All Weather Portfolio – Ray Dalio

Today’s post takes a look at Ray Dalio’s paper on the All Weather Portfolio, which dates back to 2010.

Contents

The All Weather Portfolio

Ray Dalio runs Bridgewater, one of the most successful hedge funds.

- Nowadays he is quite well known for his “Principles” book, as well as some other books on the economy and market crises.

He’s also one of the people who have done the most to popularise the risk parity approach which underlies the All Weather Portfolio (AWP).

- Although this Bridgewater paper – actually titled “The All Weather Strategy” is quite old, I only came across it recently.

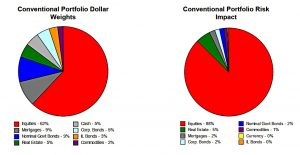

Conventional Asset Allocation

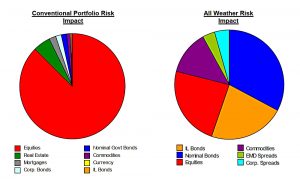

The trad 60/40 portfolio has a 95% correlation to the stock market and 88% of its risk impact derives from stocks.

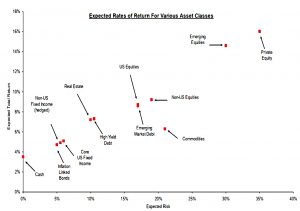

Risk and return

As we all know, risk and return go hand-in-hand.

If assets weren’t priced to outperform cash, investors wouldn’t buy them, and if higher-risk asset classes weren’t priced to outperform lower-risk asset classes, investors wouldn’t buy them either.

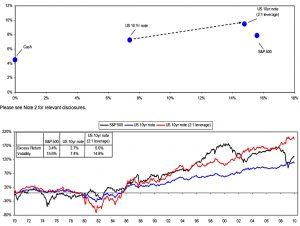

On paper, this means that people who need high returns must buy equities. But in fact, leverage offers another solution:

You can increase an asset’s share of total portfolio risk (i.e. risk share) by borrowing cash and using it to buy more of the asset (levering); you can decrease an asset’s risk share by reallocating money from that asset to cash (delevering).

Leverage can be direct, or by using derivatives, or by extending duration.

Ray uses bonds as an example.

- Applying leverage makes the risk-return profile of bonds similar to that of stocks.

Even better, they will perform well in different economic environments, which makes them useful for diversification.

The same thing applies to all asset classes:

Diversification

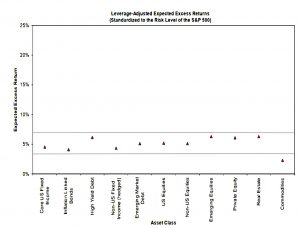

With no substantial return difference between equities and other asset classes, investors don’t need to tie asset allocation decisions to the goal of hitting your return target. Instead, they are free to choose asset classes based on their diversification characteristics.

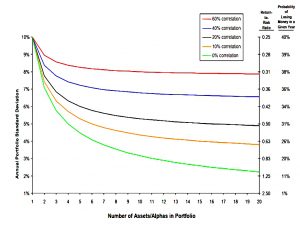

Diversification benefits are greatly amplified by low correlations.

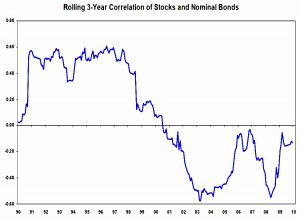

Note that correlations are not constant.

- At the time of writing, Ray was able to point to recent fluctuations in the stock-bond correlation.

Since then the correlation has stayed negative, but at my time of writing it looks as though we might be in for another regime change.

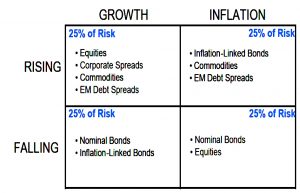

To get around fluctuating correlations, Ray thinks in terms of economic regimes.

By balancing risk equally across the four environments, we can consistently earn asset class risk premiums while minimizing the portfolio’s susceptibility to any one environment.

As well as diversifying across the environments, the All Weather Portfolio also maximises diversification within each environment.

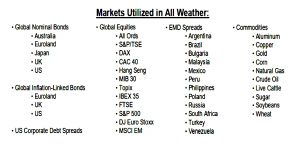

For each environment we hold a mix of asset classes, and each asset class is globally diversified. In total the portfolio invests in more than 40 markets.

