Weekly Roundup, 13th September 2021

We begin today’s Weekly Roundup with a look at TINA.

TINA

John Authers looked at why investors have no choice but to stick with stocks.

- The phrase (and subsequently the TINA acronym) was made famous by Margaret Thatcher: “There is no alternative” (to what, I can’t remember).

In recent months, that seems to have moved almost to TRINA (There Really Is No Alternative). Or perhaps even TRINAAA (There Really Is No Alternative At All).

The Bank of America monthly survey shows that far fewer expect a stronger economy, but there is no corresponding falloff in the number who are overweight equities.

- There are also fewer who believe that corporate earnings will rise.

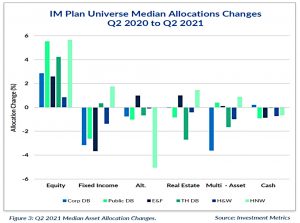

The Investment Metrics survey of changes in asset allocation shows a switch from bonds into stocks over the past year, across all types of funds.

- A net 30% say they are underweight bonds.

It remains to be seen whether TINA can survive a QE taper and potentially higher interest rates.

Redwood

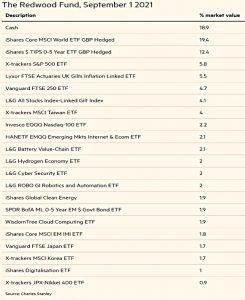

In his regular review of the ETF portfolio he runs for the FT, John Redwood said that investors are watching labour market inflation.

John is now regretting his rotation from tech into the world index:

Blessed with hindsight, it would have done even better just to stay in the US.

But will the US continue to win?

- The 2020 outperformance was due to the reliance on Big Tech during Covid lockdowns.

In 2021, it’s largely due to more stimulus in the US relative to other geographies.

The US remains the largest part of the economy of the advanced world. Its annual per capita income is more than 50 per cent above that of the UK, France or Japan. Nonetheless the share of the US in the world stock index is even higher than the US share of advanced country income.

China is the obvious alternative.

But just as China is coming closer to overtaking the US in economic size, the country is turning inward. It is attacking its own entrepreneurs and freer thinkers and giving greater priority to enforcing uniformity and building the sinews of war at home.

So John is worried – Biden seems determined to run the US economy hot, which could lead to inflation and the removal of stimulus, or even rate hikes,

Stocks on TV

In his regular FT column, John Lee surprisingly (in my view, at least) said that we need more TV promotion of stock market investment.

- He’s worried by the reliance of the masses on cash and cash ISAs, whilst so many young people are day trading crypto and options.

He also notes the high yields offered by blue chips like Legal & General (6.5% pa).

John says that he has written to the BBC about this, but there are two obstacles:

- the TV companies think there would be no viewer demand (possibly a chicken and egg problem)

- FCA and Ofcom regulations would restrict what could be said

Despite this, advertising for betting and gaming is everywhere.

Eventually, John turns to his small-cap portfolio:

The past quarter has seen my big favourites — Anpario, natural stimulants for animal growth, Cerillion, telecoms billing services, Lok’nStore, storage, and Treatt, flavours and fragrances, performing well.

He has also been buying a lot of Vitec, some Lords Trading Group, and is watching Concurrent Technologies.

To finance these purchases, I reluctantly sold a number of smaller holdings, taking good profits from Kooth, STV and Tatton Asset Management.

Pensions

Josephine Cumbo had a couple of articles on pensions.

- The first looked at the threat to the recovery in FTSE-100 dividends from new pension funding rules.

Dividends paid by the UK’s largest 100 listed companies dropped from about £110bn in 2019 to just over £70bn in 2020, but announcements so far in 2021 suggested that much of that fall could be reversed this year.

But from October, company directors can be sued over dividends which lead to a “material reduction” in the recovery to a DB pension scheme from a (hypothetical) insolvency.

Laura Amin, from actuarial advisors LCP, said:

Government and regulators are keen to avoid a repeat of scenarios where a company goes bust leaving a hole in the pension scheme after a period when large dividends have been paid to shareholders. Company boards will have to think much more carefully when setting their dividends.

Half of the UK’s 5,300 DB schemes are currently in deficit.

The second article looked at Nest Pensions’ push into private equity.

- The £20 bn, 10M member state-backed fund is planning to allocate 5% of the fund to PE by 2024.

Stephen O’Neill of Nest said:

We want private equity to play an important role in our portfolio, offering strong returns and diversification. We’re excited about the positive impact we can have on growing companies.

He expects the fund to grow to £80 bn over the next 20 years.

Nest is the first DC fund to respond to calls from the government that more of their funds should be directed to long-term investments like infrastructure and PE.

- A key objection from DC schemes has been that PE charges would breach the 0.75% pa charge cap on pensions.

This cap was recently loosened to accommodate performance fees, which in turn should mean that PE is accessible.

Planning

This week’s catch-up with Klement looks at planning.

