Irregular Roundup, 24th July 2023

We begin today’s Weekly Roundup with inflation.

Inflation

John Authers looked at the latest inflation figures from the US.

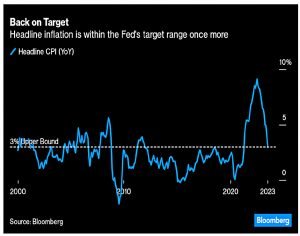

- The CPI headline number for June was down to 3%, just inside the upper limit of the Fed’s inflation target.

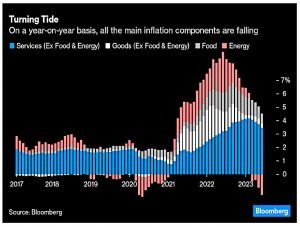

The impact of energy has turned negative, and goods inflation is almost down to zero.

- Food and services are also moving down.

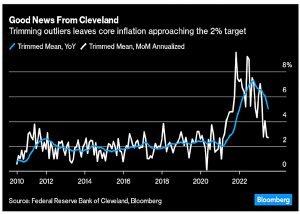

The trimmed mean calculation has core inflation approaching the 2% target, on an annualised basis:

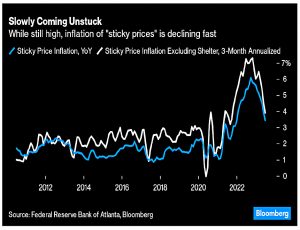

Sticky inflation is also coming under control, especially when shelter costs are excluded:

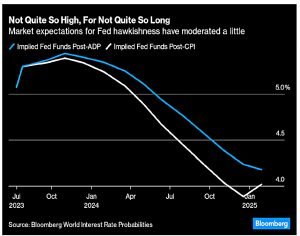

Surprisingly, the new numbers didn’t change market expectations by much – another hike in July is still seen as very likely.

Absent clear and present evidence of a recession, the Fed will be anxious toavoid a repeat of the errors made in the 1970s and 1980s, when victory over inflationwas declared prematurely and price rises intensified as a result.

The numbers sent the dollar down (to £1=$1.30 for those of us in the UK), which will boost foreign profits for multinationals.

- It also improves the situation for emerging markets (who have dollar-denominated debts and sell dollar-denominated commodities, which will go up in price).

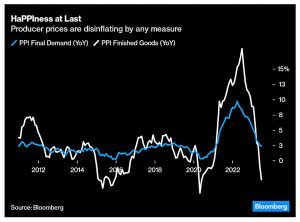

The next day, producer prices also came in below expectations.

- For finished goods, PPI is now negative:

The gap to CPI is large, as Bespoke Investment points out:

The spread between consumer prices (CPI) and producer prices (PPI) is at a record high. Prior periods where the spread hit a record high were typicallyfollowed by above-average equity returns and occurred very late in arecession or in the early stages of an expansion.

John is puzzled:

It makes sense that a big drop in the supply costs will help equities. It’s bizarre that this is happening when the economy is plainly neither late in a recession nor in the early stages of an expansion.

Perhaps we won’t see a recession.

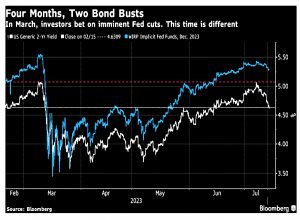

Two-year bond yields have fallen.

The level of 5.07%, at which the yield peaked both last week and in early March before the regional banks crisis, seems like an invisible barrier. But expectations for the Federal Reserve have [reaceted less]. The implicit fed funds rate predicted for the December meeting tanked even more than bond yields back in March, and it’s barely moved recently.

This time we don’t have a banking crisis, so there’s no catalyst for immediate rate cuts.

Bond yields are falling because of the suspicion that the Fed will stay too tight for too long, and ultimately damage the economy.

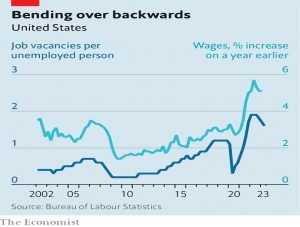

The Economist was still worried about the US labour market.

For every unemployed person in America, there are 1.6 jobs available, a ratio down a tad since mid-2022, but well in excess of the pre-pandemic norm. Since February 2020 the economy has added nearly 4m jobs, putting employment above its long-term trend line. Some 84% of prime-age workers are now in work or looking for work, the most since 2002 and just a percentage point off an all-time high.

And pay-rises are outpacing broader inflation:

Hourly earnings in June, rose at an annualised pace of 4.4%, well above the Federal Reserve’s target of 2%. A tracker by the Fed’s Atlanta branch points to annualised wage growth of around 6% this year.

The newspaper concludes that the Fed will have to raise rates in July.

Markets now assign a 92% probability to a quarter-point rate rise in July.

But good inflation numbers for July and August would probably mean that this hike was the last.

Mansion House Reforms

As expected, Chancellor Jeremy Hunt used his Mansion House speech to announce that the government would be pushing ahead with plans for superfunds in the DB pensions arena.

- He also confirmed that pension funds will be encouraged to invest in more illiquid and risky assets, such as unlisted companies.

