Weekly Roundup, 11th October 2016

We begin today’s Weekly Roundup in the Economist, with an article about emerging market bonds.

Contents

Emerging market bonds

The media this week were full of the Tory Conference and plans for Brexit, but since all this is as much political as it is economic, I’ll leave it until last.

- I’d also like to apologise in advance if I sound grumpy, but I have flu today.

Buttonwood looked at the continued buying of emerging market (EM) bonds, despite the deteriorating fundamentals.

- This is part of the “search for yield”, given that returns on cash and developed world government bonds are close to zero.

Government bonds in Malaysia and the Philippines still yield 3.6%, but that’s not enough for some people, who are buying EM corporate bonds.

- $11.5 bn has been invested this year, with returns of 13.4% so far (compared to 4.4% from US Treasuries).

There are worries over a Chinese slowdown and US rate hikes, but commodity prices have rebounded, and the IMF’s growth forecast for EM countries is 4.2% in 2016 and 4.6% next year.

The real problem is credit risk.

- 26 EM issuers defaulted in 2015, compared with 15 in 2014

- more than half of issuers are junk-grade

- 290 issuers were downgraded in 2015, with only 80 upgrades; another 152 were put on “negative watch”

The default rate of 3.1% was the highest since 2009

- 18 more have defaulted so far this year, and the trailing 12-month default rate is now up to 3.7%

- this is above the historic mean of 3.5% (boosted by defaults of 17.6% in 2002)

The other problem is world trade.

- These EM firms rely on trade with the West, and trade is low relative to GDP growth.

- The developed world backlash against globalisation (Brexit & Trump) risks making things worse.

And if the EM corporate bonds go bad, there’s no local QE to bail the market out.

- Buyer beware.

Global poverty

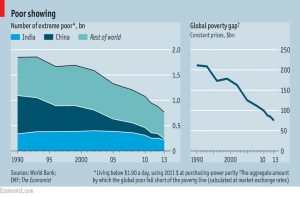

The Economist also reported on the latest global poverty figures from the World Bank.

- There are now 767M people living on less than $1.90 a day (the definition of “extreme poverty”).

From 1992 to 2013 this number fell by more than 1 bn, from around one in three of the world’s population down to one in ten.

- India and China were responsible for around 540M of this 1 bn.

This is good news, but the embarrassing part is that the newspaper calculates that only $159 bn would be needed to raise the remaining 767M above the $1.90 line.

- This is only 0.2% of global GDP.

- Taking purchasing power parity (PPP) into account, the US would only need to spend $78 bn, or 0.1% of global GDP.

Just in case this ever happens, the World Bank has redefined its ambition to end poverty with one of “shared prosperity”, which requires it to consider the poorest 40% in each country in perpetuity.

- Much as we insist on using a relative rather than absolute measure of poverty here in the UK.

The Unmortgage

Over in MoneyWeek, Sarah Moore told us about Unmortgage.com.

- They describe themselves as “the missing step between renting and getting a mortgage”.

In practice it’s a form of shared ownership.

- You put up a 5% deposit (and 5% of the purchase costs) and the company provides the rest – at up to 10 times salary (!).

So on day 1 you own 5% of the property and pay rent (or as they call it, “unrent”) on the other 95%.

- Rent goes up by the higher of RPI or 3% each year.

- You can buy more of the house equity at any point, thereby reducing your unrent.

I like shared ownership in principle.

- It’s a good way for people to get into property without the issue of saving a deposit / getting a loan dominating the first fifteen years of their working lives.

In this case, though, I’m a bit worried about the 10 times salary limit, and I’m also uncertain as to how the rent is calculated.

- Nor is it clear how market value for future purchase of equity is established.

- And people will also be wary about what might happen if Unmortgage went bust.

Shouldn’t the government / local councils be sorting out this kind of thing?

I know they have Help-to-Buy, but this only loans 40% of up to £600K.

- I’m not clear how that £240K loan would interact with the other £330K you’d need to borrow from a bank (assuming a 5% mortgage).

- It still sounds like you need a massive salary, and that getting the loan is the obstacle.

There’s also shared ownership, if you can find a council or housing association willing to sell, and you can borrow enough to buy at least 25% up front (but don’t have a joint income above £90K).

I’d like to see a national scheme to get everyone who wants a house onto the housing ladder, at whatever fractional ownership they can currently afford.

- It would give a lot more people a stake in the future.

Pension rumours

We had a couple of pension rumours this week, though we’ll have to wait for next month’s Autumn Statement to see if they actually happen. ((Though a report on pensions is due next week ))

Number one, as reported by Kyle Caldwell in Money Observer and elsewhere, was that the National Insurance qualification for the full state pension would be increased from the current 35 years to 45 years.

- That’s quite a leap, so let’s hope it’s done in stages.

The focus in the papers was on the likelihood that graduates – who start work later than “blue-collar” workers ((Are there many of these left in reality, I wonder? )) – would have to work until their late sixties (or “nearly 70” as the reports had it.

