Weekly Roundup, 11th June 2019

We begin today’s Weekly Roundup with the big story of the last seven days – the suspension of trading in Neil Woodford’s flagship fund.

Contents

Woodford

I can’t remember when I last saw so many articles on the same topic.

- But that won’t stop me from putting together another one.

There are a lot of things that I don’t like in this story:

Here’s what happened:

- Kent County Council tried to withdraw £250M+ of its pension money from Woodford’s Equity Income fund.

- Withdrawals had been ongoing for some time in the face of underperformance.

- The fund has shrunk from £10 bn at its peak two years ago to “just” £3.7 bn.

- Woodford didn’t have that kind of cash lying around, so he gated the fund until he could raise the money (by selling some or the more liquid investments).

- This has happened before – most recently with property funds after the Brexit vote – but I can’t remember it happening with a mainstream equity income fund.

- Woodford released a video saying he was ” extremely sorry” for the suspension and blaming the stock market for “anticipating” his forced sales.

- He also pledged to have no unquoted stocks in the fund by the end of 2019, replacing them with FTSE 350 stocks.

- Hargreaves Lansdown removed the fund from their Wealth 50 list.

- St James Place and Openwork also dropped Woodford as a manager of their funds.

- The share price of HL – and the listed Woodford trust – fell.

- HL has been a big cheerleader for Woodford even after the performance of his funds started to suffer.

- And Woodford, in turn, has been a big investor in HL.

- He also gives HL a discount on the fund’s fees – something that rival Terry Smith has been unwilling to provide.

- HL investors and HL’s own funds owned about one-third of the Equity Income fund in January 2019.

- HL waived its fee on the Woodford fund while it is closed and put pressure on Woodford to do the same.

- MPs put more pressure on Woodford to waive his fee.

- Woodford declined to waive his fee.

- BoE Governor Mark Carney called for a tightening in the regulation of open-ended funds to mitigate systemic risks where there is a potential liquidity mismatch.

- The FCA and Guernsey agreed to cooperate on investigating exactly what Woodford was up to over there.

- He had listed some previously unlisted companies to get around a 10% cap on how much non-listed stuff could be in his funds (this is an EU regulation, by the way).

- The snag was that listed securities are supposed to be liquid but with Woodford the only holder of these stocks, they were not traded in practice.

- Woodford also swapped unlisted assets into the Patient Capital Trust in return for shares in the trust.

- For observant investors, these actions should have been red flags, indicating that it was time to take their money from the fund.

- The FCA also said that rules around investment in illiquid assets may need changing.

- At the same time, the FCA has pointed out that fund suspensions are a recognised legitimate tool and may be in the best interests of investors.

Here are some of the takeaways:

- Investment trusts make better vehicles for illiquid investments than do unit trusts.

- Unit trusts have to respond to the daily flow of redemptions and subscriptions, whereas investment trusts can remain invested in the same assets over the long term.

- The jury is out on ETFs which invest in illiquid assets – commentators have warned that there is a crisis looming in, say, bonds, but nothing has happened to date.

- ETFs are not created or redeemed using cash – a basket of stocks is swapped for shares in the ETF itself – so they are not forced sellers in the way that an OEIC is.

- Active funds may become less popular with investors.

- This trend is well established, with younger investors, in particular, preferring passive trackers.

- Some people may be scared off equity investments forever, which would be a terrible outcome.

- Or perhaps they will become DIY investors instead – which would be a good thing.

- Star fund managers rarely outperform forever.

- Anthony Bolton is another good example, as is Tony Dye, and in bonds, Bill Gross.

- Contrarian investors are almost by definition bound to be out of favour at times.

- And outperformance is often achieved by taking on extra risk.

- A useful rule of thumb is never to buy a fund that is named after its manager.

- Diversification – as always – is crucial in investment.

- It certainly doesn’t make sense to have a large proportion of your portfolio with a single manager, however talented you believe him to be.

- Fund managers who change their styles mid-career are effectively throwing away their track record.

- Woodford was a successful long-term value and income investor but he is not yet a successful small-cap and unquoted stocks investor.

- A lot of investors don’t understand the risks they are taking with their money.

- In particular, they believe that there is a sub-group of equities that can be described as “safe” – there isn’t.

- Similar risks are being ignored with P2P lending and equity crowdfunding.

- Small-cap funds and those investing in unlisted stocks need to stay small and nimble.

- If you hold too big a share of a small company, you can’t easily unload it.