- Joachim simplifies the job of financial planning down to its essence – preparing for retirement.

The switch from DB to DC pension plans has shifted investment risk from the employer to the employee.

A University of Missouri study has looked at 2000 pension plans between 2013 and 2015, comparing plans which offered advisory services to those which did not.

When it comes to picking outperforming funds, the advisors are no better than chance. The average return in plans with advisers was about the same [but] the volatility and downside risks of the portfolios was somewhat higher.

Advisers moved investors into funds with higher risk but no compensation for that extra risk.

But that’s not the central point.

The true value add of an adviser lies in the actual planning process, not the selection of investments.

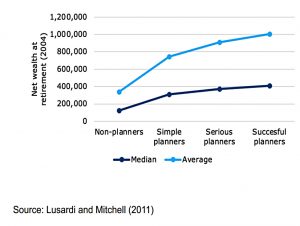

An earlier paper looked at how the type/amount of planning undertaken by investors impacted their net worth at retirement.

They distinguished between nonplanners, simple planners (people who roughly knew how much of their income to save each month or each year), serious planners (people who have a proper financial plan) and successful planners (people who have a financial plan in place and managed to stick to it throughout their career).

Even simple planning doubled net worth, and serious planning added another 30% on top.

This is where advisers really add value: making investors aware that they need to save, how much they need to save and how best to manage their income and expenses to achieve their savings goals.

Not just advisers – bloggers, too.

Crypto

The Economist travelled to El Salvador, to see if the country was ready for its looming adoption of bitcoin as legal tender.

The usual definition of legal tender is that money can be used to settle debts.

- El Salvador has also insisted that businesses must accept bitcoin as payment for goods and services.

Three-quarters of Salvadoreans surveyed in July were sceptical of the plan. Two-thirds were not willing to be paid in it and just under half knew nothing about it.

Both the World Bank and the IMF have warned against adoption, citing the potential impact on macroeconomic stability and bitcoin’s environmental costs.

President Nayib Bukele claims that the move will lead to more foreign investment and will cut the cost of remittances (money sent home by El Salvadorians working abroad).

A diaspora of some 2m Salvadoreans sends remittances worth 20% of GDP home each year. But crossborder bank and wire transfers are slow and expensive.

But bitcoin’s volatility makes it impractical for grocery shopping and debts.

- At present, even those locations accepting crypto fix prices in dollars and convert on the spot.

Two hundred “reverse cash machines” are being installed to convert dollars to bitcoin wallet balances, but these charge fees of up to 5%.

- It all sounds tricky to me, but it will be interesting to watch from afar and see how this real-world experiment turns out.

Quick Links

I have seven for you this week, the first three from The Economist.

- Goldman Sachs is floating its private equity arm

- The “Google of genomics” could be in for some anti-trust issues

- And Intel’s turnaround will affect the future of chipmaking

- Alpha Architect asked whether cryptocurrencies improve portfolio diversification

- And also wondered whether the value premium might be smaller than we thought.

- UK Dividend Stocks provided a quarterly review of their portfolio

- And a new platform wants to give retail ESG investors voting power on the cheap.

Until next time.

Did the statistic “Half of the UK’s 5,300 DB schemes are currently in deficit” come from the Cumbo article?

I ask as last figure I saw from the PPF (on a S179 basis) is around 63% (3371 of 5318) UK DB schemes are in deficit.

It does, and according to the article, the source is the PPF.

My bad; my report was out of date.

PPF August 2021 update on a S179 basis (see https://www.ppf.co.uk/ppf-7800-index) says: “There were 2,600 schemes in deficit and 2,718 schemes in surplus” i.e. 49% in deficit.

OOI, chart 5 (on page 5) of the PPF full report – click on the “view full report” button at link given above – shows the history of this statistic over the last nine years.

Incidentally, Note 3 of the full report states:

“In addition to s179, there are many different measures of a scheme’s funding position. … The different measures can give very different levels of scheme funding at any point in time and can move very differently over time.”

Slide 5 [called “the seven dwarfs” NOT the 7 circles!] of this report (https://www.actuaries.org.uk/system/files/documents/pdf/c02-new-way-looking-employer-covenant.pdf) puts some numbers to this variability – with fundedness (by my calculations) varying between roughly 60% and 100% depending on the method used.

The BDO report gives the highest fundedness when using the PPF method (presumably s179). This is not entirely surprising seeing as the PPF provides benefits that are below the legal minimum required of all other schemes. What is slightly surprising however, is that the PPF report in their annual blue book that schemes technical provisions (the funding necessary to provide the schemes benefits) are not massively dissimilar (in aggregate) to the s179 values at just under 100% +/- 5% from 2005 to 2018. This may be down to schemes opting to use a somewhat less onerous discount rate than the PPF – as suggested by the BDO slide.

It is all rather complicated!

Ooops, meant to say “purple book” – not “blue book” – above