Irregular Roundup, 8th April 2024

We begin today’s Irregular Roundup with the rich.

Abolish the Rich

The Economist reviewed two books that want to abolish the rich:

- Limitarianism: The Case Against Extreme Wealth – Ingrid Robeyns

- Enough: Why It’s Time to Abolish the Super Rich – Luke Hildyard

Robeyns thinks people should be prevented from accumulating more than $10M, or just $1M in a country that provides healthcare and a state pension.

Hildyard (who runs the High Pay Centre think tank in London) wants a cap on income, at the level that would qualify you for the top 1%.

- In the UK, that was £180K pa in 2021/22.

He also wants a fat wealth tax.

The reasons the authors give for hating the rich include:

- environmental impact (private jets)

- housing shortage (multiple homes)

- political influence and corruption

- greater marginal benefit of money for the poor

- worse public services and more poverty

Some of these claims are false:

Like many on the left, they gloss over the huge fall in global poverty over the past few decades and focus on inequality within countries, which they are sure is rising inexorably thanks to the unfairness of capitalism. But is it?

The Economist thinks any that are true should be addressed at the source:

A pragmatist might tackle these problems directly, by taxing carbon emissions, allowing more homes to be built, tightening campaign-finance laws or cracking down on corruption. But for Ms Robeyns and Mr Hildyard, everything depends on cutting the rich down to size.

And disagrees that the proposed solutions are practical:

A marginal tax rate of 100% would provoke tax-avoidance on an epic scale. Brainy advisers would strain every synapse to help rich folk hide their wealth or shift it to friendlier jurisdictions. If, against the odds, a government managed to thwart such tricks, many rich folk would emigrate.

And if all jurisdictions toed the line:

Imagine a world where any gain above £180,000 a year, or $10m over a lifetime, was forfeit. Highly productive people—such as surgeons and engineers, never mind word wizards like J.K. Rowling—would have no financial incentive to keep working.

The proposals would also kill new ideas:

You have an idea for a better mousetrap. Under the old system, you might mortgage your house to raise cash to build a mousetrap factory, in the hope of making a fortune. Under the new system, you must shoulder the same risks for a small fraction of the rewards. Potentially big ideas would stay small.

And it would mean that capital-intensive businesses would need to be state-owned.

Since the record of state-run industries over the past century has been one of cronyism, sluggishness and inefficiency, this ought to have given the authors pause.

They leave the last word to Jean-Baptiste Colbert, Louis XIV’s finance minister:

He said that “the art of taxation consists in so plucking the goose as to procure the largest quantity of feathers with the least possible amount of hissing.” He did not add: “unless it’s a big goose, in which case strangle it.”

The world is divided into two groups: those who understand the power of incentives and those who do not.

- Like so many on the left, the authors are clearly in the latter camp.

My own experience is illustrative – as soon as I reached the point where the tax system no longer incentivised further work, I stopped.

- That is why rules like the LTA are counter-productive, and an incoming Labour government would be stupid to re-introduce the limit.

Freakonomics

The Economist also looked at why Freakonomics has fallen out of favour.

- Steven Levitt, the co-author of the book, announced his retirement from academia in March, saying “It’s the wrong place for me to be. “

He popularised the techniques of economists including David Card, Guido Imbens and Joshua Angrist, who together won the economics Nobel prize in 2021.

The idea was to exploit quirks in the data to simulate the randomness that actual scientists find in controlled experiments. Arbitrary start dates for school terms could, for instance, be employed to estimate the effect of an extra year of education on wages.

This was known as the “credibility revolution”.

One of Levitt’s biggest claims – that abortion of unwanted babies reduced crime – was undermined by a coding error.

- It’s possible that no-fault divorce was more important.

The book was also criticised for trivialisation.

- Using “The Weakest Link” to uncover racism and sexism in judgements of competence is entertaining, but may not have much read-across to real-world situations.

Levitt rowed with Nobel prizewinner James Heckman (also of Chicago University) who preferred “external validity” (widespread application) to the internal form.

Mr Levitt’s counterintuitive results have fallen out of fashion and economists in general have become more sceptical. Yet Mr Heckman’s favoured approaches have problems of their own. Structural models require assumptions that can be as implausible as any quirky quasi-experiment.

Sadly, much contemporary research uses vast amounts of data and the techniques of the “credibility revolution” to come to obvious conclusions.

Gold

Duncan Macinnes of Ruffer (whose eponymous fund has been having a bad time in recent months) was banging the drum for gold.

- It’s hit a new high in dollars, alongside the new highs in the Nikkei, Nasdaq and bitcoin.

Perhaps it’s not so much that these assets are going up, but that fiat money is going down. In recent weeks, we have increased our exposure to silver and gold equities, amounting to around 7% of the portfolio.

