Lang Cat Platform Review 2018 – The Direct Investing Market

Today’s post is an update on a post from a couple of years ago – a report on investment platforms from a Scottish consultancy. It’s the Lang Cat Platform Review 2018.

Note: I wrote this article quite a few months ago and didn’t get round to publishing it at the time. The data is still pretty current and relevant though, so here it is now.

Contents

LangCat

The Lang Cat is a consultancy that largely works with product providers and financial advisers, but also compiles reports that are useful to private investors.

Last year they published “COME AND HAVE A GO: ARE YOU BEING SERVED?” – a review of UK investment platforms.

- And now they’ve published a sequel.

Last year’s report was big – 48 pages and 20,000 words.

- But this year’s version is less than half the size, and doesn’t include an awards section.

Apparently the fatter version will be out at the start of 2019, in time for ISA season.

News and views

The Lang Cat (LC) thinks that last year was a busy one in the platform market, but that a lot of movement may have translated into rather less progress.

- Interactive investor (ii) bought Trustnet (also TD Direct & the Telegraph investing service) to become the second largest direct platform after Hargreaves Lansdown.

- rplan folded, and LC thinks that many robos will follow.

- The line between guidance and advice (the latter comes with an ombudsman and a compensation scheme) remains blurred

- For me this is only an issued when the same source might provide either offering – organisations should be on one side of the fence or the other.

- Of course some robos – the ones who use relatively detailed questioning to provide tailored portfolios – might struggle to identify which side they are on.

- The high street banks have still not really entered the robo market, despite their advantages of scale economy in terms of existing funds and much lower cost of client acquisition (upselling in their case).

- it would be a shame if millions of investors were shunted in to the bank’s mediocre investments, so I’d rather see the banks buy out and scale up the best robos (it’s been mostly ETF providers doing this to date).

- Open banking has arrived, and provides another potential advantage for banks with lots of customers.

- A wishy-washy Open Market Study of platforms was completed.

- It said that things could be better, but it was hard to work out how much customers were being gouged by, and they didn’t seem too unhappy about it in any case.

- LC suggests that ten years of benign markets may underpin this happiness.

- Another review of the retirement income market found that drawdown charges are unclear and many non-advised clients (the vast majority of the market) keep too much cash.

- The proposals to fix this focused on wake-up packs and annuities, which is not terribly helpful.

Platform categories

LangCat divide the platforms they review into three types:

- Do It Yourself (DIY)

- Do It With Me (DIWM)

- Do It For Me (DIFM)

For the latter two categories they stick to ISAs, but for DIY they also have tables for SIPPs and taxable stock accounts.

Here’s their (2017) definition of DIY:

being clear on why you are investing, what you hope to achieve by the end and when that will be;

deciding how much you want (and can afford) to invest, allowing for life’s unexpected expenses;

understanding your attitude to risk and how much money you can emotionally bear to lose for the potential of gaining more;

understanding your capacity for loss and how much money you could actually afford to lose in pursuit of growth;

researching your investment options from the myriad funds, ETFs, equities and whatever else is out there;

building a portfolio from those options; and

having done all this, keeping track of both your portfolio and anything in the big wide world which may potentially affect it, and what (if anything) you should do about that.

I said last year that is sounds like they are trying to make it seem harder than it actually is.

Here is DIFM 2017:

If you really don’t want the responsibility of decision making, or would rather put your investment decisions in the hands of an expert, you can access digital advice. This may not cover your whole financial situation, just the investment in question.

The outcome will be in the form of a portfolio which is based not only on your attitude to risk but also on your goals and what you can afford to invest.

The other option is digital guidance, a process which will guide you through much of the same material and ask many of the same questions but stops short of taking responsibility for what it suggests.

And here is the middle ground – DIWM (again, from 2017):

Here , the investment decisions are yours to make but there is help available. That help tends to take one of two main forms: Fund lists and risk-based investments.

With the latter, there will be a scale from low to high with a fund or portfolio matched to each level. However, it’s for you to determine your risk-level.

