Vanguard and the Four Per Cent Rule

Today’s post is a look at a new paper from Vanguard on the four per cent rule.

The four per cent rule

I’ve written quite a lot on the topic of decumulation and even produced an e-book on the topic.

If you’d rather stick to blog posts, you can find them here and here.

When most people think about decumulation, they think about the Four Per Cent Rule

- This is a US study from the 1990s which examined the chances of making a pension pot last for 30 years, assuming that you withdrew 4% of the initial value (corrected for inflation) each year.

The general conclusion was that the pot would last, but there are a few caveats:

- The study targeted a 95% chance of success, whereas you might prefer a failsafe withdrawal rate.

- You might retire early or expect to live a long time, such that your pot needs to last for 35 or 40 years.

- You might want to preserve some or all of your capital to pass on to your family as an inheritance.

- If you start with this approach, you have the option to deplete your pot as an emergency buffer in order to deal with an unforeseen future calamity.

- The study was US-focused and international investors might use a different asset allocation.

- Economic conditions have changed since the 1990s and future returns could be lower.

- In particular, long-term returns from stocks are linked to starting valuations, and failsafe rates for high initial CAPE valuations are lower.

- The study didn’t account for fees and taxes.

On the other hand, there are a number of tweaks and techniques to increase your chances of success.

- For example, the last Vanguard presentation we looked at (in 2018) focused on dynamic spending rules (more on these later).

Our conclusion three years ago was that most of these levers worked best when you didn’t need them.

- For investors who need to preserve their pot for more than 30 years, it’s simpler to focus on an all-weather SWR.

If you are prepared to hold a globally diversified multi-asset portfolio with a high proportion of equities (70%+), then this failsafe rate is in the ballpark of 3% to 3.33% pa.

- This means that you need to save a pension pot at least 30 times as big as the annual retirement income that you need need.

Levers

The new Vanguard paper – called Fuel for The FIRE – again focuses on dynamic spending.

- But before they get to that, they provide a quick recap of the drivers of 4% success (or failure).

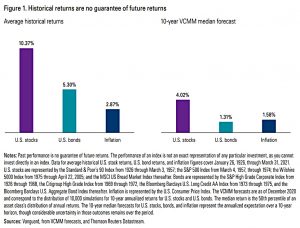

First up is returns.

- Vanguard’s Capital Markets Model (VCMM) shows much lower future returns (for US assets at least) than for historic returns.

Note also the very low forecast for inflation, which looks increasingly unlikely at the time of writing.

Another issue to bear in mind is whether Covid money printing might both push up inflation and eventually lead to rising interest rates.

- In such an environment, the stock-bond correlation could turn positive, and the traditional 60/40 portfolio could stop working.

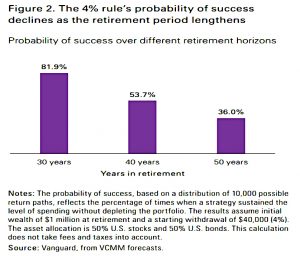

The second issue is the length of retirement.

- Moving from 30 years to 40 years takes the success rate down from a pretty bad 82% to a lousy 54%.

This calculation also ignores fees and taxes but is based on a 50/50 portfolio (which can be improved upon).

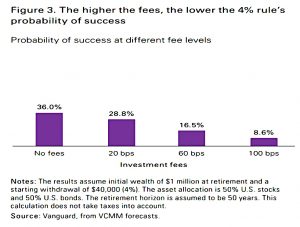

The third issue is fees.

- Since the new paper is aimed at followers of the FIRE movement, who are likely to want to retire very early, the rest of the discussion focuses on 50-year outcomes.

The effect of 1% pa in fees is cut the success rate in half compared to 0.6% in fees (or by more than two-thirds when compared to an ambitious fee rate of 0.2%).

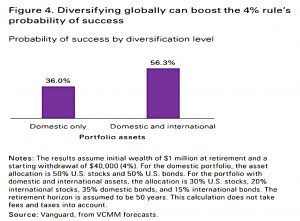

The fourth lever is diversification.

- Again, looking at 50-year outcomes, adding 20% of international stocks and 15% of international bonds to the baseline US 50/50 portfolio increases its chances of success by more than a half.

Dynamic spending

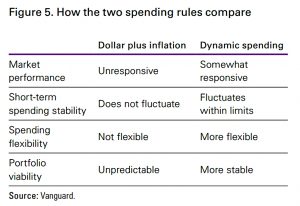

The meat of the paper looks at dynamic spending, which is increasing or reducing your withdrawal rate based on the performance of your portfolio.

- The version uses by the Vanguard paper add up to 5% to withdrawals each year and cuts a maximum of 1.5%

ERN has done a lot of work on this, and whilst the technique does work in the narrow sense, when market conditions are tough, retirees have to survive on a significantly reduced income for a long period.

- I concluded that starting with a lower but safer withdrawal rate was a simpler approach.

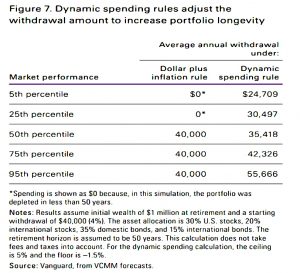

Over 50 years, the Vanguard rule makes a big difference where portfolio performance is below the median.

- Crucially, retirees do not run out of money, but their average withdrawal is as low as 60% of their initial target (ie. 2.5% pa).

Note also that with a failsafe withdrawal rate, even 5th percentile performance wouldn’t make you run out of money.

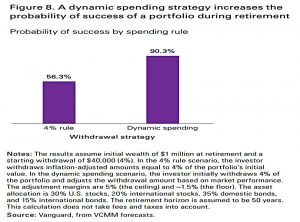

Over 50 years, dynamic spending raises the 4% success rate from a horrible 56% to a not great 90%.

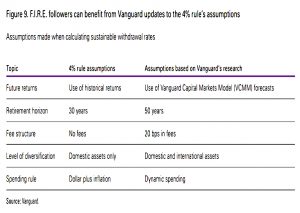

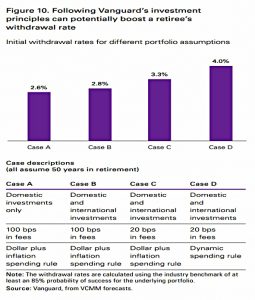

This table summarises the changes that Vanguard recommends for FIRE followers.

They are all reasonable, but I think that:

- a 0.2% pa expense rate is ambitious, and

- a set-and-forget 3.3% withdrawal rate is preferable to a dynamic 4%.

The final chart shows how these adjustments can boost a retiree’s withdrawal rate from a baseline of 2.6% back up to the famous four per cent.

That’s it for today.

- For the target audience of FIRE followers keen to retire as soon as they are able, the discussion points in the paper will be useful.

But for those of us who can afford to target a retirement pot of 33x income, a failsafe withdrawal rate still seems more attractive.

- Until next time.