Pensions Tax Blueprint – IFS

Today’s post looks at a recent report from the IFS on the reform of the tax relief system for pensions.

Contents

Pensions Tax Blueprint

The Institute for Fiscal Studies has published a study called “A blueprint for a better tax treatment of pensions”, sponsored by Abrdn (owner of Interactive Investor).

The IFS is not happy about the current incentives for retirement savings.

The current system of pensions tax provides overly generous tax breaks to those with the biggest pensions, those with high retirement incomes and those receiving big employer pension contributions.

The lump sum

The proposal that grabbed the headlines in the financial press was a cap on the 25% tax-free lump sum on pension commencement (the PCLS):

While popular, this provides a large tax subsidy to those with high incomes and big pensions but is of no value at all to those with the lowest incomes in retirement: nontaxpayers.

At a minimum, the tax-free component should be capped so that it only applies to 25 per cent of, say, the first £400,000 of accumulated pension wealth: this would still leave about four in five of those approaching retirement unaffected.

This is a common approach these days – if something doesn’t affect the majority, we needn’t worry about the impact on the minority, even if that minority has been playing by the rules for decades.

- For example, many people approaching retirement may be planning to use the tax-free lump sum to pay down their mortgage.

Jon Greer at Quilter wasn’t impressed:

Applying it retrospectively would trigger a massive backlash. You could even go as far to suggest the government might be subject to claims of human rights infringements. People would likely feel an unwritten pact had been broken and it could seriously damage the reputation of pensions.

I doubt it will happen, but I would certainly feel cheated.

Other proposals

The second big proposal is to bring pensions back into the IHT system.

- That’s not such a big problem, since the relief has only been around for a few years, but with the IHT already threshold frozen for so long, many more people are already paying IHT than were originally intended to.

It’s also the case that the current arrangements mean that many people use pensions for IHT planning rather than for providing a retirement income as intended.

Proposal number three is to exempt pension contributions from NIC, in exchange for adding NIC to pension income.

- This is a simple transfer from retirees to those of working age, and the way in which was introduced would be crucial.

There’s also a logical argument that since NICs are payments into an insurance scheme, those who have reached the age to draw from the scheme should not still be making contributions.

- And a moral one that those who didn’t receive NIC exemption on their contributions should not now be paying NIC on their withdrawals.

A fourth proposal is a 6¼% taxable top-up to all pension withdrawals, designed to even out the relief provided to basic-rate, higher-rate and non-taxpayers.

- We’ll look at that in more detail below.

On the plus side, the IFS would also like to see more generous annual and lifetime pension allowances.

- And they would like to see the LTA on DC pensions replaced by a lifetime contribution limit.

That would mean that you couldn’t breach it by accident, and you needn’t suddenly change your plans after a few years of good returns.

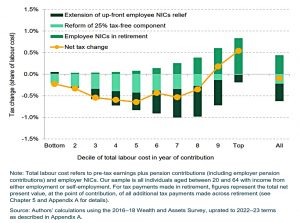

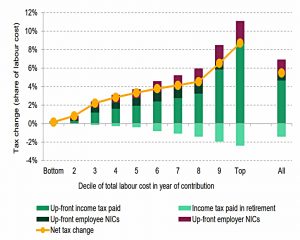

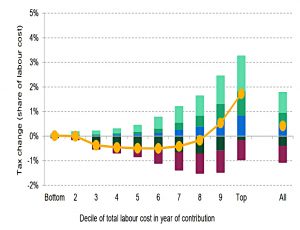

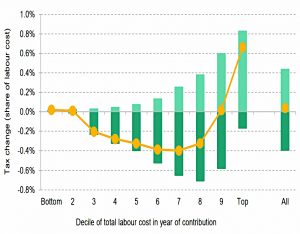

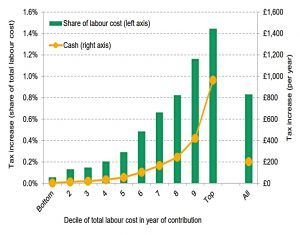

Here’s a chart of the calculated impact of all the proposals on those of working age (by income decile):

The lowest eight deciles show a net gain and the top twenty per cent lose out.

EET

Whilst I might not agree with the proposals, the report has a lot of interesting pensions data and more charts, so let’s have a quick review.

