Rethinking 60-40 – Part 4

Today’s post is our fourth visit in 2021 to the topic of whether the traditional 60-40 stocks/bonds portfolio still makes sense.

Contents

Recap

Here’s what we covered in the first three articles:

- Stocks are riskier (more volatile in price) than bonds but have higher long-term returns.

- The logic of blending two assets together comes from the idea that their prices will move in different directions.

- When stocks go down, you hope that bonds will move up in price.

- The riskiest portfolio recommended by financial advisors to customers with differing levels of risk appetite would be 80-20 stocks/bonds – and the safest would be 40-60

- So the 60-40 portfolio can be thought of as the middle option of three.

- In fact, bonds are a pretty bad hedge for stocks in any case, unless you either hold a lot of them (bad for overall returns) or use a lot of leverage (risky).

- But the 60:40 portfolio is easy to understand and has proved pretty easy to market to investors.

- It’s also done pretty well over the decades, so many investors would miss it.

The impact of inflation

- The need to rethink 60-40 all starts with the prospect of higher inflation and its potential impact on the bond-equity relationship.

- If inflation rises for an extended period, this could be bad for both stocks and bonds.

- In quant speak, the bond-equity correlation might turn positive.

- This is actually the normal relationship, but in recent years, investors have become used to bonds rising when stocks fall.

- In particular, recession-driven stock market crashes lead to a demand for safe-haven assets, which are traditionally government bonds.

- So the price goes up, and the yield goes down.

- When the economy recovers, so do stocks, but bond prices fall back.

- But as bond yields approach zero during the good times, they don’t have far to fall in a crash.

- And so they have a limited ability to protect you.

- And with bond yields close to rates on savings accounts, there’s little incentive for private investors to hold bonds at all.

Alternative assets

The simplest fix is to replace bonds with alternative assets:

- The obvious candidates are gold and cash, or perhaps index-linked bonds

- More adventurous investors might consider:

- other precious metals and commodities in general

- private equity and venture capital

- hedge funds (global macro and long/short equity)

- infrastructure funds and royalty companies

- and even a small allocation to crypto (particularly in combination with gold)

- Even more esoteric alternatives include:

- managed futures/trend-following (or CTA funds in the US)

- multi-factor market-neutral funds (providing exposure to value, size, momentum, low volatility, and quality)

- long volatility -often a simple combination of the JPY/AUD FX rate and gold (both safe-haven instruments).

- Real assets – like property, art and farmland – are another way to go.

- most investors in the UK have too much property exposure through their home (since prices are high)

- if you do choose property, be selective – perhaps choose warehousing over office space and retail

- the other two assets are difficult and expensive to access.

- Older investors, in particular, might also have DB pensions, which act as a bond portfolio without you choosing to own bonds.

Previous posts

In the previous three posts, we looked at ten articles on this topic. Interesting points included:

- Bond returns are driven by the coupon (yield) – these are currently low

- Stock returns are inversely related to starting valuations (eg. PEs), which are currently high

- The projected return on 60:40 is now just 3.5% pa

- More esoteric bonds offer higher yields, but also higher correlations with equities

- Factor premia (smart-beta funds) are another asset class to look at

- Patience and diversification are required since no single factor works all the time and many factors underperform for years (eg. value right now).

- So are hedge funds (particularly long-short equity, which is not readily available to DIY investors, and global macro, which is), options and managed futures (trend-following).

- The last two are very much DIY pursuits.

- Stocks prefer falling inflation to rising inflation

- Bonds can be diversifying even with (modest) rising inflation, but as their yields rise, they will lower portfolio returns, so the portfolio is not protected

- Index-linked bonds are less diversifying but will impact returns less

- Commodities and gold have close to zero correlation, but correlations are slightly positive when inflation is rising – they also have good returns, particularly in rising inflation

- More diversified portfolios are more stable under inflation.

- Real estate, PE and infrastructure are not true diversifiers – they depend on positive economic growth (like stocks).

- The diversification effects they show on paper are flattered by smoothed and lagged valuations.

- Managed futures and long vol generate similar returns to bonds (with higher volatility)

- Multi-factor market-neutral generates a lower return than bonds with lower volatility.

- Managed futures and multi-factor have zero correlation with stocks

- Long vol has a negative correlation

- Replacing bonds in a 60/40 with long vol works well – the new portfolio has a higher return, lower volatility and lower maximum drawdown.

- Replacing bonds with long vol, trend and multi-factor also beats the traditional 60/40, though only by a little.

