Pensions Commission – Consensus Revisited

Today’s post looks at a report issued this week which calls for a Pension Commission to be established.

Contents

The Report

The report, written by Ben Franklin, comes from the International Longevity Centre-UK (ILCUK), which is a think-tank on longevity and demographic change. ILCUK lobbies the UK and EU governments across a range of issues, including pensions.

The report was paid for (“made possible”) by Prudential, but I am hoping that this financial help doesn’t amount to sponsorship and that I can find no evidence of their involvement.

The case for the prosecution

The case for a Pensions Commission is made in three steps:

- it’s a bad time to be a pensioner or approaching retirement

(low investment returns, rising life expectancy) - retirement planning is difficult, with lots of recent policy change to digest

- a cross-party Pensions Commission is needed to re-build consensus and sort out the problem of low retirement incomes

I’m sold on the first two, but the report will need to go some to convince me of the third – I’m not a natural fan of Big Government and unnecessary bureaucracy. Nor would I like to see a commission stuffed with Party big-wigs in semi-retirement and industry shills.

The economics

The paper picks out a couple of features of the UK economy:

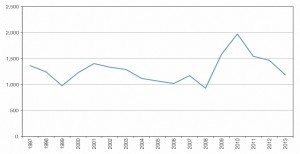

- recovery is predicated on rising household spending, but without matching incomes, savings will fall and indebtedness will rise

The evidence is mixed on this – real incomes are starting to rise courtesy of low inflation / possible deflation, but debt hasn’t come down. The report predicts household debt to income will pass the pre-crisis peak in 2018, and the savings ratio will fall to its lowest level since 1997.

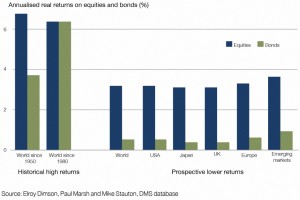

- the “new normal” means that future investment returns (on bonds and stocks) will be low, perhaps 50% lower than the 30 years before the crisis

It is difficult to see high returns under financial repression, and just as hard to see a trouble-free path out of low interest rates and QE. Whether the new normal lasts the full 30 years of retirement for today’s retirees is another question. The old normal might be back in five to ten years.

The demographics

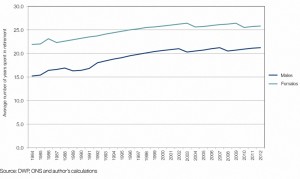

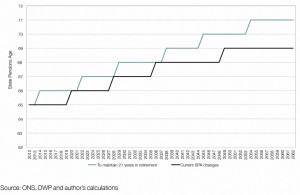

- Rising life expectancy without corresponding later retirement (yet) means that retirees in 2012 could expect 21 (men) to 26 (women) years in retirement. This is an increase of a third for men over the past 30 years and a 20% increase for women.

It’s pretty difficult to argue with these statistics. Retirement is definitely getting longer. Although there are plans in place to increase the state pension age, it’s not clear that they will keep pace with increasing longevity.

Nor is it certain that healthy lifespans will keep pace with total lifespans – how many people will actually be able to work past 70, whatever the retirement age tells them? And what about class and regional differences in healthy life expectancy?

Pensions

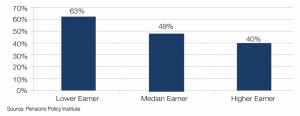

- The report takes as read that the new State Pension (around £7,500 for anyone with 35 years of NI credits) will be inadequate and that people will need to rely on their own (DC) pension.

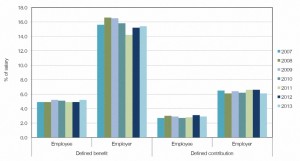

- Average annual employee contributions to DC schemes are 2.9% of salary (compared to 5.9% for DB schemes). Employer contributions are 6% (compared to 15% for DB schemes).

- The conclusion is that Auto-Enrolment as it currently stands will not deliver an adequate retirement income (defined as two-thirds of pre-retirement income) for even median earners.

