Klement on Cassandras – Part 2

Today’s post looks again at a series of articles from Joachim Klement on forecasts of doom and gloom.

Against Cassandras

There are eight articles in total, written over the summer of 2023.

- Last time out we looked at the first four, so today we have another four to cover.

Inflation

The key argument here is that printing money used to lead to inflation.

- Joachim has previously written about how this relationship has broken down since the 1990s.

First, we no longer live in a world where once a central bank prints money the money stays in the same country. Second, we no longer have to invest money in the real economy to generate profits.

When a central bank creates money, a bank doesn’t have to lend it to businesses and consumers and neither do businesses and consumers have to spend that money in the real economy. We are perfectly happy to invest it in paper like US Treasuries.

This means that the money never reaches the real economy – we get asset price inflation instead of real inflation.

This tendency for banks to not lend money in the real economy is stronger the more costly it becomes for banks to lend, i.e. the lower interest rates are and the more capital they have to hold against loans they hand out.

Joachim adds that consumers and businesses will also save rather than invest if they think that investments will do well.

This certainly seemed to be the case until Covid, when furlough money (in the UK) and helicopter money (in the US) teamed up with supply chain issues to create real inflation.

The inflation spike of 2022 was triggered predominantly by the supply shock in energy commodities triggered by the Russian invasion of Ukraine and the supply shock from global supply chain disruptions in 2021. In essence, 2022 was a repeat of the 1974 OPEC oil shock or the 1990 oil shock after Iraq invaded Kuwait.

That’s all true, but I’m sure the free money had something to do with it.

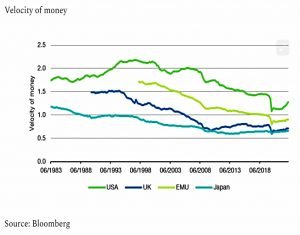

A more sophisticated version of [Joachim’s]argument is that the velocity of money is low.

Here again, we see the impact of Covid funds.

Joachim expects inflation to decline to 3% or less ben the end of 2024.

- The key risk is interest rate cuts whilst inflation is still above normal levels (as happened in the 1970s).

These cuts in interest rates then created more demand and about a year later, inflation started to rise again. Central banks were forced to reverse course once again and hike rates but starting from much higher levels than in the first round.

Which led to stagflation (high inflation and low growth).

Joachim would like to see slow cutting through 2024.

The Euro

Joachim has a confession:

I am a fan of the political project of unifying Europe and the European Union.

I must admit that I am not. But:

I think the Euro in its current form is deeply flawed and if nothing is changed, the Euro will eventually seize to exist.

So the discussion here is how long that might take, and more importantly, whether anything will change to stop it from happening at all.

The big problem with the Euro is:

With the creation of the Euro, the member states of the Eurozone gave up control over their monetary policy and entered a fixed exchange rate regime with other member states. At the same time, capital was allowed to flow freely between the members of the Eurozone.

But as the Greek debt crisis of 2011 showed, you really can’t have an independent fiscal policy either.

Reckless fiscal policy and excessive deficit spending can lead to all kinds of imbalances within the member states.

For pre-EU types, the solution is a federal government, as per the US and Switzerland.

A central government ensures that individual states cannot enter into excessive debts. [and] that major expenses like defence, social welfare and retirement systems are harmonised across states.

I can’t see this happening, but Joachim agrees that the alternative is that the Euro (and the EU) will collapse.

I would argue it won’t happen in my lifetime. But remember that many social projects were unimaginable and ‘will never happen’ until they did. Think of Catholics and Protestants living together peacefully or of black and white people going to the same school or eating in the same restaurant.

So the question becomes whether the current system can survive for another 50 to 100 years.

- Joachim thinks that it can.

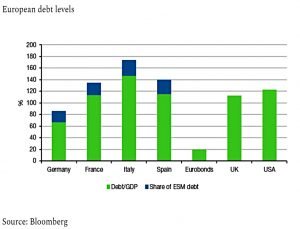

Germany has a lower debt than the US and UK, Italy has more, and France and Spain have around the same levels.

- Since the Greek crisis, we have the European Stability Mechanism (ESM) which lets Italy borrow money which is underwritten by the whole Eurozone.

The Covid rescue schemes (NGEU and SURE) were also funded by true Eurobonds, underwritten by all countries. So if Italy defaults:

The ECB could start buying the NGEU and SURE bonds in the secondary market to stabilise their prices and prevent them from defaulting.

Why can the Bank of Japan successfully monetise debt for thirty years and counting without creatinginflation or a default? If the Bank of Japan can do it, why shouldn’t the ECB be able to do the same thing?

Joachim also expect that in a crisis, extra taxes would be levied across the whole Eurozone to pay the interest on the bonds.

