LTA Revisited

Today’s post looks once more at the pensions LTA, after a spate of articles speculating about further cuts.

Contents

The LTA

The pensions Lifetime Allowance (LTA) is a cap on the value of benefits you can withdraw from your private pension(s) before you start to pay extra tax.

- Under the LTA, 25% of your pension is tax-free, and the rest is taxed at your marginal income tax rate.

Above the LTA, you pay a surcharge of 25% on income and a special 55% tax on lump sums.

- This is designed to reverse the tax benefits you received on the way in, though the absolute amounts involved could be much larger because of asset growth within the tax shelter.

The LTA is a bad idea for three reasons:

- It penalises successful investment since it is based on withdrawals rather than contributions

- It duplicates the work of the annual allowance (once £255K, now £40K), which already limits the amount you can save into a pension.

- Because your future pension value is impossible to calculate, it discourages contributions once you get to a place where you think you might exceed the LTA at some point in the future.

And that’s without discussing what the right size of the LTA should be.

Size of the LTA

The LTA was introduced at £1.5M as part of A-Day in 2006/07.

- I’m old enough to remember when it peaked at £1.8M in 2010/11, but since then the direction of travel has been downwards.

It was cut to £1M in three steps and then indexed to inflation, rising to £1.0731M in 2020/21.

I used to hope that the LTA would be scrapped before I reached age 75 (when your pension assets are taxed regardless of what you do with them), but the bill for Covid has put paid to that idea.

- The LTA has been frozen until April 2026 (indexation has been removed) and there is much speculation that it will be cut back further, to £900K or even £800K.

So how big should it be?

- There’s no reason for the government to incentivise luxurious retirements, so let’s say that your pension should be able to provide an annual income of £25K.

Indexed annuity yields at age 55 (the current minimum pension age) are 1.7%.

- This means that you would need a pension pot of £1.47M to generate £25K pa.

So for me, the LTA is way too small already (though it has been large enough in the past).

Just 7,130 people paid £283M in “LTA tax” during 2018-19 (the latest year for which figures are available) – an average of just under £40K each.

- But that total – and the average – is sure to rise.

Pension specialist Royal London estimates that 290,000 people already have pension pots larger than the LTA, though it’s not clear whether this includes people with protection at earlier (higher) limits. (( This protection – which I have – came at the cost of not making any further contributions to your pension ))

- They think that another 1.25M people will breach it eventually, even if there is no further tightening of the rules.

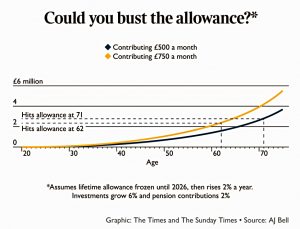

AJ Bell has calculated that contributions as low as £500 per month could bust the allowance eventually (see chart).

Pay less than 10% tax

The first article was from Ali Hussain in the Times.

- He claimed you can forget about the 55% tax surcharge and pay less than 10% tax on a £1.7M pension pot.

But when you look at the example in the article, what he (and the IFAs he quotes) mean is that the LTA surcharge will usually be less than 10% of the pot size.

- It ignores the income tax you have already paid on any money you have withdrawn.

The calculation also confirms that any growth in drawdown pots from the time they were set up will also attract the LTA tax.

- So you need to take enough out of your drawdown pots each year to prevent them from growing.

Alternatively, using UFPLS would appear to bypass this issue.

Tax tail wagging the dog

The second article was by Charlene Young of AJ Bell, in FT Advisor.

- She said it was important not to let the tax tail wag the dog.

She thought it was important to keep on saving within pensions – as we might expect someone working for one of the large pension platforms to think.

- I half agree – the LTA charge won’t make your pension less tax-efficient than a taxable account or an ISA (particularly where there is employer-matching) – but it does mean that your money is locked up for a while.

People approaching 55 (soon to be 57) might not care about a few years of illiquidity.

- But I’m sure the LTA puts off some higher-rate taxpayers in their 20s and 30s, particularly if they extrapolate the recent growth rates from the bull market in US stocks.

Doctors retiring

The second article in FT Adviser, from Amy Austin, reported that the number of doctors retiring early has trebled over the last 13 years.

- This might be down to increasing tax bills on their generous pensions.

The age of doctors retiring early has come down from 61 in 2007-08 to 59 in 2020-21. Dr Vishal Sharma, chair of the BMA pensions committee, said:

The number of doctors retiring early has increased nearly four-fold since the government began altering the NHS pension scheme and pensions taxation rules.

Don’t run scared

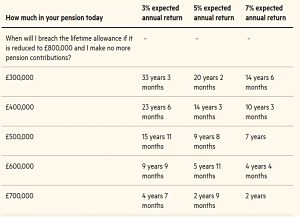

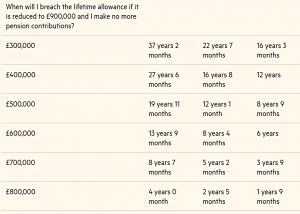

In the FT proper, Charles Calkin of James Hambro looked at the impact of potential cuts in the LTA.

