My Meetup Experiment

Today’s post is about My Meetup Experiment, in which I took over as organiser of an investing Meetup group, to find out more about how they operate.

Me and Meetup

For anyone who doesn’t know, Meetup is an online service that lets you organise groups around in-person events.

- It’s been around since 2002, but I only joined a couple of years ago (early 2017).

It’s owned by the temp office / incubator group We Work.

- In theory this means that you can host meetings at We Work locations (more on this later).

I’ve joined a few groups (this is free to do), but never found the time to attend a meeting.

- The investing groups that I have attended are mostly organised via Eventbrite, Facebook, or old-fashioned email lists.

My non-attendance to date will become ironically relevant later.

The opportunity

I joined Meetup with the medium-term ambition of setting up my own investing group.

- Then in December 2018 one of the groups I’m in sent me a message that the organiser had resigned, and did any member want to take over.

This costs $20 a month (+ VAT a total of around £19) for a group as big as this one was.

- Smaller groups run as cheap as $10 per month, if you pay for six months in advance.

The group

The group I became organiser of is called London Passive Investing Group.

- You can find it here.

It’s been around for more than two years, and has held 30 previous meetings.

At the time of writing, it has 368 members.

- That’s up a couple from when I took over.

A couple have left, and a couple more than that have joined.

- Surely I could fashion a workable group from that many existing members?

Here’s the manifesto of the group, which I left unchanged at first, apart from adding a new paragraph at the top.

- My plan was to brainstorm the future direction of the group at my first meeting.

I’m obviously not an entirely passive investor, but the core topic of investing via ETFs – and portfolio construction in general – is something that I know a lot about.

- And if the group proved to be a success, I could always start a parallel active investing group.

The survey

My single edit to the manifesto promised a survey, which went out later the same day, via Google Forms.

- You can find it here.

Out of the 366 members at the time, I got 11 responses.

- That’s a 3.0% response rate.

I have no idea how that compares with the Meetup average.

- But for comparison, my somewhat larger email list for a weekly summary of 7 Circles blog posts had a response rate of 6.4% this week.

So I was a little disappointed, and worried for the future of the group.

And of course, with such a small sample, it’s hard to know whether the respondents are a fair reflection of the group membership.

- But they are probably a decent representation of the people who might come to the meetings, which is more important.

20 questions

I asked twenty questions in the survey, but they were all multiple choice or single line answers, so the form only took a few minutes to complete.

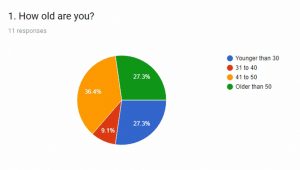

The first section was about the members themselves.

There’s a good spread of ages.

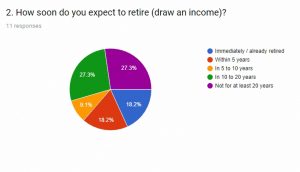

There’s quite a spread on investment horizons, too, which is not such good news.

- People close to retirement and those with more than 20 years to go are likely to want to implement different strategies.

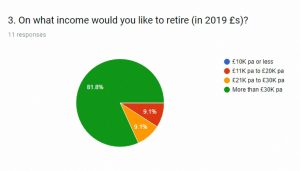

This one surprised me.

- Almost everyone is looking to have an income of more than £30K.

At a safe withdrawal rate of 3.25% pa, that needs a pension pot of more than £900K (plus somewhere to live).

- It’s possible that some people were factoring in the state pension, but that means delaying retirement to age 68 (or older).

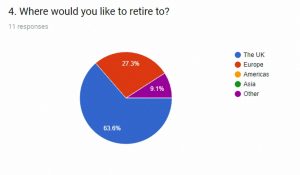

Most people plan to retire in the UK, with a few in Europe.

- One person chose “other” (Africa / Antarctica).

Question 5 asked why people joined the group.

There was no consensus here:

- Meet people / networking.

- Learn more about investing / passive investing.

- Saw the link on 7 Circles.

Question 6 asked what people liked about the group.

- Sadly, this revealed that most of them hadn’t yet attended a meeting.

Other than that, we had “diversity of views” versus “same goals”.

Question 7 was what they liked least.

- One non-London member wanted a webinar rather than a face to face meeting.

- Another member was disappointed that the group wasn’t led by a professional investor.

- I won’t take that personally as I’m so new to the group, but I would argue that I’m much better than a professional investor.

Question 8 asked how many meetings they had attended (this should have been question 5).

- Two people had attended a single meeting each.

- The other nine had never been to a meeting.

So much for the group having 350+ members.

Question 9 asked how many meetings they planned to attend in 2019.

- Three gave numerical answers, between 3 and 10.

