Weekly Roundup, 9th January 2023

We begin today’s Weekly Roundup with a look forward to what 2023 might have to offer.

Contents

2023

The FT put together a panel of six experts to advise on how best to invest in 2023.

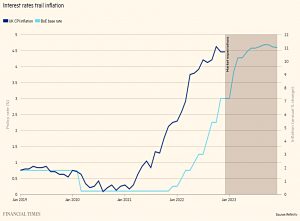

For the year ahead, the main visible financial challenge is inflation, running at more than 10 per cent in the UK. Investors need to protect the value of portfolios in real terms in what are widely predicted to be volatile markets.

The IMF is predicting 3.2% growth in 2023m the weakest forecast since 2001 apart from the 2008 crisis and Covid. A recession looks certain in Europe and likely in the US.

- The key is rate hikes – too fast and we get a bad recession, too slow and inflation doesn’t come down (and might even go higher).

We also have the risk of a property crash, especially in the UK.

The first tip was to stick with stocks. Simon Edelsten, a fund manager at Artemis, said:

You can take a cautious view of the world and still be fully invested in equities. You just choose equities that can cope with a difficult view of the world. This isn’t the time to take risks.

He recommends strong multinationals with pricing power, though these can be expensive.

The panels’ favourite geographies included the UK, along with emerging markets and Asia, especially Japan.

The panel was also keen on energy stocks, including US groups Schlumberger and Halliburton and Ashtead Technology.

- For green energy, batteries were likes, for example, Panasonic, the world’s largest battery maker.

They were less keen on tech, or at least on highly-valued start-ups.

- Established tech like Microsoft and TSMC was better-liked.

- In the UK, Kainos was tipped.

Healthcare was also liked, specifically US insurance firms and Pfizer.

- In the UK, Craneware was tipped.

Growth

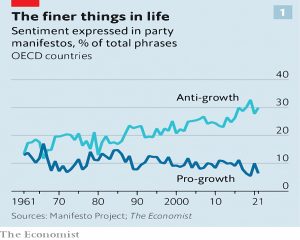

The Economist reported that the West has fallen out of love with economic growth.

- Pre-Covid rich country growth was 2% and the forecast for 2027 is 1.5% on a per capita basis.

Lots of rich countries have ageing populations and there are no more women to add to the workforce or teenagers to send to university.

- Basic technology (sanitation, cars, internet) has already been provided.

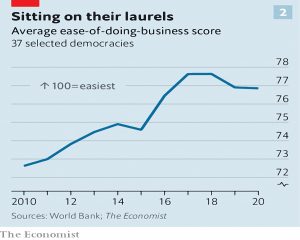

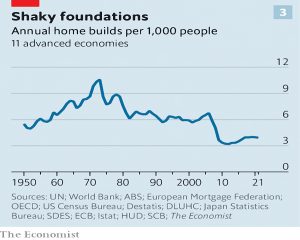

This growth problem is surmountable, however. Policymakers could make it easier to trade across borders, giving globalisation a boost. They could reform planning to make it possible to build, reducing outrageous housing costs. They could welcome migrants to replace retiring workers.

But the first suggestion has become less popular since Covid disrupted global supply chains and the other two were never that popular, to begin with.

- The unpopularity is expressed in political party manifestos.

The newspaper also notes a slowdown in tax reforms and an increase in trade tariffs and restrictions on immigration.

- There is also less enthusiasm for the construction of housing and infrastructure.

More is being spent on welfare, pensions and healthcare.

Politics is increasingly an arms race, with promises of more money for health care and social protection. Britons in their 90s receive health and social care that costs the country about £15,000 a year.

The move to service industries like healthcare makes it harder to achieve the productivity gains needed for an increase in living standards.

And government spending is increasing, which in the absence of growth means more taxes.

Much of the extra spending comes at times of crisis. Politicians are increasingly concerned with preventing bad things from happening to people or compensating them when they do.

This started with debt guarantees and eviction moratoriums during the pandemic but moved on to debt forgiveness and financial support for energy bills.

No one cheers when a company goes bankrupt or someone falls into poverty. But the bailout state makes economies less adaptable, ultimately constraining growth by preventing resources shifting from unproductive to productive uses.

Instead, we end up with zombie firms and zombie citizens.

Before social media and 24-hour rolling news it was easier to implement difficult reforms. The losers from a policy—a business exposed to greater competition from abroad, say—often had little choice but to suffer in silence. Now the aggrieved have more ways to complain.

Crypto

The Economist also wrote about Sam Bankman-Fried (SBF).

I had intended to write a dedicated article about the FTX collapse before Xmas, but I ran out of time and the moment has now passed. So let’s recap.

