A New Generational Contract

Today’s post is about a report from the Resolution Foundation (RF) called A New Generational Contract.

Contents

A new generational contract

The report argues that millennials have it bad, and that money needs to be taken from older generations (particularly baby boomers) in order to fix things.

As well as taking a look at the report’s proposals, I’ll be trying to answer four questions:

- do millenials have it bad?

- if so, why?

- do we need to do anything about it?

- if so, what?

The proposals

A lot of the proposals in the report are around the pensions system, so lets start there:

- Extend the workplace auto-enrolment system to include the self-employed and “gig economy” workers.

- That sounds like a good idea to me.

- Restrict tax relief on pension contributions to a flat rate (they suggest 28%).

- I’m fine with this, and expect it to happen at some point, though perhaps with only a 25% relief rate / 20% government bonus.

- Contrary to what the press says, most relief is actually on employer contributions, which by default would not be impacted in DC schemes but which could cause problems for DB schemes.

- A default switch to annuities from drawdown at age 80

- This might not be a bad idea for some, as annuities offer better value as one ages.

- They also like CDC pension schemes

- We don’t – see here.

- They also want to cap the tax-free lump-sum at £40K rather than the present £262.5K

- This is fine in principle, as long as it’s phased in,

- And there are grandfathering rights for those who accrued their pension pots under the existing regime.

We’ll take the rest of the proposals as a second group:

- An NHS levy paid only by those over state pension age.

- This would be an extension of NICs initially to earned income, and eventually to all pensioner income.

- NICs for people on pensions are nonsense – NI is a scheme designed to fund the state pension (( Even if that isn’t what happens to the money )) and these people have already paid in.

- Drawing out and paying in at the same time is stupid.

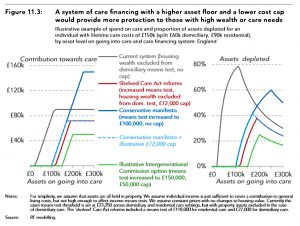

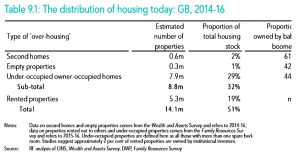

- A replacement for council tax that is closer to a land tax, designed to fund social care.

- There also would be a ceiling of 25% of net worth on what a “wealthy” individual could additionally contribute towards their care.

- I see the attractions of a land tax, but its implementation in an economy as dependent on property and as centralised around London as the UK is would be fraught with danger.

- The proposed bands add up to an annual tax of more than £20K on my own house, which for a retiree is pretty steep.

- It’s hard to see people like me sticking around to pay that, so there is significant potential for upheaval.

- Additionally, with most care users spending less than £100K, the 25% cap will not be reached by many of the people currently worried about care costs.

- There’s more on funding of social care in another recent report that we covered here.

- Cut stamp duty on first (primary) properties (ie. not second homes)

- Definitely a good idea

- RF also want a capital-gains holiday (a temporary lower rate) to allow second-homers and BTL investors to exit the market.

- But at the same time, they like institutional BTL as they also want a stamp duty exemption for institutions.

- Replace IHT with a gift tax on recipients

- I’m fine with this, though I think that their proposed lifetime tax-free allowance of £125K is an order of magnitude too small.

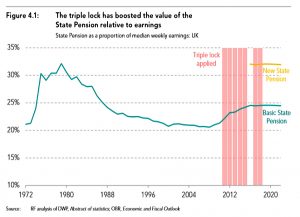

- Double-lock the state pension rather than triple lock it

- I don’t have a problem with this, but I do object to the idea that the UK state pension of around £8K per annum is generous.

- At 33% of median earnings, and with a benefits cap of £20K pa, it’s positively mean.

- Abolish fixed-term tenancies

- This is a stupid idea which would just lead to fewer rental properties (and potentially a house-price crash).

- A £10K gift to young people (at age 25)

- There’s no plan to mean-test this, and most of it will go straight into increased house prices, with few other effects on society (it can also be used for education, pensions and start-ups).

