Libra

Today’s post is a look at Facebook’s new “cryptocurrency” – Libra.

Contents

What is Libra?

Libra is a digital currency that will be launched by Facebook next year.

- Calibra is the name for the company’s version of a digital wallet that will hold Libra, and for the companies subsidiary which will operate Libra within Facebook’s systems.

Transfers will be possible in Facebook’s Messenger and WhatsApp systems (neither of which I use personally at the moment), but also via a standalone app.

- And the system will be able to handle many more transactions per hour than existing cryptosystems like Bitcoin.

The currency will be fully backed by a reserve fund investing in government bonds.

- Interest on the reserve fund will accrue to the Libra association, rather than to the consumers using the system.

- If the system takes off, this will amount to a lot of interest that is being withheld.

Libra will be pegged to a basket of major currencies, like the International Monetary Fund’s special drawing rights (SDR).

- So this looks like “narrow banking” rather than “fractional reserve” banking, albeit backed by multiple currencies rather than one.

But in fact, Libra’s deposits will include accounts at fractional-reserve banks, which rather defeats the object.

Unlike existing digital payment systems (PayPal, Apple and Google Pay), Libra would bypass the credit- and debit-card system, rather than piggyback on top of it.

What might it be used for?

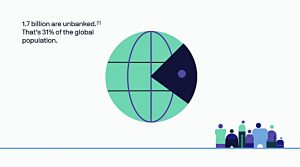

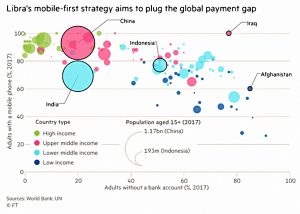

The obvious use of Libra is as a payment system for the unbanked in emerging economies.

- This would be a sort of global extension of the M-PESA phone banking system in Kenya or the chat payment systems (from WeChat and Alibaba) widely used in China.

There are 1.7 bn people worldwide without a bank account, although most of these probably don’t have too much money, either.

- Libra should also allow migrant workers to send money home easily and cheaply.

Facebook has 2.4 bn users globally, so widespread adoption of Libra would create one of the world’s largest financial systems.

- And the system will use a stable international currency rather than the local (emerging market) one.

In more developed regions, the biggest potential lies in micropayments for online activities.

- I haven’t heard too much about any plans in this direction.

There’s also the potential for cost reduction – credit card companies charge 0.25% on average ($30 bn in total), and cross-border transfers cost 5% on average.

- Of course, the credit card companies are part of the Libra consortium, so this might not happen quickly.

On the other hand, an executive vice-president at Mastercard said:

It is not a zero-sum game. Today, 85 per cent of transactions are made in cash.

Libra should also be faster, particularly for international transfers.

- And it might be convenient and cheap for payments while abroad on holiday.

Privacy issues

Facebook is an unlikely guardian of money, given its history of evasion and privacy abuses.

- But Libra will be managed by a consortium including 28 other companies.

Any firm worth more than $1 bn can join (at an initial cost of $10M), and Facebook has said that its own voting power will be limited to 1%.

- Uber, Vodafone and Spotify, Visa, Mastercard and PayPal, and eBay, Stripe and Coinbase are amongst the anchor members of the system.

VC firms and charities are also involved.

- Conspicuously missing are banks, Google, Amazon and Apple.

Whether the consortium can really wrest power from Facebook remains to be seen.

- And whether Facebook can be trusted with user’s financial data is an even bigger question.

Facebook claims that financial transactions will remain siloed from social media activity and that user ad profiles will not be based on Libra activities.

- But the real issue is whether you believe them.

Is it a cryptocurrency?

Not really, but the first thing to consider is whether that matters at all.

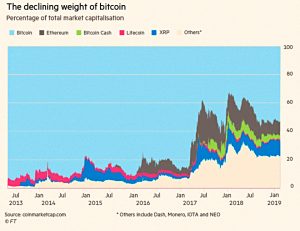

- Until the recent rally (sparked in part by the rumours of a Facebook coin), crypto was in decline.

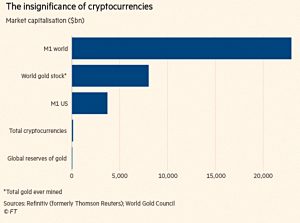

And compared to real-world money flows, crypto remains insignificant.

Bitcoin – the best-known example – has no intrinsic value and central oversight is vulnerable to fraud and burns a lot of energy.

- It’s also a poor means of exchange (being accepted in few locations) and a terrible store of value (being prone to parabolic spikes and crashes in price).

