Get Rich Stay Rich

Today’s post is a look at three articles from Meb Faber on the topic of getting and staying rich.

Contents

Meb Faber

Meb Faber runs Cambria Asset Management, which offers an interesting range of ETFs in the US (they are difficult to access for UK investors).

- He’s also written a few books, including one about portfolio construction and asset allocation that we looked at a few years ago.

We’ve also looked at his Trinity Portfolio and a momentum approach that he calls VAMO Hedge.

Meb has a podcast (The Meb Faber Show) and a recent episode directed me back to a series of posts from 2020 on the topic of getting and staying rich.

- I’ll be focusing on the investment lessons from these articles.

Get Rich

Meb begins by looking at the ways to become rich.

- There’s nothing to be said about luck (inheritance, marrying into wealth or winning the lottery).

But more than 80% of millionaires are self-made.

- Many are professionals (executives or doctor or lawyers), but this a long hard route which usually leads to “moderate” riches.

Some are entrepreneurs.

The other approach – the one we are interested in – is investing, for which Meb provides a formula:

- saving + investment + time = wealth

Of course, compounding isn’t as powerful as it used to be when interest rates (and annual returns) were much higher.

- The US stock market has historically returned 10%pa, but it’s hard to see those levels of returns in the coming decades (valuations are high and growth is low).

Meb says that the biggest challenge with this approach is the monotony:

You have no hot stock to talk about, usually no explosive market gains happening in just a short-period; instead, it’s just boring, low-cost funds and ETFs slowing grinding higher – the investment equivalent of watching paint dry.

You also have to be pretty frugal, to begin with. As Morgan Housel says:

When most people say they want to be a millionaire, what they really mean is ‘I want to spend a million dollars,’ which is literally the opposite of being a millionaire.

Market timing

Market timing isn’t as useful as you might think.

- Choosing (in advance) the winner between stocks and bonds each year from 1920 only boosts annual returns from 10% to 17%.

If you choose wrong every year, you return -0.9% pa.

Concentration and leverage

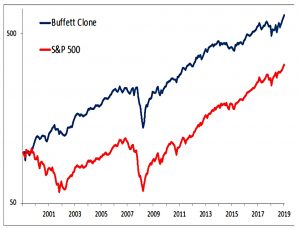

To go significantly faster than indexing, you need either concentration (like Warren Buffett) or leverage.

- The problem with concentration is that systematic approaches only get you so far.

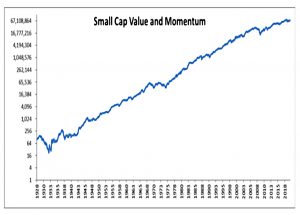

Small-cap value and momentum combined (three of the best historical outperformance factors) “only” get us to 16% pa.

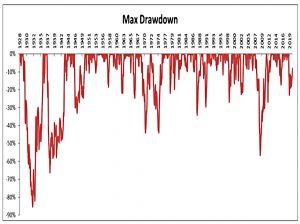

And the drawdowns are horrific.

Even worse, if you are concentrated, you are likely to be down the most when others (your friends and neighbours) are not:

To outperform the indexes you need to be different, which is fine when you’re winning, but impossible when you’re losing.

Most people can only take a year or two of underperformance, but Buffett has underperformed for 17 years.

Yet over 20 years, BRK’s stock picks (top 10 holdings, equal weighted and rebalanced quarterly)

have outperformed by 3% pa.

Meb

So what would Meb do?

I would apply the theories that underpin the Trinity portfolio, but with some leverage. I would include highly-concentrated tilts to global value stocks and global momentum stocks, but I would also pair it with an aggressive global trend following strategy. Then I’d leverage the entire allocation to around 1.5x. I think that potentially gets you to 20% [pa].

We’ll see later on that in fact Meb does something different from this – because he doesn’t think that he could handle the drawdowns.

Angel investing

Meb thinks that becoming an entrepreneur is not as risky as it sounds, because the potential rewards are high.

- But if you don’t have a great idea, or are just too lazy, there is another way.

Invest in other people who have taken the risk of starting businesses. In other words, be an angel investor. Take some of your capital earned by your sweat and

toil and invest it in other people with great business ideas.

The trick here is not to double your money on a single investment, but to find a hundred bagger.

- In this space, the big winners pay for the many small losers.

Meb says it’s easier to hang on to an unlisted 100-bagger because you have no choice.

Do you think you’ll still let 100% of it ride after it makes you five-times your initial

investment? If you say “yes,” then, okay, well, what about when it goes down 50%?

The Coffee Can Portfolio approach is hard to put into practice. but with private companies, you have little choice.

- Meb draws an analogy with your primary residence, which you aren’t looking to sell every day based on market movements.

The key takeaway is that there is no safe way to get rich quickly.

- Outperformance strategies come with risk and significant drawdowns.

Stay Rich

Meb’s second article looks at how to stay rich.

The portfolio that helps you get rich isn’t necessarily the portfolio that’s going to help you remain rich.

Concentration and leverage, the key weapons on the way up, are also the best ways to lose a fortune.

70% of wealthy families lose their wealth by the 2nd generation, and a whopping 90% by the third generation.

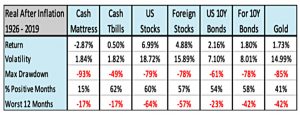

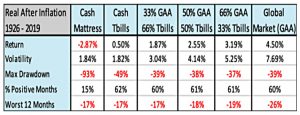

Treasury bills (short-term US government bonds) are generally seen as the risk-free asset, but because of inflation, they are not.

