Rabener on Long-Term Portfolios

Today’s post looks at a couple of research notes from Factor Research on building a diversified portfolio for the long term.

Contents

Factor Research

Nicolas Rabener has produced more than 200 thought-provoking articles for Factor Research. He recently drew on them to make recommendations on building a diversified portfolio for the long term.

The lessons he extracted from the previous 200 articles included:

- The alpha generated by mutual funds, hedge funds, and cryptocurrency hedge funds is essentially zero

- Almost all diversifying strategies do not diversify and fail when most needed by investors

- Private asset classes like private equity, venture capital or real estate are just equity exposure in disguise and provide little value

- Bonds lose most of their appeal when interest rates are close to zero

- Almost all investments are proxies for economic growth, which can be viewed as an undiversified short volatility position

Nicolas says that this means that 95% of investment products add no value.

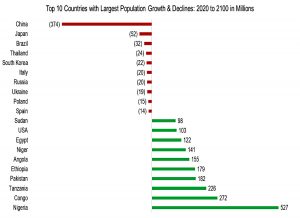

We also have difficult economic conditions to deal with:

Valuations are at record highs, debt is at record highs, and demographics are negative in most countries, which will depress future economic growth. However, not investing is also not an option given moderate levels of inflation and negative real returns on cash accounts.

Returns outlook

Large parts of the financial system can be viewed as a Ponzi scheme that relies on continuous economic growth.

If the economy is booming, then earnings and valuations tend to increase, which benefits stocks, private companies, startups, and real estate markets. Even bonds benefit given lower default risk.

However, economic growth largely relies on productivity increases and the growth of the working population.

And the outlook for both of these is poor.

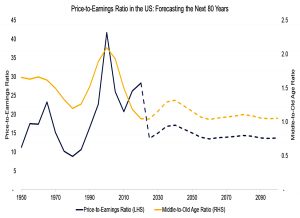

Investors prefer stocks when young and in middle age, but then switch to bonds when nearing and entering retirement.

Although the US is one of the few developed countries where the population is expected to increase, the ratio of middle to old-aged persons will decrease, which should reflect in declining equity valuations.

Volatility

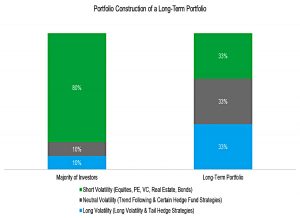

The majority of portfolios are heavily biased toward positive economic growth, which can also be called being short volatility. A more sound long-term portfolio is balanced between long and short volatility exposure.

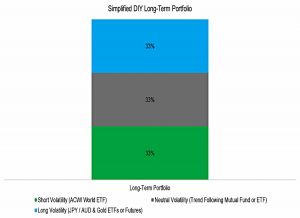

This volatility-focused version of the portfolio leaves out the factor funds which are used later and comprises three elements:

- Stocks (short vol)

- Trend (vol neutral)

- Long vol (gold and JPY/AUD)

Portfolio construction

In the second paper, (( Which was actually published first )) Nicolas goes back to basics to construct a new version of the portfolio.

Stocks are the base component of most portfolios.

Bonds have been great diversifiers in recent decades but will be less useful with rising rates, and are in any case trading at very low or negative yields (which implies low returns).

- Nicolas will exclude fixed income.

He has three diversifying strategies in mind:

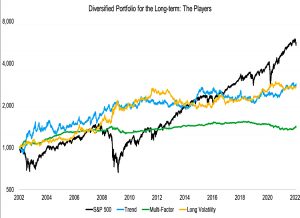

Nicolas presents returns data since 2000:

The S&P 500 generated the highest return, with the trend and long volatility generating similar returns. The factor portfolio generated the lowest return, but was also the least volatile.

Correlations

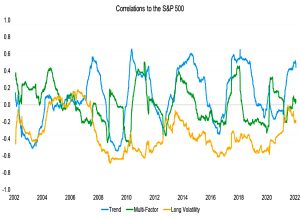

The average correlation between 2000 and 2022 was approximately zero for trend (0.1) and multi-factor (0.0), while slightly negative (-0.3) for long volatility.