Pension systems are classified using an ABC system, where each of the letters can be T for taxed or E for exempt. The three stages described by the letters are:

- Before entering the pension

- Inside the pension, and

- Leaving the pension

So the basic UK pension system is EET (tax on withdrawals) rather than the TEE system (tax before contributions) used for ISAs.

- EET is usually more generous because of the growth from a larger base, and because tax bands tend to lower in retirement.

In addition:

- 25% of the pension pot (the PCLS) is tax-free (EEE), and

- NICs are applied to employee pension contributions on a TEE basis (employer contributions are EEE – they don’t attract NICs).

So pensions are mostly EET, with some EEE and a bit of TEE, which would be confusing if the typical member of a pension scheme was interested in this kind of thing.

Contributions

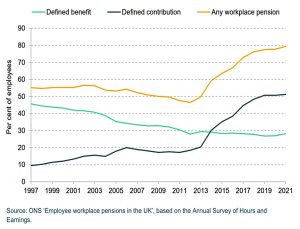

In one sense, the decline in DB pensions has been more than fixed by the introduction of workplace auto-enrolment (into DC plans).

- But there’s a big divide here between public sector jobs (where 82% have a DB pension) and the private sector (where just 7% have a DB pension).

It’s also worth noting that the default DC contributions of 8% on income between £6K and £50K do not form an adequate pension provision.

Pensioner income

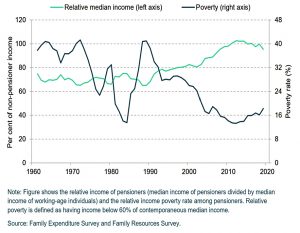

Auto-enrolment and the triple lock on the state pension mean that pensioner income has risen (and pensioner poverty has fallen) since the 1980s.

Generational wealth

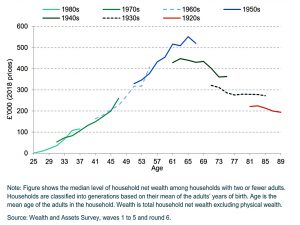

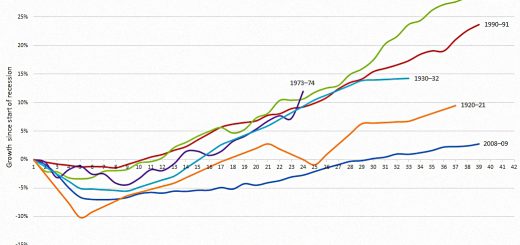

This chart is a bit more complicated to interpret, but broadly speaking, people got richer (by a particular age) from the 1920s to the 1950s, and since then things have stayed fairly constant.

- This reflects decreasing property wealth by age, which offsets increasing pension wealth.

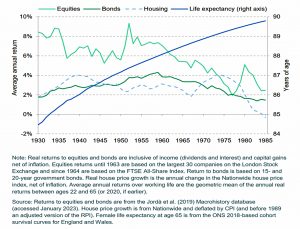

This is another complicated chart which shows that:

- Returns from stocks and bonds have been lower for younger people (as interest rates have fallen for the last 40 years)

- Returns from housing have declined recently

- At the same time as returns have been declining, life expectancy has been increasing

This makes the pension equation more difficult for younger cohorts.

- They get to live longer, but will probably have to work longer to fund their retirements.

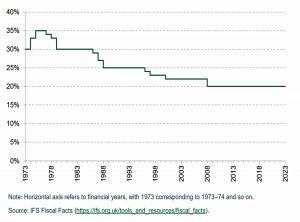

Against this, the basic rate of income tax has been falling since the late 1970s.

- The IFS argue that this constitutes a windfall gain to those who started saving when the income tax was higher (which in turn they use to justify increasing tax for those who saved into a pension believing that 25% of it would be tax-free).

Comparison with TEE

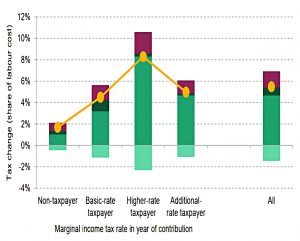

The next section of the report looks at the theoretical impact of a switch to TEE (full up-front taxation) compared to the system used today.

- Looked at by marginal tax band, higher-rate taxpayers save the most.

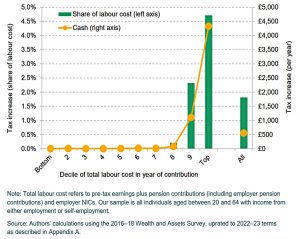

Looked at by earner decile, higher earners are getting the biggest tax breaks at present (as you might expect).

