Weekly Roundup, 13th August 2019

We begin today’s Weekly Roundup in the FT with John Redwood, who was worried about inflation.

Contents

Inflation

We’re deep into August now, and it was yet another quiet week for financial news, although we had a lot of volatility in the markets themselves.

In the FT, John Redwood looked at the risk of inflation.

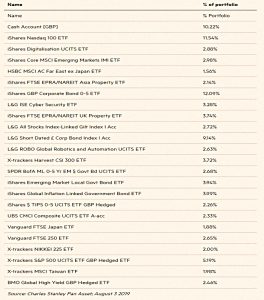

- His ETF fund is up 10.7% this year to date, despite being 50% weighted to bonds and cash.

He has a US tech bias and sold out of China and Germany in advance of the trade war tensions.

He notes that Trump wants a higher US stock market before the presidential elections next year, and is leaning unreasonably on the Fed to deliver this.

- Rate and tax cuts are possible in Europe as well as the US.

Which could lead to the inflation that John is worried about.

- But if it doesn’t materialise, stock markets could continue to deliver.

Here’s an update on the composition of John’s fund:

Yuan dollar

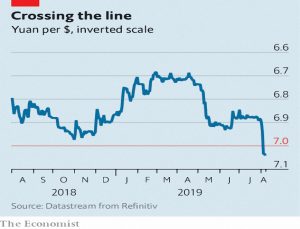

Buttonwood looked at the dollar-yuan rate, which just fell through seven (that is, rose above seven since the yuan is weakening).

- He notes the round-number fetish in financial markets, which applied to stocks as much as FX.

And also how strange it is that a currency with limited use outside China is part of the word’s most-watched asset price.

The yuan does not float like other currencies – the rate is set each day by officials with reference to a basket of currencies.

- Until June, seven was seen as a cap to the range of rates, but then the governor of the Chinese central bank said that it was not.

A big fall would make the dollar debts of chines firms larger, and risk capital flight from the country.

- The other effect is a strong dollar, which squeezes global credit since much international borrowing is in dollars.

This also leads to moves from stocks into US bonds, and lower global GDP growth.

Negative yields

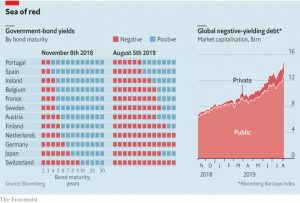

The Economist also looked at negative bond yields.

- A quarter of the world’s bonds – worth $15 trn – are now negative.

Global interest rates are coming down again.

- And inflation expectations (as shown by forward swaps) are low (higher predicted inflation ought to lead to demand for higher bond yields).

While US yields remain positive, dollar hedging costs for non-US investors turn them negative.

- Despite this, they are still seen as a refuge from the trade wars.

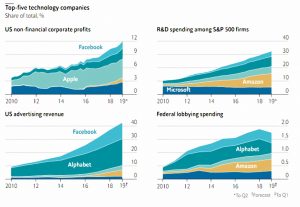

Tech titans

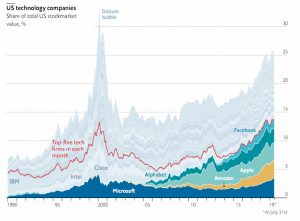

And the newspaper looked at the entrenched position of the US tech giants.

- Back in 2000, tech made up a third of the value of the US market.

This time around we’re only at 25%, but the industry is much more concentrated today.

- The top five (FAAMG) firms make up half of the sector.

Since 2010., they have spent $100 bn on buying up would-be rivals.

The key threat is regulation.

- 33% of Americans now say that tech has a negative effect on society.

- And the Department of Justice has begun an antitrust review.

This is a tricky one.

- Consumers get a lot of useful services for free (from Google) or for cheap (from Amazon).

Splitting the revenue engines (advertising and AWS) from the free stuff would be the end of this.

Consumer goods prices

The fourth article from the Economist was about consumer goods prices.

As sterling fell after the Brexit referendum in 2017, lots of UK goods got smaller, whilst remaining at the same price.

- This became known as shrinkflation.

And this is not the only example of consumer goods prices behaving oddly.

Companies with thousands of lines (say H&M) offer then at a couple of dozen price points.

- This is known as quantum pricing.

And prices change very little – retailers design products to hit their price points.

The point of this is that inflation becomes sticky, not moving as much as you would expect in either direction.

- And this, in turn, makes wages more sticky.

Bonds market catharsis?

In Bloomberg’s Points of Return, John Authers wondered whether this might be the bond market’s dot-com moment.

- He’s far from certain and concedes that yields could still move lower.

Nevertheless, there are a lot of articles expressing the view that there’s no escape from low rates.

- Using the “magazine cover contrarian indicator”, John says that the recent run of vortex imagery means that it might be time for a change.

He also refers to the soaring price of the 100-year Austrian bond.

- The chart – of a bond with a negative yield – looks like a tech stock.

- Even Mexican bonds look similar.

Meanwhile, 30-year Treasury yields are close to all-time lows.

- So maybe we are not far from the point of revulsion.

Or as John puts it in Monty Python terms:

The moment the brigadier with the big mustache appears on the screen and says: “Stop that, it’s all got frightfully silly.”

Quick links

I have eleven for you this week, the first three from the FT:

- A look at Burford Capital

- An interview with Michael Murray, the man taking Sports DIrect upmarket, and

- News that the Woodford Equity Fund is the worst UK underachiever

- Maynard Paton looked at AG Barr

- Alpha Architect was betting against beta

- And explained that if you have no skill as a fund manager, active share won’t save you

- UK Value Investor wrote about Stagecoach

- The New York Times explained how Trump and Xi can make America and China Poor again

- Collaborative fund looked at whether volatility is a fine or a fee

- Pragmatic Capitalism explained how they think of the stock market during its ups an downs

- And The Reformed Broker explained why the stock market must go down.

Until next time.