However, while the correlation of long volatility was consistently negative, it oscillated strongly for trend and multi-factor, which occasionally resulted in moderately positive correlations to stocks.

Optimisation

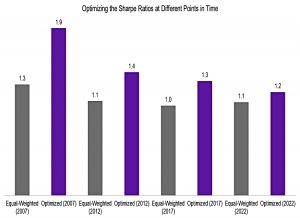

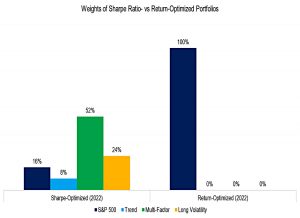

Looking at Sharpe ratio optimisation at five-year intervals:

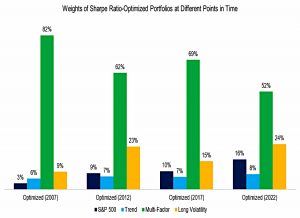

Portfolios were dominated by the multi-factor allocation, which had the highest Sharpe ratio (0.6) of the four asset classes. However, its allocation reduced over time and the portfolio has become

more diversified. The allocation to equities was remarkably small and below 20% in all scenarios.

Not surprisingly, a returns-optimised portfolio would be 100% stocks:

But stocks come with high drawdowns, and poor prospects given their high valuations and low expected growth.

Nicolas expects Sharpe-optimised portfolios to underperform out of sample, and he rules out risk parity because of the additional complexity of using leverage.

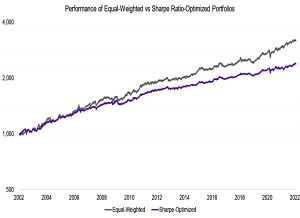

- In the end, he decides on a simple equal-weighted portfolio.

This outperforms the optimised portfolio and has a max drawdown of just 10% (compared to 55% for the S&P 500).

Implementation

Implementation for private investors is easier in the US, where there are specialist ETFs for trend and multi-factor.

- Here in the UK, we would have to do things by hand.

The other issue is psychological:

The equity position is [small] and it is questionable if bonds should be included at all, with both asset classes looking great in the rear mirror. In contrast, none of the three diversifying strategies have generated attractive returns over the last decade.

A compromise (( Of my own invention, not from Nicolas )) would be to allocate to equities according to your risk tolerance and then add as much of the three diversifiers as is practical within your portfolio.

- 40% stocks and 20% of each of the others might be a good starting point.

But even this watered-down approach would mean 10% gold, 10% FX and 20% trend, which many people would find difficult.

There are tax-shelter considerations, too.

- SIPPs and ISAs will support stocks, factor ETFs and gold, but are problematic for multi-asset trend and FX.

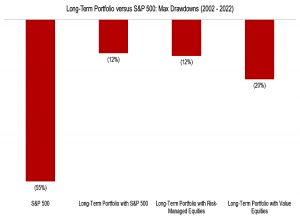

Equity considerations

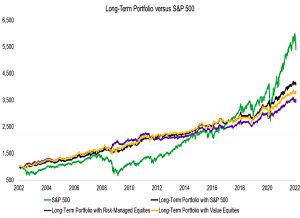

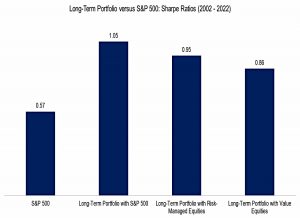

Nicolas himself looks at three options for implementing the equity portion of the simpler portfolio:

- plain S&P 500

- tactical allocation (move to cash when the index is below the 200-day average)

- value investing (in “cheap” stocks only)

These options all produce similar results.

- The plain S&P 500 option has the best Sharpe.

- And along with the tactical allocation, it also had the smallest drawdowns.

Nicolas keeps an open mind about all of the approaches:

Neither risk management nor the focus on cheap stocks has worked well over the last decade, although that does not necessarily mean that these are worse approaches going forward. Both are backed thoroughly by academic research.

That’s it for today.

- If Nicolas is correct, the traditional 60/40 portfolio won’t cut it in the future.

His radical replacement is challenging to implement (not least psychologically), but even small steps in that direction should help a little.

- Until next time.