Weekly Roundup,

18th November 2014

This week, there was a lot of attention in the papers and online about the consequences of the falling oil price. I will return to this in a later post.

So instead the weekly roundup begins in the FT magazine. Tim Harford wrote in his Undercover Economist column about research into patterns within financial markets.

Many believe that markets follow a random walk – if a future movement was predictable, it should happen immediately. Fama & French’s famous 1992 study found that small companies and value stocks outperform. There also evidence to suggest that “quality” and “momentum” are also predictive factors. Tim quotes a new paper by Harvey, Liu and Zhu examining 316 market factors previously studied, of which 296 produce statistically significant effects.

They suggest that the multiple-comparison problem (also known as the jelly-bean problem, which is essentially that if you do enough tests, some will prove to be significant) means that more than half of these factors are invalid. The good news is that still leaves plenty that are okay. Like me, the researchers prefer variables with an understandable mechanism to the more mysterious agents.

Elsewhere in the FT, the Alphaville team took a light-hearted look at the quintessential “mini-bond” investor, courtesy of a report from James Tomlins of M&G. Based on the offerings available, they conclude that the market for the product consists of “obese metropolitan oenophile punters“.

Mr. Tomlins also called for greater protection for these investors, and fuller disclosure. Without knowing what the loan is secured against it’s hard to fathom (just as with the low-yielding corporate bonds from last week) who finds these things attractive. Mini-bonds are another topic to which we will return in the future.

There was also a story about continuing problems with traded life policies, or more specifically three funds run by Centurion. Note that these are unconnected with the fund recommended by David Stevenson in last week’s roundup.

Finally in the FT, there was an entire supplement on investing in wine. A couple of articles caught my eye, both about the increasing use of online platforms such as CaveX, Liv-ex and Wine Owners. Emma Boyde highlighted the risk of fraud and the need for professional storage, ideally “in bond” to avoid duties. In my limited experience, high commissions and poor liquidity are key obstacles.

A further complication is the restriction on the marketing of wine funds to sophisticated investors only. Bordeaux remains the dominant region for wine investment, though Italian wines are increasing in popularity. Prices are down over 12 months, and moderately positive (+20%) over five years.

Adam Palin wrote about online trading platforms (Bordeaux Index, Wine Owners etc.) which have the potential to reduce margins and squeeze out old school wine merchants. Wine-Searcher is a price comparison website with 7 million wines listed. Wine Owners allows P2P trading and has partnered with Corney & Barrow. Berry Bros & Rudd have developed their own P2P platform (BBX).

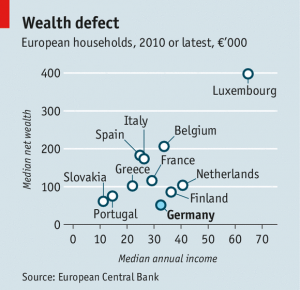

In the Economist, I noticed an article on the introduction of negative interest rates to large balances (£400K) in German banks. The article goes on to discuss the strange habits of German savers – they prefer savings accounts to stocks, property and even bonds.

I was reminded of an article from 2013 which showed the results of this policy: despite average earnings that are above median for western Europe (and double some countries), Germans are poorer than everyone else. Avoiding all risk is often the biggest risk of all.