Weekly Roundup, 8th March 2021

We begin today’s Weekly Roundup with the bond-equity relationship.

Stocks and Bonds

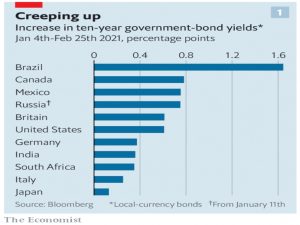

In the Economist, Buttonwood explained that people are worried about the bond-equity relationship.

- If inflation rises for an extended period, this could be bad for both stocks and bonds.

In quant speak, the bond-equity correlation might turn positive.

- This is actually the normal relationship, but in recent years, investors have become used to bonds rising when stocks fall.

When recessions hit, bond prices tend to rise sharply (their yields fall) and equity prices usually crash. When the economy recovers, bonds tend to fall in price and equity prices go up again.

Government bonds are safe assets. People rush into them when they fear for the future. Equities, by contrast, are risky assets, so people shun them in troubled times.

The longer-term positive relationship is based on yields.

This has led to lower yields (and higher prices) in other (riskier) assets, such as stocks, property and credits (corporate bonds).

The impact of inflation on stocks is linked to monetary regimes:

Under the pre-1914 gold standard, inflation was mean-reverting: if it was high one year, it would fall the next. But in the era of fiat money, especially in the 1970s, the checks on inflation were less binding.

So inflation was good for stocks, then bad, then good again after the 1990s when central banks were given inflation targets.

- But the new generation of government officials worries more about climate change and inequality than inflation.

So we could be due for another flip.

In the FT, Merryn Somerset Webb suggested that bond turmoil could lead to the end of the traditional 60:40 stock/bond portfolio.

- This is a different take on the same point as above – if bonds and stocks track together, then bonds won’t provide a diversification benefit against stocks.

In fact, bonds are a pretty bad hedge for stocks in any case, unless you either hold a lot of them (bad for overall returns) or use a lot of leverage (risky).

- But the 60:40 portfolio is easy to understand and has done pretty well over the decades, so many investors would miss it.

Merryn explains the problem:

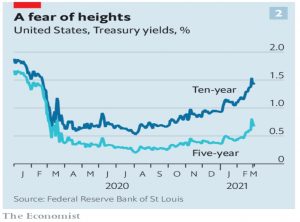

The protection you get from bonds comes from yields falling (and hence prices rising) in the bad times. But yields can only fall so far. If they are already close to zero or negative they don’t have far to fall — and hence don’t not much ability to protect you.

Merryn suggests gold, cash and value stocks as replacements for bonds.

John Redwood was confident that shares can cope with the turmoil in the bond market.

- He noted that shares sold off in the second half of February and his FT fund lose most of its YTD gains.

What really spooked investors was the return of the bond vigilantes, who used to worry governments and force interest rates up in times of higher inflation. They suddenly reappeared and took on today’s very accommodating central banks.

But as John notes, modest increases in long bond yields and in inflation can coexist with share gains in the early stages of an economic recovery.

John has rotated away from Nasdaq, tech and clean energy into more general market index funds.

- But he is running the bond allocation of the fund partly in cash until he sees where long-term yields end up.

Insiders

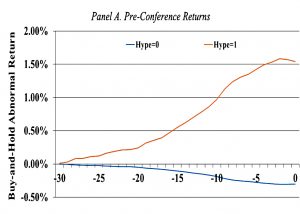

Joachim Klement explained how corporate insiders manipulate investors.

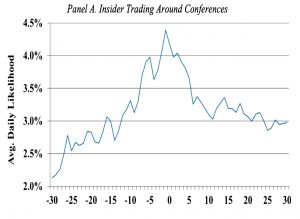

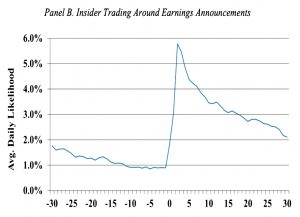

- Bushee et al (2020) looked at the likelihood for corporate insiders to sell stock in the 30 trading days before and after a company conference (Capital Market Day) and an earnings announcement.