Libra will have a relatively stable price (a user’s home currency will still fluctuate against the Libra reserve basket) and a centralised (if potentially anonymous) database of transactions.

- So Libra is blockchain technology, but not really a cryptocurrency.

- And according to blockchain purists (see below), it’s not even a true blockchain – it’s simply a federated database.

All the signs are that Libra will be set up from the start for regulatory compliance (see below).

Adoption

Shops and online stores will be incentivised to accept Libra (for a start, it will be cheaper for them – but there will also be incentives paid for by the consortium subscriptions) – but how will customers be persuaded to move away from cashback and card loyalty rewards?

Presumably, there will be discounts, at least initially.

- But there will be no government-backed deposit insurance scheme, as there is for bank accounts.

Libra will also be much faster than Bitcoin (transactions should complete in seconds, not minutes) and much cheaper (almost free, rather than a few dollars per transaction).

- And the system will cope with thousands of transactions per second, rather than Bitcoin’s seven.

What do the bankers think?

As discussed above, Libra will not start out as a real bank, or even a narrow bank.

- But its data would be very useful in lending decisions, so the temptation will grow over time.

How about the regulators?

Although Facebook claims to have consulted many regulators already, there are obvious concerns around the stability of the financial system and of nation-states’ economic sovereignty.

- JP Morgan has 50M clients, but Libra could easily have 10 or 20 times that number.

The reserve fund could easily reach $2 trn, making it a big player in the bond market.

- And cross-border flows could threaten the stability of emerging economies in particular.

The potential for use in money-laundering could be another issue.

- Some reports claimed that Facebook has said that Libra will be pseudonymous, allowing users to hold wallets not linked to their identity.

Others said that know-your-customer information would be collected and government-issued ID would be required for accounts.

- Both statements appear to be in the Libra whitepaper.

The French have been the first to object, with the finance minister saying that Libra “must not become a sovereign currency”.

- The G7 has announced it will establish a group to examine the risks that Libra poses to the financial system.

In the US, there were immediate bi-partisan calls in Congress for a probe into Libra before it goes live.

Here in the UK, Mark Carney gave a cautious welcome to Libra in his speech at the Mansion House dinner last week.

- He said that the BoE greeted Facebook’s ambitions “with an open mind” but not “an open door”.

He added that tech firms and non-banks will be allowed to store funds overnight in interest-bearing accounts at the central bank, in the same way as high street banks.

- Libra could substantially lower costs and increase financial inclusion, but he warned that Libra and other digital payment systems would need to be brought under central bank regulation.

He said:

Unlike social media for which standards and regulations are being debated well after it has been adopted by billions of users, the terms of engagement for innovations such as Libra must be adopted in advance of any launch. Libra must be a pro-competitive, open platform that new users can join on equal terms.

The Bank’s strategy to open access to a wide range of payment solutions combined with appropriate regulatory oversight of them maximises the likelihood that the payments revolution will meet the demands of the new economy and the needs of all our citizens.

Carney has just six months left in the job – and we will have had at least one new Prime Minister before his replacement is in office – but presumably, this position in some sense reflects the direction that the UK wants to go in.

And the crypto gang?

Despite all the crypto buzz words in the white paper, hardcore libertarian purists won’t like Libra because it isn’t decentralised.

- Real crypto is permissionless – no-one runs the network, so no-one can stop you using it.

At the same time, early news of Libra has given Bitcoin a boost, and some crypto fans hope that Libra might help to bring all forms of digital money into the mainstream.

Other issues

A few things that we haven’t touched upon above:

- The system is currently untested – particularly with respect to transaction volumes – and hackers will be looking forward to trying to break it.

- The consensus system used by Libra is known as Delegated Proof of Stake, which is much faster than the systems used by Bitcoin and Ethereum.

- The use of a basket of currencies to underpin Libra can be seen as the start of the process of replacing the dollar as the default world currency.

- A tech consortium with dozens of members will not find it easy to reach consensus on the future direction of the platform.

- The consortium model could be adapted to govern tech giants, even if Libra itself is a failure.

- This is presumably bad news for the other cryptos known as “stablecoins”.

- Left-wingers will see this as yet more concentration of power in the hands of big corporations.

- Librafication would allow governments to potentially track how welfare payments are spent.

- Libra can be seen as a prototype implementation of a “Fedcoin” – a national blockchain currency operated by a central bank, to support – amongst other things – negative interest rates.

It’s too early to know how Libra will pan out – all I wanted to do today was cover some of the possibilities.

- We’ll come back to this next year, closer to the launch.

Or before then, if something significant happens.

- Until next time.