Lazy Portfolios 7 – Roll Your Own

Today’s post is the seventh in a series of posts about of Lazy Portfolios. We’ll be looking to create our own Lazy Portfolio from the bottom up.

Contents

My portfolio

Let’s start with a quick recap of what we’ve covered so far.

My base portfolio is a passive global multi-asset portfolio made mostly from low-cost ETFs.

- I use 54 asset classes with an allocation based around volatility parity. (( In theory – in practice I use 37 funds as 17 asset classes are covered by non-listed assets that I own ))

A true volatility parity portfolio is quite safe (and low return), with more than 60% in bonds.

- In order to hit my target / fail safe withdrawal rate of more than 3% pa, I need to cap the bond allocation to 20%

- This allows for 75% stocks and 5% True Alternatives.

I also tweak the default allocation to accommodate global ITs and themed funds, and to support some home bias.

Lazy portfolios

Lazy portfolios are pretty much at the opposite end of the spectrum.

- Typically they involve between two and four funds, though some have more.

Their key advantage is simplicity.

- This doesn’t matter much to me – I don’t see the big difference between buying four ETFs and a dozen, or even 50.

But novice investors and those with small portfolios might find them useful.

Common portfolios

Returns are broadly proportional to volatility.

- In order to get good returns, you need to accept more volatility.

So correlations between assets – and in particular, correlations with the primary return-producing asset, stocks – are key.

- Adding poorly correlated assets can reduce the volatility of a portfolio without significantly affecting returns.

This leads to three common portfolios:

- The Max SR portfolio (volatility optimised)

- We’ll simplify this to be 60% bonds, 40% stocks.

- The Max Return portfolio, which is 80% stocks and 20% bonds

- I swap 5% of stocks for True Alternatives, to leave me with 75% stocks

- A Compromise portfolio suitable for a wide range of people,

- This might be 60% stocks, 35% bonds and 5% Alternatives.

Benchmark

We need something along the same lines as my “max return volatility parity” portfolio, but with fewer funds.

- Then we can compare the lazy allocations to our simplified portfolios.

The best I could come up with was a 15-fund portfolio.

- There are six equity funds, three equity alts, four bonds funds, one bond alt and just one true alternative asset – gold.

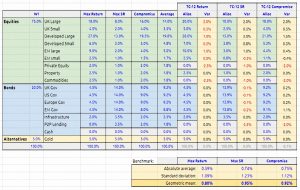

This chart shows two additional benchmarks:

- The Max SR benchmark, and

- The Compromised benchmark.

They have been derived from the max return benchmark by varying the allocations to stocks and bonds.

- Note that the two new benchmarks each include 16 funds rather than 15.

The idea is that we will compare each lazy portfolio to the three benchmarks in order to discover which type of investor it serves best (unless that is immediately obvious).

It isn’t possible to produce high and stable returns from a static portfolio under all economic conditions conditions.

- Long-term investors should stick with stocks as the core of their portfolio, using diversifiers (bonds and true alternatives) to smooth their path a little.

So we will be measuring the lazy portfolios on how well they perform this task.

One fund portfolios

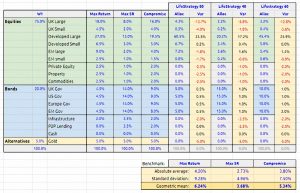

In the third article in this series, we looked at the Vanguard LifeStrategy funds.

- The three that match most closely to our three benchmark portfolios are the 40%, 60% and 80% equity funds.

Here’s how those funds look:

Relative to the appropriate benchmark:

- UK stocks are low

- Developed stocks are high

- EM is mixed – low for LifeStrategy 80, high for the other two.

- Bonds are a bit high but not too bad.

- There are no alternatives of any kind.

The variances to our benchmarks look horrific.

- We are looking for variances below 2%, and ideally below 1%.

There’s no way I could live with these errors of 3.7% to 6.2%.

Two to five funds

Perhaps surprisingly, although the Vanguard fund make poor portfolios, they are hard to beat with two, three or four funds.

- Most two fund portfolios are a version of “stocks plus bonds”, and we already have that.

- We also have decent global diversification.

What we are missing is:

- Alternatives

- Higher weighting to small caps

- Emerging markets exposure

- Home bias to the UK

Fixing each of these problems is likely to require one or more funds, so it will be difficult for small portfolios to compete.

- We didn’t find any two, three or four fund solutions that could beat the Vanguard single fund approach.

The same goes for five fund models, even though we managed to find seven of them.

- Let’s see whether even more complex portfolios can do any better.

Six funds or more

We finally beat the Vanguard funds when we got to eight funds.