Corporate insiders are prevented from trading in their company stock before an earnings announcement, but they typically schedule company conferences during periods when they theoretically can buy or sell shares of their company.

It is curious that insider sales become more likely in the days before a company event and then become less likely again in the days after the event.

Joachim notes that conferences are often preceded by press releases.

These tend to be feel-good press releases that put the company in the best light possible and hype the business and its performance. And even though these press releases tend to contain nonconsequential information, the share price reacts to this marketing campaign.

The same hyped firms also experience an abnormal negative return once the conference has passed.

By hyping the stock [insiders] can sell before a company conference and when the conference eventually proves to be rather disappointing, they are no longer suffering the decline in share price in the weeks after.

This is not illegal trading based on insider knowledge. It is simply taking advantage of the enthusiasm of investors and analysts before a company event.

SPACs

The US is going SPAC crazy.

- They raised $80bn last year, and 170 firms have already raised half that again in 2021.

SPACs are special purpose acquisition corporations – listed cash shell companies that can be used (amongst other things) to provide a quick route to market for unlisted companies.

- As Merryn Somerset Webb pointed out in Money Week, the objectives of some of these firms are (necessarily?) vague. Here’s Do It Again Corp, which has been formed:

For the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganisation or similar business combination with one or more businesses.

Merryn noted the similarity to the South Sea Corporation:

To carry out an undertaking of great advantage but no one to know what it is.

We don’t have SPACs in the UK in part because of our listing rules (Merryn mentions that trading suspended during the actual acquisition process).

- This could be a bad thing if it leads to UK tech firms listing in the US.

There is certainly an issue with the declining rate of new listings in the UK (and some would say, with the mix of existing companies on the UK exchanges).

The results of a government-commissioned review of UK listing rules (by Lord Hill) were welcomed in last week’s Budget.

- He wants to “liberalise” SPAC rules, introduce dual-class share structures (which allow founders to retain control after a public listing). and reduce the minimum free float (of tradeable shares) from 25% to 15%.

There are also tech-focused recommendations like empowering (nominee) shareholders in company votes and reducing paperwork on fundraisings.

- The lower free float might cause issues in small caps, but the other changes look fine.

We could also look at using auctions to price offers (( Hat-tip to Paul Scott here )) and preserving pre-emption rights through a first-refusal waterfall process.

Trading 212

Trading 212 are going to introduce an FX fee for trades in a foreign currency (usually dollars).

- It’s only 0.15% but charged (as normal) on both legs of the trade – so that’s 0.3% for a round trip.

Some people on Reddit are cross that a trading platform that advertises itself as “free” should have any charges.

- It should be noted that the other “free” platform in the UK (Freetrade) charges 0.45% each way for FX.

And regular brokers charge upwards of 0.5%.

- Stake – the Australian free broker – doesn’t charge for FX on trades, but it does have a £9.99 monthly fee (and changes FX on fund transfers).

Since there’s nowhere to run, we need to compare the FX charges with regular broker commissions.

- 0.15% equates to £1.50 per £1K.

My cheapest “non-free” broker is iWeb, which charges £5.

- So T212’s FX charges will exceed this at a trade size of £3.3K

For a 20-stock UK portfolio, this works out at a portfolio value of £66K.

- This matches up well with my self-imposed limit of only holding £80K with T212 (just below the FSCS insurance limit).

So my own use case for FX on T212 survives.

- Your mileage may vary, particularly if you are a day trader.

If so, you have until April to restructure your portfolio.

Quick links

I have just two for you this week:

- Alpha Architect looked at what is the right risk adjustment for momentum factor investing

- And the Economist wondered whether the pandemic might pave the way for a universal basic income.

Until next time.