Irregular Roundup, 7th May 2024

We begin today’s Irregular Roundup with swap funds.

Swap funds

Swap funds are in the news after startup firm Cache launched a product designed to make them accessible to less wealthy techies.

- Swap funds (also known as exchange funds) are designed to get around the problem facing staff in Big Tech – that a lot of their compensation comes in the form of company shares.

This means that staff have a massive exposure to the success of the firm they also work for.

- Corporate collapses such as Enron and Worldcom mean that US investors are well aware of these risks.

Swap funds provide diversification because under US tax law, pooling your shares (via a partnership) with those of staff from different tech firms doesn’t count as taxable disposal.

- Most tech staff will be sitting on large capital gains, and federal and state taxes on gains in California can reach 49%.

The issue is that until now you would have needed to hand over quite a chunk of stock – usually £1M.

- Cache lowers the bar for entry to “just” $100K.

The price for this is agreeing to a seven-year tie-up of your stock.

- On the other hand, Cache offers 90% margin loans against the stock.

Cache’s offering is currently designed to mirror the Nasdaq, though the firm is keen to widen out beyond tech.

- Sticking close to the index means that some stocks are more in demand than others (the fund is currently short of Amazon and Microsoft.

Cache founder Srikanth Narayan (ex-Uber) says:

The mission is to make these financial products – that have typically been in the upper echelon – available more broadly. All of my friends and colleagues are talking about the same thing, which is that more of their net worth is tied up in a single stock.

For Bloomberg, Matt Levine was interested in what this might do to incentives:

What if all of the midlevel employees of all of these companies ended up owning diversified portfolios of all of them?

This is an extension of one of the arguments against index investing:

If every public company isowned by diversified investors who also own all of its competitors, will those companies have less incentive to compete?

One of the main defences has been that while institutions are not incentivised to compete, the staff are. But perhaps not if Cache’s fund takes off.

There are also potential tax implications, at least for California – 6% of 2023 tax revenues came from stock grants in just Meta, Nvidia, Apple and Alphabet.

- But this assumes that Cache is used by those who would otherwise sell their stock, rather than those who would otherwise hold to retirement.

And Cache is not big enough yet – the fund only holds $50M, though it has a pipeline of a further $1.2 bn of stock.

Divestment

Joachim Klement looked at institutional divestment from fossil fuel companies.

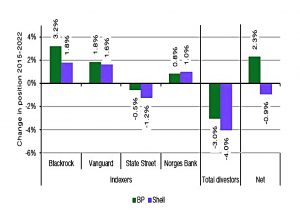

David Whyte from the Queen Mary University in London tracked the changes in shareholding of the 20 largest institutional investors in the two UK oil majors after the Paris Climate Accords in late 2015 until 2022.

The largest institutions increased their holdings – only the smaller shareholders divested.

Blackrock and Vanguard together with Norges Bank [the Norway sovereign welath fund] all increased their shareholdings in BP and Shell.

The reason is that index tracking is becoming more popular, and index funds have to hold the fossil fuel firms,

The total selling pressure from divestment campaigns was so tiny that the growth of index trackers more than compensated for it. Simply put, divesting institutions succeeded in selling all their shares to index trackers. And no matter what the management of BP and Shell are doing, these index trackers will never sell their shares.

Lotteries

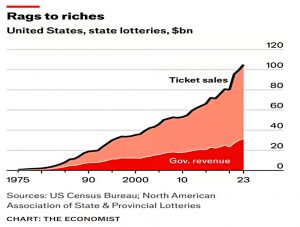

The Economist looked at the economics of US state lotteries.

- The multi-state Powerball recently offered a $1 bn jackpot, at odds of one in 292M.

Sales in 2023 were $100 bn, and lotteries retain an average of 30% of sales (compared to 10% for casinos).

Were they a single company, America’s lotteries would be the ninth-most profitable in the country.

The newspaper offers three reasons for their popularity:

- They are ubiquitous. Some 45 states, and the District of Columbia, operate them.

- Low prices mean that anyone can afford to play; vast jackpots add to the excitement.

- Proceeds tend to go to worthy causes, such as public education or programmes for the elderly.

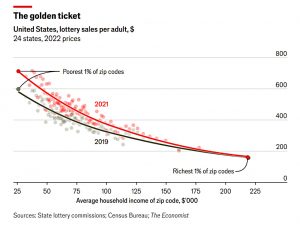

Sadly, they are much more attractive to the poor:

- In the poorest 1% of zip codes, the average American adult spends around $600 a year, or nearly 5% of their income, on tickets.

