Risk Parity and Rising Yields – AQR

Today’s post looks at whether a Risk Parity portfolio can prosper in a rising yield environment.

Contents

AQR

The paper we’ll be looking at today dates back to 2013 and was published by AQR.

- It’s called “Can Risk Parity Outperform If Yields Rise?” and was written by Brian Hurst,

Michael Mendelson and Yao Hua Ooi.

AQR (like me) views risk parity (RP) as a diversification strategy, rather than a leverage strategy as many others see it.

- I largely use an unleveraged approach to RP, preferring instead to juice returns by capping my bond allocation (at 20%) and increasing my stock allocation (to a target of 75%, which I can never reach because of my property exposure).

RP can deliver a small edge that compounds over time.

- This edge has been delivered historically, even through periods of rising rates.

But of course, RP won’t make money when all asset classes are falling, and it won’t keep up with portfolios that have a higher equity allocation during a stock market boom.

The background to the paper was a sharp rise in global government bond yields and a tough quarter for risk party portfolios.

- With the prospect of more rate raise to come (since rates were still at what were then historically low levels), was risk-parity now an unattractive strategy?

The question that this paper sets out to answer is whether the long-term edge outweighs the short-term underperformance under adverse conditions.

Risk parity

The first section of the report spells out that RP is not a leveraged bond strategy.

- Many RP portfolios allocate only a third of their risk budget to government bonds.

Nevertheless, RP is generally more sensitive to interest rates than the traditional 60/40 portfolio (which is massively exposed to equity risk).

- It’s also worth noting that although the ideas behind RP emerged in the 1950s, implementation began in the 1990s, during a period of falling interest rates.

So it was natural to examine how RP might cope with rising rates.

Interest rate regimes

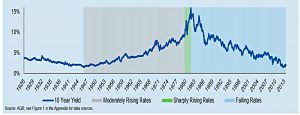

The chart above shows a full cycle of interest rates, from 1.6% in 1945 to 15.8% in 1981 and back down to 1.6% in 2013.

- Of course, in the years since the paper was written, we’ve actually seen rates fall to effectively zero – but that didn’t seem likely at the time.

AQR break that cycle into three periods:

- moderately rising rates (grey)

- sharply rising rates (green)

- falling rates (blue)

The report looks at a simulated three-asset RP portfolio through these three regimes.

- The analysis begins in 1947 rather than 1945 since that’s when decent commodity price data is available.

The portfolio is an equal split (on a risk basis) between equities, bonds and commodities.

- It is rebalanced monthly to a 10% annual volatility target (12-month historical volatility is used to predict future volatility).

Performance

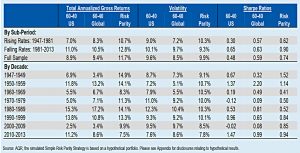

The first table shows results for an RP portfolio against a US 60/40 and a global 60/40.

- RP does best, both overall and during the rising and falling rate regimes.

The contribution from commodities is crucial.

Speed matters

The worst regime for RP is a rapid increase in rates.

- Rate shocks often lead to de-risking and a move to cash.

Sharply higher rates reduce the present value of future cash flows from stocks and bonds, and so their price.

- Bonds usually fall in price, but with stocks, there is a balance between the lower PV of future cash flows and the higher expected cash flows themselves.

This enables RP portfolios to cope with rates rising at a moderate pace, but sharp rises still hurt.

The second table splits out 1979 to 1981 when yields rose the most.

- From 1947 to 1979, rates rose by 7.6%, but over the next two years, they rose by another 6.4%.

All the portfolios underperformed cash during these two years, but RP performed the worst.

Assets matter

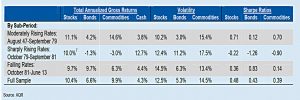

The third table shows the performance of the three asset classes through the interest rate regimes.

- All assets did well over the entire period.

- Equities benefited from a multiple expansion from 11.3 in 1947 to 23 in 2013 (this expansion favours 60/40 portfolios relative to 60/40).

- Bonds beat cash even through the era of moderately rising rates.

RP outperforms when one of the asset classes fails to deliver (bonds from 1947 to 1981 or commodities from 1981 to 2013).

- Stocks and commodities offset the weakness of bonds when interest rates were rising.

Bond timing

AQR downplay the idea of timing the bond market:

In order to add value from “timing” the bond market, not only must one predict the future direction of interest rates correctly, but also be right on the speed and magnitude of the yield moves.

Bond prices reflect the market’s expectation of the future path of interest rates. Investors usually expect rates to rise which leads to an upward sloping yield curve (yields further out in the future being set higher than short term yields).

Upward sloping yield curves enable bond investors to earn both the coupon and the ‘roll down’ return as long as the term structure remains similar, giving bond investors a cushion against the possibility of rising yields.

Conclusions

Although RP will suffer for a year or two during the sharpest rate rises, over the long-term its compounded edge should lead to higher returns than from traditional 60/40 portfolios.

- The potential issue here in 2022 is that while bonds may suffer as rates rise in response to inflation, equity multiples are now close to record highs (particularly in the US), and so stocks may not compensate.

RP portfolios would then be relying on commodities (and to an extent, index-linked bonds).

- Until next time.