Irregular Roundup, 15th April 2024

We begin today’s Irregular Roundup with the equity risk premium.

Contents

Equity Risk Premium

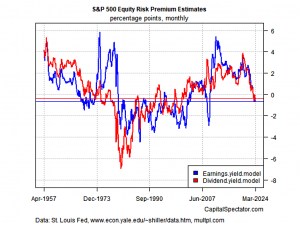

The Capital Spectator (CS) reported that the US Equity Risk Premium (ERP) remains negative, implying that recent gains have been at the expense of future returns.

- The ERP is the forecast of excess returns from stocks above the risk-free rate (typically the US 10-year Treasury yield).

CS used two methods to estimate the ERP:

- the earnings yield model (EYM) and

- the dividend yield model (DYM)

The EYM simply subtracts the bond yield from the S&P 500 earnings yield.

- The DYM uses the Gordon Growth Model and Dividend Discount Model to add a growth estimate to the current dividend yield.

CS uses the rolling 10-year growth rate for the US economy (from real GDP numbers).

The assumption here is that the stock market’s dividends will grow in line with economic activity over the long run.

Both models give a negative number for the first time in decades (probably the dot com boom).

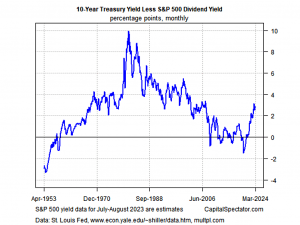

The 10-year yields around three per cent more than the stock market, which hasn’t happened since before the 2008 crash.

Bonds continue to present a competitive alternative to stocks, which in turn has asset allocation implications.

CS raises two caveats:

- Perhaps AI has changed things.

- Trend tends to dominate in the short run, and stocks are heading up.

When does the longer-run valuation outlook overtake the shorter-run trend factor?

There’s no easy answer, and within the stock universe, value has been losing out to growth for a couple of decades now.

Nonetheless, from a calculated risk perspective, the case for incrementally adopting a defensive posture has a certain appeal.

Investment taxes

In his Money DIstilled newsletter for Bloomberg, John Stepek looked at the effect of investment taxes on share prices and the behaviour of companies.

- He referenced research from the Bank Underground blog of the BoE.

If a company decides to raise funds by sellingshares in itself, it needs to make sure its offering is appealing to investors. But that return only happens after costs.

So if you are going to have to pay income tax onyour dividends and capital gains tax (CGT) on any profits you make, then you’re going todemand a commensurately higher return on your investment.

So the higher the taxes, the higher a firm’s cost of capital.

- It will raise less money and have less to invest.

Here in the UK, ISAs shelter shares from CGT and income tax on dividends.

- However, AIM stocks only became eligible for ISAs in 2013.

The effective tax rate for private investors owning AIM stocks dropped from roughly 10% a year (outside the ISA) to 0% (inside the ISA). That translated to a lower cost of capital for the companies involved.

According to Alex Kontoghiorghes of the BoE:

[AIM share prices] became permanently higher than they would have been. Companies issued more equity and debt in response to their new lower cost ofcapital [and] used their newly issued capital to invest in their tangible assets and increasepay to their employees.

Investors bid prices up because they didn’t need their returns to cover the tax they were no longer paying.

- The IHT exemption for AIM stocks has a similar impact, and the tax exemptions on EIS and VCT companies are also exploited.

John suggests that scrapping stamp duty on UK stocks might help to revive the ailing UK stock market, and I agree.

If you really wanted to be radical, you might even look at how to extend the inheritance tax relief available on AIM stocks to the wider London market.

It’s a nice idea, but I can’t see a Labour government being too interested in IHT loopholes.

Here and now

Joachim Klement wrote about the consequences of living in the here and now.

- A recent study from Claremont Graduate University looked at how the things we are doing right now impact how much we care about the future.

Volunteers were told that they would get a slice of bread or a large plate of ice cream to eat. After ten minutes the experiment would end with them being exposed to the result of a coin toss made before the experiment began. If the coin came up heads, they would get a 100V electric shock (painful, but not dangerous).

So we have a good short-term activity (ice cream) and a neutral one (bread), followed by a good future (no shock) or a bad one (shock).

The question was if the volunteers would choose to know the result of the coin toss right away before they got their food or later after they had their food.

Joachim says he would always want to know, but most people don’t.

If people were given ice cream, they were more than twice as likely to wait to be told the result. Why ruin the pleasure of eating ice cream with the knowledge that you are going to pay for it later?

A second experiment asked whether subjects would like to hear the results of a cancer test before or after the weekend.

If people had planned something enjoyable, they were more than twice as likely to avoid getting possibly bad news on the weekend.

The results have financial implications:

If people are happy today and busy consuming stuff, they stop worrying about and planning for the future. Young people should think about their retirement or saving for a house, yet they are busy going to parties and hanging out with friends all the time.

Joachim doesn’t have a fix for this, and neither do I. There are also political implications:

As long as people are happy with their lives and can easily afford to go on vacations, have a beer with friends at their local, or have a relatively easy time getting on the property ladder, they are not too worried about politicians screwing the country with their ineptitude. But let houses become unaffordable or let there be a recession and people suddenly become much more engaged.

