Understanding Self-Directed Investors

Today’s post is about a recent report from the FCA on Understanding Self-Directed Investors.

Contents

Younger investors

I missed this report when it was published in March and only came across it on Reddit in April.

- From the title, I hoped the focus of the report might be people like me – DIY investors living off their savings.

But of course, the focus instead is youngsters.

- The FCA is worried that kids are being drawn into “high-risk” assets like crypto and FX, crowdfunding and CFDs. (( I would dispute that there really is such a thing as a high-risk asset. In the same way that there is no such thing as bad weather, only inappropriate clothing, there are high-volatility assets – but there are still sensible ways to incorporate these into diversified portfolios. ))

Perhaps this is a knee-jerk reaction to this year’s crypto boom and the Reddit/GameStop shenanigans in January – or perhaps the research was done before that (we’ll soon find out).

But the FCA is right to be worried:

These higher risk products may not always be suitable for these consumers’ needs as nearly two thirds (59%) claim that a significant investment loss would have a fundamental impact on their current or future lifestyle.

Other key findings include:

- There is a new, younger more diverse group of investors, drawn to the accessibility of the new trading apps.

- The covid pandemic lockdown has provided these investors with more spare time and more disposable income.

- They are more likely to be female, under 40 and BAME.

- They rely on social media – often YouTube, Reddit and Twitter – for tips and news.

- These investors have high confidence and claim extensive investment knowledge which they in fact lack.

- They have a high-risk appetite and often invest based on emotion and “gut instinct”.

- Four out of ten self-directed investors are driven more by the thrill of investing – and the status effects from owning the right “brands” of investment – than by the functional elements of saving for retirement.

This certainly chimes with my experience since lockdown began.

- I like the trading apps and regularly use several of them

But I also spend a lot of time on Twitter and Reddit and the online bulletin boards have been swamped with cocky beginners over the past year, to the point of rendering many of them unusable.

Sheldon Mills, FCA Consumer and Competition director said:

Some investors are being tempted – often through online adverts or high-pressure sales tactics – into buying higher-risk products that are very unlikely to be suitable for them.

We encourage the ability to save and invest for lifetime events, particularly for younger generations, but it is imperative that consumers do so with savings and investment products that have a suitable level of risk for their needs.

Investors need to be mindful of their overall risk appetite, diversifying their investments and only investing money they can afford to lose in high-risk products.

The research

The FCA commissioned consultancy BritainThinks to carry out the research.

- They surveyed 517 self-directed UK investors (those without IFAs) from August 2020 through January 2021.

- 45 investors were interviewed in-depth over the phone

- 20 took part in online research to observe their “investing journey.”

- The study also used pre-existing research on self-directed investors.

Investor groups

The FCA classified investors into three groups:

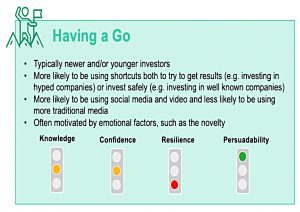

- “having a go”

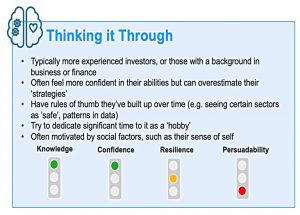

- “thinking it through” and

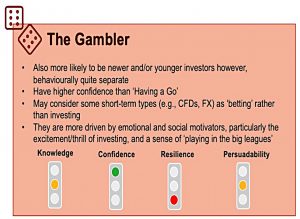

- “the gambler”.

According to the report:

Thinking it Through are 38% more likely to have studied maths, business or economics-related subject at university and 28% more likely to have worked or currently work in finance than Having a Go.

Drivers

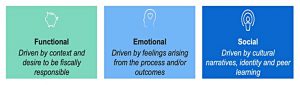

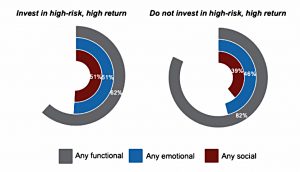

There are three main drivers of investing – functional, emotional and social.

- The relative importance of these three drivers varies between the various types/groups of self-directed investors.

