Weekly Roundup, 5th November 2019

We begin today’s Weekly Roundup in the FT, with Merryn Somerset Webb, who was writing about insurance.

Contents

Insurance

The particular flavour of insurance was roadside recovery, as supplied by firms like the AA and the RAC.

- Merryn’s first claim in 10 years didn’t go well, with a three-and-a-half-hour wait for the van.

In the period since her last claim, the invested premiums would have grown to a value somewhere north of £2K, enough to arrange her own tow-truck many times over.

- Remember, self-insurance is the way to go.

Cannabis

David Stevenson wrote about the cannabis sector – something we looked at a few weeks ago.

- David has hosted a couple of cannabis events recently and has noticed similarities with the cryptocurrency hype from two or three years ago.

It’s a tricky area for UK investors, so long as recreational use remains illegal in the UK.

- Profits from legal use in the US can still be regarded as the proceeds of crime.

And while there are forecasts of huge growth, the Canadian sector index is down more than 20% over the last quarter, and close to 50% down from the March peak.

- It’s a similar tale in the US.

In Europe, the story is about medicinal rather than recreational use.

- That’s less attractive to me, with a profile closer top biotech than to alcohol and tobacco.

Corbyn watch

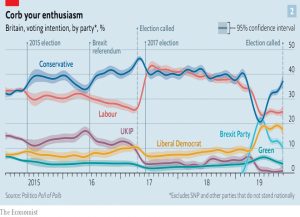

At the start of yet another general election campaign, the Economist examined Labour’s “radical left-wing agenda”.

At least £25bn a year would be put towards infrastructure investment, in part through the creation of a “national investment bank”. Water and energy firms would be brought into public ownership. The Bank of England would be given a new mandate.

The state would forcibly transfer 10% of the equity of large companies to their workers and compel pharmaceutical firms to supply drugs cheaply. Private schools would be abolished. Britain’s working week could fall from five days to four.

Britain’s 5% current account deficit makes is reliant on foreign capital inflows.

- So a borrowing binge could quickly lead to problems.

In practice, it’s not very likely that Labour will win a majority.

- A coalition with the Liberal Democrats might mean that the most radical policies would not be enacted, though the SNP might be more accommodating, particularly if Corbyn supported another independence referendum.

The Economist is not convinced that Corbyn and McDonnell would struggle to implement their programme.

- Getting the 10% share confiscation through might be tricky since the UK has 100 bilateral investment treaties designed to prevent such expropriation.

Capitalism

The Economist also looked at a new book on the future of capitalism by Branko Milanovic.

The book describes two kinds of capitalism:

- Liberal meritocratic capitalism (the US), and

- Political capitalism (China and other EMs).

Liberal meritocratic capitalism is more egalitarian than classical capitalism, thanks to welfare states inherited from social democrats. Its distinguishing feature is a tolerance for inequality. Political capitalism, in contrast, is illiberal.

It’s not clear whether political capitalism will evolve into liberal capitalism, or whether the opposite might happen.

In liberal meritocratic capitalism the wealthy invest heavily in their children’s education and the talented earn huge sums. The elite uses its economic power to cultivate political power, pushing societies toward the establishment of a permanent ruling class that cannot be dislodged.

Political spending in the US, in particular, is very concentrated amongst the very rich.

Emerging markets

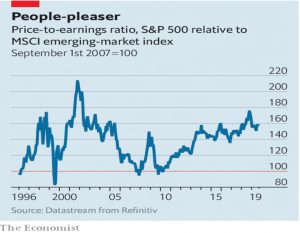

Buttonwood looked at the appeal of emerging markets.

As capital rushes into an ever narrower set of favoured rich-country assets, there is growing anxiety that it might all suddenly unwind. At least emerging markets are an uncrowded trade.

The main reason that EMs are generally out of favour is that many of them are crisis-prone.

- They are also linked to China’s supply chain, and therefore exposed to the US/China trade war.

On top of that, India, South Africa and Russia have their own problems.

You should expect out-of-favour markets to be cheap. But they also tend to be uncrowded, and so less at risk of a sudden surfeit of sellers over buyers.

So the appeal of EMs is that they lack superficial appeal.

Sneaky bosses

Bartleby looked at the contribution made by managers in firms.

- A recent study used a “public goods game” to examine this.

This involves investing tokens for returns that are distributed to all players, not just the investors.

- Thus the game analyses collaboration and free-riding.

The game in the study applied different rules to managers and workers.

Contributions were higher when team members were divided into managers and workers than when they were not. The mere presence of managers, it seems, even notional ones, encouraged workers to collaborate.

End results were much better when managers were allowed to contribute than when they were not. Understandably, workers who feel they are doing all the work are reluctant to chip in.

But managers were also sneaky:

Where they had discretion over the returns they received, they skewed the rewards to workers in the early rounds, when the sums were small, thereby encouraging underlings to stump up.

They then awarded themselves a higher proportion of the bigger pot in the later rounds, when it was too late for the workers to react.

This has some bearing on the use of share options.

[Options] encourage [managers] to pay spare cash to investors, often through buy-backs, which tend to boost the share price in the short term. In contrast, new investment tends to lower earnings per share immediately afterwards—and with it the share price.

Two-tier funds

In FT Adviser, Imogen Tew reported that the FCA was looking at separating funds for retail investors from those for institutional investors.

- The thinking stems from the large attempted withdrawal from Woodford’s equity income fund by Kent County Council, which triggered the fund’s collapse.

Industry reaction to such a proposal has been negative.

- Commentators worry that this might lead to fewer, smaller, more expensive and less diverse funds for retail investors.

There is also the issue of how to classify funds invested via wealth managers and advisors.

Fed rate cut

John Authers reported in his Bloomberg newsletter that the Fed cut its target rate for the third meeting running.

- As usual, Fed chairman Jay Powell tried to be hawkish in his comments, warning that no further cuts might be needed.

But of course, he provided a get-out:

If developments emerge that are a cause for a material reassessment of our outlook, we would respond accordingly.

Economist Steve Blitz commented:

This means it will take recessionary signals to cut and that, in turn, means they will be too late to avoid recession.

John points out that whenever the Fed cuts by more than 75 basis points in a cycle (which it has now done), a recession invariably results.

- The interest rate futures market reckons there is only a 20% chance of a fourth cut in December.

But the chance of a cut by next year’s presidential election is still 70% (admittedly down from 95% last month).

Quick links

I have nine for you this week:

- Flirting with Models looked at Global Growth Trend Timing

- The FT wrote about Apple’s entry into video streaming

- Alpha Architect looked at Liquidity as a proxy for Size

- And at whether Anomalies can survive Insider Disagreement

- Klement on Investing looked at Calendar Anomalies

- And at Property Ladders

- And at Abgeschlossene Halbbildung (you’ll need to read the article to find out what that means)

- Early Retirement Now asked who is afraid of a bear market?

- And the Adventurous Investor wrote about the coming decarbonisation battle.

Until next time.