Irregular Roundup, 28th May 2024

We begin today’s Irregular Roundup with Jim Simons.

Jim Simons

Jim Simons, founder of Renaissance Technologies (Rentech) died earlier this month at the age of 86.

- His Medallion fund is probably the most successful of all time, with returns between 40% and 66% (depending on who you listen to) for decades, making the idea of efficient markets (the EMH) look silly at first glance.

They also provided an answer to the finance equivalent of “Ten Famous Belgians” – if technical analysis works, where are all the rich technicians? From their disclosure documents:

Renaissance uses quantitative analysis, specifically, mathematical and statistical methods, to uncover technical indicators with predictive value. This analysis is used to construct proprietary computer models that use publicly available financial data to identify and implement trading decisions.

It is a bit more complicated than that – Quant funds make money, but they aren’t stuffed with guys drawing lines on graph paper or looking for funny shapes in price charts.

He was a mathematician and hired other math experts – other firms do the same now, but he was first, and hardcore.

- He also stayed away from Wall Street groupthink by working out of Long Island.

Of course, the fund quickly became too large for outsiders to invest in and was restricted to staff.

- The larger funds that anybody rich could buy into were more comparable to other quant firms.

As John Authers pointed out:

Unlike the other pivotal figures in investment, such as Warren Buffett and Charlie Munger, George Soros, Peter Lynch, Jack Bogle or Ray Dalio, Simons avoided publicity. Interviews with him were rare, and he never presented his investment ideas in a book.

The recent “biography” (more of a history of the personnel involved in Rentech) by Gregory Zukerman also gave little away:

“Fundamental trading gave me ulcers.” Simons set out to build an automated trading system that could discover fleeting and overlooked patterns in prices.

“I want models that will make money while I sleep,” Simons told a friend at the time. “A pure system without humans interfering.”

Matt Levine reminded us that in “More Money than God” (2010), Sebastian Mallaby talked about Simon’s deputies:

Brown and Mercer trained themselves to approach problems in a manner thatmade sense for computers. Presented with apparently random data and no further clues, they sift it repeatedly for patterns, exploiting the power of computers to hunt for ghosts that to the human eye would be invisible.

“The signals that we have been trading without interruption for fifteen years make no sense,” Mercer explains. “Otherwise someone elsewould have found them.”

Thus the Medallion fund remains the archetypal black box as far as outsiders are concerned.

- And Simons is known to relatively few outside the quant world, considering his massive success.

Cliff Assness of AQR said:

To state the obvious, if we (or I) had a deep knowledge of how Medallion did it we’d do it too! I have always assumed they were quite early to things like stat arb, HFT, factor investing, natural language processing of financial news, etc., and were particularly good at optimally trading very high frequency signals and slower ones (a non-trivial trade-off) together.

But he also points out that the restricted scale of Medallion means that the EMH has not quite been killed off:

They figured out an amazing way to take out a few billion dollars a year from markets with very low (not zero) risk. That is nothing to sneeze at to put it very very mildly! But they didn’t crack how to run 100s of billions in institutional capital with anything like that risk-adjusted return.

Returns from private markets

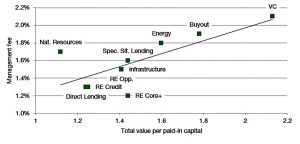

Joachim Klement looked at a study by Wayne Lim of Harvard of the returns from private markets.

Wayne somehow convinced an advisor to institutional investors to share the data of 10,791 private capital funds from around the world with vintage years from 1969 to 2020.

Jochim chose total value to paid-in capital (TVPI) as his measure of return, though he didn’t explain why he prefers it to IRR.

My limited exposure to private markets is mostly in the form of VCTs (which are not true VC).

- I measure both IRR and TVPI, but the VCT cycle of adding more capital every few months to evergreen funds means that IRR is more useful to me.

The funds never fully return the capital, and they trade at a discount to NAV, so each subscription produces a hit to TVPI (until you add back the tax relief).

One thing that is immediately obvious is that higher returns beget higher fees. Nothing unusual there, that is just how the financial industry works.

More interesting is the split of returns versus fees:

More established strategies like real estate show lower fees compared to the average level of return. More exotic strategies like natural resources or energy investments, on the other hand, show higher fees relative to the level of TVPI.

This indicates an inefficient market:

As funds become more mainstream, fees are increasingly reduced because more funds compete for the same pool of money.

Joachim makes four other points:

- Larger funds are cheaper

- European funds are cheaper than US ones

- Higher fees do not mean better returns

- Higher management ownership does mean better returns

I would also note that VC is the sub-class with the best returns (and the highest fees).