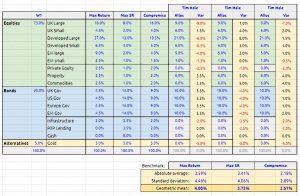

Here is Tim Hale’s Global Style Tilts 4 Portfolio:

- UK stocks 9%

- UK small stocks 6%

- Developed stocks 21%

- Developed small stocks 6%

- Emerging markets stocks 6%

- Commodities 6%

- Property 6%

- Bonds 40%

Note that this portfolio still doesn’t meet my personal target for how close to the benchmark a portfolio needs to be, even against the Compromise benchmark (40% bonds).

Roll your own

Now it’s time to see if we can beat Tim’s portfolio with one of our own.

- We’ll start with the same number of funds, and gradually add more to fill in the gaps compared to our benchmark.

I’ve previously described Tim’s portfolio as having eight funds.

- But this relies on finding a “miracle” bond fund which allocates to the four bond asset lines in our benchmark.

So for the purposes of this section we’ll call it an eleven-fund portfolio. (( Note that Tim has two bond funds rather than four, and one of these is allocated to inflation-linked bonds ))

Probably the main reason that Tim’s portfolio beats the Vanguard funds is its UK bias.

- Compared to our benchmarks, Tim’s portfolio is lacking in private equity, bond alternatives (infrastructure and P2P – not cash) and gold.

Bottom up

If we look at the averages across our three benchmark portfolios, the asset classes (in descending order of weight are:

- Bonds – 40% (split four ways)

- Developed stocks – 24.6% (split by market cap)

- UK stocks – 17.5% (split by market cap)

- EM stocks – 6.7% (split by market cap)

- Gold 5%

- Infrastructure 2.5%

- PE, Property, Commodities, P2P – each at 1.8%

So the best use of 11 funds is perhaps:

- Bonds (counts as four funds)

- Developed stocks

- UK stocks

- EM stocks

- Gold

- Developed stocks small

- UK stocks small

- Infrastructure

Many people will be uncomfortable with the lack of an allocation to property, but the maths says that infrastructure is more useful.

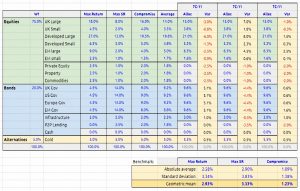

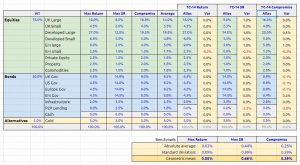

This 7C-11 portfolio has variances that are 25% lower than the Tim Hales portfolio.

- But it still fails my test for how close to the benchmark it should be.

Matching the benchmark

Now that we’ve demonstrated that we can beat the Hales portfolio with 11 funds, we can tailor the fund to match the three benchmarks.

Tweaking the there portfolios reduces the variances by more than half.

- This 7C-11+ portfolio is also the first one to come within my tolerances for maximum deviation from the benchmarks.

On the other hand, I don’t like the fact that it includes no property, so let’s add that next.

7C-12

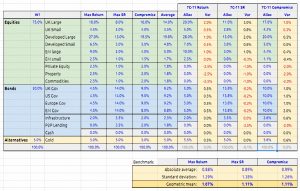

The 7C-12 portfolio has an average variance that is around 20% lower, which is not a bad return for a 9% increase in the number of funds.

Let’s add private equities and commodities next.

7C-14

The 7C-14 portfolio has less than half the average variance of the 7C-12 portfolio.

- The 7C-14 Max Return portfolio in particular now has a very low variance.

As a next step, we could add P2P lending and an an explicit small cap EM fund, but then we would have the same number of funds as in our benchmarks.

- So that’s it for our look at Lazy Portfolios.

Conclusions

It might seem obvious that the more funds you add, the closer you can get to your benchmarks, but I wanted to answer several questions with this series of articles:

- Just how bad is a one-fund portfolio?

- Not as bad as I expected, but around three times worse than I’d like.

- How good are the classic Lazy Portfolios?

- Not very – none of the two- to five- fund portfolios are better than a single Vanguard fund.

- How many funds do we need to do better?

- Eight, including a “magic” bond fund (so also nine, or eleven, depending on how you are counting) – courtesy of the Tim Hales portfolio.

- Can we do better than that “best” portfolio with the same number of funds?

- Yes we can – see the 7C-11 portfolio.

- Is our bottom-up portfolio good enough?

- Only if we tailor the three allocations to match the three benchmarks as closely as possible – this is the 7C-11+ portfolio.

- Is there anything missing from this portfolio?

- Principally the equity alternatives, which we added in two stages: (1) property – 7C-12, and (2) PE and commodities – 7C-14

- Can we improve further?

- We could add P2P lending and an an explicit small cap EM fund, but then we would have the same number of funds as in our benchmarks.