- The proposed gift is deeply infantilising.

- We should be telling young people to take responsibility for their lives (and for society), not giving them a handout.

- Lowering the voting age.

- I’d like to raise it to 30 and bring back a property qualification.

So that’s thirteen big ideas, of which maybe seven are good.

Optimism

Let’s move on to a look at whether millennials are hard done by, starting with opinions.

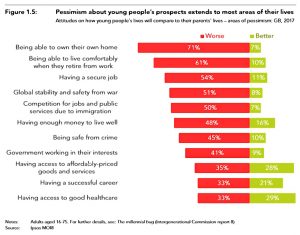

People are mostly pessimistic about the prospects for young people, though clearly some of these opinions have no basis in fact:

- more crime?

- the government not working in their interests?

- cheap goods and services?

- good healthcare?

These are dangerous questions to ask the UK public.

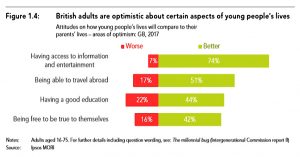

There are also a few areas where people are optimistic:

- These are easier to go along with.

Housing

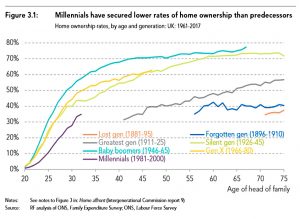

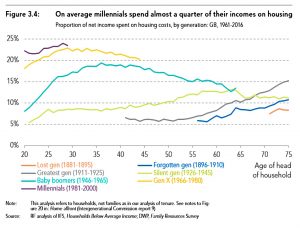

There’s not much doubt that housing is more expensive than it used to be.

This is obviously not directly down to baby boomers – there are structural changes, too:

- the population has increased, and household sizes have decreased

- more people now live and work in the big cities, and transport links to external dormitories haven’t improved (in terms of commuting speed)

- we haven’t built enough houses, particularly where they are most needed

- it’s easier to borrow more, and low (real) interest rates mean that repayments are less painful than they used to be.

So houses are more expensive, and it’s harder to get a deposit together.

- But if you can do that, banks will lend you more and it will cost you less to repay your debt.

- And a fixed-rate mortgage – one that protects against rising interest rates and the problems of negative equity – is much easier to obtain.

Other consumption

And on the other hand, lots of things other than houses – clothes, food, energy, entertainment, travel, technology – are much cheaper than they used to be.

So is one form of consumption more privileged than others?

- Should it essentially be protected as a human right?

If it is a human right, what is the correct level of provision?

- For example, you might think in today’s society, internet access is a basic human right. But you probably wouldn’t include a Spotify and / or Netflix subscription along with that.

Following that analogy, what is morally wrong with more millennials renting today than baby boomers 20 years ago?

- We might agree that high levels of home ownership are generally better for society, but is that a moral issue)

Perhaps boomers be compensated for all the CDs and DVDs they bought because Spotify and Netflix hadn’t been invented?

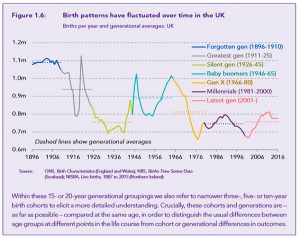

Demographics

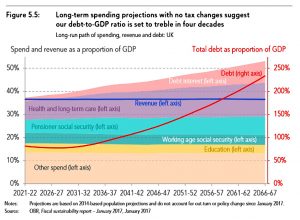

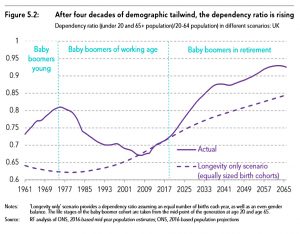

The other factor which is definitely worse than it used to be is the dependency ratio.

- there are more pensioners per worker than there used to be, and this is only going to get worse.

