FCA RDR FAMR Evaluation – Alphabet Soup

Today’s post looks at a report from the FCA evaluating the impact of the Retail Distribution Review and the Financial Advice Market Review – it’s the FCA RDR FAMR Evaluation.

FCA RDR FAMR Evaluation

The RDR pre-dates the FCA, having been commissioned by its predecessor the FSA (Financial Services Authority).

- It came into effect in 2012.

The FAMR was launched in 2015 and the RDR FAMR review was begun in May 2019.

The FCA believes that the financial advice market is improving.

- I find that hard to believe, particularly for smaller investors.

Advice is a closed shop (a regulated activity) and as such is very expensive.

- Investors would be better served if this regulation was removed so that investors with less than say £100K to invest can receive the advice that they need.

The FCA accepts that too many people hold cash rather than investing and that many do not seek or receive advice.

- They look for help from automation, tailored guidance services and simpler advice services.

And they seem to accept that over-regulation might be an issue:

We understand that the current regulatory framework may pose challenges to further

market development in sufficiently meeting these consumer needs, and recognise our

role in making sure the regulatory issues noted in this report are explored and

addressed, where possible.

That was going quite well until we got to “where possible”.

Industry reaction

As you might expect, the industry is not universally in favour of less regulation and/or lower fees.

Rory Percival, formerly of the FCA, thought there would be a focus on Product Governance rules, which force advisers to meet the needs of their target markets:

There is nothing the FCA can really do to improve competition from the demand side

given the trust basis of the market and lack of consumer price sensitivity. Prod compliance should encourage greater competitiveness in the services across the market.

I can’t see it myself.

- I think that the people not currently receiving advice are price sensitive, though it’s true that they also probably have trust issues.

Heather Hopkins, MD of NetWealth, focused on regulation:

Charges are important – they have a huge impact on financial returns. But we need to root out the reasons for the charges. The cost of regulation keeps climbing – FCA fees, FSCS levies, PI cover and admin to comply with the rules.

Martin Bamford of Informed Choice also focused on the cost of regulation:

It’s a bit rich of the FCA to criticise the IFA market for lack of price competition, when our costs are being driven ever higher by regulatory failure and the growing burden of FSCS levies.

If the FCA wants more price competition and wider service delivery

it must take immediate action to address the huge cost of providing compensation to customers of failed firms.

Henry Tapper saw the problem as people not wanting to pay to be told how to behave:

The FCA’s review is short on answers and long on problems. Advice remains a “minority sport” practiced by the wealthy in pursuit of wealth preservation.

For the majority of people, financial advice seems to be a commodity with a price cap of £250, putting it in the same price bracket as [subsidised] medical prescriptions, dentistry and of rather less importance than the cost of watching the TV.

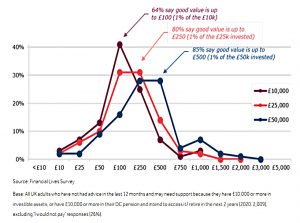

Research for the report found that 26% of people would not be willing to pay even £10 for advice.

- Those who would pay wanted to pay less than 1% of their pot (and who can blame them).

With typical IFA fees in the £2K to £5K range, that rules out people with less than £200K (who in any case, don’t want to pay more than £250).

Becky O’Connor of interactive investor said:

More than nine in ten UK adults have not received financial advice. It’s just too expensive for most people and so it doesn’t reach many of those who could benefit.

Moira O’Neill, also of ii, said:

Most of the industry clings to an old-fashioned percentage fee charging structure, which is essentially a wealth tax, penalising customers as their wealth grows.

Andrew Morrow, of OpenMoney, said:

The industry must do more to cut costs, simplify communications and improve transparency by using technology, alongside human advisers, to offer regulated advice around straightforward products that meet people’s future financial needs and goals at far lower fees than traditional advice.

Sarah Waring at Quilter warned of the “glacial pace” of change:

It has been some time since the regulator’s interventions through RDR and FAMR and there is palpable frustration from both the sector and the regulator that more improvements haven’t been made. Many people think financial advice isn’t for people like them or they wouldn’t benefit from it.

Consumers

The first section of the report looks at the consumer perspective.

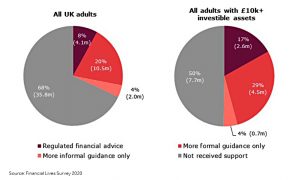

- Note that the target customer the FCA has in mind is someone with a minimum of £10K in assets.

There are five key findings here:

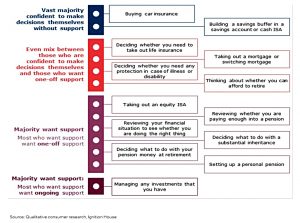

- Most people are comfortable with less complex financial decisions – without seeking advice.

- Most would like (one-off) support for more complex decisions (eg. investing in a stocks ISA)

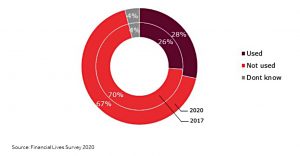

- Use of what the FCA groups together as “support services” is up from 26% in 2017 to 28% in 2020.