The MiFid II rules on free (bundled) research from brokerages will also be scrapped.

- And the government will support a new trading venue for private companies.

hunt noted that comparable schemes in Australia are much more likely to invest in private markets and have therefore enjoyed greater returns.

- Nine of the largest pension providers (Aviva, Scottish Widows, L&G, Aegon, Phoenix, Nest, Smart Pension, M&G and Mercer), who represent two-thirds of the DC workplace pension market, have agreed to allocate 5% of their default funds to unlisted equities by 2030.

- That’s an increase from less than 1% at present and would mean £50 bn of investment if the rest of the market follows suit.

The government claims this will make pension pots 12% larger over time, a gain of £16K for the average earner.

- Of course, riskier investments can also go wrong, leading to smaller pots, but in general, UK pensions are very risk-averse at present, with a bias to liability matching rather than growth.

To support the change, a new “value for money” framework will be introduced, under which pension firms base their investment decisions on returns and not costs. Schemes which are held not to achieve the best possible outcomes for members will be merged into larger and better-performing schemes.

- The lack of scale in UK schemes is a key obstacle to properly diversified portfolios.

Pensions minister Laura Trott said:

Although many schemes are now closed they hold £1.7 trillion worth of funds that I want to see working for members, employers and the economy and I welcome innovation in the DB landscape that will increase protection for members whilst also supporting wider economic initiatives.

Superfunds have the potential to improve the likelihood of members getting their benefits in full, whilst providing employers with a new, affordable way to manage their legacy pension liabilities. Superfunds are also ideally placed to contribute to greater investment in assets that support the UK as a whole [and] align with wider government initiatives designed to stimulate economic growth.

Work and Pensions Minister Mel Stride said:

British workers should have the confidence that their pension savings are working as hard as they are. Our reforms will benefit savers and society – unlocking investment into pioneering UK businesses, growing the economy, and helping the record number of people in this country saving into a pension to achieve the retirement they want.

Over a five-year period, there can be as much as a 46 per cent difference between the best and worst-performing pension schemes. This means that a saver with a pot of £10,000 could have notionally lost £5,000 over a five-year period from being in a lowest-performing scheme.

Nicholas Hyett of VCT/EIS broker Wealth Club commented:

We have always viewed the rules restricting the promotion of free research on smaller and medium-sized companies as far more damaging than the problem they set out to solve. The collapse in research on smaller companies made stock markets less dynamic, reduced trading activity in smaller companies and probably hit retail investors hardest. Europe is already looking to roll back some of these rules and the UK should absolutely follow suit, although it may take years for smaller company research to regain the vibrancy it once had.

A trading venue for private businesses looks like an oxymoron – private business are, by definition, illiquid and don’t trade their shares on an exchange. If such an exchange generated lots of volume then what would separate it from a public exchange, and if volumes are low then what is the point. This feels like an ambitious policy that may ultimately struggle to deliver.

But former pensions minister Ros Altmann thought that 5% within seven years was too little and too slow:

I would urge the chancellor to be bolder in his welcomeinitiatives to ensure more of our domestic pension fund contributions aredirected to benefit British growth. It is time for revolution, not evolution, with more money being used at home,rather than leaking overseas.

Britain is falling behind in terms of productivity and technology funding. This is threatening our country’s position as a global financial centrethat punches well above its weight.

Small pots

Another announcement from the government concerned the “small pots” created when people move to a new job and leave their deferred workplace pension behind.

- These pots (mostly less than £1K in size) total £27 bn.

The government has decided against the pots following their owner to the new job (and the new pension provider – the so-called “pot follows member” option).

- Instead, default “consolidator” schemes will be created to sweep up pots less than £1K in size (though an opt-out will be available).

Pensions minister Laura Trott didn’t rule out further options in the future:

In the longer-term, a simpler system of workplace pension saving could emerge to deal with the issue that new pension pots are created each time someone starts a new job, for example, a lifetime provider model with each saver stapled to a ‘pot for life’.

This is the Australian model.

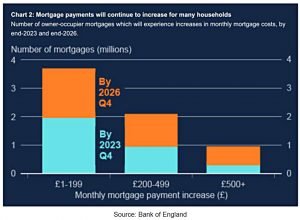

Mortgages

The Bank of England has warned that rising interest rates will force households and businesses to cut back on spending, leading to a negative impact on the UK economy.

- But the number of affected households should not reach the levels seen in 2007.

Nevertheless, around 1M households will see a £500 per month increase in their interest payment by the end of 2026.

- Two-year fixes hit 6.6% last week, the highest in 15 years.

Quick Links

I have seven for you this week, the first three from The Economist:

- The Economist wrote about Tesla’s surprising new route to EV domination

- And said that Hollywood’s blockbuster strike may become a flop

- And thinks that Your employer is (probably) unprepared for artificial intelligence

- Alpha Architect asked Does investing in a more concentrated fund result in better performance?

- And looked at Reducing the Risk of Momentum Crashes

- UK Dividend Stocks explained Why I’m selling my Beazley shares after strong share price gains

- And Discipline Funds asked What Does an Inverted Yield Curve Tell Us?

Until next time.