Irregular Roundup, 17th July 2023

We begin today’s Weekly Roundup with inflation.

Inflation

The Economist looked at disagreements over how to fix inflation.

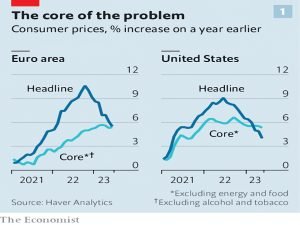

Inflation is falling mostly because energy prices are down, a trend that will not last for ever. Underlying or “core” inflation is more stubborn. History suggests that even a small amount of sticky underlying inflation is hard to dislodge.

As for the appropriate treatment, the first area of dispute is whether workers (and their high wage demands) or companies (and their excess profits) are to blame.

- We have more on this under “greedflation”, below.

The second split is geographical.

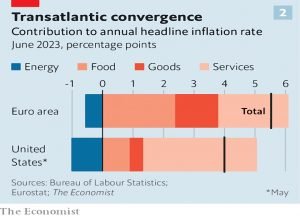

Uncle Sam spent 26% of GDP on fiscal stimulus during covid-19, compared with 8-15% in Europe’s big economies. And Europe faced aworse energy shock than America after Russia invaded Ukraine, both because of itsdependence on Russian natural gas and the greater share of income that is spent on energy.

Since Eurozone inflation is driven far less by overheating, policy can be much looser.

- Energy subsidies during the winter have not led to overheating and may have avoided an inflationary mindset in consumers by blunting price increases.

Financial markets expect [interest rates] to peak at around4% in the euro zone, compared with 5.5% in America.

(Here in the UK, we’re bracing for 6.5% to 7%).

Despite different underlying drivers, the shape of inflation on each side of the Atlantic is converging.

Inflation is increasingly driven by the priceof local services, rather than food and energy.

This means that domestic spending is key, and the higher core numbers (and higher wage inflation) in Europe matter.

The final area of disagreement is what rate of unemployment will be needed to bring labour markets back into balance, and whether the target level (probably between 4.5% and 5.5%, up from 3.7% in the US at the moment) can be achieved without triggering a recession.

- It’s hard to see how one can be avoided unless prolonged high inflation is tolerated.

Greedflation

The Economist said that “greedflation” is a nonsense idea.

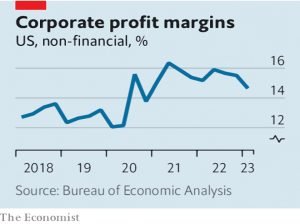

The idea that greedy companies were to blame has taken a knock in America, where corporate profits are falling even as consumer prices continue to rise too fast. But that has not stopped the notion taking hold across the Atlantic.

The UK government has asked regulators to look for price gouging and ECB president Lagarde also seems keen on the idea, which is in part a left-wing reaction to the right-wing idea that wages are the key inflation driver.

Central bankers live in fear of wage-price spirals. Last year Andrew Bailey, governor of the Bank of England, asked workers to “think and reflect” before asking for pay rises.

In fact, wages have lagged inflation to date (but that doesn’t mean that big raises in the future won’t lead to more inflation).

The greedflation thesis thus “muddles inflation’s symptoms with its cause”, according to Neil Shearing of Capital Economics. Wages have tended to play catch-up with prices, not vice versa, because, as the IMF’s economists note, “wages are slower than prices to react to shocks”.

This doesn’t mean that firms are to blame, either.

[US} profit margins surged after vast fiscal stimulus during the pandemic, which amounted to more than 25% of GDP and included three rounds of cheques sent directly to most households.

With no off-setting interest rate hikes, this money drove a consumer-spending boom which “overwhelmed covid-strained supply chains”.

- Too much cash chasing too few goods means higher profits (and higher prices).

- Russia’s invasion of Ukraine spread this effect from goods to energy and food.

Europe is behind the US in this cycle, but it is following a similar path, and it’s likely that profit margins will decline this year.

Even in there had been some profiteering, the economic case remains:

The fact that companies raise their prices in response to shortages is not only defensible but desirable. The alternative to letting the price mechanism bring supply and demand into line is to rely on something worse, such as rationing or queues.

The right lesson to draw from the past two years is not that companies have got greedier,but that workers suffer when policymakers let inflation run out of control.

Savings rates

The Financial Conduct Authority (FCA) has intervened in the retail deposits market, telling the big four high street banks to raise savings rates more quickly

- The Bank of England (BoE) has managed 13 consecutive rate rises, taking the base rate to 5% and mortgages to 6%.

Apparently, the high street banks haven’t been keeping up.