Comparison with EET

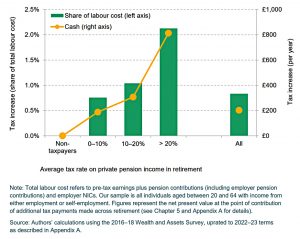

The section after that compares what we have now with EET – so no 25% tax-free lump sum but full tax and NIC relief on the way in.

- This system raises slightly more tax than at present, but it all comes from the top 20% of earners.

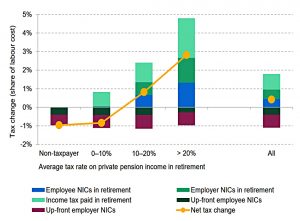

Looking at retirees, all of the extra tax would be raised from those whose average tax rate is greater than 10% (which I guess would be those with more than £25K pa of pensions).

Costing the options

Chapter 7 of the report looks at the impact of the various options for reform.

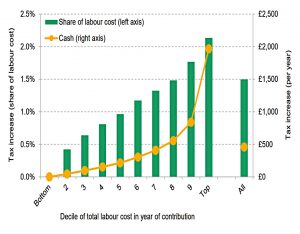

First, up is limiting pension tax relief to the basic rate of 20%.

- This massively impacts the top two deciles of the earnings distribution, but hardly affects anyone else.

A 30% flat rate of relief goes even further, with negative impacts for the top two deciles and positive ones for everyone else.

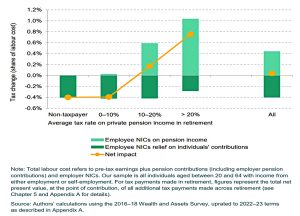

Adding NIC relief to employee contributions, but pairing this with NICs charged on pension withdrawals, has a similar pattern of effects but at a smaller scale.

It also has similar impacts on retirees to the EET system, with those averaging more than 10% in tax at the moment paying even more.

Adding NICs back to employer contributions affects everyone, particularly the top deciles.

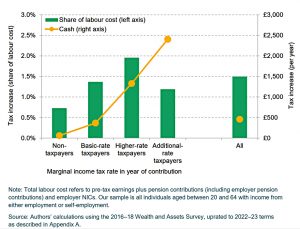

And also particularly higher-rate taxpayers.

Abolishing the 25% tax-free component also hits the top earnings deciles disproportionately.

And in retirement, hits those who already pay more tax on their pensions.

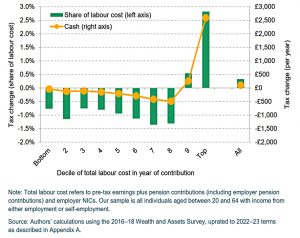

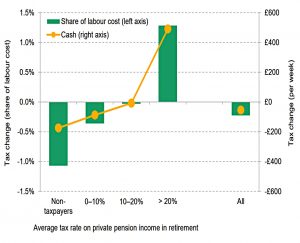

Finally, the IFS presents the embodiment of its Robin Hood goal to take money from the richest pensioners and give it to the poorest.

- Replacing the 25% tax-free lump sum with a 6¼% taxable top-up would mean that those paying an average of less than 20% tax on their pension income would not lose out at all.

The downside is that is it not self-funding (the average person would gain a little from the change).

It’s fair enough if the government (or more likely, a future Labour government) wants to do something like this for future pension contributions.

- But applying it retrospectively to those of us who have been planning for retirement and contributing to pensions for forty years is immoral.

Until next time.

So one week it is the possible demise of ISA’s and the next week pensions are under attack. And this in a country, that according to Eddie George on Sunday, just does not save enough! Joined up thinking indeed??

Hard to believe the lengths people will go to to dodge the inevitable conclusion that if you consistently live beyond your means you will ultimately all have to pay for it!

This morning the Resolution Foundation was back with a recommendation that it should be harder to get money out of pensions. It will be like this until we get through the Budget in March.

You are of course correct and the period leading up to every budget often seems to be “silly season”.

Having said that there is a serious point and that is that all this doom and gloom may inadvertently cause an already sceptical public to be less and less prepared to invest for the long term.

IMO the 25% tax free should be viewed as a bonus for locking up your money in a pension for many years and not some sort of scam for the relatively wealthy to further fund the rest.