- That compares with just $150, or 0.15%, for those in the richest 1% of zip codes.

- The poorest households spend roughly 30 times more on lotteries.

And Covid has made the gap bigger.

Dividends

For Investors’ Chronicle, Alex Newman claimed that dividends are more important than ever.

- He begins with Modigliani and Miller’s 1961 argument that the capital structure of companies is irrelevant to the value, and by extension, there is no optimum dividend payout ratio.

In practice, taxes change this situation, making debt more efficient than equity, and share buybacks more efficient than dividends.

Today, the dividend irrelevance theory is a foundational lesson of corporate finance. It helps explain why businesses ranging from some of the world’s most successful companies, such as Amazon and Alphabet (US:GOOG), to London’s three largest stock market debutants of recent years – THG, Deliveroo and Oxford Nanopore – have never paid a dividend.

Alex has a different argument:

At some point, whether out of choice or necessity, assets need to produce an income.

Which I would argue would come from a partial share sale.

- Of course, selling when the share price is down is harmful (in the same way that share buybacks above intrinsic value aren’t helpful).

But the converse is true – sales at high prices (and buybacks at low prices) are helpful. And as Alex points out:

The pro-total return crowd could cite plenty of counterexamples of dividend cuts that were compounded by income investors’ subsequent forced selling.

Dividends are not a good thing (unless they are tax-advantaged, as those from VCTs are in the UK).

- But the belief that they are is another one of those bad investing ideas (along with IPOs, annuities, averaging down, “it’s different this time”, lottery stocks and indeed lottery tickets) that will never die.

Investment Trusts

For the FT, Sally Hickey reported on the hedge funds circling UK investment trusts.

- The average discount to NAV on the UK’s £200 bn of ITs is now 9%.

The discount has put some investment trusts on the brink of being wound up or targeted by hedge funds including Paul Singer’s Elliott Management and Boaz Weinstein’s Saba Capital.

Sally identifies three problems that have led to the recent unpopularity:

- Higher interest rates lured investors into government bonds

- The proliferation of alternative vehicles [ETFs] allowing easy access to a range of global assets

- In 2022, the way investment trusts’ fees were presented to some investors was changed, in response to new guidance on rules originally introduced in 2018.

ITs have an advantage over OEICs for investing in illiquid underlying assets (for example, property or private equity) but ETFs have the same advantages.

- I have personally moved the majority of the money I used to hold in ITs over to ETFs, though I still hold dozens of the former.

Hipgnosis

After months of crisis and disappointment with the Hipgnosis Songs Fund (SONG), we now have a bidding war.

- Blackstone has made a counter-offer of $1.24 per share in cash to the previous offer of $1.16 from Concord.

It turns out Concords is backed by Apollo, so this is now a battle between private equity titans.

- The share price is up 40% in a week and almost back at the 2018 launch price (though still more than 15% short of its all-time high).

Blackstone said that this was its fourth offer for SONG, with the previous offers being rejected by the new board.

- Blackstone is the majority shareholder in HSM, the funds’ managers, and HSM has a call option for six months on the funds’ assets.

HSM would only need to match Concord’s offer, which is higher than the NAV and the pre-offer share price.

- But the option expires if HSM is terminated for breach of contract (as the new board may be looking to do).

Labour watch

The Labour Party keeps its cards close to its chest on tax plans, so we must look to think tanks for clues.

The Institute for Fiscal Studies (IFS) has recommended removing three IHT reliefs to raise £3 bn a year.

- Scrap the AIM stock exemption

- Cap the agricultural and business property exemption

- Tax pensions when they are passed down to descendants.

£3 bn is a decent hike on the current IHT take of £7 bn a year, but it’s a drop in the ocean in the context of annual government spend.

- Still, I can see Labour making any or all of these changes, despite the consistent unpopularity of IHT.

David Sturrock of the IFS said:

Inheritance tax is littered with special reliefs and exemptions which make the tax unfair.

Quick Links

I have six for you this week:

- Of Dollars and Data asked Whose Tax is it Anyway?

- Bloomberg reported that Apollo Had Some Death Bets

- The Economist said that America’s reckless borrowing is a danger to its economy—and the world’s

- Joachim Klement looked at Exorbitant privilege or why the UK cannot do what the US does

- Alpha Architect wrote about Momentum and the Clarity of the Trend

- And Discipline Funds has a great Macro Dashboard.

Until next time.