The Advice Gap

Today’s post is a look at an old report from OpenMoney on the advice gap in UK financial services.

OpenMoney

OpenMoney is the name for what was once robo-advisor evestor, run by Anthony Morrow, who says:

There’s a justifiable belief that traditional face-to-face financial advice is only accessible to those who have already accumulated wealth.

Robo-advice is often touted as filling the mass market advice gap, but while some digital providers now offer one-off advice, many simply offer online investment management without real financial advice and personal recommendations.

It still trades as evestor as well.

According to the report, OpenMoney “combines online financial advice with intuitive money management tools to help you make the most of your money”.

- So it has a dog in this fight, even if the firm is now distancing itself from robo-advice.

The advice gap

The report is called The UK Advice Gap, and it sets out to discover whether consumer needs for advice and guidance are being met.

- The research was carried out by YouGov, and the report appears to have been put together by The Lang Cat consultancy.

The report builds on similar work by Citizens Advice in 2015.

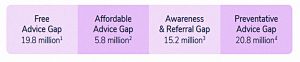

There are actually four advice gaps:

- The affordable advice gap affects consumers who are willing to pay for advice but think it is too expensive.

- The free advice gap affects people who want advice but are unable to pay for it and are unaware of, or unable to access free services.

- The awareness and referral gap affects people who do not know where to get advice.

- The preventative advice gap affects those for whom non-money issues can impact their financial position.

The number of people in the affordable advice gap is up by 400K since 2015.

- The free advice gap has increased by more than 5M people, as has the awareness and referral gap.

- The preventative advice gap is actually shrinking, down from 23M in 2015.

The survey

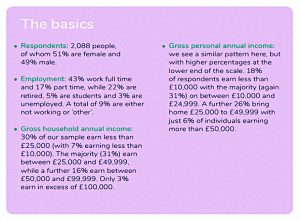

More than 2,000 people were interviewed in January 2019.

- 60% were employed and most earned between £25K and £50K.

- Only 3% earned more than £100K.

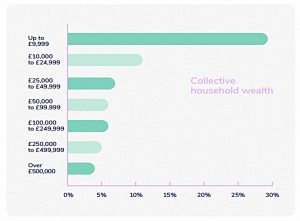

Median net worth was around £50K.

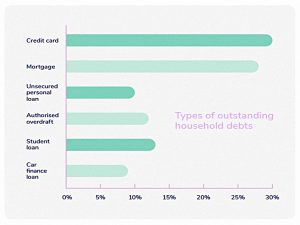

Mortgages and credit card debts were the most common form of debt, but only 30% of people had these.

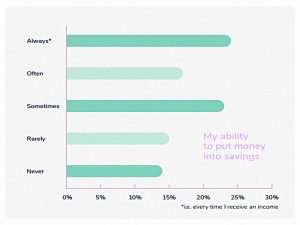

Savings

Most people struggle to save reliably.

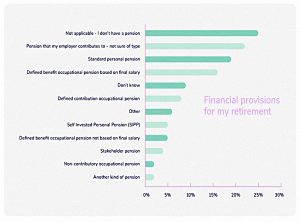

Less than a third of people have a pension other than a work pension.

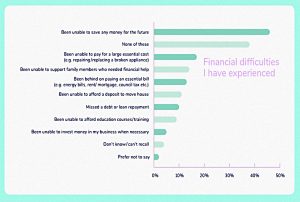

Problems

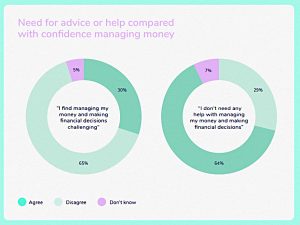

- 30% of people find managing money challenging

- During the last year, 46% have run out of money before

their next pay packet - 33% have used short-term credit

- 27% have borrowed money from friends and family

- 46% said they had been unable to save any money for the future

- 17% said they had not been able to pay for something they needed

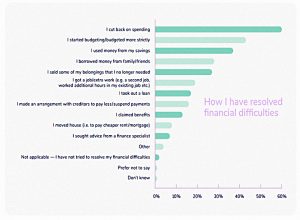

The most common solution was to back on spending, followed by stricter budgeting (the same thing?) and using up savings.

- Only 7% had looked for financial advice.

Confidence

Pensions look to be the most confusing area for most people.

25% only plan one month in advance and while one-fi fth (21%) plan a year or more in advance, a similar proportion (19%) don’t plan ahead at all.

Advice

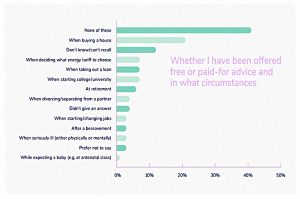

41% have never been offered advice.

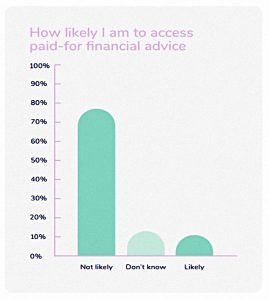

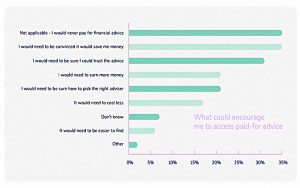

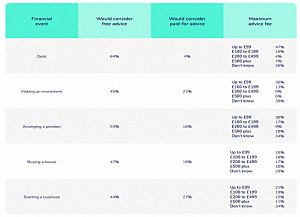

Only 10% were likely to pay for advice.

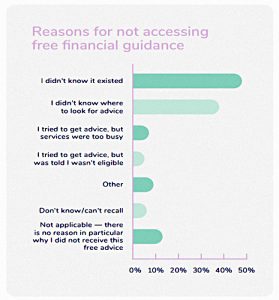

Most people don’t know that advice exists, or where to look for it.

45% would prefer to do their own research, and 32% thought that they did not need guidance.

Agencies

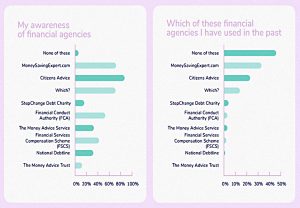

MoneySavingsExpert, Citizens Advice and Which are the chief source of advice.

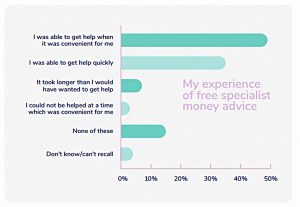

People are generally happy with the advice they have received.

OpenWork

As luck would have it, IFA network OpenWork (no relation) published their own research a week after OpenMoney.

- They found that 15% of people saw a financial adviser (23% for men, 10% for women).

Another 56% said they would benefit from advice.

- Amongst the under-35s this rose to 71%.

Forty per cent of respondents would like their employer to offer advice.

- 40% also worried that they did not know enough about money

- and 33% were not confident with money.

The numbers are different, but the existence of an advice gap is underlined.

Conclusions

This is not a particularly easy problem to solve.

- Good advice is expensive, and most people don’t want to pay for it.

Further, those with smaller portfolios (less than £250K and in particular, less than £50K) would find it difficult to justify in any case.

These reports don’t offer any quick solutions – they simply describe the scale of the problem.

Key findings include the gap between how good people think they are at managing their finances and the problems that they are running into.

- And that people are unaware that advice/guidance exists, and how they can get hold of it.

Robo-advisors have not been the magic wand that some people hoped they would.

- They mostly match investors to model portfolios on the basis of a risk questionnaire.

There’s still time for that to change, as robos currently have only a 1.8% share of the online investment market.

- Until next time.