Irregular Roundup, 22nd April 2024

We begin today’s Irregular Roundup with the Destiny Tech 100 fund.

Destiny Tech 100

Over a couple of his Bloomberg Opinion newsletters, Matt Levine looked at an unusual stock – the Destiny Tech 100 (NYSE:DXYZ), a US version of an investment trust that invests in unlisted tech startups.

He began with the problem facing the employees of hot startups – they can’t sell shares because they aren’t listed yet.

- There might also be internal restrictions – the firm doesn’t allow sales, or has the right of first refusal (ROFR), or you just need their permission for any sales.

Some firms offer periodical buybacks to solve that, but maybe yours doesn’t, or not in the size / not at the price you want (or can get elsewhere).

- The way around this is a forward contract – money changes hands now, but the stock moves after the IPO.

And the guy who paid for the stock in advance might decide to sell on the forward contract before we reach the IPO.

Forward contracts are not allowed by a lot of startups, so they could be difficult to enforce.

- And a startup with ROFR might try to enforce that even after the IPO.

This brings us back to the newly-listed DXYZ.

- DXYZ holds shares (and forward contracts for shares) in 23 startups (including Stripe, SpaceX, OpenAI, Discord and Epic Games) and plans to increase this to 100 firms.

DXYZ was listed at $4.84 (its NAV at launch) but soon went to $80 (and beyond).

- That’s a market cap of $875M and a NAV of $54M – a premium of more than 1,500%

If each of this fund’s holdings goes up 1,000% by the time they go public, people who bought into the fund today will lose money.

If you buy shares in DXYZ, you are getting almost no exposure to Stripe and SpaceX; you are mostly getting exposure to DXYZ’s own premium. More than 90% of the value of the stock is premium; the portfolio is an afterthought.

Stripe in particular has said that the forward contracts are not legal and they will enforce their ROFR.

- DXYZ notes this risk in its IPO prospectus, which Matt finds funny.

The safest way for a forward contract to work is for the company not to know about it: once it goes public, the seller just delivers the unrestricted stock and never tells the company. But once you put it in a prospectus, the company knows!

This makes operating a fund of unlisted startups – a nice idea, allowing plebs like us (in the US, at least) access to hot firms – quite tricky in practice.

Matt interprets DXYZ as a meme stock:

“This is a way for ordinary investors to get access to hot startups” is a good meme, whether or not it is true as a matter of arithmetic. If the only publicly traded way to get access to hot startups has $50 million worth of hot startups, there’s no law of nature that prevents it from trading at $1 billion.

DXYZ founder Sohail Prasad seems to agree:

The public listing of DXYZ has become a cultural moment that’s taken on a life of its own.

It’s a shame, but also quite funny, that the only way to access highly rated unlisted startups is via a fund which is even more highly rated (by an order of magnitude).

The obvious fix is for DXYZ to sell lots more shares at the current high premium.

Right now DXYZ has, call it, $1 billion of stock and a $50 million portfolio, a 1,900% premium. If it sells another $1 billion of stock, and invests the proceeds into new private-company stakes, it will have $2 billion of stock and a $1.05 billion portfolio, a 90% premium. Progress!

Easier said than done, of course:

DXYZ doesn’t just have to raise the money; it also has to deploy it, to find good private companies (or their shareholders) who are willing to sell it shares at reasonable valuations.

But VC firms have this problem all the time.

- Maybe they could offload some shares to DXYZ.

Fixing the UK market

Also for Bloomberg, John Stepek returned to the topic of how to fix the UK stock market.

- The latest firm to hint at leaving is Shell.

CEO Wael Sawan is clearly not ruling it out. He’s fed up with investors failing to appreciate the company. “I have a location that clearly seems to be undervalued.” Rival oil companies seem to attract a much higher rating in the US.

John thinks the current low valuations in the UK can’t last.

Either the companies up and leave and get a better valuation for themselves and their shareholders elsewhere; or investors finally wake up and realise that they’ve been leaving £20 notes on the floor because they don’t like the colour of the carpet. Either way, holders benefit.

Along with the abolition of stamp duty, John has another idea that would help, this time aimed at fixing investment trust discounts.

The main issue today is over a piece of dull-but-crucial paperwork called a KIID. it makes investment trusts look significantly more expensive than they are, and it means that institutions and advisers don’t want to touch trusts.

The KIID requirement is an EU regulation that could be abolished, but there seems to be no political will to achieve this.

- This is a shame because getting rid of KIIDs would mean that UK brokers could sell us US ETFs (who can’t be bothered to issue a KIID).

Now that really would be something to celebrate.