That’s quite a chunk – my metals holdings are at 2.1% right now (or 2.6% if you include BTC).

If you wanted one asset to express Ruffer’s long-term view – concerns about financial stability, inflation volatility and financial repression – gold might well be it. And, despite the new nominal highs, gold is still around 50% below its inflation-adjusted price peak in 1980.

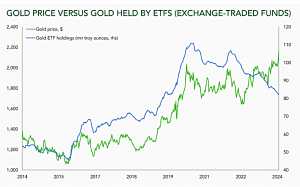

The new high for gold comes surprisingly against ETF outflows.

This gold bull market isn’t being powered by retail investors, wealth managers or advisors. A recent Bank of America survey found that 75% of advisors had less than 1% of their portfolios in gold and less than 10% were considering increasing their positions.

Duncan says these investors are heading to the bitcoin ETFs instead. So who is behind it?

Since the full-scale invasion of Ukraine, central banks and emerging market savers have been mega buyers of bullion, but they don’t buy ETFs or stocks. The western banking system could be a dangerous place for anyone who might one day be deemed a bad actor by capricious authorities – much safer to have bullion.

Meanwhile, as interest rates rose, gold came to look expensive relative to the dollar, real yields or cash rates, so investors have not been buying, leading to outflows from ETFs and miners.

Duncan notes that gold stocks are down 53% from 2011 and 35% from 2021.

They are shunned due to a history of poor capital allocation and ESG concerns. Listed miners’ valuations are attractive and the stocks are naturally leveraged to a rising gold price.

Other than price momentum, there are three potential catalysts for the bull to roar:

- Interest rates coming down

- Inflation going back up, or

- The crypto bubble popping.

Which brings us to:

Bitcoin $350K?

In his Adventurous Investor newsletter, David Stevenson looked at the evidence for a Bitcoin price of $350K (around five times the price at the time of writing.

His primary source is the Chairman of Phoenix Digital, a former NFT vehicle now converted to hold a collection of crypto assets.

- Phoenix trades on the Acquis exchange at a massive discount to NAV, so it’s a bit of a punt, but the firm is promising a capital return of 100% of NAV following the BTC halving later this month.

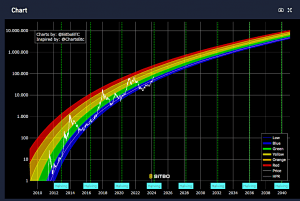

The first exhibit is the rainbow chart from Bitbo:

[Bitbo is] a real-time Bitcoin dashboard that allows anyone to monitor on-chain data, view live price action, and track key economic indicators. The rainbow chart shows the technical outlook for many crypt traders, based aroundthe all-important halving dates, with the next halving coming in April.

It’s based on regressions:

The Halving Price Regression (HPR) is a non-linear regressions curvecalculated using only the bitcoin prices on the 3 halving dates. Thismethod excludes the hype cycles to create a conservative trend line. Theb lue band is on trend (+/- 6 month) with each band above being anotheryear ahead of the trend line. Green = 1 year ahead of trend, Yellow = 2 years ahead, etc.

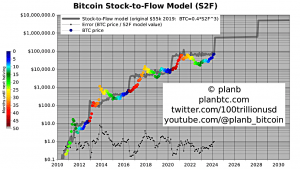

The second piece of evidence is the Stock-to-Flow chart from Plan B, which we looked at during the previous BTC bull run.

The model assesses asset scarcity by comparing stock to annual production, dividing the current stock (total supply) of Bitcoin by the annual flow (new supply). The higher the stock-to-flow ratio, the higher the price.

Or as David puts it:

We’ve seen a massive increase in cryptocurrency buying because of the new rules allowing bitcoin tracker funds to register in the US. But this increase in demand (and improved liquidity, I would guess) will cause a supply constraint as the halving kicks in. We’ll see a big reduction in bitcoin mining output just as the demand increases.

Here’s hoping.

Quick Links

I have eleven for you this week:

- David Stevenson said that The investment company bubble has burst and the shakedown begun

- UK Dividend Stocks gave their Portfolio 2024 Q1: Results season review

- The FT watched as Momo goes vertical

- And reported on The fading ex-Mag7 earnings outlook

- And said that Buffered ETFs make gains in retirement portfolios

- The Economist asked Could weight-loss drugs eat the world?

- And said Think Tesla is in trouble? Pity even more its wannabe EV rivals

- FT Adviser reported that UK investors pile into US equities in record quarter

- AQR said that The Long Run Is Lying to You

- Advisor Perspectives said Think UK Stocks Are Cheap? Try Buying a Whole Company

- And Alpha Architect looked at Short Campaigns by Hedge Funds

Until next time.