DIY ISAs for Funds

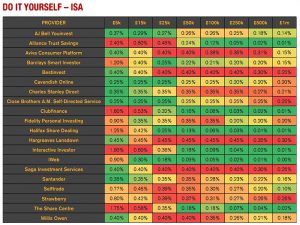

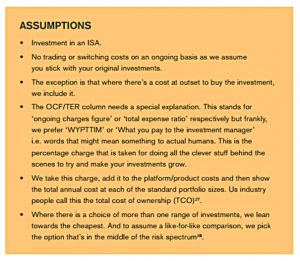

The core of the LC report is a series of colour-coded tables, also known as heat maps.

- They compare costs on the various platforms.

First up is DIY ISA for funds..

- They include platform charges and annual admin costs

- LangCat assume four transactions (in funds) per year.

- They include smaller portfolios (£5K, £10K and £25K) and a larger portfolio (£1M) than we do, so they have eight data points per platform to our four.

They don’t include the cost of the underlying investments in the DIY heatmaps, so focus on the colours rather than the numbers.

- Our tables here on 7 Circles include underlying investment charges.

In the range we focus on (£50K to £500K), only three platforms are completely green:

- iWeb (our favourite) ((Halifax are also green but they are the same service as iWeb in a more expensive form ))

- ClubFinance

- Interactive Investor

This is the same result as last year.

- The “charges in pounds” table isn’t there this tme.

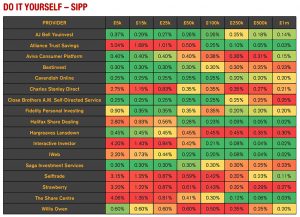

DIY SIPP for funds

This is similar to the first table, but with any extra charge for a pension (these are surprisingly common) added in.

iWeb is now the clear winner in our range of portfolio sizes, as it was last year.

- This is a bit surprising to me, as for a stocks / ETFs / ITs SIPP, AJ Bell works out a little cheaper than iWeb.

- But I use both platforms in any case, so there won’t be any radical change of direction for me.

This is a trading account, not an ISA or a SIPP.

- As such it’s not too much use to us.

- LangCat assume 12 trades per year.

Most platforms don’t have an annual percentage charge for such accounts.

ClubFinance are cheapest, followed by X-O, iWeb, SVS X-O and IG (lots of letters there).

- This is exactly the same as last year.

- With no extra charges for ISAs, iWeb and X-O work out very cheap for this.

Club Finance requires further investigation.

- They’ve been taken over by Wealth Club, and the VCT / EIS / IHT services have been merged.

The Club Finance Frequent Trader stock account was discontinued in September 2018.

- Their website shows no trace of an ISA.

Clients were directed to the James Brearley Icon service, which includes an ISA, but whose charges looked astronomical to me.

It remains disappointing that LangCat don’t look at DIY ISAs and SIPPs for shares / ETFs / ITs.

- If you want a SIPP for shares (or ETFs), then YouInvest and Fidelity are the cheapest.

- If you want an ISA for shares / ETFs, then iWeb is the cheapest.

More information can be found here.

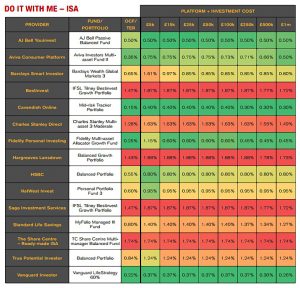

Do It With Me

Here we are looking at ISAs.

- Initial transaction costs are included, but there’s no switching.

- Investments in the middle of the risk spectrum have been chosen.

This year’s table has an extra column for the ongoing costs of underlying funds.

Only four platforms beat our 0.5% pa target at any of our portfolio sizes:

- AJ Bell, Cavendish online, Fidelity and Vanguard.

We still haven’t looked at Cavendish in detail, so we must get round to that.

Do It For Me

This is the same as Do It With Me, but with more emphasis on your personal circumstances (usually via an online questionnaire).

- This is most useful table for me, as it’s easy to compare with the costs of DIY portfolios, for which they offer a complete replacement.

The only sub-0.5% platforms here are:

- evestor (we’ve already reviewed them).

- ETF matic – new to me, and which we must look at

- IG, just about, for £500K or more

A couple of other scrape under the bar at £1M, but most people won’t be interested in that level yet.

Conclusions

I’m a big fan of the Lang Cat issuing a report like this for free, and their heat maps are pretty clear.

- But choosing funds for ISAs and SIPPs, and restricting shares / ETFs to trading accounts only is a strange approach.

I won’t be changing any of my platforms as a result of the report, but I do have a few details to checkout.

Until next time.