In the meantime, John points out the double discounts available on ITs that invest in UK stocks.

There are 21 investment trusts in the UK equity “universe” with market capitalisations of more than £100 million. More than half offer dividend yields above the FTSE All-Share’s 3.8%. And a full two-thirds of those have outperformed the wider FTSE All-Share index in total return terms over the past year.

And they all trade at discounts to NAV (with an average discount of 7%).

VCTs

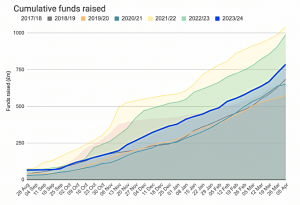

Alex Davies from VCT broker Wealth Club (WC) reported on the funds raised by VCTs during the tax year just gone (2023/24).

- New money fell by 18% to £882M, which is still the third-highest year on record.

The two higher years were 2021/22 and 2022/23 and I guess that the abolition of the LTA last year meant that some funds were diverted into pensions.

- VCTs look a lot more attractive once your pension pot is full.

WC had more stats on VCT investment:

- The average age of Wealth Club VCT investors is 58.1

- The biggest age group (by amount invested) is 56-65

- 83% male /17% female

- £10,651 is the average amount invested per Wealth Club client per VCT (last year)

- £35,600 is the average total amount that Wealth Club clients invested in VCTs (last year)

Alex commented:

Despite the economic uncertainty over the last year VCT sales still managed to achieve their third highest tally on record. This was helped by investors who had been sitting on the sidelines for much of the year pouring money in at the last minute.

Taxes are at a 70-year high and traditional investments like buy-to-let and pensions have been squeezed. Venture Capital Trusts are simple and highly tax efficient. VCTs are also exciting: you’re backing some of Britain’s youngest and brightest companies.

LTA watch

For FT Advisor, Amy Austin reported that HTRC is telling people to delay taking pension benefits or making transfers until incorrect legislation around the abolition of the LTA can be fixed.

This list of circumstances which should mean a delay is:

- scheme-specific tax-free cash protection, or a transfer of a case with enhanced protection

- enhanced protection and primary protection cases with protected lump sum rights of more than £375,000

- the payment of a lump sum death benefit from funds which crystallised before April 6, 2024

- any transfer from drawdown to a Qrops

- any transfer to a Qrops which involves pre-April 2006 benefits

That’s quite a specific list, so most people shouldn’t be affected. HMRC said:

We will confirm timings [for fixes] as soon as possible. The [new] regulations will be retrospective.

ETF Fees

Fidelity has announced that it will be adding a surcharge for investors who want to use ETFs from specific issuers in the US.

- The providers include some favourites of mine, like Simplify (though I don’t use a Fidelity account to buy them).

The fee is $100 (it’s unclear if this is annual or per holding) and comes into force in June 2024.

- The chosen firms are not part of a “maintenance agreement” with Fidelity (whatever that is – it sounds like a listing fee).

Fidelity says that the ETFs on the list make up only 0.5% of the funds on their platform.

- It’s also worth noting that Fidelity offers zero commissions in the US, whereas I’m still paying £10 per (infrequent) trade.

A Fidelity spokesman said:

We remain committed to providing clients choice with an open architecture investment platform. Support fees help maintain the technology and service operations needed to ensure a secure and positive experience for investors.

This is clearly a step in the wrong direction, but we already don’t have universal access.

- Lots of platforms in the UK offer restricted lists of ETFs to a lesser or greater extent, and ISAs have more restrictions than SIPPs, with GIAs usually best (though obviously taxable).

It’s best to use a range of providers so that you can at least access your chosen fund on one of them.

Quick Links

I have fourteen for you this week:

- The Economist said that Daniel Kahneman was a master of teasing questions

- And explained Why the stockmarket is disappearing

- And warned that America’s interest rates are unlikely to fall this year

- And said that Generation Z is unprecedentedly rich

- Disciplined Systematic Global Macro Views reminded us to Always come back to stock-bond correlation as the key diversification issue

- Merryn Somerset Webb said You Get a Summer House, I Get a Summer House

- Alpha Architect looked at The Performance of the Hedge Fund Industry

- The FT asked Should governments tax the great boomer wealth transfer?

- And reported that London house prices underperformed the rest of the UK for the past 8 years

- And said that It’s time to help the multi pension generation

- And that Wealthy investors have weathered the inflation storm

- Bloomberg said Too Many Passive Investors? There’s No Such Thing

- NextAvenue said that Younger generations don’t want your collectibles

- And Josh Brown wrote about Red Lines

Until next time.