I won’t be using the 7C-11+ portfolio – or even the “7C-16” benchmark – because with a large portfolio the hassle of buying 30 or 50 ETFs is comparable to that of buying 10 ETFs in large size.

- But for people with portfolios in the £20K to £50K range, these Lazy Portfolios might come in handy.

Until next time.

Hi Mike,

A very interesting read with a number of points to consider, thank you. I’ve been recently trying to see how UK versions of a number of the portfolios mentioned ( risk parity / higher bond portfolio models) might compare against something like a single Vanguard LifeStrategy fund or a global equity/ global bond fund tracker combo but I didn’t have the smarts to work it out. Someone from the monevator site kindly provided a link to this site when I asked about this type of topic.

I hope you don’t mind me asking a few uneducated questions.

Your model portfolios 7C-11+ to 7C-14 would be too much for someone like myself to balance and being small investor 11 funds currently wouldn’t be practical for me.

Do you think it would be possible to create a reasonable copy of one of your models (7C-11+ to 7C-14) using a Vanguard LifeStrategy fund ( or a two fund global equity / global bond tracker combo) at the core to reduce the number of funds and then add a number of the missing components (property, gold, small cap) in basic chunks of 5% or 10% amounts to produce something of an improvement to the core fund without adversely affecting the outcome?

I realise it may not perform as well as your models but could a reasonable basic facsimile be produced?

Would creating a portfolio with such a core be more difficult to rebalance/maintain the other outlying components?

Would the results improve the core (Say VLS 60) be enough to be an effective substitute at a reasonable cost or would things begin to unravel or be too watered down/unbalanced?

Could something be done using two multi asset funds (example VLS60 + fidelity multi asset allocator growth fund which has property)? Or do the pieces in (currently available) differing multi asset funds just simply not fit to allow them to work together in this way.

Thank you again for the great read and sorry for the long post.

Thanks for the comment, Barry. I think there are two main issues here:

– the issues with the Lifestrategy-style funds, and

– the perceived complexity in using more than a couple of funds.

The real problem with a single fund is market-cap tracking. You have (say) 60% in the US, weighted to the largest issues. Under most market conditions, this is a bad idea. Unfortunately, when the largest firms in the world (the FAANGs) have recently been the best performing (the last decade) it looks like a good idea.

So the Vanguard indexers are pretty happy at the moment, but I wouldn’t sleep if I had 60% allocated to the US.

Adding more “extreme” supplements than the usual assets (gold, property if you have none in the non-listed world) would help, but I’d be surprised if any portfolio with less than 8 funds would be better than the single fund. You could experiment a great deal with the weightings, but this risks a form of over-fitting to the past – in general, simple rules work best.

The second issue is complexity. I track 41 asset classes each morning and all that involves is looking at a spreadsheet for 10 seconds. If any asset class has drifted from its target by more than my minimum trade size, I make a trade later in the day.

The real problem is portfolio size. Below £50K, I think it’s better to stick with the single fund, plus perhaps say 5% gold and 5% property as ballast if you prefer. Above £100K, I would always use a multi-fund approach.

It should also be noted that the last 15 years have been pretty unusual in terms of macro-economics, and we might expect some more surprises in the rest of the decade. So any portfolio built around classical principles might turn out to be sub-optimal.

We’ll always know what would have been the best portfolio in hindsight, but I’m after the best portfolio for the long-term in an uncertain future.

Cheers, Mike

Hi Mike,

Thank you very much for spending the time to explain further. I had the gist of your article but didn’t fully understand all the workings.

I’m in the sub £50k category and realised what I suggested wouldn’t be as effective as your model portfolios however your reply provides me with the glimpses of improvement I was looking for – a portfolio with a single multi asset fund + bolt-ons of 5% in both property & gold may help but won’t fix any sub optimal allocations within the single fund.

I’m not aware of any single funds which stand out as better examples to use for their choice of allocations as many follow similar themes. I did read somewhere about a fund which used equal weightings for one US index but tracking one index didn’t seem a very diverse enough.

Thank you once again for your generosity in sharing your knowledge and taking the time to answer my questions.

Hi Barry,

Thanks for the kind words. The thing to watch out for with simple approaches is overexposure to the US.

Thinking about the questions in this post might help you move towards the portfolio that is right for you:

https://the7circles.uk/taking-a-view-twenty-questions-for-investors/

Cheers, Mike

Hi Mike,

Thank you for the link. Some good questions that I think need careful consideration before deciding on the answers. Some of your example answers are also very useful in illustrating a number of points. I was particularly drawn to your point on equal weightings for geographical regions which you also highlighted in your responses here.

Thanks again for your time and help.

Kind regards, Barry