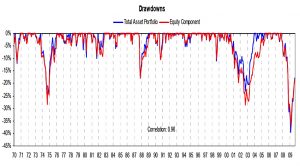

Results

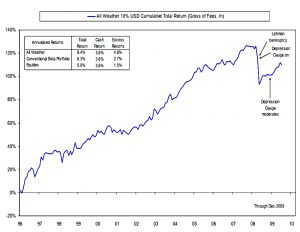

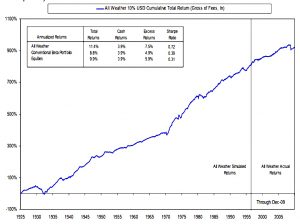

Ray’s paper presented actual results from 1996 when he first implemented the strategy.

Since the strategy’s inception in June 1996, it has produced roughly 8.4% annualized return (gross of fees) with annualized volatility of roughly 11% and has outperformed both equities and a U.S. conventional portfolio.

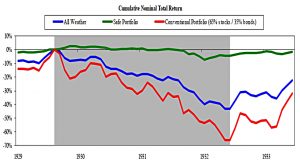

He also provided simulated results back to 1925.

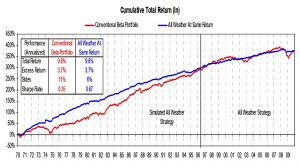

The results can be compared to a benchmark in two ways:

- Setting the AWP to the same return level as the conventional portfolio, to demonstrate lower risk

- Setting the AWP to the same risk level as the conventional portfolio, to demonstrate higher returns

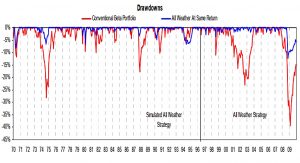

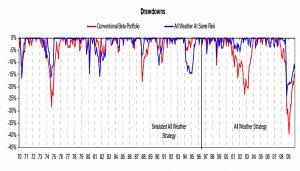

We can also do the same with drawdowns:

Bad times

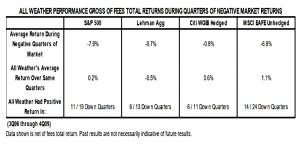

Ray also provided results for market down quarters, and for the great depression of the 1930s.

Because depressions are caused by a debt overhang, they usually only end when there is a restructuring of debt through some combination of a) bankruptcies, b) actual restructuring of debt contracts, and/or c) inflation (which implicitly changes the terms between debtors and creditors).

Bridgewater developed a “depression gauge” which signals the need to switch to a “safe” version of the AWP.

The Safe portfolio is comprised of a balanced mix of hedged global government nominal bonds, hedged global government inflation-indexed bonds, government bills, and gold.

While the All Weather mix did much better than the equity-heavy conventional portfolio, it still experienced materially negative returns. However, the Safe Portfolio remained relatively well insulated during this period.

Bridgewater used their Depression Gauge during the 2008 financial crisis.

Conclusions

Here’s a recap of Ray’s main points:

- Institutional portfolios at the time he was writing were under-diversified.

- This meant that they provided too little return for the level of risk that they took.

- Over allocation to equity and equity-like risk (often 75% or 80%) was the key issue.

- The typical portfolio had a 90% correlation to the equity market.

- Ray recommends that we allocate risk rather than capital (cash)

- Stocks are risky, so a 60% cash allocation is like an 80% risk allocation.

- The large allocation to stocks results from chasing high returns

- But leverage offers another way.

- The All Weather Portfolio is a risk-balanced portfolio of many asset classes, designed to produce equity-like returns with less risk.

- It also provides more consistent returns across a wide range of economic environments.

- The underlying theory is that asset classes are priced to have long-term expected returns above cash that are proportional to their risk (they have similar Sharpe ratios).

- The means that leverage can be used on low-risk assets to raise their risk and returns to equity-like levels.

- When risk levels are equalised, the key factor becomes the correlation between assets.

- The All Weather portfolio is based on Bridgewater’s understanding of the structural relationship of asset classes in different economic environments (rather than a simple historical optimization).

- Severe depressions hurt even the AWP, and you need to switch to a “Safe Portfolio”.

That’s it for today – it’s been fun for me to go right back to the source and see the thinking behind the first implementation of risk parity.

- Until next time.

OOI, the 2010 Bridgewater paper called Engineering Targeted Returns & Risks starts with the following caption summary:

“In 1996, Bridgewater Associates established the All Weather principles for asset allocation, which have now been more broadly adopted under the banner “Risk Parity.” In 2004, Mr. Dalio wrote an article in which he explained these principles. That article is reprinted here, with relevant updates.”

Thanks for the tip.