Thanks to the introduction of Eurobonds in 2020, the fiscal headroom for the Eurozone is about three to four once-in-a-century pandemics or ten to twenty global financial crises. And that should get us through the next 50 to 100 years without a problem.

World War 3

Most people think about geopolitics in the narrow sense of war, civil war, and terror acts. And many investors think that these things matter for their portfolios.

Joachim thinks they mostly do not.

- In the previous post, we looked at a chart of stock markets since 1900.

You will not be able to find the Vietnam War, Afghanistan or the Iraq Wars, September 11, or other geopolitical events in this chart. They simply don’t matter, or at least

they don’t matter for more than a few days or weeks.

Of course, some things do matter:

The Russian invasion of Ukraine did matter because of the impact it had on energy prices and in particular natural gas prices. Learning how to identify which geopolitical events matter and which ones don’t is key to being successful as an investor.

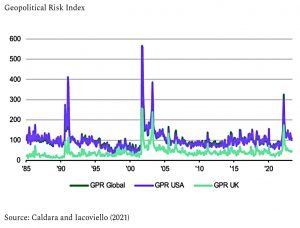

The Geopolitical Risk Index [GRI] by Dario Caldara and Matteo Iacoviello is based on news

reports about geopolitical events like wars, civil wars, terror attacks, etc.Since 1985 the major spikes indicate the US war against Iraq in 1991, the September 11 terrorist attacks, the start of the Iraq Wart in 2003 [and] the Russian invasion of Ukraine in 2022.

But only the Russian invasion led to a bear market.

The start of the Iraq War was literally the day when the multi-year bear market ended and a new bull market began.

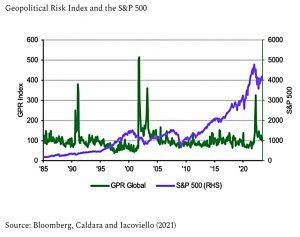

The correlation between the S&P and the GRI is close to zero (-0.06).

If I restrict my analysis only to the 5% largest spikes in the Geopolitical Risk Index the correlation with the S&P 500 in the same month is -0.16 and with the S&P 500 in the following month is +0.05. In other words, not even one in twenty geopolitical risks matters for the stock market.

Returning to the common theme of his articles, Joachim says that the stakes are so enormous for geopolitical crises that the most likely outcome is that someone will stop escalation before it is too late.

We rarely fall off a cliff. And investing based on the assumption that we will fall off a cliff is going to lose you money.

Performance impacts

Article number eight looks at the performance impact of listening to Cassandras.

- Or in other words, at tail risk hedging.

The performance track record of tail risk strategies is so poor that you would be ill-advised to even think about hedging such extreme events.

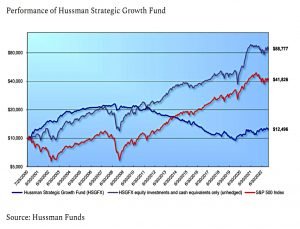

To make his point, Joachim picks on the Strategic Growth Fund run by John Hussman.

His fund tries to beat the S&P 500 through two components. First, he is a traditional stock picker, selecting stocks in the US that he thinks will outperform the index overall. Second, he can temporarily hedge all or parts of his portfolio against downside risks through the use of derivatives.

This worked well in 2008, when he hedged successfully, but has been unsuccessful since 2010.

Hussman is a good stock picker and has outperformed the S&P 500 by a significant margin before the tail hedges were implemented.

But the negative impact from the tail hedges swamped that outperformance.

Since the inception of the fund, the annual return of the fund was 0.99% compared to 6.54% for the S&P 500.

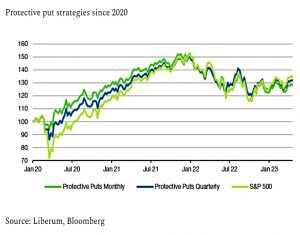

Joachim quotes another study that looked at three portfolio protection strategies:

- Out-of-the-money put options

- Straddles for long vol exposure (used by lots of hedge funds)

- Long Vix futures

None worked well, but:

The performance of the different tail hedging strategies varied by a large amount and was timing and path dependent. In other words, if you can time the markets well, tail hedging can be profitable.

But of course, if you can time the market you don’t need tail hedging.

Even since 2020, hedging has lost money.

And that is in a period when we had the worst pandemic in 100 years and a bear market in the S&P 500 as well as a spike in inflation to 40-year highs. The outperformance you accumulated during the pandemic year was gone by mid-2021. To make money [you] would have to be able to time both the start and the end of the pandemic.

And that’s – we’ve looked at all of Joachim’s eight articles.

- I don’t know about you, but all this optimism has cheered me up a little.

Until next time.