottom

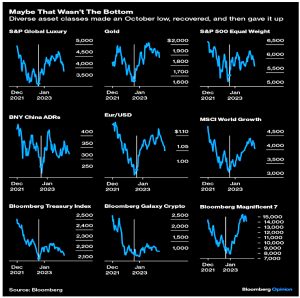

John Authers said that last October has proved not to be the bottom.

- That was when the Fed said that the pace of rate hikes would slow, and the 10-year yield began to fall from 4.5%

In March we had a spike above 4.2%, leading to regional bank failures in the US and the sale of Credit Suisse to UBS.

- The Fed added liquidity and bond yields fell again.

But now yields are high again, passing 4.6% at the end of September.

- And many asset classes have followed bonds lower.

The Magnificent Seven tech stocks are the key exception.

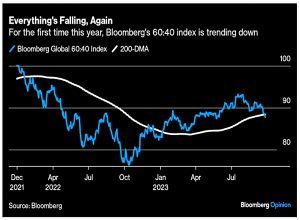

- But the industry standard 60-40 portfolio is not.

The popularity of the Big 7 says that people are still cautious:

The appeal of the Magnificent Seven is that they’re well established and can’t go too far wrong.

They have several (not too convincing) reasons to be:

- a high oil price

- a possible US government shutdown

- this would lead to a cessation of government data collection, which would make a data-dependent Fed freeze

- it might also lead to more US credit rating downgrades, which might this time reduce the appeal of Treasuries and the dollar

- the potential triggering of a lot of protective put options, which could make the writers of the options hedge by selling stocks in advance

- a repeat of the “hawkish pause” from the Fed at this month’s meeting, when the same outcome last month triggered this rise in bond yields

The underlying fear is that the Fed holds rates high until something breaks:

IHT

Rumours are still swirling that Jeremy Hunt might abolish inheritance tax in the November Budget, so the FT took a look at the numbers.

- IHT is currently levied at 40% on estates over £325K.

Married couples can pass their allowance to a surviving spouse, and they can each pass £175 of the value of the family home on to their children.

- So the maximum exemption for a couple is £1M.

Other exemptions include farmland and shares in unlisted companies, including those on AIM.

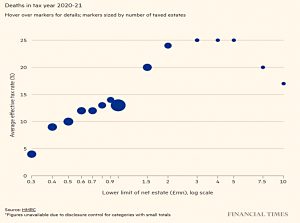

The effective rate paid rises with the size of the estate from £300K up to £2M, where it flatlines until £5M.

- Above that, the effective rate falls again.

The allowances have been frozen for a number of years, so fiscal drag means that more IHT is being raised each year.

- In 2020-21 a record £5.8 bn was collected.

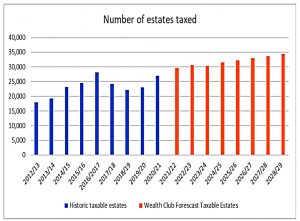

It’s not collected from too many people, though – 27K estates paid tax out of 722K deaths in 2020-21.

- That’s less than 4% of estates.

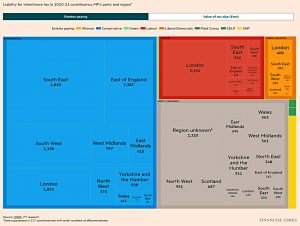

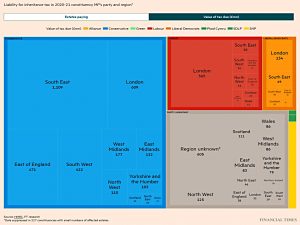

Although the chart doesn’t show it clearly, the number of taxable estates is rising – up 17% in 2020-21.

- Housing has a lot to do with this, as most people paying IHT have expensive properties in London and the South East.

The two regions each accounted for £1.3bn of the total IHT tax liability in 2020-201, or 45 per cent of the IHT liability across the whole UK. The average tax bill in London was £279,200.

This also means that most IHT-paying estates are in, and most IHT is collected from Tory-voting constituencies.

The FT suggests that this might be why Sunak wants to abolish it, though in fact IHT regularly comes top of polls looking for the most hated tax in Britain.

- When Gordon Brown was thinking about a snap election in 2007, George Osborne pushed him into a rethink by promising to cut IHT.

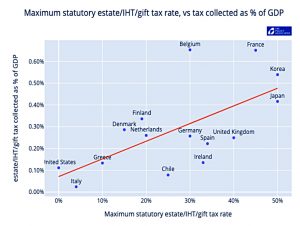

Dan Neidle from Tax Policy compared UK inheritance tax with that of other countries.

- In particular, he looked at kids inheriting from two married parents.

- The point at which inheritance tax first applies is much later in the UK than in most other countries. An average UK estate of £335k isn’t taxed – equivalents in many other countries are.

