Lazy Portfolios 6 – Six or more funds

Today’s post is the sixth in a series of posts about of Lazy Portfolios. We’ll be looking portfolios made up from six or more funds.

Contents

My portfolio

Let’s start with a quick recap of what we’ve covered so far.

My base portfolio is a passive global multi-asset portfolio made mostly from low-cost ETFs.

- I use 54 asset classes with an allocation based around volatility parity. (( In theory – in practice I use 37 funds as 17 asset classes are covered by non-listed assets that I own ))

A true volatility parity portfolio is quite safe (and low return), with more than 60% in bonds.

- In order to hit my target / fail safe withdrawal rate of more than 3% pa, I need to cap the bond allocation to 20%

- This allows for 75% stocks and 5% True Alternatives.

I also tweak the default allocation to accommodate global ITs and themed funds, and to support some home bias.

Lazy portfolios

Lazy portfolios are pretty much at the opposite end of the spectrum.

- Typically they involve between two and four funds, though some have more.

Their key advantage is simplicity.

- This doesn’t matter much to me – I don’t see the big difference between buying four ETFs and a dozen, or even 50.

But novice investors and those with small portfolios might find them useful.

Common portfolios

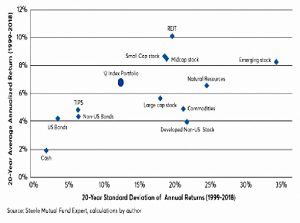

Returns are broadly proportional to volatility.

- In order to get good returns, you need to accept more volatility.

So correlations between assets – and in particular, correlations with the primary return-producing asset, stocks – are key.

- Adding poorly correlated assets can reduce the volatility of a portfolio without significantly affecting returns.

This leads to three common portfolios:

- The Max SR portfolio (volatility optimised)

- We’ll simplify this to be 60% bonds, 40% stocks.

- The Max Return portfolio, which is 80% stocks and 20% bonds

- I swap 5% of stocks for True Alternatives, to leave me with 75% stocks

- A Compromise portfolio suitable for a wide range of people,

- This might be 60% stocks, 35% bonds and 5% Alternatives.

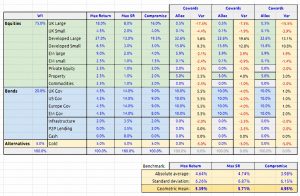

Benchmark

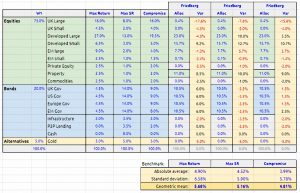

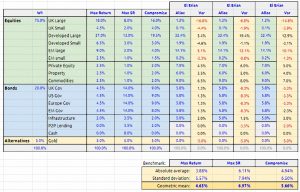

We need something along the same lines as my “max return volatility parity” portfolio, but with fewer funds.

- Then we can compare the lazy allocations to our simplified portfolios.

The best I could come up with was a 15-fund portfolio.

- There are six equity funds, three equity alts, four bonds funds, one bond alt and just one true alternative asset – gold.

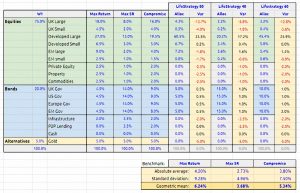

This chart shows two additional benchmarks:

- The Max SR benchmark, and

- The Compromised benchmark.

They have been derived from the max return benchmark by varying the allocations to stocks and bonds.

- Note that the two new benchmarks each include 16 funds rather than 15.

The idea is that we will compare each lazy portfolio to the three benchmarks in order to discover which type of investor it serves best (unless that is immediately obvious).

It isn’t possible to produce high and stable returns from a static portfolio under all economic conditions conditions.

- Long-term investors should stick with stocks as the core of their portfolio, using diversifiers (bonds and true alternatives) to smooth their path a little.

So we will be measuring the lazy portfolios on how well they perform this task.

One fund portfolios

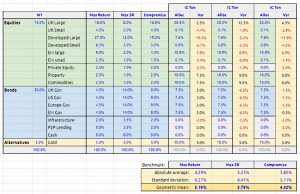

In the third article in this series, we looked at the Vanguard LifeStrategy funds.

- The three that match most closely to our three benchmark portfolios are the 40%, 60% and 80% equity funds.

Here’s how those funds look:

Relative to the appropriate benchmark:

- UK stocks are low

- Developed stocks are high

- EM is mixed – low for LifeStrategy 80, high for the other two.

- Bonds are a bit high but not too bad.

- There are no alternatives of any kind.

The variances to our benchmarks look horrific.

- We are looking for variances below 2%, and ideally below 1%.

There’s no way I could live with these errors of 3.7% to 6.2%.

Two to five funds

Perhaps surprisingly, although the Vanguard fund make poor portfolios, they are hard to beat with two, three or four funds.

- Most two fund portfolios are a version of “stocks plus bonds”, and we already have that.

- We also have decent global diversification.

What we are missing is:

- Alternatives

- Higher weighting to small caps

- Emerging markets exposure

- Home bias to the UK

Fixing each of these problems is likely to require one or more funds, so it will be difficult for small portfolios to compete.

- We didn’t find any two, three or four fund solutions that could beat the Vanguard single fund approach.

The same goes for five fund models, even though we managed to find seven of them.

- Let’s see whether even more complex portfolios can do any better.

Tim Hale

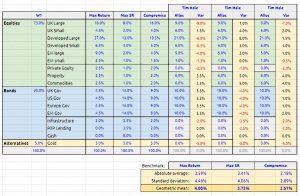

Tim Hale’s book Smarter Investing contains a lot of example portfolios.

