Weekly Roundup, 25th June 2019

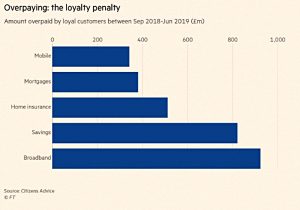

We begin today’s Weekly Roundup in the FT with the Chart That Tells A Story. This week it was about the cost of customer loyalty.

Contents

Customer loyalty

The big story of the week was Facebook introducing its “cryptocurrency” Libra, but I plan to deal with that in a separate article.

In the FT, James Pickford looked at data from the Citizens Advice Bureau (which seems to have dropped Bureau from its name) on the cost of customer loyalty.

- Customers overpaid by £3 bn in the six months from September 2018.

Broadband providers appear to be the worst offenders.

- Mobile is much better, presumably because consumers shop around for a new handset every year or two.

- It also appears that not swapping after your fixed contract period is up does not lead to overpaying.

Under new proposals from the government, industry watchdogs would be able to fine companies without having to take them to court.

- The FCA has already begun to investigate the savings, mortgage and insurance markets.

- Ofcom is setting up a new compensation scheme for broadband and mobile.

Mid-life MOT

Lucy Warick-Ching wrote about the concept of the mid-life financial MOT, aimed at those turning 40.

- I’m not a great fan of the “learning moments” approach to finance – I think that you need a plan for life that you review every year or two.

Here are the key topics for the MOT, as suggested by Schroders:

- Work, family situation, where you live, how you spend your time.

- Plans for the next year, five years, 10 years, longer?

- Any anticipated changes to your financial situation?

- Reduce working hours, move house, big expenditure, inheritance

- Top priorities for your money?

- Tax efficiency, maximum returns, financial security

- Dependents?

- Spouse, children, siblings, other relatives

- What does money mean to you?

- Freedom and independence, or is it stressful or confusing

- Previous experience of financial advice and current expectations

Other things to discuss include the pensions LTA, life cover and income protection, and wills and POA.

Inflation

Michael Mackenzie looked at the threat from inflation in a world of sub-zero bonds.

The amount of global negative-yielding debt this week rose to an all-time peak of $12.5tn.

Against this backdrop, the rush for alternative investments, private equity funds and bonds that pay a positive yield will only intensify.

Michael expects yields to remain lower for longer, with modest expectations for growth and inflation.

- But he is worried about inflation and the relaxation of central bank targets, even though a decade of QE has failed to generate any.

This would, of course, be bad for holders of long term bonds with low coupons.

- But I see no sign of it yet.

Interest rate cuts

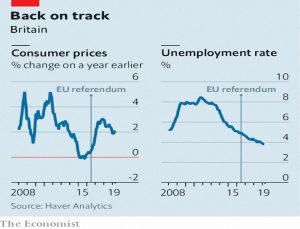

The Economist thinks that the next move in UK interest rates will be a cut rather than a raise.

- November 2017 saw the first (tiny) rate rise since the 2008 crisis, and another one followed nine months later.

But expected inflation above 2% has disappeared once more.

- Unemployment continues to fall but hasn’t led to wage inflation yet.

One theory is that productivity is improving, which would allow employers to absorb higher wages without passing them on to consumers.

- And higher import costs from the sterling devaluation following the Brexit vote appear to have been passed on in one go, rather than being phased over several years.

- The trade war between the US and China may also be a factor, depressing global demand.

It’s still possible that a smooth exit from the EU in October will heat up the economy and lead to a rate rise.

- But a further extension or a no-deal exit would be more likely to lead to a rate cut.

Currency wars

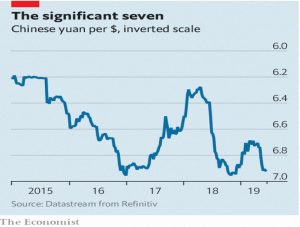

Buttonwood wrote that the world is primed for currency wars.

- The US is complaining that Europe and China are both trying to weaken their currencies.

The idea is that a weak currency will lead to stronger GDP growth.

Seven yuan to the dollar has been seen as an important threshold. Should the yuan ever breach that level, it would surely drag other currencies down with it.

China now seems to think that there is no red line at seven and that a flexible exchange rate would provide “an automatic stabiliser” for the economy.

- If the currency wars begin, the best boltholes are likely to be the yen, the Swiss franc and gold.

But a US-China trade deal might still see them avoided.

NHS buyers’ clubs

The Economist also reported that frustrated patients are clubbing together to import drugs that the NHS will not provide.

- Patients are legally allowed to import three months’ supply of a drug for personal use.

The newspaper quotes the example of Orkambi, a cystic fibrosis drug for which the pharma firm Vertex charges £104K per patient per year.

- But Vertex doesn’t have a patent in every country so the buyers’ club is importing a generic version of Orkambi from Argentina at a quarter the price.

Which makes one wonder why the NHS doesn’t do this directly.

- It even appears that the government is allowed to use a “crown use” licence to override the patent in the UK.

But of course, we wouldn’t want to signal that patents were not secure in this country.

Quick links

I have six for you this week:

- Enterprising investor looked at continued investment in low-yield bonds

- Alpha Architect looked at Factor Research on Steroids

- And at the curse of popularity

- RunPofits analysed 408 IPOs from 2011 to 2019

- UK Value Investor said that Royal Mail’s 13% dividend yield wouldn’t make him invest

- And The Economist looked at the new wave of Business Service Tech IPOs.

Until next time.