- Fund managers are paid a lot of money but don’t share in the downside risk with their investors.

- Funds (and managers) sometimes stray from doing what it says on the tin.

- The Equity Income fund clearly doesn’t just hold “quality companies that can deliver sustainable dividend growth”.

- We may be in for some form of governance obligations for providers of best buy fund lists.

If you want to read more, here are some links to the more interesting articles:

- Merryn Somerset Webb in the FT.

- And in MoneyWeek.

- The Economist

- David Stevenson on CityWire.

- Roger Lawson on the ShareSoc blog.

- Monevator

- Ian Cowie in the Sunday Times.

Pension savings

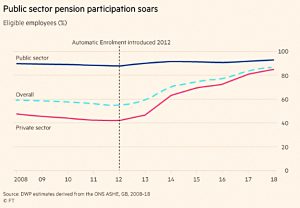

In The Chart That Tells A Story, Lucy Warwick-Ching looked at workplace pension participation rates.

- 87% of private sector workers are now enrolled, compared to just over 40% when auto-enrolment was introduced in 2012.

- Public sector rates are even better, at 93%.

More than £90bn was saved into workplace schemes last year.

Minimum contributions went up to 5% (3% from the employee) in 2018.

- This year they rose to 8% (5% from the employee), so it will be interesting to see if that impacts participation rates.

At the same time, even 8% pa is not enough – double that would be more like it.

Pensions for deposits

For FT Adviser, Imogen Tew reported on a proposal from housing minister James Brokenshire to allow first-time buyers to fund their deposits from their pensions.

- This risks a shortfall in retirement savings, though presumably repayment of the deposit to the pension pot could be linked to mortgage repayments.

There would then be the risk that people who didn’t keep up repayments and lost their house would also lose part of their pension.

- And perhaps a bigger problem would be that it would also push up house prices even further.

I think this is a pretty dumb idea – the whole reason for pensions existing is for them not to be accessed until you retire.

- Pensions are a safe backstop that you can’t get your hands on.

Obviously, this restriction puts people off pensions savings, but that should be balanced against tax relief incentives and nudges like auto-enrolment.

- And if too few people are saving, we could always make pension contributions compulsory, as in Australia.

As for housing, we need to build more and give tax breaks for older homeowners to downsize.

LTA appeal

HMRC has dropped its appeal against the pension saver who accidentally breached his LTA indexation protection by making further contributions.

- The man involved had £1.8M of protection and would have been given a £400K tax bill.

This is good news, but even better news would be the scrapping of the LTA entirely.

Bond yields

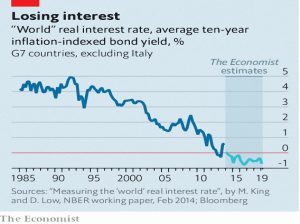

In the Economist, Buttonwood looked at ever-declining bond yields.

The yield on a ten-year Treasury bond has plunged from 2.5% to 2.1% in the past month. Ten-year Bund yields have turned negative again and have reached a new all-time low.

There are a couple of possible reasons for the decades-long trend:

- Increased saving from demographics leading to lower rates to clear the market.

- ZIRP and QE in response to the 2008 crisis.

The key point is the lack of inflation on the horizon – which would be required to change the trend in the short-term.

- So yields/returns on all assets will stay low, and prices will look correspondingly high compared to long-run averages.

But when rates finally rise, most asset prices should fall.

P2P restrictions

In the wakes of the collapse of Lendy, Money Observer reported on new rules from the FCA which will restrict retail investors to holding “just” 10% of their wealth in P2P loans.

- That’s still way too much in my opinion.

Interestingly, the restriction will not apply to investors who have paid for financial advice.

It’s also not clear how the cap will be enforced since investors will be reluctant to divulge details of all their worldly assets to a website in order to make a few loans.

- It’s likely that many of the people using P2P will never have totted up their net worth and asset allocation.

A test of investors’ understanding of P2P risks will also be introduced from December 2019.

Quick links

I have seven for you this week:

- The FT looked at three ways that Big Tech could be broken up.

- Alpha Architect looked at the Re-Death of Value.

- And asked whether factor momentum is really everywhere.

- UK Value Investor wondered whether Sainsbury’s was worth its discounted share price.

- The Telegraph wrote that Beyond Meat had been hit by short selling (it seems to have recovered ok).

- Musings on Markets looked at Tesla.

- And Flirting With Models examined Tactical Credit.

Until next time.