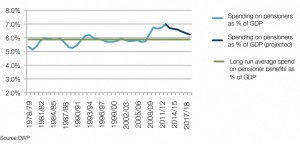

There’s a lot to consider here. Is the new state pension not enough? If so, what is? Can the state afford any more at the moment? Spending on pensioner benefits has been rising in recent years, but the government believes that recent reforms have managed to get this figure back towards its long-term trend, at least in the short-term.

Looking further ahead the demographics are insurmountable: state pension costs are expected to rise from 5.5% of GDP to 7.9% over the next 50 years, and health spending to rise from 6.4% to 8.5% of GDP.

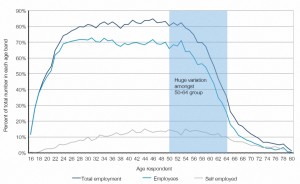

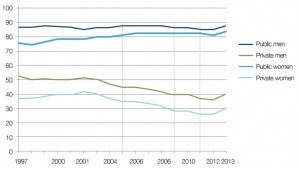

The chart below shows how private sector pension membership has fallen as generous DB pensions have been replaced by DC pensions. In the public sector where DB pensions persist, there has actually been an increase in membership. The uptick since 2012 reflects the phasing in of auto-enrolment.

DC contributions are clearly not enough, but how do you get people to defer gratification? This isn’t just a pensions problem. And if everyone did begin to save for the future, what would that do to a consumer-led economy?

Young people don’t want to lock money away in a product that can’t be accessed for thirty years, and whose rules change with every government. You could make contributions compulsory, but which politician will push that one through?

The Proposed Commission

The report sets out a fairly vague brief for the proposed commission:

- define target outcomes for retirement savings and extended working lives

- develop a mechanism for tracking progress towards these

- consulting to decide whether new policy is needed

- set out the rights and responsibilities of individuals, employers and government

- report to the Secretary of State for Work and Pensions, the Chancellor of the Exchequer and the Prime Minister

- comprise 4 “experts” – an academic, a charity, and employer and am an employee

The scope for left-wing bias in a four-person commission with an academic, a charity head and an employee (read union leader) is staggering. Good luck making this a cross-party enterprise.

Issues to consider

The report describes a number of issues that the commission might look into;

- raising (Auto-Enrolment) savings levels

- compulsory savings

- tax incentives

- expansion of ISAs

- longer working lives

- how to pay for long-term care as part of retirement income

- macroeconomic forces and likely investment returns

- the trade-off between savings policy and economic growth

- inter-generational differences and support for specific cohorts

The last point, in particular, worries me – that sounds like robbing old savers to help out poor young people.

Timescales

The proposal is to set up the commission immediately after this year’s General Election. The commission’s first report would replace the planned review of Auto-Enrolment in 2017. This report would set an agenda for the next 10 years to ensure stability.

Conclusions

- Pensions are in a mess. We’re all living longer and not many of us are saving enough.

- Setting up a commission to recommend that we force workers to save a bit more and work a bit longer probably won’t fix things.

- That said, without compulsion we are a long way from persuading today’s twenty-somethings to consume less and lock away their money for thirty-plus years.

- We need to aim a bit higher and work towards harmonising the minimum wage, the maximum working-age benefits, and the state pension. Then we really would all be in it together.

- If workers earning more than minimum wage want to save a bit more for a more comfortable retirement they should be encouraged (existing vehicles like SIPPs and ISAs are more than enough),

- We need to sort out the elephant in the room that is public sector DB pensions – the maths just doesn’t work anymore.

- We should also introduce an element of regional indexation to state benefits and public sector wages because at the moment you can live like a king in Scotland on money that would make you a pauper in London.

- Finally, we need to come up with a definitive solution for looming long-term care costs. At the moment, many people’s savings (and then their home) will be swallowed by care costs. ((Because the “hotel” costs – board & lodging – of care are excluded from the proposed £72K contribution cap.)) A true cap must be set on personal liability so that people can plan for the long-term.

Until next time.