Weekly Roundup, 7th November 2022

We begin today’s Weekly Roundup with inflation.

Inflation

John Authers looked at the optimism around a prospective decline in inflation.

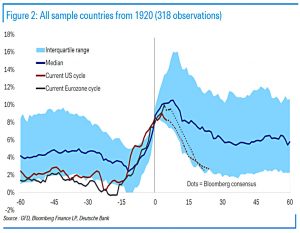

- Jim Reid of Deutsche Bank looked at 318 instances of inflation reaching 8% over the last 100 years (in either a developed or emerging economy).

The consensus view (as collated by Bloomberg) is for as rapid a fall back to 2% as ha ever taken place.

- The median result has us at 7% even five years from when 8% was first hit (say end of 2026).

Once prices are rising this fast, inflation begins to embed in people’s expectations, and more work is required from monetary policy to bring it down.

The macro-economy is unlikely to offer the chance of a pivot any time soon. A financial accident might force central banks to reverse – we need to be careful what we wish for.

Yield curve control

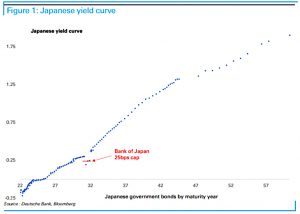

John also looked at the localised impact of “yield curve control” (YCC), as currently practised by the Bank of Japan.

The three dots sitting below the curve are the three reference maturities that the BoJ program is targetting.

- The 10-year yield is stuck at 0.25%, as the central bank intends, but the nine-year and the eleven-year bonds both yield much more.

So the real-world financing conditions in Japan are little impacted by the program.

- John thinks that YCC should be abandoned (which might have the effect of boosting the yen).

The chart comes from George Saravelos of Deutsche Bank, who said:

The “broken” curve not only demonstrates the scale of policy distortion but its likely limits too: With the Bank of Japan reaching near-full ownership of those three specific bonds, the time is soon approaching where these bonds will stop trading in their entirety and the market will simply cease to exist. There will be no willing seller of 10-year bonds at the Bank of Japan’s designated purchase “price”.

ESG pushback

John’s third piece this week looked at a letter to Larry Fink, BlackRock CEO, from John Schroder, Louisiana’s state treasurer.

- The state is divesting from all BlackRock funds because of the latter’s pro-ESG position.

Schroder writes:

Your blatantly anti-fossil fuel policies would destroy Louisiana’s economy. This divestment is to protect Louisiana from actions and policies that would actively seek to hamstring our fossil fuel sector.

Your support of ESG investing is inconsistent with the best economic interests and values of Louisiana. I cannot support an institution that would deny our state the benefit of one of its most robust assets. We cannot be party to the crippling of our own economy.

That’s a lot of ways of saying the same thing, and the thing is dubious.

- BlackRock still offers non-ESG funds, and Louisiana used to own some of them.

At the same time, the state is within its rights to invest with whoever it wants.

The issue gets less clear when we consider that fund managers might be backing ESG because they think it has long-term economic benefits (rather than shorter-term financial returns to fundholders).

- Or even worse, because of some wider non-economic benefits in the future.

John explains it generously:

The act of offering someone a pension means giving them a good and comfortable retirement. For ESG advocates, that means boosting clean energy so that they don’t retire into an arid and polluted environment. For Louisiana, it means making sure that its state’s citizens don’t find themselves retiring into a depressed landscape of abandoned oil derricks and deprivation.

All investing involves some vision of the future, and ESG is just one of many divisive issues today.

- But both sides of the aisle now seem to believe that investing can further a political agenda, rather than seek optimum returns.

Schroder further disapproves of BlackRock’s shareholder activism:

You call for a “transformation” of our entire economy that will not be made through a democratic process. Instead you talked about how, “[b]ehaviors are going to have to change and this is one thing we are asking companies. You have to force behaviors. And at Blackrock, we are forcing behaviors.” So much for democracy.

This is another spin on the agency problem – BlackRock can be relied upon to vote in the best interests of BlackRock rather than follow the wishes of their investors (even if they claim the ability to intuit those wishes).

John rightly points out that shareholder pressure is a key part of capitalism, but this is pressure by proxy, one of the problems with passive investing:

Passive owners do not have the deterrent of selling stock. With fund managers committed to limiting their fees, and buying the stocks in their benchmark regardless of valuation, that is a recipe for unaccountable companies whose managers can do whatever they want. It’s for this reason that passive investing has been dubbed “worse than Marxism” by its critics.

He sees the dangers:

A lot of money is ultimately controlled by politicians. It’s not at all clear to me that working pensioners will benefit.

