Weekly Roundup, 4th June 2019

We begin today’s Weekly Roundup in the FT with John Lee, who was talking about his small-cap portfolio.

Contents

Small caps

The highlights were a takeover bid for events and exhibitions firm Tarsus (a few years earlier than John expected), and a visit to the Richmond HQ of broadcast and photo equipment provider Vitec (a former and now current holding).

- Other companies mentioned included Air Partner and property firm Daejan.

Zeroes

David Stevenson wrote about the strange death of the zero-dividend preference share.

- Zeros are issued at a discount to their final redemption value so that the implied interest is rolled up and can be taken as a capital gain instead.

Twenty years ago lots of zeros were issued by investment trusts known as split-capital trusts.

- This ended in a bust involving too much leverage and incestuous cross-holdings between trusts.

David describes an ongoing problem with the zeros in what used to be Ranger Direct Lending, which is being wound up.

- The zero holders are due 127p per share in July 2020 and have turned down an offer of 116p today.

There are far fewer zeroes available to private investors today.

- And those that are available typically yield between 3% and 5% pa.

Since challenger banks will often lend to funds at these rates, this means fewer zeroes in the future.

- If you are interested, David recommends the AIC and Quoted Data as sources of information.

Rate Cuts

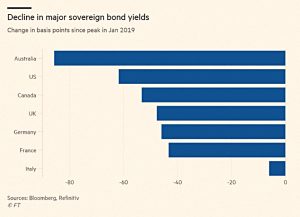

Michael Mackenzie said that the bond markets are yelling rate cut but that the Fed was unlikely to listen.

This week, a red flag was hoisted with the 10-year [Treasury] yield dipping well inside that of three-month bills. Not since the summer of 2007 has the yield on a 10-year note dipped 21 basis points below its 90-day peer.

Michael thinks that the Fed will only cut rates when one or more of inflation, consumption and business investment falls.

- He also expects equity declines and a stronger dollar.

In the Economist, Bartleby explained why managers should listen to shareholders.

- A new paper has found that when shareholders approve the issuance of new shares in advance, the stock price rose by an average of 2%.

When managers issued stock without shareholder approval, the share price went down by an average of 2%.

Managers may want to issue shares to fund expansion of the company, allowing them to control more assets and demand a higher salary.

Investors, meanwhile, may worry about the impact of expansion on long-term returns and dislike the dilution of their control.

Other agent-principal conflicts include the placing or offering of shares to selected investors.

- These tend to cluster just below the minimum level that must be approved.

The latest battleground is ESG investing.

- Managers often resist such “interference”, even though meta-studies indicate that companies with better ESG records outperform.

Central banks

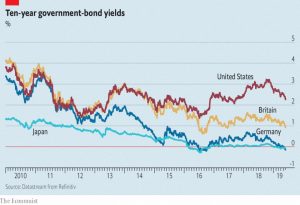

The newspaper also looked at the tools that central banks will need to equip themselves for the next recession.

- A decade after the last recession, the Fed’s benchmark interest rate is at 2.25% to 2.5%, which gives little scope for rate cuts.

Previous recessions have required cuts of around double that size.

The Fed has a conference this week to discuss what should be done, but is it too late?

- Both Trump and left-wingers on both sides of the Atlantic are now keen to influence central bank policy.

The only change that the Economist expects to come from the Fed meeting is that the inflation target of 2% would apply to an average over the economic cycle.

Overshoots during booms would make up for shortfalls during busts.

The theory is that this might help deal with interest rates stuck near zero, by boosting inflation expectations in a downturn. That would mean real rates were lower, giving the economy a boost.

But inflation has undershot the 2% target for 85% of the time since it was introduced in 2012.

- Investors may not believe central bank promises to get inflation higher.

The other tools used so far are QE and forward guidance.

- The one that hasn’t been used is negative rates – people would hoard cash rather than pay banks to take their deposits.

The Economist would like to see a GDP target introduced, but I have a lot of problems with GSP as a measure (see here and here).

Other ideas include a payment to all citizens (effectively helicopter money).

- 0.7% of GDP has been suggested, which might translate to around £200 in the UK.

- This is intended to represent half of the drop in consumer spending in a recession.

More targeted measures would include increases to food stamps, welfare and unemployment benefits.

- Other groups argue for temporary tax cuts.

China’s US bonds

The Economist also looked at China’s holding of US bonds.

- China holds $1.1 trn of US debt, built up when it was selling the yuan to encourage export-led development.

It now manages the yuan against a basket of currencies, so it’s no longer buying Treasuries.

- But neither has it sold many.

China could dump the bonds and try to saturate the market for Treasuries, but it’s a big market.

- US deficits mean that the amount of outstanding bonds grows by $1 trn a year.

It’s possible that the US might need to increase interest rates on Treasuries (and hence its own borrowing costs) in order to get them away.

- But its more likely that the dollar’s role as the principal reserve currency and that of Treasuries as the global safe asset would mean that investors kept on buying regardless.

Inequality

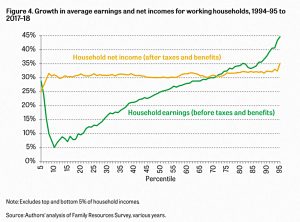

In MoneyWeek, Simon Wilson looked at inequality and in particular at a new paper from the Institute for Fiscal Studies (IFS).

- The UK has a high income Gini of 0.35, but it has not got worse over the last thirty years.

The 90:10 ratio (of the 90th percentile income to that of the 10th percentile) is also slowly falling, and is now down to four times.

- The top 1% owns 20% of the UK’s wealth, less than in Germany or Denmark.

They also have 8% of the income, a proportion that has stayed flat over the last 20 years.

Strikingly, the UK has a redistributive tax regime which cancels out the effect of more rapid wage growth at higher incomes.

Big Picture Investors

This bit is a repeat of an announcement from last week.

- Regular readers will be aware that since January I’ve been organising a Meetup group in London around Passive Investing in ETFs.

You can find out more about the London Passive Investing Club here.

- And you can register for the next meeting here.

I now also have a companion group for active investors.

- It’s called Big Picture Investors and you can find out more about it here.

You can register for the inaugural meeting here.

Quick links

I only have five for you this week:

- The FT reported that Europe is leading the charge on sustainable investing.

- Alpha Architect looked at the skewness effect in commodities.

- The Economist reported on Facebook’s planned new blockchain-based currency.

- And on the effects of the trade war on finance.

- And Flirting with Models outlined their Systematic Value Philosophy.

Until next time.