- In his 2013 article about Lazy Portfolios on the Monevator site, “The Accumulator” included the Global Style Tilts 4 Portfolio as one of his choices.

Strictly, this is a ten fund portfolio.

- But there are a couple of value tilts and a pair of bond funds.

Our simplified version has eight funds:

- UK stocks 9%

- UK small stocks 6%

- Developed stocks 21%

- Developed small stocks 6%

- Emerging markets stocks 6%

- Commodities 6%

- Property 6%

- Bonds 40%

At first glance, this looks a lot more like our benchmark portfolios.

Finally, we have a portfolio that beats the one-fund Vanguard approach.

- But it’s taken eight funds to get there.

And this portfolio still doesn’t meet my personal target for how close to the benchmark a portfolio needs to be.

- Even when measured against the Compromise benchmark, which has a 40% bond allocation.

Big Rocks

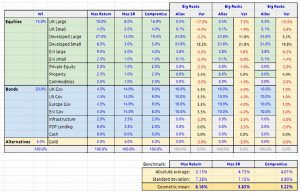

Big Rocks is a portfolio from Larry Swedroe.

- It has eleven funds, but there are a few value and dividend tilts in there.

Here’s our modified version, with seven funds:

- 18% US stocks

- 18% small cap US stocks

- 6% property

- 9% international stocks

- 6% international small cap stocks

- 3% emerging markets stocks

- 40% bonds

I think the overweight to small caps has hurt this portfolio.

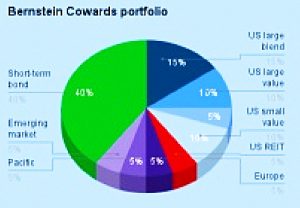

Coward’s portfolio

The Coward’s Portfolio comes from William Bernstein.

- It has nine funds, but there are value tilts and two international funds.

Here’s our modified version, with six funds:

- 25% US stocks

- 15% small cap US stocks

- 5% property

- 10% international stocks

- 5% emerging markets stocks

- 40% bonds

The results are slightly better than Big Rocks, but not close to the Tim Hale portfolio.

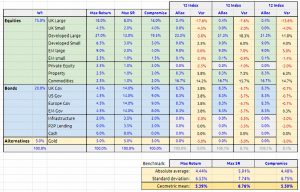

12 Index portfolio

I found this portfolio on a site called Financial Planning (via reddit).

- Although it tracks 12 indices, four of them are bonds and two are commodities.

- Plus there is a US mid cap fund.

Here’s our modified version, with seven funds:

- 16.7% US stocks

- 8.3% small cap US stocks

- 8.3% property

- 16.7% commodities

- 8.3% international stocks

- 8.3% emerging markets stocks

- 33.3% bonds

The strange overweight to commodities makes this the worst of the four portfolios that we’ve looked at today.

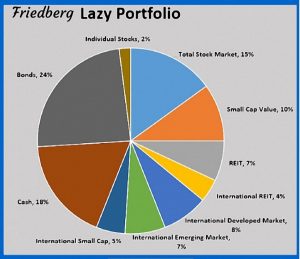

Friedberg Lazy Portfolio

This portfolio comes from Barbara Freidberg at Personal Finance.

- It has ten allocations, but we can make a few combinations.

Here’s our modified version, with seven funds:

- 17% US stocks

- 10% small cap US stocks

- 11% property

- 8% international stocks

- 5% international small cap stocks

- 7% emerging markets stocks

- 42% bonds

This portfolio is very overweight small caps, but it’s the second best of the five that we’ve looked at so far today.

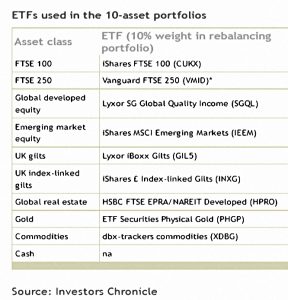

IC Ten

The Investors Chronicle put together a 10-fund portfolio as part of a trend-following system.

- We can combine the two bond funds with the cash, and also the two UK funds.

Here’s our modified version, with eight funds:

- 20% UK stocks

- 10% international stocks

- 10% emerging markets stocks

- 10% property

- 10% gold

- 10% commodities

- 30% bonds

Despite the overweights to property, commodities and gold, the IC Ten displaces the Friedman portfolio as the second best that we’ve seen today.

El Erian

When we looked at Meb Faber’s post (later a book) on Asset Allocation strategies back in 2015, my favourite portfolio came from economist Mohamed El-Erian.

- It’s an eleven fund portfolio, but there are three bond funds and a special situations fund in there.

Here’s our modified version, with eight funds:

- 15% US stocks

- 23% international stocks

- 12% emerging markets stocks

- 6% property

- 9% commodities

- 7% private equity

- 5% infrastructure

- 23% bonds

Four years later, the variances look very average compared to the other portfolios with six or more funds.

That’s it for today.

- We’ve looked at seven portfolios and the Tim Hale allocation has come out on top.

It’s the only portfolio to beat the Vanguard single fund approach, probably because of it’s UK bias.

In the final article in this series, we’ll “roll our own” Lazy Portfolio by looking at allocations from the bottom up.

- Until next time.

Maybe I have misunderstood you, but the message seems to be that it will take quite a bit of work to better the Vanguard single fund approach. Or, have I jumped the gun?

Depends on your perspective. One takeaway is that the lazy portfolios so far are worse than a single Vanguard fund. Another takeaway (for me) is that none of the famous Lazy Portfolios are good enough to use.

In the next article we look at whether we can build a portfolio with few funds that is actually useful (to me).