- The annual nominal return since 1926 was 3.4%, but the biggest real drawdown in the 20th century was 49%.

The slow erosion of wealth with T-bills is a bit like the frog sitting in water that’s simmering toward a boil.

Here are the drawdowns for other asset classes:

US Stocks: -79%

Foreign Stocks: -78%

10 Year US Bonds: -61%

Foreign Bonds: -78%

Gold: -85%

60/40

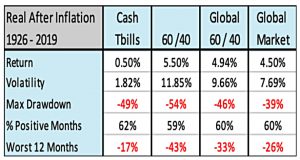

The classic 60/40 portfolio has a 54% max drawdown, and even a global 60/40 has a 46% drawdown.

- Adding gold gets Meb closer to the Global Asset Allocation (GAA) portfolio from the book we looked at some years ago.

The GAA has a max drawdown of 39% but gives up 0.5% pa in returns to get there.

Nearly every allocation (or single asset class) will likely decline by at least 30% on a real basis – and probably more – in your lifetime. That’s a hard pill for many to swallow.

History would suggest that investing across a broad global portfolio with some cash has been a safer allocation than T-bills alone.

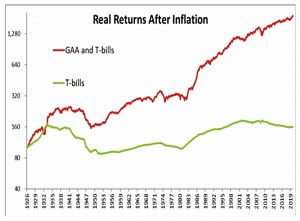

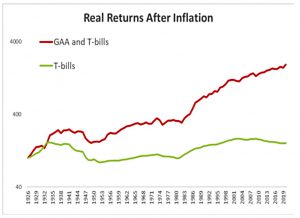

Meb’s solution is to combine GAA with cash to reduce losses to T-bill levels, but with greater returns.

This chart shows monthly returns for the 66% GAA / 33% T-Bills portfolio.

Volatility looks better if we switch to annual values.

What does Meb do?

I’m somewhere “in between” when it comes to wealth-generation and wealth-preservation strategies. I have a young family with plenty of financial needs, so I’m still trying to generate wealth.

On the other hand, I’m trying to be thoughtful about my family’s financial future, so that means certain preservation strategies as well. And as I mentioned before, I really like to sleep soundly.

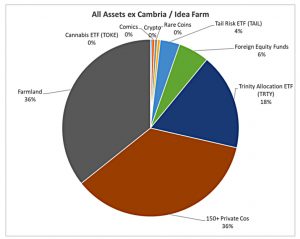

Most of Meb’s wealth is tied up in Cambria and in his research firm, The Idea Farm.

- These investments are part of the Get Rich portfolio.

Excluding these, Meb’s investments are split into three groups:

- Farmland (Stay Rich)

- 150+ private companies (Get Rich)

- a public investment portfolio

All you historians will recognize this allocation as approximating the 2,000-year-old Talmud portfolio that is spread equally across real assets, businesses, and “safe” reserves.

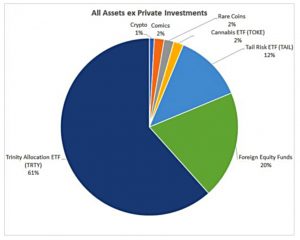

Meb’s public portfolio is basically in Cambria funds (Stay Rich).

I think it’s important to have skin in the game. If I don’t believe in Cambria’s funds enough to invest my own money here, why should anyone else? So, for better or worse, I invest all the public assets I can into funds I manage. Then, I leave it on autopilot.

Meb also has small allocations to coins, comics, cannabis and crypto.

Crypto falls into what I’d call the “regret minimization” bucket. I’m not really attracted to crypto as an asset class, but I’m willing to make an allocation in line with their market cap in the global market portfolio (about 0.05% currently) mainly to avoid regret if the space ever goes up in value 100x.

Conclusions

It’s been an interesting tour of Meb’s thought processes, but some work is required to translate this over for a UK private investor.

- We don’t all have our own funds to invest in (or a family farm, for that matter).

But while the particular funds he uses may be unavailable to us, many elements of his approach are reproducible.

Meb’s goal remains an ambitious one:

I prefer a moderate risk portfolio that targets higher returns than buy-and-hold with lower volatility and drawdowns.

The way he does this in his listed portfolio is “buy and trend”, which is another name for the Trinity portfolio.

- This is 50% trend and 50% value- and momentum-tilted global buy and hold portfolio.

The goal of these [trend] strategies is to reduce volatility and drawdowns, while still targeting similar returns to buy and hold with low correlation.

I am moving my own portfolio towards this kind of allocation.

- But in the absence of dedicated UK trend-following funds, my home-brew approach is developing slowly.

There’s also the issue of not knowing how much trend is optimal – estimates I have seen range from 10% to 50% of your listed portfolio (which translates to 5% to 27% for me).

- Meb uses 50% of 18%, so 9% (he would have a bit more but the options in his tax-sheltered accounts are limited).

I’m at the bottom of my target range right now, but I expect to move towards the middle over the next three to four years.

The nearest I come to Meb’s angel investment portfolio is VCTs, which are tax-advantaged in the UK.

- Historically they have made later-stage investments in more boring sectors, but the regulations are regularly tightened, and they move closer to angel investment every year.

I currently have a 2.5% allocation here, but this will increase to at least 5% over time.

- I don’t expect to come close to Meb’s 36%.

That’s it for today.

- Until next time.