Weekly Roundup, 3rd July 2018

We begin today’s Weekly Roundup in the FT, with Tim Harford. He was looking at two potential solutions to a jobs crisis produced by automation.

Basic Income or a Jobs Guarantee?

Summer seems to have come early this year, as there was very little of note in the financial press last week.

Tim Harford looked at two potential solutions to a jobs crisis produced by automation – basic income (BI) and a jobs guarantee (JG)

- We’ve looked at Basic Income on more that one occasion previously (spoiler alert – it’s not a terrible idea but it’s too expensive to implement).

- We haven’t looked at the Jobs Guarantee in detail, but we will in a future post.

Tim says that not all the jobs need to be replaced by robots, 30% to 40% would be enough to produce a crisis.

- His focus was on which of the two possible solutions would make us happier.

Not only do I think that BI is too expensive, I also think that the Silicon Valley types who push it are hopelessly optimistic about human nature.

- They see basic income as “venture capital for everyone”, and they expect people to become artists, inventors and poets.

- I see it as massively extended welfare, with millions told that they can’t produce anything of value.

The Jobs Guarantee risks a similar fate if it is clear that the jobs are fake.

- But at the same time the behaviour of workers who have to get up in the morning and turn up on time is likely to be less antisocial than that of people who get the money whatever they do.

The literature (on normal jobs and unemployment, not basic income or a jobs guarantee) suggests that involuntary unemployment makes people unhappy.

- Money is only part of it, with a loss of prestige, identity and self-worth counting for more.

Which suggests that the jobs guarantee might be a better idea.

- Tim also cites recent studies of lottery winners which suggest that they are scaling back their hours rather than quit work entirely.

At the same time, happiness studies show that commuting to and from work makes us feel bad.

- And for low status jobs or those for which we feel overqualified – both risks for the kind of work that the JG might provide – the work itself also produces negative feelings.

The JG will also remove autonomy and control from individuals – they need to punch the clock – which could make things worse.

- But at the same time, people like to keep busy and social contact is good for us.

Tim can’t make up his mind, but ignoring the financial cost, I prefer the Jobs Guarantee because of the wider benefits to society, not the effect on the individual.

- I’ll come back to this topic in a future post to work out whether we can afford one.

Chinese bonds

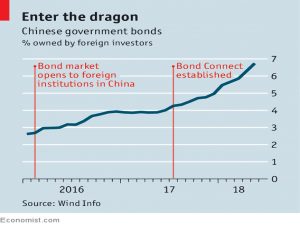

In the Economist, Buttonwood looked at why foreigners are buying Chinese government bonds.

- This year, foreigners have been the biggest buyers, as China opens up to capital flows.

As China’s economic power increases, some think that the yuan will supplant the dollar in the same way that the dollar replaced sterling.

- But that’s not why they are buying the bonds.

It’s become a lot easier for foreigners to buy the bonds in recent years.

- The market was opened up to foreign institutions in 2016, and then last year Bond Connect (a link to Hong Kong trading) was established.

The bonds will be added to the global index next year, and they yield 3.6% pa.

- They are less volatile than other emerging market bonds and they have a good record as a diversifying asset.

The downside is that the Chinese debt to GDP ratio is now 260%.

- Cynics fear that China is opening its market just in time for foreigners to get stung in the bust.

Wage or tax break?

On Pension Playpen, Henry Tapper looked at whether a pension is a “wage in retirement” or a “tax-incentivised wrapper“?

- He thinks it should be the former, I think it should be the latter.

A pension used to be a wage, when it was provided by the state, or by a paternalistic employer (as a DB pension).

- But we are nannied no more, and a DC pension is simply an incentivised pot into which you can save money that you need in retirement.

How you access that money in retirement, and whether you run out of it, should be nobody’s business, unless we want to start checking what everybody spends all their money on.

Henry thinks that people like me (( He’s actually targeting the 6% of people who take “holistic financial advice”, but he means the rich )) should keep quiet and let the system be better arranged for “the unlucky sods who need a replacement income in later life”.

- I don’t believe that luck comes into it

- And I double don’t want to be forced to turn my pension pot into a drip-fed income for life on extremely unfavourable terms.

DB pensions aren’t coming back, so neither is the “wage in retirement”.

Quick links

To make up in part for the small number of articles covered above, I have a lot of links for you this week.

- On his blog Musings on Markets, Aswath Damodaran was pretty scathing about Tesla’s prospects.

Put bluntly, there is no chance that Tesla can deliver what it needs to, in terms of scaling up revenues and improving profitability, to justify its market capitalization, without raising new equity along the way.

Either Musk knows this, and really does not mean what he says, in which case he is being deceptive, or he does not, in which case he is delusional.

Neither is a good character quality in a CEO, especially one at a young company that needs investors on its side.

That article encouraged me to hunt back through less recent updates, so here are four more articles on:

The Economist also had a couple of articles on Netflix – 1 and 2.

- They also looked at Coinbase.

The Times had a couple of interesting articles:

- the first reported that short sellers are circling Metro Bank.

- the second said that inequality is falling, but nobody will believe it.

Dual Momentum looked at The Evolution of Investing.

UK Value Investors said that UK Property prices could stay flat for another 10 years.

The Adventurous Investor reported on a Structured Product that he felt was a proper income alternative.

Seedrs provided an update on its secondary market.

A new paper suggested that the size effect might not exist.

The Reformed Broker looked at Three Uncelebrated Edges.

Henry Tapper looked at how Reckless Prudence can break a pension system.

Pragmatic Capitalism looked at “Passive Investing” in two parts – 1 and 2.

Research Affiliates suggested that using index funds amounts to “Buy High and Sell Low“.

Alpha Architect looked at Vanguard’s new Fair Value CAPE.

- They also suggested that you Trust The Process.

And finally, FT Advisor reported that the pension industry had agreed to new time limits on transfers.

Until next time.