Infrastructure

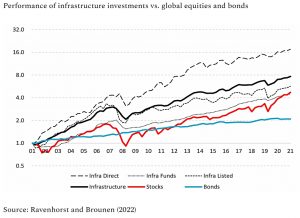

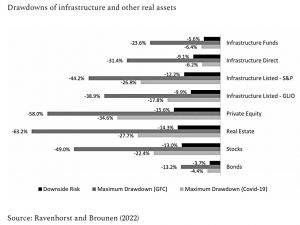

Getting back to inflation, Joachim Klement looked at whether infrastructure is a useful hedge.

- He is a fan of the asset class, and with good reason, as infrastructure has outperformed over the last couple of decades.

We have had more than a decade of low inflation and infrastructure investments performed really well, benefitting from a steady decline in discount rates that increased the net present value of future cash flows.

Infrastructure is a long-duration asset and is sensitive to discount rates.

- Declining rates have protected infrastructure during recent crises, leading to lower drawdowns.

Similarly, infrastructure should suffer when discount rates rise, even when their revenues are inflation-protected.

If this discount rate effect dominates in times of low inflation it should also dominate in times of rising inflation. While cash flows of infrastructure projects rise with inflation, this increase is slower than the devaluation of the project due to rising discount rates.

In the long run, both listed and direct infrastructure will provide a hedge, but over the short run, only direct investment does.

Buying infrastructure as an inflation hedge only works if you have an extremely long investment horizon as pension funds do. For most investors, doing so is likely to result in disappointment.

Brands

Joachim also looked at the value of a brand in a tough year for corporate earnings and valuations.

One key to success in 2022 was to focus on companies with “pricing power” and the ability to defend profit margins in a world of fast rising costs. One shortcut to identifying companies with pricing power is to look at businesses that have a well-recognised brand.

This used to be Buffett’s approach (Gillette, Coke etc).

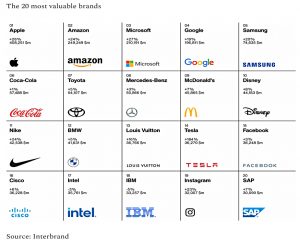

Here are the current top 20 brands.

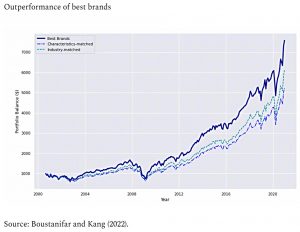

Joachim looked at a paper using the strategy of buying the top 100 brands each year.

- The paper in question benchmarked this portfolio against control groups matched on characteristics like valuation, size and profitability and another matched by industry.

The brand portfolio outperformed by 3% to 4% pa.

The outperformance of the best brands is driven by a systematic underestimation of how good these brands are. Analysts systematically underestimate the pricing power and future earnings growth associated with these brands. This leads to a systematic underpricing of these shares and a constant stream of positive surprises.

The effect seems to be particularly strong for brands developed in-house rather than acquired (the former category would not appear on the balance sheet).

The only snag with this idea is implementation – a 100-stock portfolio is a little large for a private investor and I don’t know that there’s an ETF that matches well to the strategy.

Fund names

In the FT, Brooke Masters reported on SEC plans to crack down on (US) funds with misleading names.

- Funds would need to prove that 80% of their investments match what it says on the tin.

A similar rule has existed for 20 years but was aimed at asset classes like stocks and bonds.

- Thematic funds were explicitly excluded, but a rise in the number of funds adding an ESG label without making meaningful changes means that the scope needs to be widened.

Asset managers are predictably unhappy, arguing that terms like “income” or “value” vary depending on market conditions and that the new restrictions will make active funds more like closet trackers.

- Applied too rigidly, it could make a small-cap manager sell a growing firm too soon.

There are also concerns about the 30-day remediation window that the SEC plans to impose.

George Raine, a partner at lawyers Ropes & Gray said:

Imagine something goes massively wrong or massively right with a particular sector. It becomes a ticking time bomb. Everyone knows that after 29 days there are going to be all of these mutual funds that are going to have to sell or buy.

I think that funds should do what they say they will so that investors can trust their top-down allocation.

- That doesn’t preclude an “unconstrained” category, where you are backing the manager’s judgment fully.

Quick Links

I have eight for you this week, the first four from The Economist:

- The Economist wondered Will people pay $8 a month for Twitter?

- And asked What went wrong with Snap, Netflix and Uber?

- And explained What big tech and buy-out barons have in common with GE

- And looked at Facebook and the conglomerate curse.

- Mauldin Economics warned of Dangerous Assumptions

- Rob Carver worked out the Optimal trend following allocation

- Alpha Architect reviewed Momentum Factor Investing: 30 years of Out of Sample Data

- And also looked at Market Risk and Speculative Factors.

Until next time.