- the key outcome will be rising health and social care costs for the elderly.

Recent governments have tried to offset this through immigration, but this brings its own problems:

- loss of social cohesion

- increased demand on public services

- displacement of minimum-wage indigenous workers onto welfare

Pensions

The idea that millennials have a bad deal on pensions is hard to support.

- DB pensions started being withdrawn (in the private sector) early during my career.

- It’s people a few years younger than me who really have the pensions gap.

Millenials should do fine through workplace auto-enrolment, if they stick with it.

Income

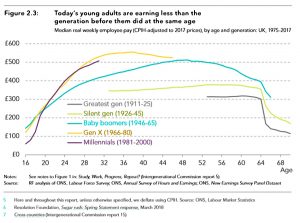

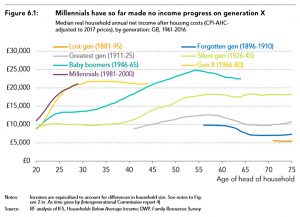

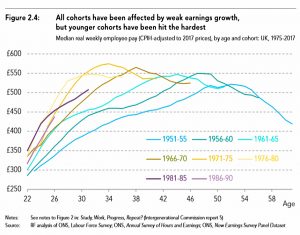

The report’s claims on millennial income are fairly dodgy.

- Gross incomes are high.

And even disposable incomes (after housing costs) are only lower than the preceding generation (Gen-X).

- They are still higher than those of the generation that is targeted to compensate millenials (the boomers).

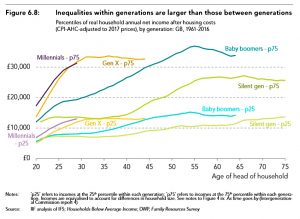

In fact, inequality within generations is worse than that between it.

The RF seem to hold as gospel that each generation should be richer than the previous one – this is the definition of the generational contract that they seem to hold.

- But why should that be so?

As Martin van der Weyer put it in the Spectator:

What’s more like a contract is the idea that if you work for 45 years, pay your taxes and stay out of jail, you should be able to look forward to a relatively comfortable old age.

Martin also suggests the £10k “prize” should be awarded on the basis of competition (by explaining what they would do with the cash).

- And that each individual prize should be funded by a single rich old person, who would hand it over face-to-face.

That way, the donor could also offer the recipient a bracing lecture on how to shape up.

I could get behind that.

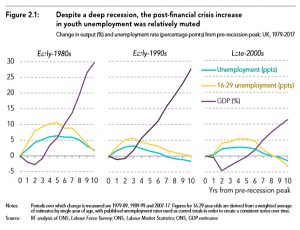

One other relevant factor here is the relatively benign nature of the recession following the 2008 financial crisis.

- The financial crisis might have been second only to the Depression of the 1930s, but the real-world effects were much less severe than, say, the early 1980s recession that I graduated into.

- So millenials have been spared the early blight on their careers that my half the boomers received.

Conclusions

Millenials don’t have it bad, and we don’t have to do anything about it directly.

- Houses are more expensive, but it’s easier and cheaper to borrow the money to buy one (which is partly why they are more expensive).

- We should build more houses, and think about limiting population growth.

- Lots of other things are cheaper, and we have no intention of compensating older generations for that.

- Millennial incomes are higher than for all generations other than Gen-X.

- The great recession of 2008 was not as bad as people think.

- And there’s no reason why every generation should be richer than the last.

- Health and social care costs will be driven higher by unfavourable demographics, as they are around the world.

- But pitting young against old is probably not the way to go about dealing with it.

- Millennial pensions will work out fine, and the state pension is not generous.

The Resolution Foundation claims that a new contract is needed in order to strengthen the bonds between the generations.

- Taking from boomers to provide handouts to millennials does the opposite, and will promote the intergenerational conflict they claim that they want to prevent.

Until next time.

Just read this post – apologies, but I must have missed it when you posted it a couple of weeks ago.

I agree with your findings.