- Three said as many as possible.

- Five were cagey or asked me to “show my value”.

More than 80% would not pay more than £5 to attend a meeting.

- 36% would not pay anything.

I’m now very worried for the future of the group.

- People who don’t make a financial commitment are prone to become no-shows on the day. (( The previous organiser said she’s had some problems with this ))

- And I know from my financial coaching that the less people pay, the less seriously they take the information they receive.

On top of that, free meeting locations in central London are not easy to come by.

- I could also see myself becoming distracted over time if there were no financial incentive whatsoever to continue.

The next section looked at the members’ existing portfolios and investing experience.

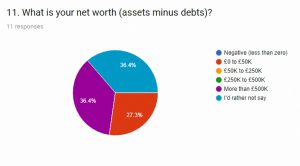

36% were not willing to say how much they were worth.

- Of the remainder, 40% have less than £50K and 60% have more than £500K.

That’s three very different groups responding to this question.

Taking house equity out of the equation simply knocks one person down from the £500K+ band into the £50K to £250K band.

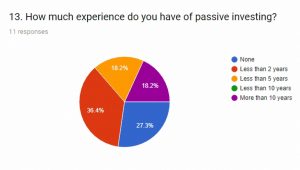

80% of respondents have less than 5 years of experience.

Only 36% have a majority passive portfolio.

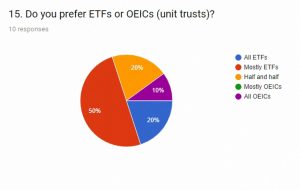

There is at least a preference for ETFs over OEICs.

Question 16 asked about brokers:

- Interactive Investor was most popular, with three votes.

- HL, AJ Bell, Vanguard and DeGiro were also mentioned.

- Three people had no broker / investment platform.

The group was split down the middle on home (UK) bias in asset allocation.

Respondents were mostly keen on stocks.

But a significant minority were over-keen on bonds and cash.

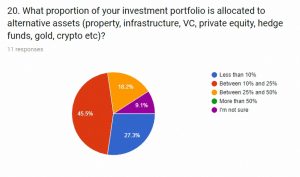

Alternative assets were surprisingly popular.

A meeting

Despite the poor survey response, it wouldn’t be a true experiment without arranging a meeting.

The lack of enthusiasm for paid meetings presents something of a problem here.

- The regular investor meetings that I’ve attended have been based around meals in rooms above pubs.

The room itself is usually free, but including drinks, attendees spend upwards of £20 each during the meeting.

- That probably wouldn’t play well with people who won’t pay more than £5.

So we immediately had a venue problem.

I decided to set up a meeting without a location, and ask the members to help.

- But no suggestions were forthcoming.

In the end, I called in a favour to borrow a room for free.

- This is obviously not a long-term solution.

Conclusions

London is a big city, and ETFs are a topic that should have widespread appeal.

- But it looks as though the capital can’t support a self-help and education group on the topic.

- Or maybe there’s a great one in existence already.

In the end, three people came along to the February meeting – so this particular Rome clearly won’t be built in a day.

- I’ll publish a post on what we discussed at the February meeting next week.

And there will be another meeting in March, for anyone who is interested.

I have a resolution each January to try to meet with and to help less experienced investors.

- But it looks like 2019 might again not be the year when this takes off.

Until next time.

Interesting experiment – at least people did turn up and hopefully, this will continue to grow. Do you know what the attendance was like for the meet ups arranged in the past?

I’m a member of a couple of Meet Up groups (for walking) – the main thing is that there’s no expensive venue to pay for when people meet up to go walking but it’s obvious that the regulars have become friends so will almost always guarantee good attendance (average around 20 each meet up).

I can see why people might be reluctant to fork out a fiver to attend (as they don’t know what they’ll be getting in return) – however, meet up in a room in a pub, it’s their choice to spend £20 on their favourite pints.

I think the previous attendance was four to eight with a lot of dropouts on the day of the meet, so we’ve gone backwards. What I’m surprised by is not really the general lack of enthusiasm, more that 97% of the existing group members have yet to interact with me at all, never mind turn up.

I’m afraid the pubs in central London would insist on a minimum spend, so leaving it up to people’s whims on the day wouldn’t work. Some of the groups I went to last year spent upwards of £500, though I guess others might spend as little as £150.

I know there are investors paying £500 for day seminars, so £5 for two hours doesn’t seem bad to me. The tube fare into town is £4.80. I guess people have different priorities for their cash than I do.

Running a group is certainly not a money-making exercise. I’ll keep it going for another month or two and see what happens.

The lack of participation is surprisingly – why join a group if you’re not really interested in joining in or interacting?

Good luck with your efforts, I look forward to reading your update on this.