If it falls to £800,000 then someone with £500,000 in pension savings, generating 7 per cent a year net returns on their portfolio, will hit the ceiling in seven years (at the current allowance level it is 11 years and four months). Dial down your risk and bring returns to 3 per cent and it will be 15 years and 11 months before you breach the limits (25 years and 11 months at today’s limit).

This is fiendishly complex and there are numerous factors to take into consideration when deciding your own response. You might ask why any chancellor ever thought such a charge sensible. It is surely simpler to limit how much people put into their pension and the rate of tax relief, rather than penalising their success at investing money wisely. But we live with what we are given.

Conclusions

- The LTA is already too low and could get lower.

- It penalises success and planning ahead, and discourages saving for your future.

- Calculating your best course of action is fiendishly difficult.

- There are no ways to avoid the majority of your potential extra tax charge.

We haven’t learned much today.

- Until next time.

Re:

“She thought it was important to keep on saving within pensions – as we might expect someone working for one of the large pension platforms to think.

I half agree ….. ”

Does this sort of imply that with the benefit of hindsight you perhaps should not have applied for protection?

Not at all – once they cut the LTA and you can’t get your money out, protection is the best option.

But (1) the LTA shouldn’t exist (there’s a contribution limit already); (2) it shouldn’t ever be cut (inevitably, people will have contributed based on the previous higher limit); and (3) even if – after the cut – you still like the tax relief on pensions, you can’t really work out when to stop contributing because your investment performance is such a big factor.

If I had known the size of the bill I will be facing when I hit 75 I would have stopped work sooner.

Thanks for the clarification, which was as expected.

Unfortunately, the rules are what they are, they are also IMO rather complex and we all just have to try and find our best way through them.

Also, could you say a bit more about the section that starts “The calculation also confirms …..” as I understood this to operate the other way round re UFPLS and flexible drawdown (FD). That is, every UFPLS is a BCE whereas FD is tested once at crystallisation and usually only again at 75.

You are right that UFPLS is a crystallisation event and that FD is tested twice. UFPLS avoids the second test on the same money, though you can save just as much tax by making annual FD withdrawals.

Growth in the FD pot does not escape the LTA tax, but withdrawals just attract income tax.

Here are some links from Royal London and Thomson Reuters confirming withdrawals are not tested:

https://adviser.royallondon.com/technical-central/pensions/benefit-options/benefit-crystallisation-events-and-the-lifetime-allowance-charge/

and

https://uk.practicallaw.thomsonreuters.com/9-380-6449?transitionType=Default&contextData=(sc.Default)

Thanks for the links.

The potential beauty of the FD approach vs UFPLS is that assuming you fully crystallise (ideally under the LTA) you will have no further LTA penalty to pay if you correctly manage your annual withdrawals up until you reach 75. You will, of course, pay income tax on the FD withdrawals – and that is true for (75% of) the UFPLS withdrawals too. However, going the UFPLS route adds all incremental growth after the first UFPLS to the percentage LTA used.

All far too complex IMO.

The ‘best’ path is highly dependent on your personal situation and is also subject to future changes in the rules too.

My apologies, should have really said “all subsequent withdrawals” rather than “incremental growth” above.

Thus, provided your total withdrawals (until you expire) using UFPLS remain under the LTA (strictly speaking 100% of the LTA) there is no LTA penalty to pay. This becomes harder to achieve if the LTA decreases over time.

As you said, it depends on personal circumstances. Three of mine which are relevant:

– I have no chance of staying under the LTA

– my partner still works

– I need a lot of annual after-tax cash flow but also some dry powder in the tax-free lump sum for when she does finally quit

So UFPLS suits me, though my understanding is that it’s not very popular generally.

I did some scenario modelling when I hit 55 and the only thing that seemed advisable was to use up your LTA before hitting 75, in whichever fashion you choose. But for people who want to pass on their pension, even that might not be a good idea.

Yup, it sure is complicated – throw in DB’s and IMO it can get even more situational/personal.

I think I can see where you are coming from.

My overall plan (post jumping ship) was to try to empty my DC before commencing my DB and stay under the LTA – so, in principle at least, I should not really need to worry about BCE5. Having said that, I have already had to revise some aspects of this plan due to changes in the rules.

I have just spotted a mistake with my description of UFPLS above.

The rules are such that it should not possible to exceed the LTA using UFPLS, see e.g.

https://adviser.royallondon.com/technical-central/pensions/benefit-options/ufpls-explained/

and explicitly the condition: “The individual must have available lifetime allowance”.

Apologies.

I think we all agree the LTA area is fiendishly complicated.

All very useful stuff. I did some modelling around this and was surprised to realise that when you start looking at total project life time tax ( ie inc income tax and potential IHT) that many of the LTA reduction ideas that work in isolation didn’t work in the round. Of course it depends on what IHT etc mitigation you have.