Alternatives in DC Pensions

Today’s post looks at a report from the PPI on the use of alternative assets in DC pensions.

Contents

Alternatives in DC Pensions

The report from the Pensions Policy Institute (PPI), a ” not-for-profit educational research organisation” has the long-winded title ” Could DC pension default investment strategies better meet the needs of members?” (( The report is sponsored by the Association of Investment Companies, which would no doubt like to see their members’ trust included in more pension schemes ))

- It looks at how the addition of other asset classes to default DC strategies could help certain scheme members who don’t fit the typical profile.

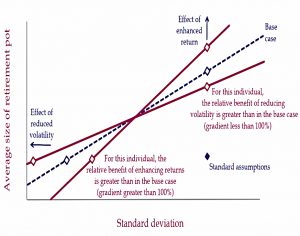

Adding assets – increasing diversification – would allow strategies to either increase their returns or to reduce their volatility, each of which could be beneficial.

- Assets need to be assessed at the portfolio level rather than on their individual characteristics since even assets offering volatile return patterns can reduce a

portfolio’s volatility.

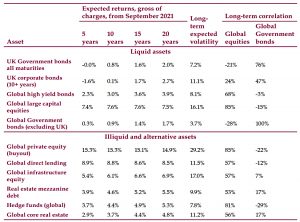

The PPI worked out that a median earner with 10% to 15% per cent of illiquids would end up with a pot between 2% and 3% higher.

- That sounds pretty conservative to me – I would expect a full risk parity approach to add many times that amount of benefit over a working life.

Against these benefits has to be set the potential for increased complexity and higher costs.

Since auto-enrolment, more people are now saving into DC schemes and the default strategies apply to more savers.

- The vast majority of DC pension members do not select an investment strategy for

themselves – 90% within master trusts or multi-employer schemes remain in the default.

The PPI said:

In selecting an investment strategy, trustee boards must weigh the potential for strong returns, the volatility of the asset values, the potential for significant losses in value and practical considerations such as cost, liquidity and ease of access.

Head of policy research Daniela Silcock said:

DC scheme default investment strategies determine how the contributions of millions of pension savers are invested. They provide a service to those who cannot or do not want to choose their own investment strategy, one that involves judgements about the balance between risk and reward and does not levy unduly high charges on members.

However, default investment strategies are inherently broad-brush as they are required to meet the needs of many people and are generally designed with the “typical” member in mind. This report explores whether members with certain characteristics might benefit from more focus on returns, or risk management, than members who fit the typical profile.

Judicious investment into illiquids and alternatives could, in some cases both enhance returns and reduce volatility, benefiting the whole membership. However, these strategies will require extra time and resources. In seeking to implement them, it is important not to lose the benefits of default strategies, in particular, the low cost and simplicity.

Association of Investment Companies (AIC) director Guy Rainbird said:

How default funds should access these assets is a key question. Investment companies are tried and tested vehicles for investing in illiquid assets. They have a closed-ended structure that protects funds against fire sales and suspensions while offering liquidity through their listing on the stock market. They have a track record that in some cases extends back beyond the global financial crisis.

This does not apply to other proposed solutions for allowing pension funds to access alternatives, such as the Long-Term Asset Fund (LTAF), which would rely on notice periods to resolve liquidity mismatches and could run into problems if those notice periods prove too short.

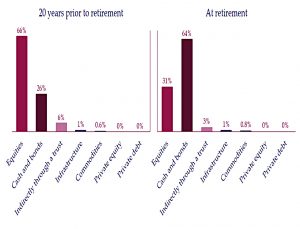

Increased returns

Enhanced returns would help:

- people who work for longer (past the State Pension Age, SPA)

- With larger pots, they can better withstand the potential investment downside

- higher earners

- As per group 1

- those who accumulate marginal amounts of savings

- These people are less dependent on their DC savings and so less impacted by potential losses

- those with patchy work and contribution patterns, and

- As per group 3

- those with defined benefit savings in addition to DC savings

- With a lot of guaranteed income, these people can be less risk-averse

Lower volatility

Reduced volatility would help:

- people who stop contributing at younger ages (before SPA)

- these people are more dependent on DC income and volatility could lead to a lower income

- people who use uncrystallised funds pension lump sums (UFPLS)

- taking money from the pot apparently increases sensitivity to volatility (( I use UFPLS myself and I’m unclear on the mechanism here ))

- those who purchase an annuity, and

- As per group 2

- those without supplementary savings

- This group is totally dependent on DC income and so very sensitive to loss.

New asset classes

The report talks about four new asset classes, beyond the existing stocks and bonds:

- private markets (presumably private and other unlisted equity)

- real estate

- “other alternatives” – infrastructure, commodities and hedge funds, and

- “selected parts” of the fixed income market – privately-listed debt and credit

The authors note that such assets can be more volatile and/or less liquid than stocks and bonds.

- They can also cost more and require higher levels of due diligence and ongoing monitoring.

The increased volatility also makes future value projections more difficult.

Prompts and tailoring

The report covers two other options apart from adding alternatives to the default portfolios:

- prompting members about non-default strategies (including self-select options) and

- collecting additional member data (such as income level, gender, ethnicity, ability, caring responsibilities, other savings and assets, and attitude to risk) in order to better tailor strategies to the members.

There are a couple of issues here:

- schemes/employers informing members about appropriate investment strategy could be seen as giving advice, which is a regulated service, so protection for the scheme would need to be added to the system

- gathering additional data raised cost and privacy concerns

Conclusions

This is a sixty-page report which basically has one thing to say:

- the problem with one-size-fits-all solutions is that they don’t fit all people equally well.

The two main options for fixing this are:

- Improve the default so this fits more people better

- It’s not clear how to balance the trade-offs here

- Use the characteristics of individual savours to nudge them towards options that might be a better fit.

- This comes in two flavours: use what we already know about them, or collect more info.

For me, a better approach would be to educate people so that they can make their own choices with their own money, but we as a society seem to have given up on this.

The part of the report that the financial press has picked up on is the potential use of alternatives to lower volatility, increase returns or possibly both.

- I believe that diversification is the biggest – if not the only – free lunch in investment, so I am a fan of this development.

Until next time.

Re your footnote 2):

Page 24 of the report describes how the report interprets their selected “measures of impact”. The metric of interest is called the “gradient”.

Fig A6.3 IMO provides a somewhat clearer viewpoint.

And, as usual, all the underlying assumptions are important.