- By the time we get to estate values of 27 x average earnings (£1m in the UK), every country on the chart is charging tax, except the UK and the US (plus of course the countries that don’t have an inheritance tax at all).3

- On the other hand, the UK rate is higher than most, and so starts catching up fast. When we reach estates worth 80 x average incomes (£3m in the UK), the UK has one of the highest theoretical effective rates of inheritance tax in the world.

But since we have loopholes for larger estates, we don’t collect as much tax as our higher rate would suggest. The main exemptions are:

- The £1M for passing on a house

- The farmland/woodland/AIM shares exemption

- An exemption for foreign property of non-doms

Dan is not impressed:

A tax with an unfortunate combination of a high rate (which makes it unpopular and motivates avoidance) and poorly targeted/overly-generous exemptions (which enable avoidance).

He’d like to lower the rate to 20% and get rid of the exemptions.

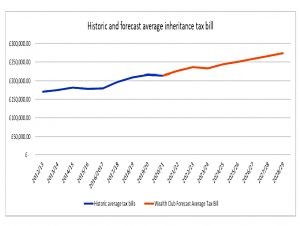

Wealth Club (WC), the VCT and EIS specialist that also offers AIM share portfolios, has issued a series of emails on the subject of IHT.

- They noted that receipts from April to August 2023 were up £300M on the same period last year to £3.2 bn.

WC calculates that the average bill will be £234K in this tax year.

They also expect the number of estates being taxed to rise to 35,000.

WC investment manager Nicholas Hyett said:

This increase is being fuelled by years of soaring house prices and frozen allowances. The combination of rising house prices and inflation will push up both the number of families paying inheritance tax and the amount they pay.

The two key avoidance measures they pointed out were:

- giving money away early, and

- AIM shares.

The final email focussed on the potential impact of the abolition of IHT on the AIM market.

- Some observers have suggested that 30% of AIM market ownership is within IHT portfolios, but WC disputes this.

They also think that IHT raises too much cash for the government to abolish it completely.

- They expect instead tweaks like tiers and a larger nil-rate band.

Hyett again:

Abolishing IHT would be bad news for AIM. There is billions of pounds invested in specialist AIM products precisely because of its potential to mitigate IHT bills. Withdrawing that relief would inevitably hit company valuations and has the potential to create serious market disruption.

Of course one of the purposes for IHT relief on AIM is to encourage investment into smaller fast growingcompanies which in turn creates lots of jobs and economic growth. Radical moves that put that at risk would fly in the face of the government’s wider policy to support smaller company investment.

We’ll find out who is right in November.

InvestEngine

InvestEngine, the ETF platform free for DIY portfolios and offering a business account, has now added a SIPP to its range.

- Unfortunately, the SIPP is not free.

There’s a 0.15% charge on top of the ETFs for a DIY portfolio or a 0.25% charge for a managed portfolio.

- SIPP charges are capped at £200 pa, which is the same as Hargreaves Lansdowne but close to double the AJ Bell charge (£120 pa) and more than four times the FiIdelity charge (£45 pa for a limited range of ETFs).

Close, but no cigar.

ESG

Blackrock has closed a couple of ESG funds as the movement faces a backlash in the States from conservatives.

- State Street, Janus Henderson and Columbia Threadneedle have done the same during 2023.

According to etf.com, more sustainable funds have closed this year in the US than in the previous three years combined.

- ESG became popular in 2020 and 2021, and dozens of funds were issued, but they are currently showing poor performance and suffering outflows.

Three years post-launch is a common time to close funds that don’t prove popular.

- ESG funds also face regulatory pressure from the SEC to prove that their portfolios match their name, rather than just track broad indices.

ESG is still doing well in Europe, though.

Crypto

Chase (or as I like to think of them, JP Morgan) sent me an email last month saying that from today, if they think I’m making a payment related to crypto assets, they will decline it.

- This is, of course, in order to keep my money “safe from fraud and scams”.

If you’d still like to invest in cryptoassets, you can try using a different bank or provider instead. We’ve made this decision because fraudsters are increasingly using crypto assets to steal large sums of money from people.

There clearly is a lot of fraud in crypto, but I still think that I ought to be able to send my money wherever I want.

This is yet another example of the hard time that crypto is having at the moment.

- The diversion of all the hot VC money into sexy AI projects isn’t helping.

If the Bitcoin halving scheduled for April 2024 doesn’t inject some life into the market, then we can probably call it.

Quick Links

I have four for you this week, the first three from The Economist:

- The Economist explained Why a British challenger bank got into trouble

- And Why a British challenger bank got into trouble

- And said that Investors should treat analysis of bond yields with caution.

- And Of Dollars and Data showed Where Michael Lewis Went Wrong.

Until next time.