- FTX collapsed in November and CEO (SBF) went on a media tour to try and paint himself as well-intentioned (but dumb) rather than a fraudster. (( He was helped in this by several left-leaning media outlets – perhaps coincidentally, SBF was one of the biggest donors to Democratic causes in recent years ))

SBF was a leading light in the “effective altruism” movement whose members apparently want to make a lot of money so that they can give it all away.

After a superficially baffling delay, SBF was arrested in the Bahamas, but he is pleading not guilty.

- Two members of his team (including his former girlfriend) are pleading guilty, so perhaps the delay in arresting SBF was to allow time to secure their cooperation.

SBF himself was extradited back to the US but is out on $250M of bail (funded by his parents and two other people).

SBF ran two main firms – Alameda Research, a sort-of hedge fund (founded in 2017) and FTX trading, a crypto exchange (founded in 2019).

- Between them, he raised $1.8 bn in equity investment.

SBF used to be a trader at hedge fund Jane Street, and Alameda started out as a bitcoin arbitrage firm, buying crypto in Asia and selling it on more favourable exchanges.

- But the growth of SBF’s empire was driven by FTX, which was valued at $32 bn in early 2022.

SBF became the poster boy for “safe” crypto, running ads that showed him hob-nobbing with film stars and supermodels.

- He also made the fatal hubristic mistake of sponsoring a sports stadium.

The SEC now alleges that FTX deposits were diverted to Alameda to fund trading and VC investing (as well as a lot of real estate for SBF and his family. and the Democratic donations we mentioned earlier).

- SBF also bought 8% of Robinhood.

SBF is also accused of instructing FTX staff to add loopholes to FTX risk management software that excluded Alameda from internal risk procedures.

- This allowed Alameda to run a permanent negative balance on the FTX exchange.

Alameda was also instructed to prop up the value of FTX’s own token (FTT), used by Alameda for collateral.

When the crypto market crashed in 2022, people wanted their money back from Alameda, so more money was diverted from FTX.

- FTT also crashed.

FTT wasn’t asset-backed, so its value basically reflected the popularity of FTX.

The crisis was eventually triggered by tweets from the CEO of rival exchange Binance.

- Poor internal controls meant that FTX couldn’t liquidate assets quickly enough, fuelling a panic.

At first, SBF tried to ring-fence the US operations of FTA from the collapse in its international operations.

- He also claimed not to know that Alameda owed so much to FTX (and was unable to replay it).

SEC Chair Gary Gensler said that SBF:

[Built a ] house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto.

It’s not clear that SBF will come to trial.

- With Caroline Ellison, who ran Alameda, and Gary Wang, co-founder of FTX, likely to testify against him, he might want to strike a plea deal.

Nor is it clear how SBF and his colleagues thought they could possibly get away with this.

- What end game did they envisage, other than possibly constantly rising crypto prices?

If there is no trial, we might find out via finance author Michael Lewis, who with great timing has been shadowing SBF for months with a view to a book and a film.

The new head of the Financial Conduct Authority (FCA) is reportedly not a fan of crypto.

- Ashley Adler has just begun a five-year term as chair of the FCA.

He was formerly the CEO of the Securities and Futures Commission in Hong Kong.

In December, he told a Treasury Select Committee that crypto was widely used to launder money:

I think it should be regulated further. Our experience to date of [crypto] platforms, whether FTX or others, is that they are deliberately evasive, they are a method by which money laundering happens in size. [They] bundle a whole set of activities which are normally segregated [which]gives rise to massively untoward risk.

In FT Advisor, Sally Hickey reported that fewer than one in 10 advisors think that crypto belongs in client portfolios.

- The survey of 226 advisors found that only 6% were in favour.

The main reason given was that crypto is outside the regulatory scope of the FCA.

- Despite this, 35% of advisors reported increasing interest in crypto from their clients.

Only a third of IFA admitted to not understanding crypto.

Andrew Inwood, principal at CoreData, who carried out the research, said:

Cryptocurrencies are volatile and unpredictable and recent events underscore the potential perils of investing in the sector. These findings show that advisers are nervous and wary of cryptocurrencies and for good reason.

Gaining a better understanding of cryptocurrencies and their risks will allow advisers to have more informed conversations with clients who are showing greater levels of interest in digital currencies.

Quick Links

I have four for you this week:

- UK Dividend Stocks provided the 2022 Year-End Review for their portfolio

- The Economist noted that Investors conclude that Tesla is a carmaker, not a tech firm

- Mauldin Economics forecasted the Year of the Pause

- And Aleph Blog published a quarterly update on Estimating Future Stock Returns

Until next time.