I guess this was supposed to make for a dramatic headline, but given that the state pension age is already scheduled to rise to 67 within the next 15 years, it’s a fair bet that people under 25 at the moment will be working beyond 70 in any case.

Apparently the government is concerned that working class people die younger and get less of a pension.

- I do hope this reported motivation is hogwash, but HL has apparently written to the government requesting early access to pensions for those with poor life expectancy.

Here’s a quote from Tom McPhail:

We could vary the state pension based on gender, post code, occupation or even ethnicity.

I’m not in favour of this.

People die young for all sorts of reasons.

- It’s not the government’s job to make sure that everybody gets the same number of years of state pension.

They should stick to making sure the pension is adequate and that the public finances can support it.

The second rumour was a repeat of the previously discussed idea to vary pension tax relief according to age and income.

- It already does vary according to income (via marginal tax rates) but in the “wrong way”.

I agree that we need to get young people saving, but there’s too much collateral damage with this idea.

Most people don’t have much money when they are young, and their serious saving happens after the age of 40 (when they can finally see retirement around the corner).

- If the tax rules change now, it’s likely that we’ll just create another problem with those aged 35 to 50.

The way to get young people to save is to increase workplace pension contributions (for both the employer and employee), and to make them compulsory.

We also had the news that the Money Advice Service will be merged with the Pension Advisory Service and Pension Wise, in order to save money.

- Good idea, but let’s hope nothing gets lost in translation.

- People need as much access as possible to free impartial information.

Sterling weakness

We’ve talked before about Sterling falling in value, but the further deterioration in the £/$ ratio – around $1.23 as I write ((But I remember $1.05 back in the 1980s – we had double-digit interest rates back then )) – made the headlines once more.

Falls of 15% against the dollar happen pretty frequently, actually.

- We’ve had one every six years since the 1970s, and an even bigger one in 1967 (when PM Harold Wilson famously said that devaluation would not affect “the pound in your pocket”). ((He also managed to squeeze “The Gnomes of Zurich” into a speech, which is pretty good ))

I’m pretty relaxed about FX.

- The exchange rate is a safety valve for the economy, and this is what is supposed to happen when we hit a rough patch.

Things tend to average out over the long run, and even now the FTSE-100 is close to an all time high, and my foreign investments are doing very well.

- I intend to live in the UK for the rest of my life, and so 95% of my expenditure will be in pounds.

It’s not a big deal to me how many $ or € my £s can buy.

Lots of people are agitated, though, so let’s take a closer look.

Not A Yes Man had an article on the “flash crash” in Asia last week.

- The basic impact from the fall in the pound is that we can expect some inflation from imports.

- Perhaps as much as an extra 1.5% pa.

Given that the August CPI figure was only 0.6% pa, this would only take us back up to the Bank of England’s target.

- And if interest rates have to push up a bit, then at least it will be from 400-year lows.

Gilts should fall (yields should rise) but from an extreme high.

- This will push up the cost of borrowing if there is a Keynesian fiscal stimulus in the Autumn Statement.

On the plus side, exports should do well.

I can’t see anything to panic about yet.

- Call me when (if) we get to dollar parity.

Too many graduates

I’ve been saying for a long time that we have too many graduates in this country, and now even the Guardian agrees with me.

- Larry Elliot was responding to a report from the CIPD (the Chartered Institute of Personnel and Development)

Why I was at college, only 7% of the population went to university.

- Now its more than 50%.

We don’t need 50% graduates.

- The CIPD reports that more than half of graduates take “non-graduate” jobs, and that 45% of student loans (now averaging £44K) will never be repaid.

Let’s bring back apprenticeships and technical education (along with Mrs May’s grammar schools).

- But which politician will be brave enough to tell parents that their precious doesn’t need a degree after all.

Tory conference

And finally, the Tory conference.

- It was a bit of a mixed bag, to be honest.

The clarity on Brexit – we want control of immigration, which probably means leaving the single market – was welcome.

- As was the attack on the metropolitan elite, and the “citizens of the world” (really, “citizens of nowhere”).

- I also like the switch of focus from the poorest in society to those “just managing”, if this term can be sufficiently well defined.

But the unelectable shambles that is the Labour party at the moment means that it was inevitable that Mrs. May would try to seize the centre ground, dragging the party left even of where Cameron and Osborne had taken it.

- There was quite an attack on free markets (she pledged to “repair” them), with interventionist polices (“the good that government can do”, the industrial strategy and the review of zero hours contracts) and even worker (and consumer) representation on company boards.

- She attacked mismanagement of pension schemes and talked about rip-off utility companies.

- And I’ll be interested to see how she funds everything, not least her “NHS not BHS” commitments.

For those of us hoping as recently as a year ago for a reforming Conservative government, it’s a bit of a disappointment.

- It seems the accidental Prime Minister ((As Len Shackleton called her on the IEA blog )) wants to look like Thatcher but push policies that Tony Blair would have gone for.

- I hope she can make this unlikely emulsion stick.

In the end it will come down to Brexit.

- Unless they make a hash of it, the Tories are nailed on for the 2020 election.

Until next time.