- Automated services (robo-advisors) have only been used by 1.3% of UK adults in the last 12 months.

- Most users of “guidance” had found it somewhat helpful, but on a minority found that it helped “a lot”.

Here’s a chart showing the modest growth in the use of guidance:

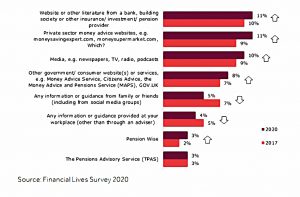

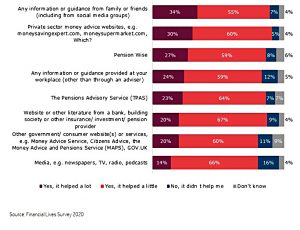

The next table shows which sources of guidance people used.

And this one shows how helpful the advice was, by source.

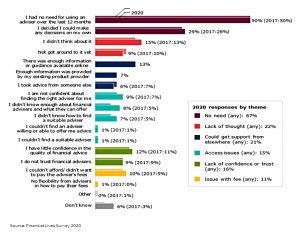

Here are the reasons that people gave for not seeking advice:

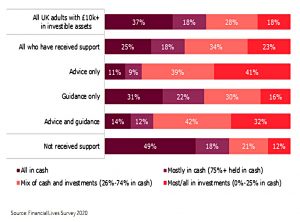

The next chart shows the potential impact of advice and guidance.

- It shows the mix of cash and real investments for adults who received a given level of advice:

The industry

The next section looks at the industry landscape. There are seven key findings here:

- UK financial support is split between “holistic advice” and factual information, with little in between.

- “Streamlined advice” and “personalised guidance” would be useful intermediate services, to be accessed in a more flexible, transactional way.

- It’s not clear what the regulatory regime would be for these services.

- Automated advice has had little takeup and doesn’t apply any competitive pressure to traditional advice (such pressure might be beneficial).

- There is little competitive pressure, in general, to force advisors to innovate or reduce costs.

- Holistic advice tends to lead to ongoing advice.

- Holistic advice is expensive (relative to automated advice) but it’s not clear how customers assess value for money.

- Analysis of international markets (USA, Netherlands, Australia and Switzerland) leads the FCA to believe that greater transparency on charges and services can lead to “increased consumer engagement and [a greater] focus on

the value proposition of services”.

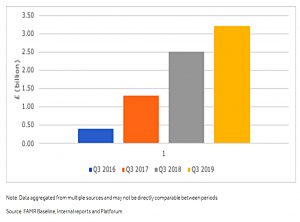

This chart shows the growth of automated advice, but the numbers remain very small:

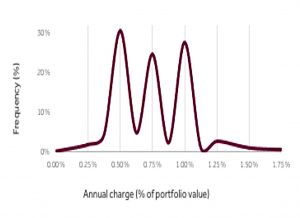

The lack of competition in the industry shows up in the clustering of charges:

More than 80% of ongoing advice services had ongoing charges set at only

3, round, price points. One-off advice was slightly less concentrated, with 50% set at just 3 price points, including 38% of one-off services charging 3% of the portfolio value.

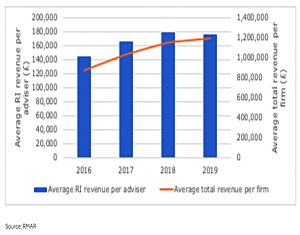

It’s also clear from the revenues per advisor, which sit at £175K pa:

The biggest cost to advisors (as with most of the financial services industry) is onboarding new clients, which seems impervious to technological advances:

Firms said the initial onboarding and fact-finding for new customers remains a lengthy, manual process with fixed costs of around £1,000.

Advisor perception

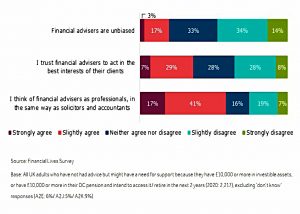

Attitudes to financial advisors are not great:

- Only 20% think they are unbiased (48% disagree)

- 36% think they act in the best interest of clients (36% disagree)

- 58% think they are professionals (26% disagree)

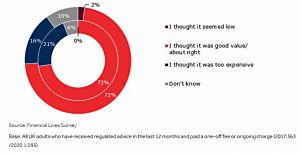

Yet most people who have actually paid for advice think that the amount they paid was about right.

Yet those who have not had advice think that 1% is the amount to pay, even on small pots like £10K.

- IFA fees are an order of magnitude larger than this.

Conclusions

The FCA points readers of their report to their Call for Input on Consumer Investments, which closed on 15th December 2020.

- No doubt a further report will be forthcoming.

It seems to me that nothing will change until the FCA accepts the central contradiction in financial advice in the UK:

- They would like simpler advice to be available to customers with smaller pots

- But advice is a regulated activity, requiring exam passes, industry sponsorship and annual government levies for advisor eligibility

Until people like me are allowed to provide low-cost advice, we will be stuck with high-cost advice affordable only by the wealthy.

- Until next time.