Rethinking 60-40 – Part 4

The implications of higher inflation on the 60/40 portfolio remains a hot topic.

- A month after the third post, I already have another seven articles to potentially cover.

But since we are becoming quite familiar with most of the issues, I’m going to focus on the most interesting ones.

Man inflation paper

First up is the hedge fund group Man, with a paper on “The Best Strategies for Inflationary Times“.

- It’s a thirty-page paper, so I’ll just reproduce part of the abstract:

Unexpected inflation is bad news for traditional assets, such as bonds and equities, with local inflation having the greatest effect.

Commodities have positive returns during inflation surges but there is

considerable variation within the commodity complex.Trend-following provides the most reliable protection during important inflation shocks. Active equity factor strategies also provide some degree of hedging ability.

The best factor strategy was quality (along with momentum).

Man also look at crypto, concluding that bitcoin is a speculative asset with a positive beta to the US stock market.

- Which makes bitcoin a poor inflation hedge.

Verdad

Verdad referenced the MAN paper in a newsletter called “Equity Investing in Inflationary Environments”.

Verdad also backs commodities, particularly oil and gold.

They also summarise the Man findings on equity strategies.

Harvey et al. find that trend and quality have been top performing strategies in inflationary regimes historically, as trend would have pushed investors out of stocks at the start of their drawdowns while high quality companies tend to be more resilient in bad times.

Energy stocks also do well, though not as well as the commodities themselves.

- Small size does particularly badly.

Verdad then carried out their own analysis of trend.

Their four approaches were long the S&P (when above the 200MA) vs:

- Short the S&P 500

- Gold

- 10-year Treasuries

- Energy stocks

Gold was the best option, particularly under inflation.

- This comes at the price of 40% max drawdowns, double the level of the S&P/Treasuries version.

Using S&P trend with energy stocks doesn’t work.

Factor Research

I’m a big fan of Nicolas Rabener at Factor Research.

- Recently, he put out a note called “Myth Busting: Equities are an Inflation Hedge“.

According to a recent survey of quantitative investors at a JPMorgan conference, 47% of respondents believe commodities are the most effective security against inflation, followed by equities (27%), rate products and Treasury inflation-protected securities (TIPS, 10%), and other instruments (17%).

Nicolas is not so sure about stocks:

Since operating businesses can increase their prices at will, the theory holds, they can mitigate the negative effects of high inflation by simply raising their prices along with it. Does the data support this argument?

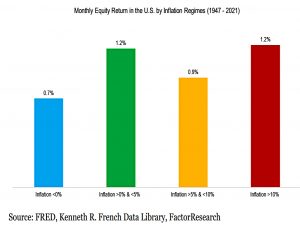

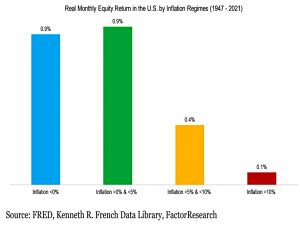

Inflation has little effect on nominal returns from US stocks.

Stripping out inflation makes it clear that inflation higher than 5% pa is bad for stocks, though returns don’t turn negative.

- You would need to be able to ride out the drawdowns, though.

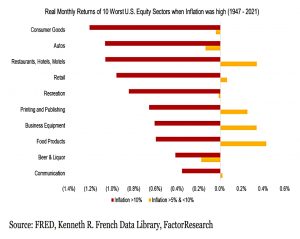

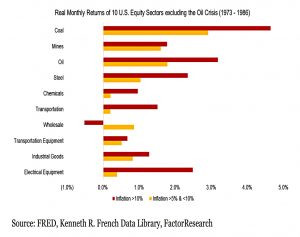

Nicolas also looked at sector returns.

The worst-affected sectors were those that dealt directly with consumers — consumer goods, autos, retail, etc. Despite their ability to adjust their prices at will, these businesses seem to struggle to pass the increases to their customers.

Most of these sectors did OK with inflation below 10%.

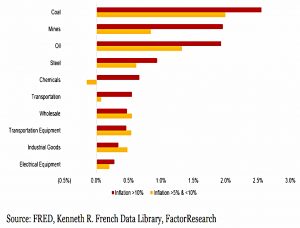

In contrast, the sectors that most benefitted from high inflation were almost identical during the two higher inflation regimes: specifically, energy and materials.

Nicolas worries that the oil crisis in the 1970s could be a factor in the results.

But the world is reducing its dependence on fossil fuels and the US fracking industry has helped increase supply. So while the energy sector has been a good bet against inflation historically, that trend may not persist going forward.

