Options 11 – SpinTwig Efficiency

Today’s post is the eleventh in our series on options trading. We look at SpinTwig, who we met in an earlier post when he backtested ERN’s strategies.

Contents

The story so far

The lessons from the articles so far were getting to be quite extensive, so I have moved them to their own page.

SpinTwig

SpinTwig has a website and a discord server.

- I get the free version of his newsletter, which is mostly concerned with backtests of various options strategies.

He will also carry out bespoke testing for a fee, and he provides coaching for people working towards financial independence and FIRE.

He also has a series of three articles on how to trade options efficiently, and those are what we will be looking at today.

- As usual with options, the articles are written from a US perspective and will require some interpretation for UK investors.

SpinTwig means three things by efficiency:

- High Return – generating the most income per trade

- Low Volatility – generating similar amounts of money per trade

- Repeatable – consistently repeating the two goals above

That sounds good to me.

Options

SpinTwig starts with some definitions that we are already familiar with:

- puts and calls

- strike price

- intrinsic value

- days to expiry (DTE)

- extrinsic value (time value)

- theta (rate of decay of extrinsic value)

- premium (intrinsic + extrinsic value)

- (implied) volatility (from the Black Scholes model and/or splines and interpolation)

- OTM/ITM – out of/in the money

Brokerages

SpinTwig (ST) mentions three:

- Robinhood – free, but not available in the UK

- TastyWorks (TW) – $1.20 to open and close a 1-contract position

- Interactive Brokers (IB) – $2 per round trip

Both TW and IB are available to UK investors.

- TW was recently bought by IG, but I don’t know if this will have any impact for those of us in the UK.

Underlying

Liquidity is hands down the most important attribute of an option. It’s what allows a trader to get in and out of a position at a fair price. Liquid options also have more accurate probabilities, per the Black Scholes model, than illiquid options. Option liquidity is typically measured by volume and open interest. Highly-liquid options will usually have a tight bid-ask spread, often times as narrow as a penny or two.

SPY (the S&P 500) is the most liquid contract.

- SPY also has lower idiosyncratic risk than single-stock options, since it is an index of 500 stocks.

Buy or Sell?

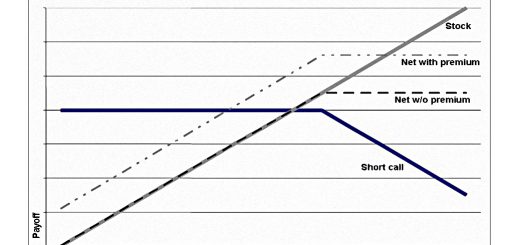

ST says that selling is best because a buyer can only win in one way:

- When the price moves in a favourable direction at a speed sufficient to overcome the drag from theta.

Sellers can win in three ways:

- when the price is flat (they keep the premium)

- when the price moves favourably (option not exercised)

- when the price moves unfavourably, but only a little (not enough to outweigh the premium)

I’ve also seen research suggesting that options markets are dominated by buyers of insurance who will overpay.

- Thus buying options usually loses money and selling them makes money.

Duration

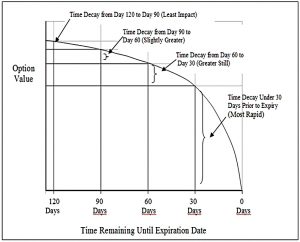

Selling options relies on their value depreciating over time.

- This depreciation (theta decay) accelerates as the expiration date approaches.

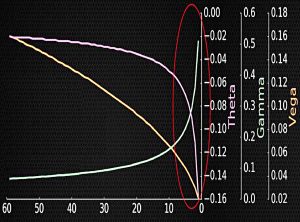

This implies we should sell the shortest options available but in practice, the price volatility of the option (the gamma) is very high in the last few days of an option.

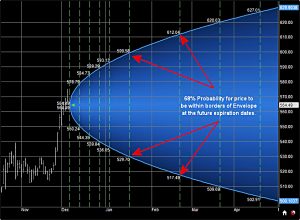

To test this, ST looks at 45 DTE strangles.

- A strangle is holding a call and a put position at different strike prices (on the same asset and expiry date).

It appears that ST has sold both a call and a put (a short strangle), but the chart in the post is labelled as a short straddle (selling a call and a put at the same price).

Closing at 21 DTE is (slightly) more profitable than hanging on, though anything past 21 DTE looks reasonable.

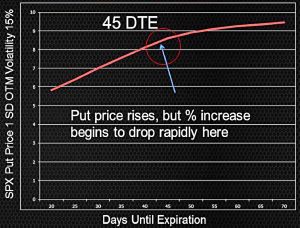

ST uses 1SD strangles with 30-day holding periods to show that 45 DTE is the best place to start.