The next chart shows the relative importance of the drivers for those who do, and those who do not, invest in high risk, high return assets:

Demographics

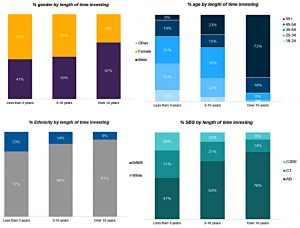

The next chart compares the characteristics of investors with less than 3 years of experience to those with 3 to 10 years, and those with more than 10 years of experience.

That more experienced investors are older should be no surprise, but there are also trends in gender, class and ethnicity.

- And more significantly, the newer investors are much likely to be Gamblers or Having A Go.

Information sources

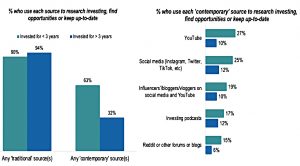

Most self-directed investors report that they often come across investment opportunities in the course of their day-to-day lives, rather than specifically researching them.

Newer investors are much more open to using “contemporary” sources of information – social media, bloggers, podcasts and Reddit.

Algorithms can play a large part in their investment decisions. Similar articles being prioritised and recommended by apps can create a perception of ‘buzz’ around a topic or investment type. This kind of buzz has led to surges in investment in cryptocurrency, and stocks like Tesla.

I am guilty of using all of these “new” sources myself, though perhaps not towards the same goals or with the same results.

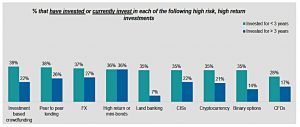

Asset types

New investors are keener on almost every kind of high-risk asset (as defined by the FCA).

- Mini bonds are the only asset that experienced investors are as likely to fall for.

Note that I would regard FX and Crypto as legitimate assets within a large diversified portfolio, though they are not ideal for beginners.

Resilience

The new group of investors appears to have lower financial resilience.

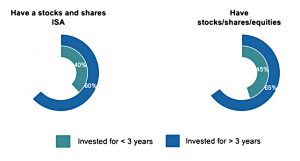

Nearly two thirds (59%) claim that a significant investment loss would have a fundamental impact on their current or future lifestyle, compared with two in five (38%) of those who have been investing for more than three years.

They are also less likely to hold stocks or a stock ISA.

They are also far more likely to be under financial pressure in their day-to-day lives. Those that have been investing for less than three years are more than twice as likely to see their household bills and credit commitments as a burden.

Industry reaction

Becky O’Connor, from Interactive Investor, said:

We want young people to invest – in their pensions and for their families’ futures. But we want them to think long and hard about it, do their research and take the time and effort to understand things like risk from different types of asset classes.

Most young people don’t have money to burn – so potentially throwing it away on high risk investments is a big waste when there are so many life challenges down the road for them that they might need that cash for.

Quilter financial planner Heather Owen said:

Investments have never been more accessible, and retail investors can buy and sell

securities, including complex options and derivative contracts, at the click of a button.This has exposed young people to risks like never before, with two thirds of young people surveyed saying that a significant investment loss would fundamentally impact their current or future lifestyle.

While it is pleasing to see more young people interested in investments, it is clear they are not sufficiently aware of the potential pitfalls of investing, with 45% not even considering losing money as being a risk of investing.

Adrian Lowcock of Willis Owen said:

Questions such as “why am I investing in the first place” and “will this specific investment help me achieve my goal” are fundamental, and should be a starting point.

Steve Bee of OpenMoney said:

The FCA’s findings are concerning. One can’t help but wonder how many of those involved in the research consulted a financial adviser before dipping their toe into volatile asset classes such as cryptocurrencies, or have the foundations in place to make informed decisions that will support their financial goals.

We cannot expect all younger people to understand how they should invest and this is exactly why we believe free financial advice should be offered in the workplace across the board.

Conclusions

New research in this area is always welcome, but the big question is whether the FCA believes that the best fix for the problems it has uncovered is more education or more regulation.

- Education is fine, though as someone active in that area, the phrase “you can lead a horse to water …” comes to mind.

Regulation is another matter entirely.

- We have a long tradition in this country of imposing restrictions on the sensible in order to protect the idiotic.

As you might expect, I’m not in favour of this – we need to encourage individual responsibility and let people suffer the consequences of their actions.

- Worryingly, January’s ban on crypto derivatives – which has cost me and many others a fortune in easy trading profits, and has likely dissuaded zero crypto bugs from investing – suggests that the FCA is currently in regulation mode.

This means that serious DIY investors will be unable to welcome this report as much as they would like.

- Until next time.