Unfortunately for politicians, a low-growth future means that paying for the distracting bread and circuses will become more difficult.

Factor decay

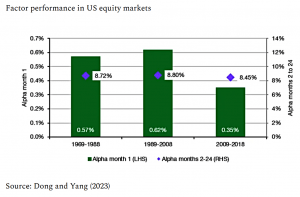

Joachim’s second article looked at the role of retail investors in factor decay (following the publication of an anomaly).

When academics describe a market anomaly, they form portfolios based on some past observations, then let the portfolio run for a month and do the entire exercise again. The hope is that this monthly rolling process will systematically create outperformance.

But systematic investors (like me) try to exploit these factors, to the extent that the factors weaken or even disappear.

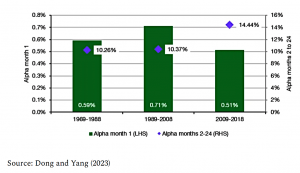

The chart shows the average performance of 260 factors [over time]. Looking at the green bars shows that since 2009, the average outperformance of these factors has almost halved from about 0.6% to 0.35%.

But looking at the blue diamonds, which show performance from months 2 to 24, there is no decay.

Essentially, instead of reconstituting factor portfolios every month, the researchers let each factor portfolio run for two years .

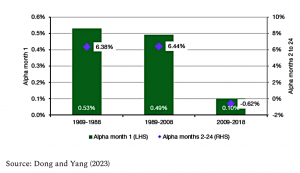

The difference is retail investors, who trade with the momentum factor, but against value (they prefer growth) and quality (they prefer lottery stocks with unlikely large returns).

Retail investors trade against some 60% of the anomalies and with about 40% of the anomalies.

Where retail trades with the factor, decay is severe, even when portfolios are held for two years.

Where retail trades against the factor, the factor is much more stable over one month and even improves over months 2 to 24.

When retail investors trade against systematic factors, the flows of retail investors push against the factor, share prices correct much slower and mispricing survives for longer.

Scottish Mortgage

US activist hedge fund Elliott Advisors has taken a 5% stake in UK tech investment trust Scottish Mortgage (SMT – I hold).

- Tom Slater manages the fund but until March 2021 it used to be run by James Anderson – one of the few star fund managers to quit at the top (when SMT was the largest investment trust in the UK).

- Since Anderson retired, SMT is down 20%, despite the recent AI rally in tech.

SMT has also announced a £1 bn buyback, worth 9% of the fund’s value and designed to close the discount to NAV.

- The announcement alone has shrunk the discount from 15% to 7%.

Elliot has previous with UK ITs.

- In 2017 it persuaded Alliance Trust to switch to a multi-manager approach (after a seven-year campaign).

Industry commentators are worried about the worth of the unlisted firms on SMT’s books (valued internally at 26% of NAV) and point out that the fund’s best period came when interest rates were close to zero.

- The buy-back will of necessity be funded by selling listed assets, which means that the proportion of unlisted assets will increase.

Elliot partner Nabeel Bhanji said:

We are grateful for the dialogue we have had with the board and management. We strongly support the company’s recently announced £1bn buyback – the largest buyback programme ever announced by a UK closed-end fund.

Tom Slater said:

We have a long-standing commitment to keep the discount low. [But] over the past two years we have had other calls on our available capital. We have paid back about £400mn of debt as we wanted to maintain a strong balance sheet at a time when the value of our listed holdings was falling. We also [made] follow-on investments in some of the unquoted stocks. It’s the board’s decision to do a buyback and their responsibility is to all shareholders.

Hipgnosis

Shares in SONG went up 8% at the end of last month after a due diligence report for the company’s auditors and lawyers was critical of the fund’s manager (HSM).

- If HSM were to be dismissed for breach of contract, a sale of the firm (possibly to Blackstone, owner of HSM) would be more likely.

The report confirmed the previously announced over-valuation of the music rights portfolio and said that HSM overstated revenue and profits.

- Growth projections were also ambitious.

This led to HSM over-paying for 67 of the fund’s 105 catalogue acquisitions. HSM disputes the findings:

There are aspects of the report that HSM strongly disagrees with and considers to be factually inaccurate and misleading. HSM will respond to the company’s board in due course.

Quick Links

I have eleven for you this week:

- Alpha Architect explained how to go about Minimizing the Risk of Cross-Sectional Momentum Crashes

- The FT told us to Forget boomers vs millennials, the next conflict is millennials vs each other

- And reported that Private investors have ramped up gilt purchases

- The Economist asked When will Americans see those interest-rate cuts?

- And said that The rich world faces a brutal spending crunch

- And bid us Welcome to an artificial-intelligence Utopia

- And that Generative AI has a clean-energy problem

- And asked What are “golden visas”?

- Discipline funds also wrote about interest rate cuts, asking No or November?

- UK Dividend Stocks gave us their UK Top 40 Quality Dividend Stocks: 2024 Q2

- And Bloomberg said that The LSE Losing Giants Like Shell Is a Very Real Threat

Until next time.