Next, ST plots the option premium against time (for a 1SD OTM SPX put with volatility at 15%).

- He also describes this as a 16-delta put (more on delta later).

The optimum point on the curve is again 45 DTE.

- After this, additional time leads to diminishing returns in extra premium.

Delta

One of the uses of the delta is as a predictor of the probability of a winning trade (the win rate or probability of profit [POP]).

- An option with a delta of 50 has a 50% chance of expiring in profit.

- An option with a delta of 10 has only a 10% (100 – delta) chance.

As you would expect, the lower the delta (the higher the chance of selling for a profit), then the lower the premium.

Volatility

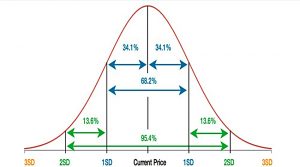

The implied volatility (IV) of an option is the annualized percentage option price range for a one-SD move in the underlying.

So a stock trading at $100 with an IV of 25% has a 68% (1-SD) chance of trading between $75 and $125 in 12 month’s time.

- As IV increases, the price per unit of time increases.

One way to look at this is that the option is worth more because the chance of the strike price being hit is higher when volatility is high.

Higher IV gives us two options:

- More premium for selling at the same delta (POP)

- The same premium for trading at a lower delta (higher POP)

Call or put?

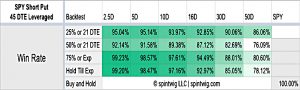

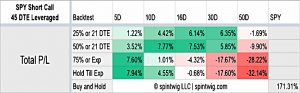

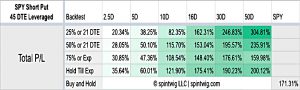

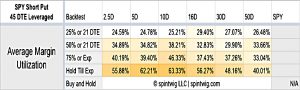

ST compares selling leveraged and unleveraged (cash-secured) calls and puts:

ST recommends puts:

Puts are consistently profitable over time no matter which strategy is implemented. Meanwhile, selling calls is essentially unprofitable unless leverage is used and even then it’s still a potentially-unprofitable strategy.

Or to put it another way, there is no red in the put tables.

Profit targets

In the next section, ST compares profit targets (closing early whilst ahead) versus stop losses (closing early when behind).

Before we get into the detail, it’s important to make two points:

- ST is using static stop losses, not trailing ones

- Selling put options is clearly different to trend-following or swing trading in stocks.

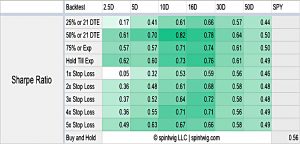

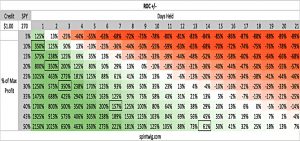

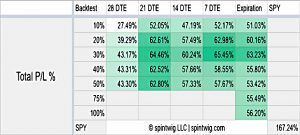

ST refers us back to the chart above of P&L % on SPY short Puts (45 DTE, cash-secured).

- The top three rows look at taking profits early, and the bottom five rows look at stop losses.

Taking profits is better than using stop losses, but my reading elsewhere leads me to believe that the best strategy is to hold until expiry (row four of the table).

- ST’s backtest puts this somewhere between the 75% and 50% take profits.

Looking at win rates, both 75% take profit and hold to expiry look good.

Hold to expiry has probably the best Sharpe ratios overall, but 75% and 50% take profits (and the 5x Stop Loss) are close.

Early exit

ST likes to close early in order to avoid the most volatile period for an option, the last few days (see the chart above with theta, gamma and vega).

- He refers us back to the P&L table from the duration section above, where setting a profit target and closing early was more profitable than just a profit target.

I will need to do more research here, as my previous understanding was that hold to expiry was the best strategy.

Leverage

St compares the Kelly Criterion (an approach that targets the highest returns, whilst minimising the risk of going bust) with risk-adjusted returns.

- The Sharpe Ratio (SR) seeks instead the highest return or unit of risk (volatility).

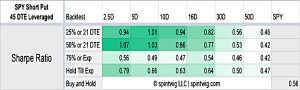

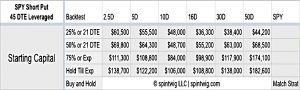

ST compares the SR from the SPY Short Put 45 DTE Cash Secured (see Profit targets above) with the SR from a leveraged SPY Short Put 45 DTE.

