Weekly Roundup, 17th August 2020

We begin today’s Weekly Roundup in the Economist with a pair of articles looking at the economics of vaccines.

Contents

Vaccine economics

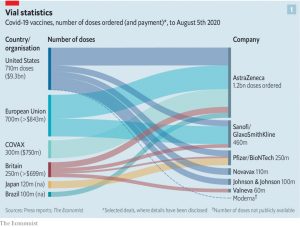

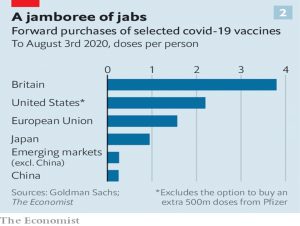

The first article from the Economist argued that the world was spending nowhere near enough on the search for a vaccine.

- The second added more detail, and some graphs.

If you fail to eat a pizza within an hour, you will die from hunger. Most people would immediately order a pizza—and not just one Margherita, but lots of them, from several different parlours. You would not care that some of the pizza would be sure to go to waste.

It’s a striking thought experiment, but the world is not dying, and there is no Just Eat for vaccines.

- At the same time, the newspaper may have a point that the $10bn spent to date is not enough.

This should buy 4bn doses of vaccine, but many will fail or will require more than one dose.

- The world might need five or ten times as many doses to be produced.

Which in turn might need $100 bn of funding, far less than the $7 trn spent so far by governments on income and job protection.

Measuring value

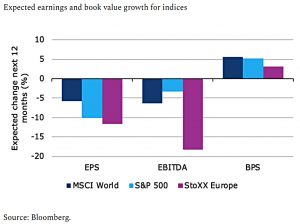

Joachim Klement looked at how to measure value.

- The basic problem is that trailing numbers – for example, the earnings in a PE ratio – are no longer representative.

I would argue that trailing numbers are still better than analysts’ estimates of future numbers, particularly since Covid-19.

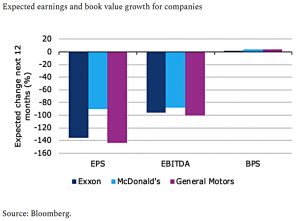

Joachim’s solution is to fall back to price-book (PB), which also has issues:

- Book value doesn’t deal well with intangibles, most importantly by not distinguishing between productive IP and deadweight goodwill from acquisitions.

On the other hand, book value is stable – typically twice as stable as EPS or EBITDA.

The effect is even clearer when we drop down to the level of individual companies.

Activist fund managers

Joachim’s second article was about activist fund managers.

- He says they are great, but not at being activists.

The first example he uses is billionaire Bill Ackman of Pershing Square (( Disclosure: I hold this fund ))

- Ackman coped very well with the Covid-a9 crash, taking a big short at the right time (previously, his fund had suffered from big losing positions in Herbalife and Valeant).

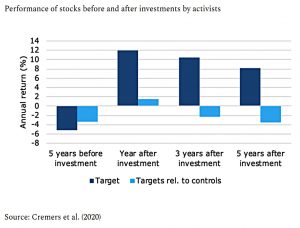

A new study finds that activist investors have an alpha of around 4% pa.

- The companies they invest in perform much better afterwards.

But when a control group of similar forms ignored by activists is introduced, the activist outperformance shrinks dramatically and is concentrated in the first year after investment.

- So in fact, activists are great stock-pickers, and great at timing their investments (both buys and sells).

But they aren’t activists – they just have very concentrated portfolios.

Private Equity

John Authers looked at the ever unpopular asset class that is Private Equity (PE).

The popular narrative is that leveraged buyouts allow private equity operators to strip assets, cut staff and move on having pocketed the value.

PE has boomed over the past 15 years, just as public equity markets have shrunk.

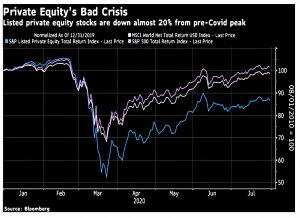

PE has had an OK decade, beating the world index but lagging the S&P 500.