Capitalism

In a second article, Jopachim confessed to being a fan of capitalism, but worried about being in the minority.

- I know how he feels.

Capitalism is one of the best inventions humans have ever made. Capitalism is responsible for creating more wealth and progress than any other economic system ever invented.

Lifting people out of poverty, feeding billions and improving health are among its many achievements (not to mention the internet, smartphones and now AI).

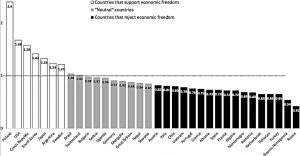

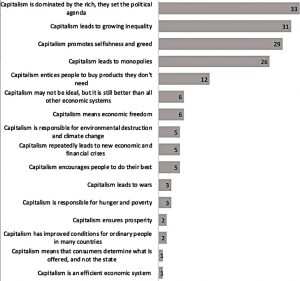

A recent survey of 35K people in 34 countries suggests that most people are not convinced.

The UK is classed as neutral, but many more countries are anti-capitalist than pro-capitalist.

The idea that capitalism is dominated by the rich is in the top 5 answers in 33 out of 34 countries. I can live with that.

The notion that capitalism is an efficient economic system in the top 5 statements of only one country. And the statement that capitalism has improved conditions for ordinary people only in the top 5 of 2 countries.

Capitalism needs some PR.

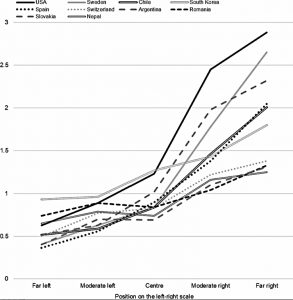

Joachim also had some political data.

- Whilst lefties generally don’t like capitalism, the picture on the right is more complicated.

Zitelmann identified a set of ten countries (among them the US, Sweden, and Switzerland) where people are more pro-capitalist the more to the right they are on the political spectrum.

Sadly the UK is not in this group.

Yet in more countries than that (16, to be precise), being on the far right of the political spectrum is associated with being more critical of capitalism. In these countries (among them the UK, Germany, and France) the moderately conservative people tend to be most in favour of capitalism.

The outlook for most is pretty bleak.

Commodities

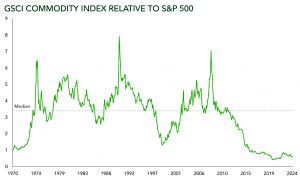

For Ruffer, Jasmine Yeo argued that commodities are cheap and could help with higher and more volatile inflation.

It has been an emotional ride for markets in recent months, with disinflation euphoria and hopes of multiple interest rate cuts making way for sticky inflation and interest rates staying higher for longer. Investors are increasingly questioning whether they need more exposure to the material world for a truly diversified portfolio.

The data released in April supported the idea that disinflation has stalled.

Core CPI rose at a three-month annualised rate of 4.5% in March and core PCE – ticked up to a three-month annualised rate of 4.4%. Both uncomfortably above central banks’ 2% target.

Commodities are as cheap as they have been for more than 50 years and might provide some protection if inflation ticks up again.

[Recent Ruffer research] explored asset class performance during inflationary episodes across the US, UK and Japan over the past 100 years. Commodities had a perfect track record of generating positive real returns during inflation regimes, averaging an annualised real return of 14%.

Ruffer sees a risk of 2% becoming the inflation floor rather than the ceiling and warns that gold alone won’t provide protection.

It was found to be unreliable on its own, having returned 13% annualised on average, but with positive returns only two thirds of the time. The Ruffer portfolio has 10% in the commodity theme, across oil and gold mining equities, copper and silver bullion.

Same here, minus the copper (I was too busy with tax year end and restructuring a portfolio to take the buy signal).

- I’m not sure Ruffer is right, but I do think most people re too optimistic about the prospects for stocks and bonds – particularly once we get through the elections on both sides of the Atlantic.

ARK

The European versions of the ARK active tech ETFs have finally arrived, some months after ARK took over Rize ETF.

- Some might think this is too late, having missed the tech boom that made manager Cathie Wood’s (now somewhat tarnished) reputation.

But no doubt there will be another tech bubble at some point in the next twenty years, and now we have three ARK funds to access it through:

- ARK Innovation (ARKK)

- ARK Artificial Intelligence & Robotics (ARKI) and

- ARK Genomic Revolution (ARKG).

Quick Links

I have just two for you this week:

- UK Dividend Stocks reported that Close Brothers has suspended its dividend: Should I sell?

- And Alpha Architect found Momentum Everywhere, Even Cross-Country Factor Momentum.

Until next time.