Small Cap Quality Time – GMO

Today’s post looks at a recent paper on the merits of Small Cap Quality.

GMO

The paper was published by GMO in October 2022 and was written by Hassan Chowdhry and James Mendelson.

The paper argues that Small Cap has become noticeably cheap this year. Coincidentally:

GMO recently launched a Small Cap Quality Strategy to take advantage of the alignment of attractive long-term small cap quality stock characteristics and compelling short-term valuations.

This strategy is touted as having the Holy Grail of being ” well-positioned to outperform while offering defensive characteristics”.

The Opportunity

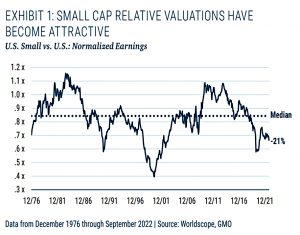

Small cap stock valuations have fallen 39% from their post-Global Financial Crisis peak versus the broader market. Within the U.S., small caps trade at a 21% discount versus their typical relative multiple.

Of course, valuations don’t fall for no reason, and in this case, the driver is a looming economic slowdown (and a possible severe recession).

- So you have to believe that the small caps you buy will survive unscathed.

Quality

GMO’s approach is to add “quality” to the mix – a notoriously vague term:

Companies that exhibit high margins, high returns on capital, low debt, and stable fundamentals.

Since 1976, small cap quality has outperformed the small cap asset class in the U.S. by 1.8% annualized and has also outperformed the all-cap U.S. market by 2.8% annualized.

Junk

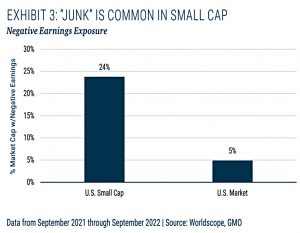

Junk stocks – here defined as those with negative earnings – are much more common amongst small caps, but these are easy to screen out.

Investors tend to overpay for shares of weaker and more volatile businesses, perhaps lured by overly optimistic projections or lottery-ticket-like chances for sizeable payoffs.

This behavioural flaw is what creates the opportunity in small cap quality.

Risk and reward

Small caps are more volatile than large caps, but within that universe, adding quality increases returns and reduces volatility (just as it does in the overall market).

Down markets

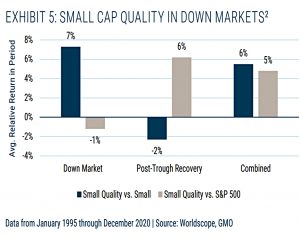

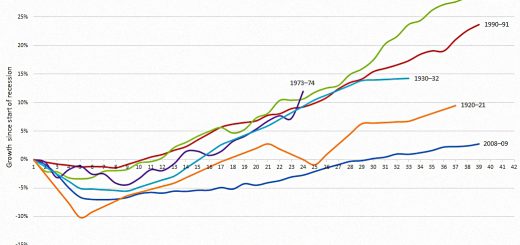

Against the market (the S&P 500), small-cap quality underperforms during the downturn but outperforms in the recovery.

- Over the cycle, it outperforms by 5%.

Against small caps generally, quality outperforms in the downturn and underperforms during the recovery.

- Over the cycle, it outperforms by 6%.

Finding quality

Though they are always looking for strong management and the potential for high returns on capital, GMO use a different methodology to find Small Cap Quality than they do for large-cap quality.

- With large-cap, there is a track record of outperformance, and the key question is whether the price is attractive.

Within the small cap universe, companies that screen as high quality tend not to be as dominant in their industries, and they typically have shorter track records of success. Thus, the core investment question shifts to, “Are we confident that this business is, in fact, amazing?”

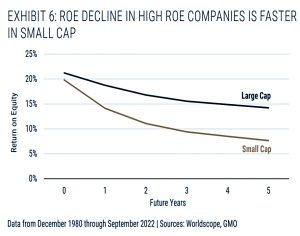

Small-cap quality firms are less likely than large-cap equivalents to retain their quality characteristics over time.

- The chart shows that the decline in high ROE is faster in small caps.

So GMO uses fundamental research to identify which companies have a sustainable competitive advantage.

- Fewer than 200 small caps out of 2,800 US stocks pass the quantitative quality tests, and only around 80 of these pass the fundamental tests.

Of these, GMO selects 40 to form the high-conviction portfolio for their Small Cap Quality Strategy product (for which this white paper is basically a puff piece).

Conclusions

The paper aims to funnel you into a specific product from the firm its authors work for, but I prefer to view it as more research on factor outperformance.

- Small Cap Quality has a good risk-reward profile, and it’s reassuring to see that it outperforms the market and plain vanilla small cap through a down market cycle (the down market and the recovery combined).

I won’t be buying the GMO product (( I’m not sure that I can, as a UK private investor )) but I will feel better about topping up my allocation to Small Cap Quality factor funds.

- Until next time.