PE has had a bad crisis and is still more than 15% down from its pre-Covid peak.

But perhaps its bad rep is not entirely deserved:

A survey of the academic literature shows that buyouts do improve productivity, and not just by cutting jobs, which tend to rise when privately held companies are taken over.

The main source of improvement comes from private firms that were relatively unproductive in the first place.

But buyouts of public companies, which tend to be bigger, lead to job losses.

In Europe, things are not so bad – PE is a net job creator.

John concludes:

Buyouts of big public companies [like RJR Nabisco], the kind that garner the most publicity, are the least successful and justifiable.

Joining the index

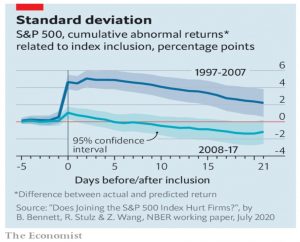

The Economist looked at why joining an index might not produce the abnormal returns that it used to.

- Tesla is due to join the S&P 500 after posting four consecutive quarters of profits.

This is usually seen as a good thing because index funds have to buy new members of indices, driving up their share price.

- And increased common ownership of large companies by the leading index funds is thought to reduce competitive pressure and increase shareholder returns.

But as passive investing has increased (from 3% to 40% of portfolios) this boost has become weaker, and may now even be negative.

- A new study has found that before 2007, index inclusion led to a 4.9% boost which took a year to dissipate.

From 2008 to 2017, the initial boost was less than 1%, and returns turned negative within three weeks.

There are two possible explanations (which are not mutually exclusive) :

- Passive investors are price insensitive, which could make managers over-confident

- More passive investors mean fewer activist investors to hold managers to account, impacting corporate governance.

More houses

The Economist also looked at the government’s planning reforms, designed to get housebuilding moving again – not that you would know there was a problem where I live, where every available space and amenity (eg. DIY stores) has been turned into 2-bed rabbit hutches.

The grand plan is to shift from a regime in which councils vet individual houses to an American-style zoning system, which will designate land by type.

The government will issue local councils with binding house-building targets, adding up to 300,000 a year nationally.

Zoning sounds okay to me, so long as there is a zone which prioritises single-family housing – I don’t think this is top of the agenda for my local council.

There will be three main zones:

- Growth areas for major development

- Renewal areas for “gentle” densification

- Protected areas where building will be restricted.

- Here’s hoping I live in a protected area.

The green belts around towns like London and Cambridge will remain protected, but the Section 106 rules which allow the council to extract cash for affordable housing (often elsewhere) will be replaced by a national tax.

- This should help.

There will also be a “beauty” test, based around historically attractive construction.

- Of course, the Economist doesn’t approve of this, but I think that the ugliness of new buildings is one of the key reasons that Nimbies oppose them.

Endowments

Over at Chief Investment Officer, they reported on a new study which shows that the average university endowment has underperformed the basic 60/40 stock/bond portfolio over the past 58 years (1961 to 2019).

- The underperformance was around 1% pa, which the authors claim is the typical difference between the costs of active and passive investing.

The only period of outperformance for endowments was the past 20 years, which includes the decade in which they came to prominence.

- Underperformance in the most recent decade is not a great surprise, since the largest stocks in the largest markets have done so well (making indexing hard to beat – the “ruler problem”) and interest rates have continued to fall (making bond prices rise).

I’ve never seen comparative data for pre-2000, and it seems to me that a lot of the vehicles exploited so well by endowments from 2000-09 (PE, hedge funds) would not have been so well-developed during this period.

- So whilst it makes a good headline, the results are not so surprising as they seem.

The true test of multi-asset diversification (other than shocks like Covid-19, which it seems to have passed OK) will come when (if?) a handful of tech monopolists are no longer the stocks to beat, and when (if?) interest rates start to rise once more.

Quick links

I only have four for you this week:

- Mauldin Economics looked at the Second Great Depression

- Alpha Architect examined whether trend following can reduce sequence risk

- And looked at Cross-Asset Signals and time-series momentum

- And the Economist reported that Covid-19 seems to have changed lifestyles for good.

Until next time.