But when he removed the date from 1973 to 1986, the same sectors mostly still outperformed.

Nicolas concludes that the stocks that do hedge against inflation are largely commodity proxies, and direct exposure would be preferable.

- But even this approach has issues:

The Goldman Sachs Commodity Index (GSCI) trades today about where it did in 1990. Such a position would be unbearable for most investors. A bet on commodities is like a bet against human progress: It is probably a losing long-term proposition.

He recommends trend-following and CTAs instead.

Kepler

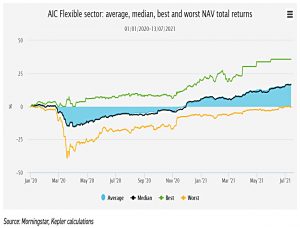

Kepler looked at the AIC flexible investment sector, in the hope of breaking it into more useful segments.

- This analysis didn’t have a specific inflation angle, but the trusts in this sector include the ones that many investors would regard as defensive through stock market crashes.

As such, they mich be the funds that investors reach for to replace the broken bond portion of a 60/40 (if, indeed, they decide that bonds are broken).

The close convergence of the median and simple average suggests that performance [has] been relatively equitable. Yet the disparity between the best, worst, and average performers at any one point suggests to us that the sector is clearly not a homogenous blob. This is most dramatically seen during crisis points such as the initial coronavirus crash in March last year.

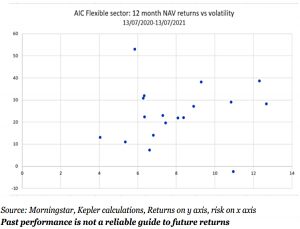

As you can see from the plot of returns against volatility, it’s a diverse sector.

- In fact, it has the highest divergence (difference between best and worst) of any AIC sector).

Kepler breaks it down:

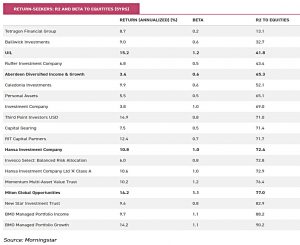

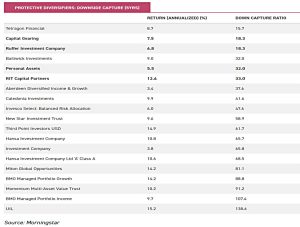

We highlight four potential categories: one-stop shops, return-seeking diversifiers, protective diversifiers and hedge fund strategies.

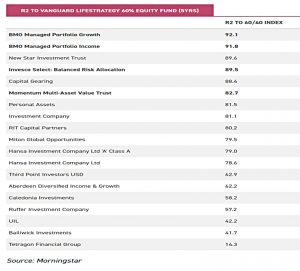

The one-stop-shop section is closest to 60/40 alternatives in their own right, so they are benchmarked against the equivalent Vanguard fund.

A trust with an r2 above 0.8 could be considered a candidate for the role of a 60/40 portfolio, either as a one-stop shop or the core of a broader portfolio.

There are nine such trusts, including Capital gearing, Personal Assets and RIT Capital Partners.

Looking at the R2 compared to stocks allows Kepler to identify true diversifiers.

- Ruffer, Caledonia, Personal Assets, Third Point, Capital Gearing, RIT and Hansa are familiar names on the list.

Tetragon’s portfolio is a combination of private equity, event-driven stocks, convertibles, real; estate and hedge funds, and looks interesting.

- Bailiwick appears to focus on Channel Islands companies.

Kelper also looks at downside capture relative to stocks – once again, a small number is a good number.

- Tetragon, Capital Gearing, Ruffer, Personal Assets, RIT and Caledonia do well here.

Here’s a summary of the fund characteristics.

Conclusions

That’s it for today – the message is the same as last time:

- There’s no “silver bullet” asset that you can replace your bonds with, but there are plenty of options that you can use together to achieve the same effect.

Which ones you feel comfortable using is down to you.

- After today’s article, we can add multi-asset funds to the list.

I’m a diversification maximalist, so I’ll be using everything that I can get my hands on:

- Cash

- Gold and other precious metals

- Commodities in general

- Private equity and venture capital

- Hedge funds (global macro and long/short equity)

- Infrastructure funds and royalty companies

- Trend-following

- Multi-factor investing (particularly momentum, quality and value)

- Multi-asset investment trusts

- Property

- DB pensions

On the maybe/how to list I have:

- Long vol

- Options

- Index-linked bonds (if they start to go up in price)

- Crypto

- Art

- Farmland

Until next time.