Using leverage widens the range of sharpe ratios. That is, it amplifies the conservativeness of lower-risk strategies such as selling 2.5-delta and 5-delta positions as well as amplifies the volatility of higher-risk strategies such as 50-delta positions.

So the appropriate strategy will depend on your risk and return objectives.

Capital Allocation

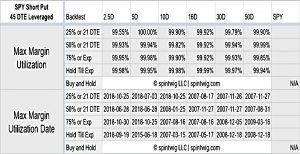

How much of your capital should be at risk? Well, it depends on the underlying, the delta used, exit strategies, what the margin capital is invested in and many other variables.

Oh dear, this sounds complicated.

All I’m getting from this is that hold until expiry uses more capital on average (as you would expect).

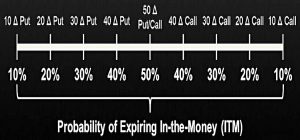

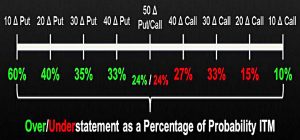

Overstatement of Delta

Because implied volatility (IV) is typically overstated, the standard delta percentages are wrong.

The win rate on hold-till-expiration short put trades is higher than expected across the board while the win rate on hold-till-expiration short call trades is lower than expected in some scenarios.

So puts are better than calls.

Overstatement of duration

Similar to delta, the rise in volatility with duration may not be accurate, and the discrepancy might vary with duration. So:

Do we get more bang for our buck using short-dated options, longer dated options or does duration make no difference? It appears longer-dated options exhibit a greater overstatement of movement.

ST concludes that options closest to 45 DTE are the sweet spot.

- 30 to 90 days is fine, but in general, one or two weeks is sub-optimal.

Tax efficiency

The next section in ST’s second article discusses tax efficiency, from a US point of view.

- Unfortunately, (as far as I know) there’s no way to hold options in a UK tax shelter.

On the other hand, we don’t have the short-term/long-term capital gains split that they use in the States.

- Here in the UK, gains above £12K will be taxed at 20% – that’s about all you need to remember.

Trade occurrences

We’re into the third article now, and I found the first section confusing on the first reading.

- It’s called trade occurrences but really it’s about diversification.

The objective is to diversify across time, deltas and IVs. Instead of deploying all our capital in a single trade, perhaps sell one or two options over the span of a day or week.

Personally, I approach this (across all forms of investing, not options) by setting a “speed limit” on how many trades I can make each day and week.

- I also have standard trade and risk sizes for all the different types of trade that I make.

Capital efficiency

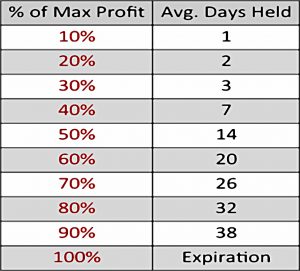

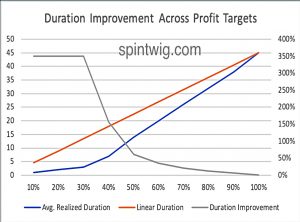

ST graphs the duration improvement across profit targets:

Options reach the smaller profit targets in an accelerated, nonlinear fashion. The trend levels off significantly after reaching 50% max profit.

ST looks at a 16 delta 270 PUT on SPY with 45 DTE, which yields $1 in premium.

- If held to expiry this would return an annualised 3% on the underlying capital.

But holding for different periods at different profit targets produces a wide variety of returns.

- The cells with boxes are the average time taken to reach a particular profit target.

The second chart shows the variances against the 3% pa average expiry return.

- ST recommends closing at 10% profit after two days, so that capital can be deployed into another trade.

This sounds quite like a full-time job to me.

- At the time of writing, I am not trading options, but I do place spread bet trades on most days.

My average holding period is 33 days, and that’s fast enough for me.

Micro E-mini futures

The final section of ST’s third article looks at a “new” (in 2019) micro contract that could be attractive once it has attracted sufficient liquidity.

Conclusions

There’s been a lot to take in today.

ST draws a number of conclusions from his three articles:

- Brokerage: Robinhood

- Not for those of us in the UK – Interactive Brokers or Tasty Trade instead.

- Underlying: SPY

- Action: Sell

- Instrument: Put

- Duration: closest to 45 DTE

- Delta and volatility: dependent on trader’s risk and return targets

- Close trades at profit targets, and close trades early if profit target is not reached

- I will probably start by holding to expiry.

- Manage risk at order entry by selecting delta and number of contracts, as opposed to after the fact using stop-loss orders

- Stop losses appear to work differently with options than with trend-following, so I am happy to go with this for now.

Until next time.