- They offer rates between 0.9% and 1.75%, whereas the market-leading easy-access account (from a small building society) currently pays 4.35%.

I don’t use any of the big four for savings, so I hadn’t noticed (I’m using Chase, Marcus, Santander and Aldermore at present, in case you are interested).

- The high street rates do look pathetic, but I’m not sure the FCA should be telling the banks what to do.

Surely it’s down to savers to vote with their cash and move it to a higher-paying account.

- Banks are allowed to set whatever interest rate they think will make them a profit.

And of course, higher interest rates mean higher profits:

-

- NatWest profits were up by 50% in 1Q23 to £1.9 bn, Lloyds made £2.3 bn, up 46%, Barclays made £2.6 billion, up 27% and HSBC tripled its quarterly profits to $12.9 bn.

The FCA said:

Many people are feeling the squeeze from rising interest rates and prices, so it is more critical than ever that they are offered fair and competitive saving rates. We continue to

urge savers to shop around to make sure they’re getting the best deal.

Treasury Committee member Angela Eagle said:

This blatant profiteering has been shocking, and it’s clear to me this behaviour is miles away from theincoming requirement for firms to treat their customers fairly and with respect.

Committee chairman Harriett Baldwin added:

With interest rates on the rise and our constituents feeling squeezed by rising prices, it isonly right that the UK’s biggest banks step up their measly easy-access savings rates.

That sounds like virtue signalling to me, and they overlap between those suffering from inflation and those worried about their deposit rates will not be massive.

- Savings accounts are not a long–term defence against rising prices, at any combination of interest rates and inflation.

Pensions

Further to our article last week on pension reforms, the FT had a piece announcing that Chancellor Jeremy Hunt has reached an agreement (brokered by The Lord Mayor of the City of London) for pension funds to invest 5% of funds within DC pensions into “productive assets” (private equity and startups).

- The new deal was to be announced in the Mansion House speech on July 10th.

Hunt told the FT that there would be no compulsion involved:

This is about evolution, not revolution. We are not seeking Big Bang II on this. We aren’t going to do mandation. The requirement that you invest a certain proportion of your assets in UK funds is not on the table.

A lot of people in the industry will be relieved to hear that.

Hunt added:

This is not an attempt to divert capital into productive assets in a way that would be detrimental to the interests of pension fund holders. Everything we do we will seek to secure the best possible outcomes for pensionsavers, with any changes to investment structures putting their needs first and foremost.

It will not be a UK commitment. You come to London because you have experts hereinvesting all over the world, where they get the best returns.

Hunt remains keen on the consolidation of Britain’s 28K small schemes:

We will look at whether there should be powers of intervention in situations where it’s highly unlikely a fund is able to get the returns it needs.

This focus on larger schemes with more adventurous allocations and better returns is modelled on Canada and Australia.

But DB schemes (now largely in the public sector) are likely to remain in gilts:

Those who invest in our gilts are helping to fund vital public services and support for households facing high energy bills. Any changes must recognise the vital role they play.

Another planned change is the repeal of the EU’s MiFID rules on the bundling of free equity research alongside brokerage services.

[We] will allow people to opt out ofunbundling. That’s really important because if we’re going to be the world’s next Silicon Valley we need a really strong research sector that’s able to give valuations ofcompanies with no profits and no assets.

French EIS

The French government has published a report praising the UK’s EIS/SEIS scheme for investment into startups.

- It proposes that a similar scheme is introduced in France, with tax reductions of 30% to 50% for investments worth up to €500,000 per person per year.

The UK government recently refused to commit to an extension of EIS beyond 2025.

The existing French scheme has much lower investment limits (on the company end – no doubt influenced by EU rules) and two-thirds of UK investments exceed the French limit.

- The report also notes that the UK has 37K angels, compared to just 5.5K in France.

Nicholas Hyett from Wealth Club (the UK’s leading VCT/EIS broker) said:

This is important international recognit on for two schemes whose futures were in question just months ago. The French report describes EIS and SEIS, together with VCTs, as “undeniable factors” in the UK’s success as a start-up powerhouse and the “premier start-up ecosystem” in Europe.

UK start-ups benefit from a certain ‘je sais exactement quoi’ – it’s the EIS and SEIS schemes, and it’s no surprise that other countries are seeking to replicate them.

Quick Links

I have three for you this week:

- The Economist said Britain hands Microsoft’s Activision deal an extra life

- Discipline Funds looked at The Immaculate Disinflation

- And UK Dividend Stocks examined Top 40 High-Yield Blue-Chip UK Stocks

Until next time.